stu99

Neighborhood social networking site Nextdoor (NYSE:KIND) has had a rough ride in the public market. Since de-SPACing, the stock has fallen over 85% from its peak and today trades at just 2.7x expected 2022 revenue. Further the company has a war chest of $660 million in net cash on its balance sheet ensuring that the business will weather any economic storm. In addition, during 2022, insiders have purchased shares at higher prices than where the stock is currently trading.

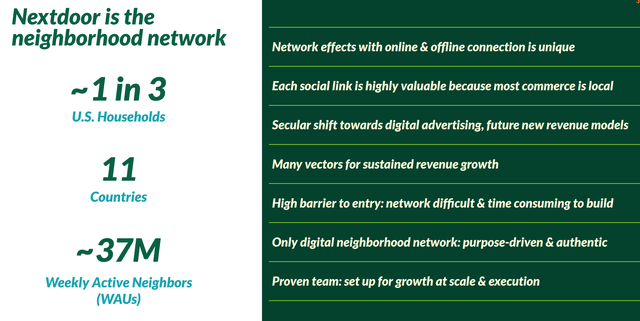

Nextdoor Overview (Nextdoor Investor Presentation)

While Nextdoor is an afterthought relative to social networking sites like Facebook (META), Instagram, Pinterest (PINS), and Twitter (TWTR), the company does have significant reach with 1 in 3 US households using the site weekly. Similar to Facebook blue, the demographic skews toward 35+ adults as the target market is homeowners looking to connect with their neighbors. I view this as a positive:

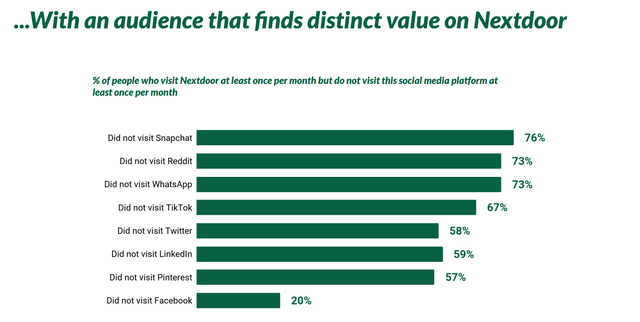

A. Adults are more loyal to existing social networks whereas tweens and teens are more comfortable adopting new networks which allowed for the rapid rise of Snapchat (SNAP) and TikTok. This can be seen in the graphic below which shows significant overlap with Facebook (mainly used by adults) with much less overlap with Snapchat and TikTok.

B. Homeowners are more affluent than average and are in their prime spending years (age 35-60).

Nextdoor Investor Presentation

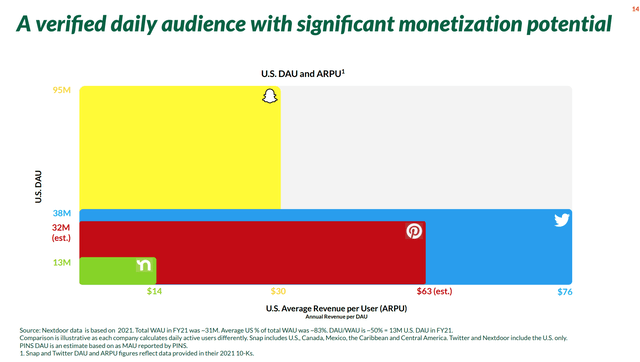

While Nextdoor has been successful in growing its top line in recent years (more than doubled revenue between 2019-2021), revenue growth has slowed in 2022, owing to 1. more difficult economic environment/online spending environment in general and 2. slowdown in housing related expenditures – partly due to slowdown in the US housing market but also a reversal of strong ‘stay at home’ spend of 2020-21 during the pandemic. The long-term bull case for Nextdoor is predicated upon the company driving ARPU higher – as you can see below, Nextdoor significantly lags other social networks:

Social Network ARPU (Nextdoor Investor Presentation)

While I believe that there is upside to Nextdoor’s ARPU, I doubt the company will ever achieve the levels of Twitter which has a user base that spends significantly more minutes per day on the site (and thus can be served more advertisements).

Frankly, I don’t know that the company will ever be able to achieve significant levels of profitability as a standalone company. That said, with an attractive niche targeting US homeowners, it seems reasonable to me that the business could be acquired at a significant premium to its current price. I explore that in the next section.

Why do I think Nextdoor is cheap and what might a buyer pay for the company?

Historically social networking stocks have traded at much higher prices (6-10x revenue) than what we are currently seeing in the market today (3-5x). Elon Musk looked to be paying about 6.5x 2022e revenue for Twitter when the deal was announced in April but the outlook for revenue has deteriorated since that time (everyone seems to agree that Musk overpaid for Twitter).

I can think of two logical strategic buyers – Pinterest and IAC (IAC)/Angi (ANGI) (note IAC owns 85% of Angi). Pinterest may be able to cross-pollinate the user bases of the two companies (as shown above there is about 43% overlap between the two companies in the US), in particular in overseas markets as Pinterest is a global enterprise and Nextdoor has global aspirations. In addition, there would be significant opportunities for cost savings in R&D, sales/marketing, and overhead.

IAC/Angi is less likely given that IAC may be uninterested in allocating more capital toward Angi which has struggled mightily since IAC merged it with HomeAdvisor in 2017. I see it as a potential fit because both companies are targeting homeowners (in fact, Angi advertises heavily on Nextdoor).

Giving Nextdoor credit for the cash on its balance sheet and assuming a multiple of 3-6x 2022e revenue, I get a potential value of $3.40-4.30 per share indicating upside of 35-70%. I believe downside is relatively limited as Nextdoor has net cash per share of $1.40 per share on its balance sheet (56% of its share price).

It is worth noting that there is at least one insider who seems to agree with me and has accumulated tens of millions worth of the shares thus far in 2022.

Conclusion

I think Nextdoor is reasonably attractive here and expect shares will do well over the next 3-5 years. That said, there are many attractive stocks in today’s market – as such my position in Nextdoor is relatively small.

Risks

Continued weakness in digital advertising – Nextdoor has already reduced guidance by nearly 15% earlier this year but a further slowing of the economy could lead to another revenue miss.

Be the first to comment