Thomas Barwick

Author’s note: This article was released to CEF/ETF Income Laboratory members on October 9th.

In keeping with my coverage on inflation-hedge ETFs, and due to reader interest, decided to have a look at the Direxion Auspice Broad Commodity Strategy ETF (NYSEARCA:COM).

COM invests in a diversified basket of commodity futures, but can go flat individual commodities when these experience downwards trends. COM’s strategy has been moderately successful in the past, significantly reducing losses, while only moderately reducing gains. The net effect has been a positive on most risk-adjusted metrics, but a negative from a long-term total return perspective.

In my opinion, COM is a reasonable investment opportunity for more risk-averse commodity bulls. On the other hand, more bullish, aggressive investors should pick other funds.

COM – Overview and Investment Thesis

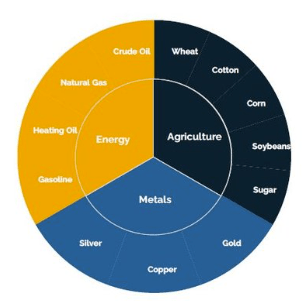

COM is a diversified commodities ETF, tracking the Auspice Broad Commodity Index. Said index can invest in up to twelve different commodities, from three different industries. Weights are dependent on volatility. Commodities are as follows.

Auspice

COM’s commodity exposure is gained through futures contracts. These are contracts to buy or sell a particular commodity on a specific date for a specific price. These contracts are structured in such a way that buyers, including COM, profit from rising commodity prices, but suffer losses when these decrease. Expect gains if prices increase, and vice versa.

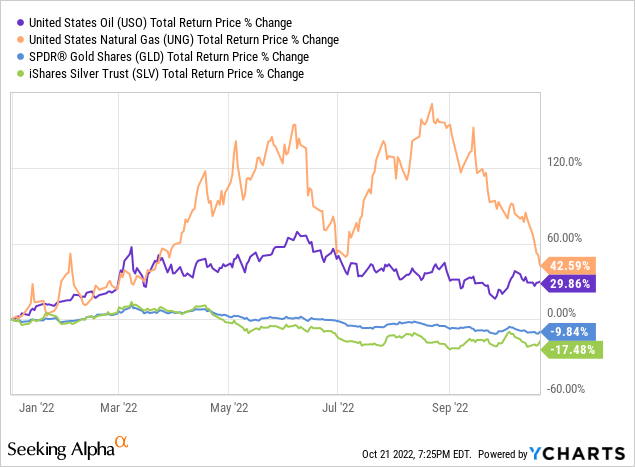

COM’s diversified commodities exposure ensures the fund profits from most broad-based increases in prices / high inflation. Other funds and investments might focus on a specific commodity, and so might see losses and underperformance during inflationary periods, if their specific commodity does not increase in price. This is a very real, very important issue, and one that has impacted many commodity ETFs and investors in the recent past. As an example, most gold and silver funds are down YTD, as precious metal prices remain subdued even as inflation skyrockets. Oil and natural gas funds, however, have seen very strong gains, as energy prices have increased.

Investors interested in profiting from / hedging against inflation could have chosen to invest in single-commodity ETFs, but doing so would have been very risky. Choosing gold or silver would have led to losses, although choosing oil or natural gas would have led to significant gains. Investors could also have chosen diversified commodity ETFs, including COM, which would have almost certainly seen gains from broad-based increases in prices, as was indeed the case.

Choosing COM means investors don’t have to choose which commodity to focus on, with the risk of choosing wrongly and seeing losses, but instead invest a little bit in every commodity, ensuring moderate gains.

COM’s diversified commodities exposure make it a fantastic inflation hedge, and one which should outperform if inflation remains elevated.

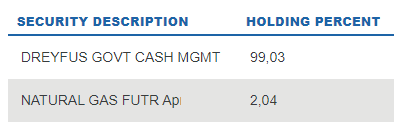

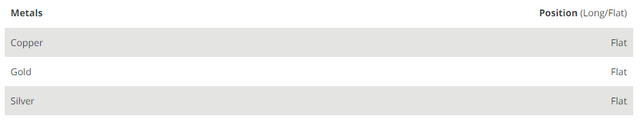

There are, however, several ETFs with a roughly comparable value proposition to COM. These include the Invesco DB Commodity Index Tracking ETF (DBC), and the Invesco DB Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC), previous covered here. COM differs from these funds in one key way: the fund goes flat individual commodities if these are experiencing a downwards trend. As an example, if gold and silver prices are down, the fund sells its gold and price futures, and retains the cash until prices stabilize. Gold and silver prices have decreased YTD, and the fund is flat these two commodities, as expected.

Commodity prices have generally declined these past few months, as supply chains improve, commodity production increases, and demand decreases as rates rise. Due to this, COM is currently flat most commodities, with the sole exception of natural gas, with a tiny 2.0% allocation. Fund holdings are as follows.

COM – Cropped by Author

COM’s market-timing strategy has a simple, logical rationale. Commodity prices are cyclical: prices go up for a couple of years, then down for a couple more years, and so on. By selling individual commodity futures when prices start to decline, the fund aims to minimize losses during commodity price crunches. By going long when prices stabilize, the fund aims to deliver strong returns when commodity prices boom. By minimizing losses while maintaining returns, the fund seeks to reduce risk, increase risk-adjusted returns, and increase long-term returns / returns through the entire cycle. In theory at least. In practice, the situation is a bit more complicated. Let’s have a look.

COM – Performance Analysis

COM’s strategy has been moderately successful in the past, especially in regards to minimizing losses. The impact on performance has been broadly positive, but complicated.

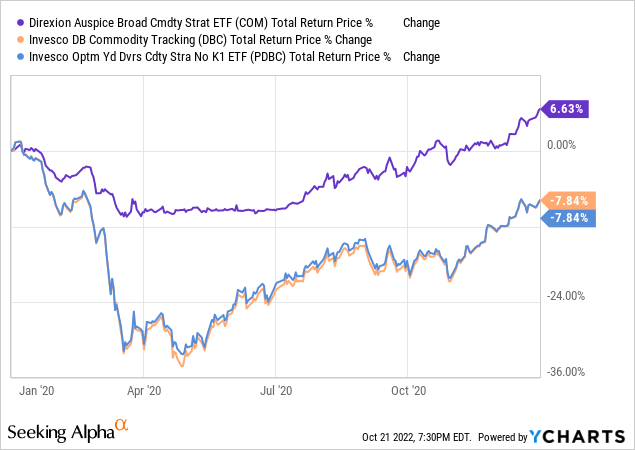

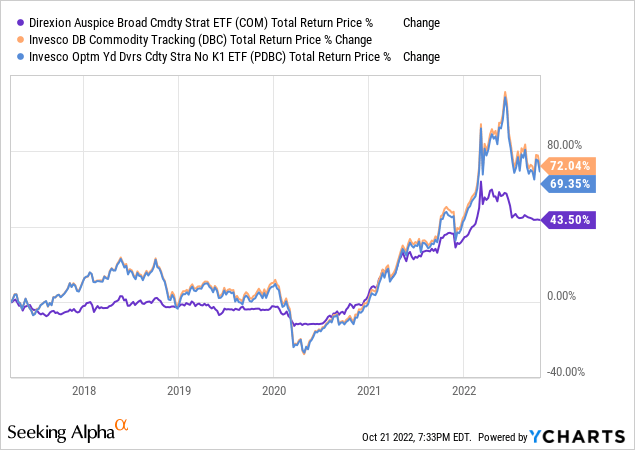

COM’s strategy successfully shifted to cash during the two previous commodity price crunches, significantly reducing losses during the same.

COM saw losses of less than 10% during 1Q2020, the onset of the coronavirus pandemic, compared to losses of almost 30% for both DBC and PDBC. COM went long sometime in July, seeing gains of around 17%.

COM’s timing was not perfect. The fund sold after commodities had started to decline and so saw some losses. The fund bought after commodities had started to increase, missing some gains. COM’s timing was, however, reasonably good, avoiding more in losses than it missed in gains. The net result was therefore positive, with COM significantly outperforming relative to its peers for the year.

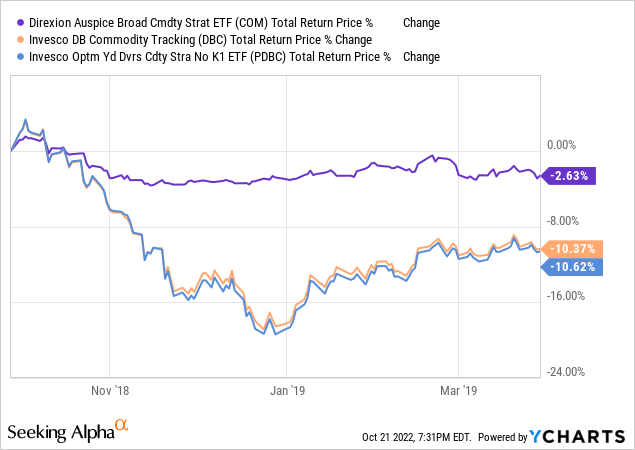

COM also successfully avoided some losses during the prior commodity price crunch of late 2018 / early 2019. Prices dropped by less during this time period, so the strategy delivered comparatively fewer gains / reduction of losses, but it was a success nonetheless.

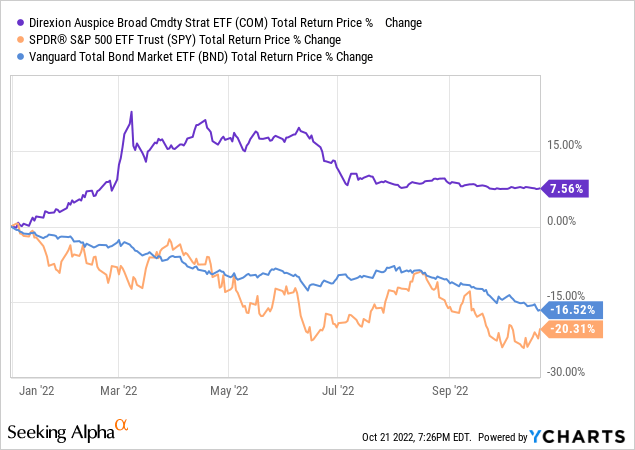

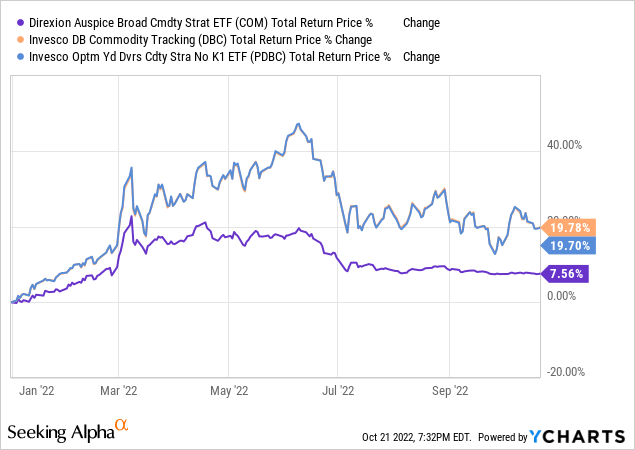

COM’s strategy has been less successful at ensuring strong returns when commodity prices increase: the fund sometimes holds significant cash when this happens, leading to lower gains. This has been the case YTD, with the fund underperforming relative to its peers.

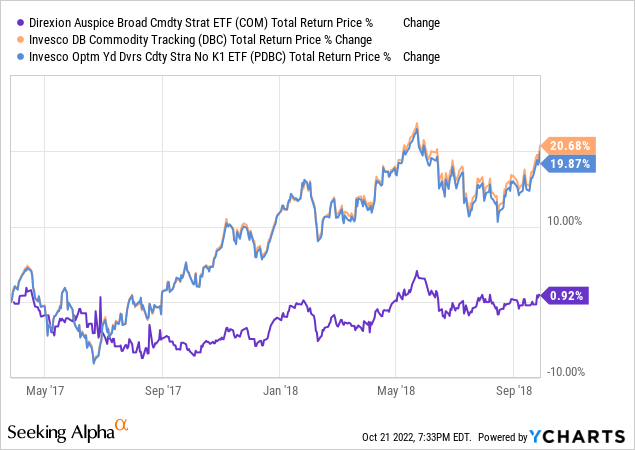

It was also the case during the prior commodity price upswing, from early 2017 to late 2018.

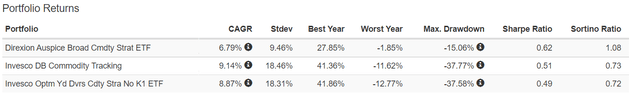

COM’s strategy has led to lower losses and gains in the past. The net impact of this is, well, complicated, varying by metric.

The net impact has been negative from a long-term total return perspective, with the fund underperforming relative to its peers since inception.

The net effect has been positive from a risk perspective, with the fund seeing much lower drawdowns and losses during commodity price crunches than its peers. See the graphs above.

The net effect has been positive from a risk-adjusted or risk-return perspective, with the fund boasting a stronger Sharpe and Sortino ratio than its peers. Results are as follows, COM is the fund at the top.

From the above, COM’s investment thesis seems clear enough. The fund provides investors with diversified exposure to commodity prices at a lower level of risk, and stronger risk-adjusted returns, than its peers.

In my opinion, and notwithstanding the above, I think that COM’s peers offer a much more compelling value proposition. Commodity ETFs are meant to provide strong returns when commodity prices increase, and COM compares unfavorably to its peers in this regard. Risk-adjusted returns and loss minimization do matter, especially for more risk-averse investors, but investors could achieve something similar to COM by allocating a smaller amount of cash to DBC or PDBC, freeing up funds for other uses.

COM’s value proposition is particularly suspect right now, as the fund is currently mostly invested in cash. Investing in COM right now means going cash, and then, potentially, going long commodities once commodity prices start to increase. Although there is nothing inherently wrong with this, it seems to offer very little in value for most / all investors. Commodity bulls would be better off investing in DBC or PDBC, both of which currently invest in commodities, in my opinion at least. Investors wishing to tie up funds in cash until commodity prices increase can simply do so themselves: no need to buy COM for this.

Due to the above, I would not be investing in the fund at the present time.

As a final point, I think an investment in COM makes much more sense once the fund shifts to commodities. At that point, the fund would become a long commodities fund with a built-in loss reduction strategy which has worked in the past. Do remember that this is not the case right now, as the fund is currently almost fully invested in cash.

Conclusion

COM offers investors diversified exposure to commodities, and aims to reduce losses through a market timing strategy. COM’s below-average level of risk and above-average risk-adjusted returns make the fund a reasonable investment opportunity for more risk-averse commodity bulls, although I think its peers have broadly superior value propositions.

Be the first to comment