hapabapa/iStock Editorial via Getty Images

The financial technology market is, to me, one of the most interesting areas to consider and invest in. At the end of the day, it all centers around building a quality platform that adds value to the users of it and that can utilize that value add to build revenue and cash flows. Although there are plenty of costs involved with such a venture, the process is generally not asset-intensive like a railroad or a manufacturer. One often overlooked player in the financial technology space that only recently went public is NerdWallet (NASDAQ:NRDS). Over the past few years, management has done well to grow the company’s top line. While profitability has recently become a problem, cash flows for the firm look alright. And for an enterprise in this space, shares are trading at levels that don’t seem unrealistic.

An underfollowed fintech play

NerdWallet describes itself as a platform dedicated to empowering consumers, which includes individual consumers as well as small and medium-sized businesses, so that they can make smarter financial decisions. The company does this by offering guidance to consumers on its platform in the form of educational content, tools, calculators, product marketplaces, and even their own app. Financial guidance provided by the company focuses on topics ranging from credit cards to investments to mortgages and more. By coming to understand what a consumer on its platform finds value in, the company then works to offer them financial services provided by third-party firms to meet their needs. At the end of the day, the company generates revenue by matching said consumers with their financial services partners and collecting a fee as a result. These fees can be generated when a particular action is taken, or when a link is clicked or when a lead is generated or when a loan is funded.

For much of its life, NerdWallet was a privately held company. The firm grew to $44 million in annual revenue before taking any outside equity. Eventually, management decided to take the firm public. This took place in November of 2021 when the business generated net proceeds from its IPO of $140 million. In terms of what drives growth at the company, the answer is a mixture of factors. For instance, in 2020, the company acquired Fundera, an online platform that connects small and medium-sized businesses with lenders and other resources. This includes features like advice and loan comparison offerings that you might not find elsewhere. Also that year, the company acquired Know Your Money, an online provider of financial guidance and tools for both consumers and businesses located in the UK.

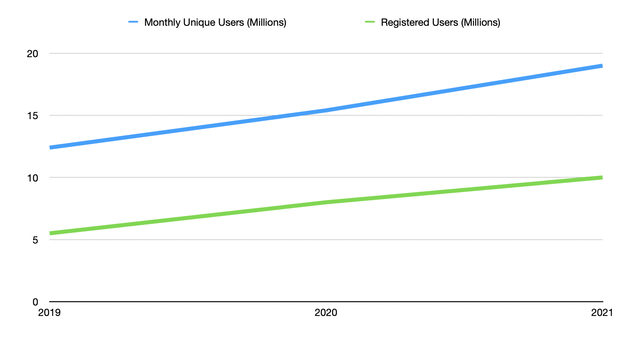

However, the biggest determinant of the company’s revenue is the number of users that it has. Back in 2019, the business had just 5.5 million registered users. This expanded to 8 million in 2020 before climbing to 10 million in 2021. Another important metric for the company is the MUU, or Monthly Unique User. This is defined as the number of users that spend at least one session in a given month on the company’s platform. Over the past three years, this increased from about 12.4 million to roughly 19 million. Long term, I fully suspect that a growing population, the prospect of continued geographical expansion, the recognition that financial literacy is important, and other factors will continue to add to the reasons for users to visit the company’s platform. In fact, data provided by management supports this view. Consider their take on Gen Z. One study the company referenced so that 89% of Gen Z members surveyed said that it is a priority for them to learn about personal finance. And 75% mentioned that they are interested in taking personal finance classes. As the younger generations age, and wealth transfers to them, they will be more in need of financial guidance than ever before.

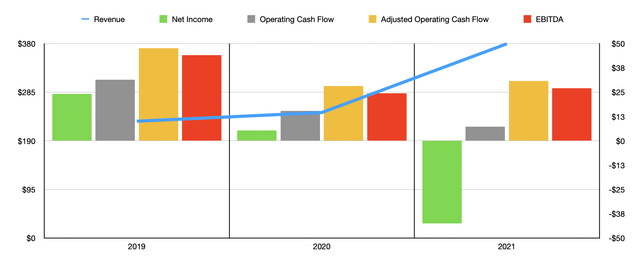

As a result of this expansion, the company’s sales benefited. Revenue totaled $228.3 million in 2019. By 2021, it had grown to $379.6 million. When it comes to profitability, the picture has been a bit different. Back in 2019, the company generated net income of $24.2 million. This dropped to $5.3 million in 2020 before turning into a net loss of $42.5 million last year. Though at first glance this may be worrisome, investors need to consider the contributors to this decline in profitability. Research and development costs, for instance, are largely investments focused on the growth of the firm. Those grew from $46 million to $62.2 million over the three-year window covered. Sales and marketing costs grew even more, surging from $115.6 million to $271.3 million. These are costs largely centered around advertising and promotion for the business. During this window, the company also saw stock-based compensation more than triple, climbing from $5 million to $17.9 million. And it suffered from an $18.1 million charge as a result of a change in the fair value of contingent consideration related to earnouts in 2021. That’s a one-time item that normally shouldn’t repeat itself.

Perhaps more important than profitability would be cash flow. This picture has been a bit more favorable for investors. Although at first glance, it looks as though cash flow declined, dropping from $31.4 million in 2019 to just $7.2 million in 2020, the picture changes some if we adjust for changes in working capital. Although it did decline from $47.7 million in 2019 to $28.1 million in 2020, it rebounded some to $30.8 million last year. A similar trend could be seen when looking at EBITDA. This metric ultimately moved from $44.1 million in 2019 to $24.4 million in 2020 before climbing back up to $27.1 million in 2021.

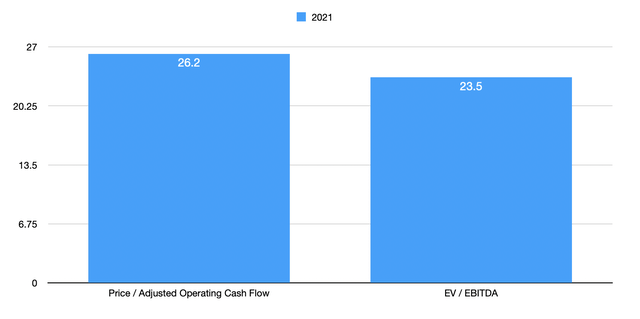

Pricing a company like this can be a bit tricky. But if we take the company’s 2021 results, we find that shares are not all that expensive considering the growth the business has experienced. On a price to adjusted operating cash flow basis, for instance, the firm is trading at a multiple of 26.2. Meanwhile, the EV to EBITDA multiple of the company is even lower at 23.5. The reason why the latter is lower is because the business has no debt on hand and has cash and cash equivalents of $167.8 million.

Takeaway

Based on the data provided, I will say that NerdWallet makes for an interesting prospect for investors who might be drawn to the financial technology market. The company uses its platform to create value for its customers, many of them incurring no cost in the process, while also pairing them up with financial service providers that can better fit their needs. So long as current growth trends persist, I could see shares ultimately rising in the years to come. Because of this, the firm could well be an attractive opportunity for growth-oriented investors who are focused on the long term. However, for those focused on the value philosophy, shares probably are closer to being fairly priced at this time.

Be the first to comment