Denys Yelmanov

Merger arbitrage

It has been a good year for merger arbitrage, but a particularly bad one for pre-arbitrage takeover candidates. As equity and credit markets stumbled, a higher than average number of potential deals were abandoned. While this has been treacherous territory, this is one worth considering.

Who?

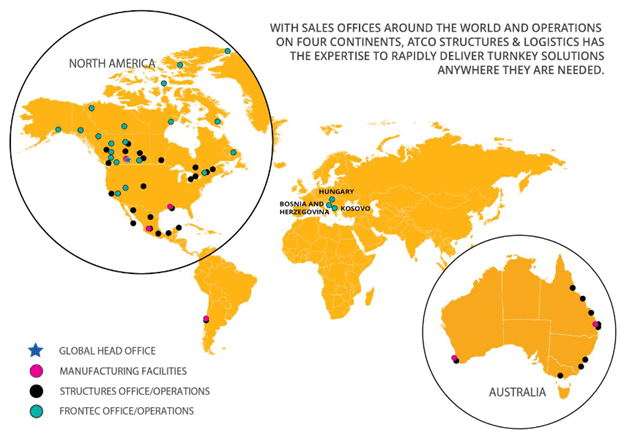

Atlas (NYSE:ATCO) operates containerships and an asset manager. It charters containerships with long-term and fixed-rate time charters to container liner customers. It also operates a fleet of diesel electric generators. The market has not given it enough credit for their assets and world-class asset allocation.

Atlas (ATCO)

What?

Fairfax Financial Holdings Limited formed a consortium with the Washington family and Atlas’ chairman David Sokol to buy the company for $14.45 per share. The potential buyer in aggregate currently owns 68% of ATCO. On Aug. 18, the company formed a special committee to work with Morgan Stanley (MS) on evaluating the offer.

When?

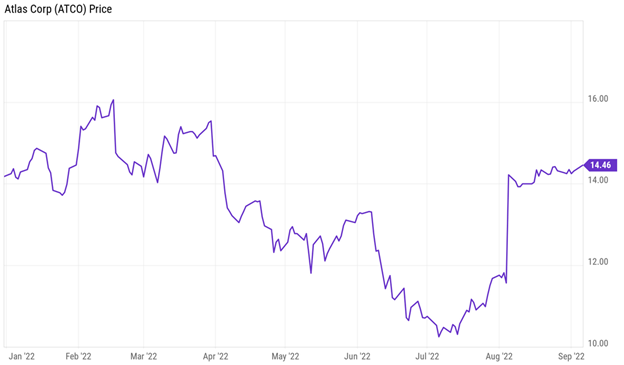

The offer was launched on Aug. 4, 2022. The prior price of around $11.57 gives a reasonable approximation of its standalone market price over the near-term, absent a change of control.

Atlas (Y Charts)

Where?

Atlas is based in London.

Atlas (ATCO)

Why?

The bidders will probably have to bump their bid to at least $16.50 to get a deal done. Shareholders mostly oppose the current offer. Charlie Frischer’s letter reflects my view and probably reflects the view of a majority of ATCO owners. Today, Albright Capital Management also indicated that they are a “no.” Others are likely to emerge in the days ahead.

Mr. Sokol has a problem: We like him. We have confidence in his asset allocation and the business he has built, and so see no reason to part with it for 1x book value. We see every reason in the world why he and Prem Watsa want to buy it for that price. But Sokol has attracted like-minded owners who will be somewhat obstinate counterparties. He will either need to bump by at least a few dollars or give us an opportunity to join the buyer group. I’m all for opportunistic, low ball bids as long as I’m able to seize that opportunity.

Caveat

There’s already some takeover premium priced into the stock. You could lose some money over the short-term if no deal materializes.

Conclusion

These are extremely sophisticated bidders committed to getting a deal done. While they hate overpaying, they have a lot of room in which to negotiate a friendly deal.

TL; DR

Buy ATCO.

Be the first to comment