peterschreiber.media/iStock via Getty Images

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on March 13th, 2022.

Closed-end funds aren’t a sector or asset class within themselves. They are simply a wrapper for their underlying holdings. That being the case, the biggest influence on their performance would come from the sector and underlying positions overall. However, the manager’s selection also does impact the end result too. The portfolio strategy of the fund can also play a significant role in where and how these funds will be invested as well.

As an income investor, utility and infrastructure holdings are one area where I’m overweight and have a natural affinity. I’m loaded up on various utility/infrastructure funds for their perfect fit of providing steady income and stability in price. Some of the CEFs do utilize leverage, so stability can be a subjective matter.

It has been quite some time since doing an update on this sector; the last time was over a year ago. Today, I wanted to update the coverage by reviewing the performance, valuations, distributions and potential future appeal of several of these equity utility/infrastructure funds. Several infrastructure funds came about in 2020 through a transition of energy funds.

Those funds include the Kayne Anderson NextGen Energy & Infrastructure, Inc. (KMF), Cushing NextGen Infrastructure Income Fund (SZC), Ecofin Sustainable and Social Impact Term Fund (TEAF) and Tortoise Energy Infrastructure (TYG). I hold all of these funds but believe they are different enough from the other funds we’ll touch on today. I think it would make for a great discussion on their own article.

On top of that, several “hybrid” funds aren’t focused primarily on mostly equity holdings. They include significant holdings in preferred or other fixed-income investments. Those, too, would be an excellent fit for a different article. That includes John Hancock Tax-Advantaged Dividend Income Fund (HTD), Virtus Total Return Fund Inc. (ZTR), Wells Fargo Advantage Utilities and High Income Fund (ERH) and Franklin Universal Trust (FT). I’ve covered most of these funds in other articles, so a deeper dive is available.

Finally, MainStay CBRE Global Infrastructure Megatrends Fund (MEGI) was launched in October 2021. That fund will be included in the future but is too new at this time. I covered that fund relatively recently for more details. The infrastructure fund that was new in the previous coverage, Aberdeen Standard Global Infrastructure Income Fund (ASGI), I will include this time.

Utility Funds Review

Here is the screening of the funds in the sector. It is sorted by total annualized NAV performance over the last 10-year period and sorted from highest to lowest. ASGI doesn’t have a 5 or 10 year annualized performance. If I’m missing any, please let me know, and I can add them to the list for review next time. The data is as of March 11th, 2022, except for the performance is from the month ended February 2022. The information was from CEFConnect, which gets their data from Morningstar.

| Ticker | Premium/Discount | Distribution Rate | Effective Leverage | 1-Year NAV | 5-Year NAV | 10-Year NAV |

| (UTF) | 1.46% | 6.87% | 27.27% | 19.39% | 10.41% | 11.10% |

| (XLU) | 2.94% | 19.97% | 9.08% | 10.66% | ||

| (DNP) | 15.37% | 6.84% | 24.51% | 23.60% | 7.83% | 10.64% |

| (UTG) | 1.13% | 6.88% | 20.29% | 12.52% | 6.12% | 10.40% |

| (BUI) | 0.72% | 6.10% | 10.15% | 10.80% | 9.23% | |

| (MGU) | -16.46% | 5.13% | 29.54% | 24.10% | 8.21% | 8.83% |

| (GUT) | 76.04% | 8.33% | 27.97% | 19.04% | 5.99% | 8.62% |

| (GLU) | 1.17% | 6.30% | 37.96% | 6.06% | 4.70% | 5.34% |

| (DPG) | 5.96% | 9.31% | 31.75% | 23.07% | 2.92% | 4.82% |

| (MFD) | -8.57% | 8.33% | 27.03% | 21.52% | 4.75% | 4.74% |

| (ASGI) | -12.55% | 6.78% | 12.46% |

To start, in 2022, the utility sector has been a source of defensiveness, as we often see from the sector. It is the second-best performing sector on a YTD basis as measured by the Utilities Select Sector SPDR ETF (XLU). However, that isn’t saying much as the only positive sector by a wide margin has been the energy sector as of writing. Using XLU isn’t necessarily that great of a benchmark for many of these funds. However, I include it for some context.

First, CEFs are going to appeal to income-oriented investors. Secondly, the ETF invests in large-cap U.S. utilities only. Looking at these other funds – you will see not only utilities but other infrastructure holdings. That includes energy holdings and global positions. Over the last decade, investments outside the U.S. have performed relatively poorly compared to their U.S. counterparts.

So on a 10 year total annualized NAV return basis, XLU has beaten almost all of these. Several of these funds have outperformed XLU now when looking over the last year. This was seemingly helped by their weightings toward energy exposure that XLU doesn’t have.

A couple of initial observations and stats:

- The average premium is 6.43%, though the Gabelli Utility Trust (GUT) is an incredible outlier that has brought this average up significantly. Excluding GUT, that brings the average to a discount of 1.31%.

- The average distribution yield for the group of funds comes to 7.09%.

- The effective leverage for the group comes to an average of 28.29% – with BlackRock Utility & Infrastructure Trust (BUI) and ASGI carrying no leverage at all.

- The average performance from the sector on a total NAV return over the last 1-year period comes to 17.19%.

- The average performance from the sector on a total NAV return over the last 5-year period comes to 6.86%. This was dragged down mostly by Duff & Phelps Utility and Infrastructure Fund (DPG) as being a really poor performer during that period.

- The average 10-year total annualized NAV return comes to 8.19%. That is well below what XLU has delivered. It was dragged down by the weak performances in Gabelli Global Utility & Income Trust (GLU), DPG and Macquarie/First Trust Global Infrastructure/Utilities Dividend & Income Fund (MFD).

Cohen & Steers Infrastructure Fund (UTF)

UTF came in as the best performer over the last 10 years. They were a strong performer on a 5-year NAV total return basis as well. The 1-year NAV performance was underperforming from some of those funds that have a higher allocation to energy funds. However, it would appear that its overall more stable performance over the years has delivered this outperformance in the longer term.

This is one fund that I had recently put back into my portfolio with the latest volatility. The fund’s valuation became much more reasonable at a fairly shallow premium. That was a big difference from the near 10% premium the fund touched at the beginning of 2021. That was when I sold the position in favor of HTD and Reaves Utility Income Fund (UTG). For more details on that subject, I had previously covered that topic.

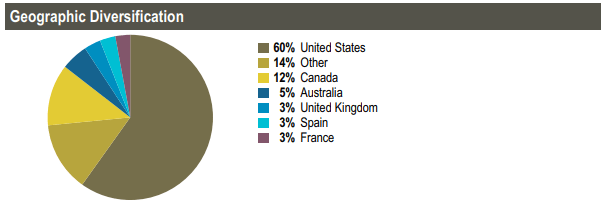

UTF is also the only fund that had also beaten XLU’s performance. Which is a contradiction of my previous comments on global positioning. UTF was able to buck that trend despite its global positioning over the years. They also incorporate a small sleeve of preferred and fixed-income into their portfolio. Below is their global allocation from their Fact Sheet at the end of 2021.

UTF Geographic Diversification (Cohen & Steers)

Overall, I think UTF can remain a strong fund going forward. I’d have to put it near the top of my list over the next 10 years. Unless it started trading at double-digit premiums again, I don’t see myself selling this fund.

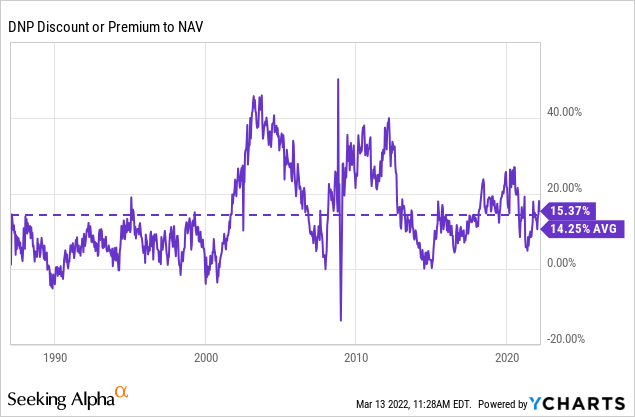

DNP Select Income Fund (DNP)

DNP is definitely an income investor favorite. They have the longest streak of never cutting their distribution of any closed-end fund that I know of. I went into more detail on the fund somewhat recently, but the main takeaway is the stability of its distribution is its strongest selling point. They have maintained a monthly $0.065 going back to 1997. Before that, they had a payout of $0.06 going back to 1992. It could have been a longer streak, but none of the sources I use go back further.

Unfortunately, the higher premium can be a turn-off as well. This could be a case where making an exception to buy a fund at a premium might be okay for some income investors. At the same time, the current discount isn’t too far from its long-term average, going back as far as YCharts will go.

YCharts

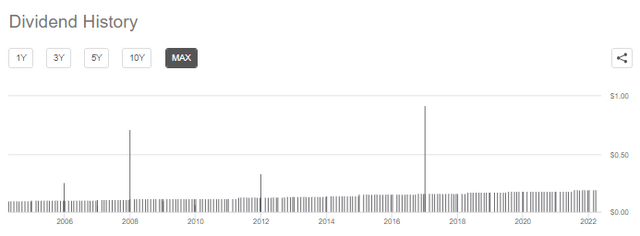

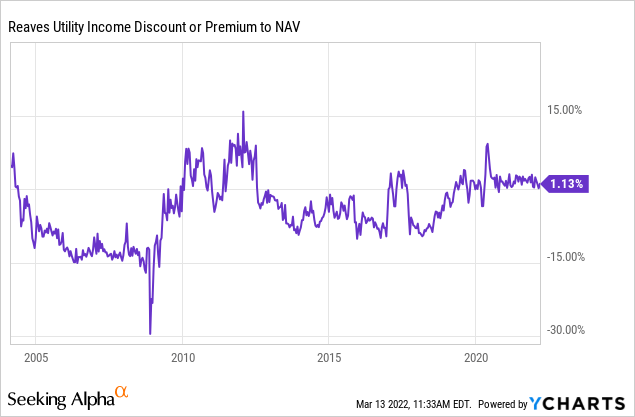

Reaves Utility Income Fund (UTG)

UTG is another income investor favorite. In this case, its distribution history doesn’t go back nearly as far as DNP. However, what it lacks in the length of history, it makes up for by increases over time. The most recent increase was in 2021, when they bumped it up a penny a month. That was the fund’s 12th increase since it launched in 2004.

UTG Distribution History (Seeking Alpha)

What is also notable is that being launched before 2008, it is one of only a handful of funds with no distribution cuts during that time. DNP is another one to hold that title.

The fund has enjoyed premium pricing since around 2019 rather regularly. However, before that, the fund had traded at discounts fairly frequently. Then there was another stint in 2009 to around 2012, where premiums were also a regular occurrence.

YCharts

That makes UTG a fairly interesting prospect at this time. In my opinion, it could be a strong performer going forward. However, if the valuation sinks from here back to a discount, the actual share price performance could leave investors underwater. I don’t have any plans of selling my position here.

BlackRock Utility & Infrastructure Trust and Aberdeen Standard Global Infrastructure Income Fund

I wanted to touch on these funds together because they are the two funds that don’t employ any leverage on their portfolio. That could make them relatively more stable than the other names. A more conservative investor might prefer these two. However, ASGI is rather new, so some investors would want to give it several years before committing any capital to this fund.

BUI has a more extended history and utilizes an options overlay strategy on their portfolio too. That means that this is another way to enhance returns during flat markets potentially. In a slightly down market, it could provide some downside protection too.

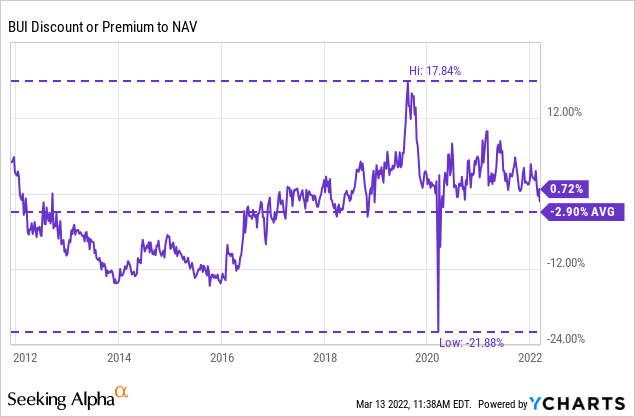

That being said, ASGI is one of the best deals in the sector at this time in terms of discount valuation. BUI has been flirting between a discount and a premium lately, though it is no stranger to high premiums or wide discounts. This is a really hard fund to peg on what it should really be valued at. We can see for many years a wide and persistent discount. Then in 2017, it went to a premium and had hardly looked back. 2020 saw a sharp discount open up briefly through the COVID-induced market crash.

YCharts

I hold both BUI and ASGI, no plans to sell either. I like their approach with not utilizing any leverage, and it gives me a broader diversification to a basket of fund sponsors.

Duff & Phelps Utility and Infrastructure Fund, Macquarie/First Trust Global Infrastructure/Utilities Dividend & Income Fund and Macquarie Global Infrastructure Total Return Fund (MGU)

DPG, MFD and MGU are on the bottom half of the performers. Specifically, DPG and MFD were the worst-performing funds of this group. One of the reasons for this is their over-exposure to energy-related investments.

MGU last reported a 30.73% allocation to energy infrastructure. DPG shows midstream exposure at 21.8%, plus “infrastructure” at 16.5%. I’d be willing to bet some of that infrastructure is energy-related. MFD lists its “oil, gas & consumable fuels at a 25.25% allocation.

That’s why it makes it quite clear that they were the worst-performing over the last 5 or 10 year annualized performances. However, over the previous year, that has completely flipped. MGU is the top performer – followed by DNP – then DPG and MFD. That’s quite the reversal and can be tied directly to the energy exposure, in my opinion.

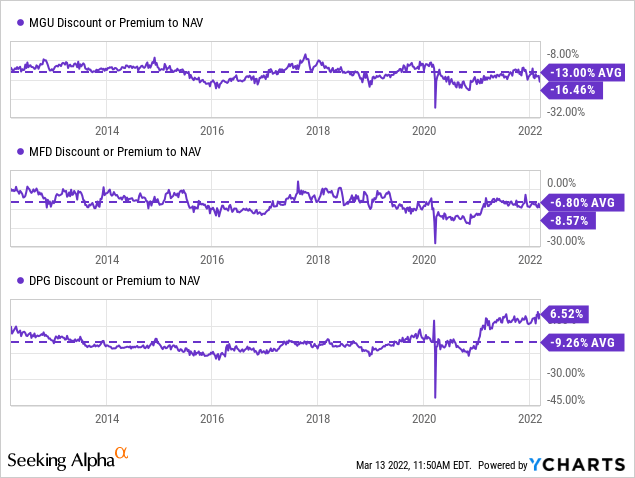

Of these three, MGU seems to be the best positioned to take advantage of further energy outperformance based on it being the best value in the space. MFD could also be a good choice. I’d probably avoid DPG due to its higher valuation.

YCharts

Gabelli Global Utility & Income Trust

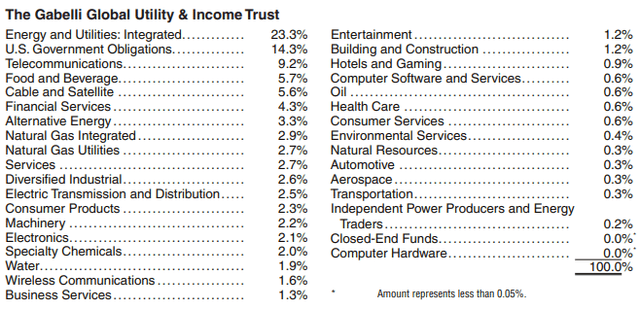

GLU is an interesting case. They also have a sizeable allocation to energy, at least when they last reported at the end of 2021. “energy and utilities: integrated” was 23.3%.

GLU Sector Weightings (Gabelli)

Yet, they haven’t participated in the energy rebound that DPG, MFD and MGU are experiencing. Instead, it is the weakest performer over the last year. The second weakest performer over the last 5 years and only beat out DPG and MFD on a 10-year basis.

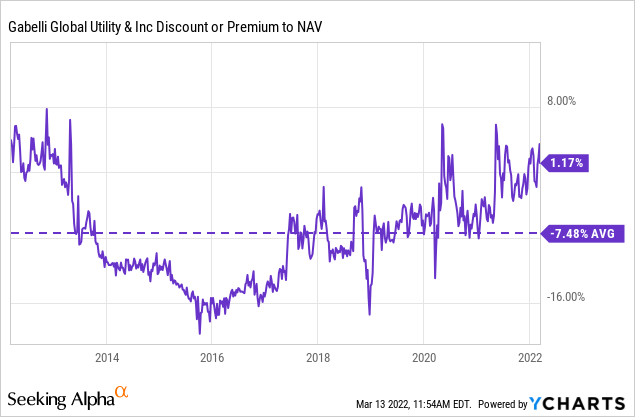

I can’t really explain it, but investors still feel compelled to push the fund to a slight premium at the moment. Investors like it enough to move it to well above its average discount over the last 10 years as well.

YCharts

I can’t really explain what investors might be seeing here. The strongest selling point for the fund is that it is also one of the few funds that haven’t cut its distribution since its inception pre-2008. The yield itself isn’t too dangerously high either, so a cut doesn’t seem imminent.

With GLU, you also have the largest position in Swedish Match (OTCPK:SWMAF) at the end of 2021. This is a tobacco company with operations in Sweden. They also carry the largest amount of leverage, more leverage than we see in most equity funds overall.

For me, GLU would be an avoid at this time as there are better alternatives, in my opinion, from this list.

Gabelli Utility Trust

I saved GUT for last since it is the easiest: sell.

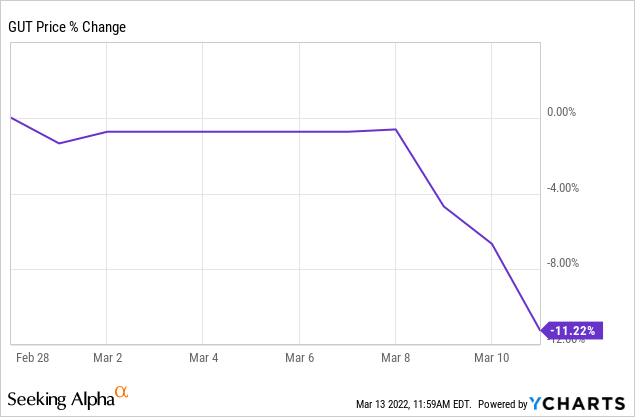

Although, the bright spot here is that they recently announced a rights offering. While that will more than likely crash the price, it will be accretive as shares are being offered at a fixed price above NAV. This is the performance since the announcement.

YCharts

Conclusion

In summary, I think that utilities and infrastructure funds can be a key part of an income investor’s portfolio. They provide relatively more stable returns when you are in the right funds in the sector.

- I believe that UTF, UTG and DNP are all worthwhile, solid long-term investments in the sector. A more patient investor might wait for DNP’s premium to come down before making a purchase.

- BUI and ASGI I would similarly view as favorable long-term investments but could be more conservative utility funds since they don’t utilize leverage.

- MGU and MFD could be great if you are looking for some heavier energy exposure or suspect that energy still has higher to run.

- Based on valuations, I’d avoid DPG and GLU. However, GLU might be an outright sell as well due to the current valuation. Investors already holding these could continue to hold or look for alternatives.

- GUT is a sell.

These are all, of course, only based on my opinion of looking at the metrics. I’m sure others could come up with their own ideas and come to different conclusions after doing their own due diligence. That would also be taking into consideration their own objectives and goals.

Be the first to comment