jbk_photography/iStock Editorial via Getty Images

Investment thesis: Although Mastercard is a great company, the increasingly strong possibility of a recession indicates this is not the time to add a new position.

Mastercard (NYSE:MA) is a payment services company. They are the second-largest company in this sector, behind Visa in market value.

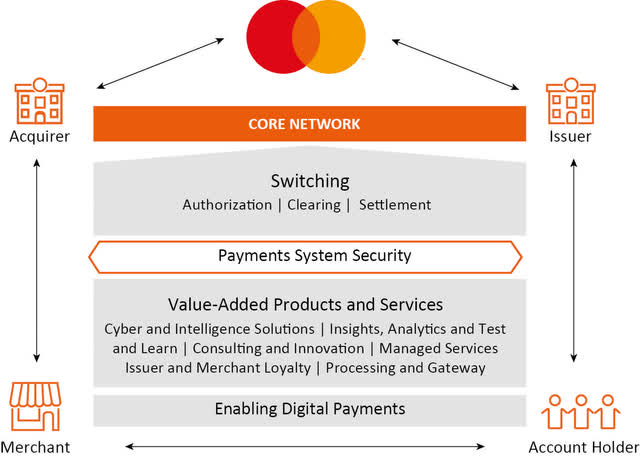

The company itself doesn’t issue credit. It facilitates payment, as explained in its latest 10K:

In a typical transaction, an account holder purchases goods or services from a merchant using one of our payment products. After the transaction is authorized by the issuer, the issuer pays the acquirer an amount equal to the value of the transaction, minus the interchange fee (described below) and other applicable fees, and then posts the transaction to the account holder’s account. The acquirer pays the amount of the purchase, net of a discount (referred to as the “merchant discount” rate), to the merchant.

The following graphical representation is from the 10K as well:

Basically, the company provides a network that connects consumers, financial institutions, and merchants.

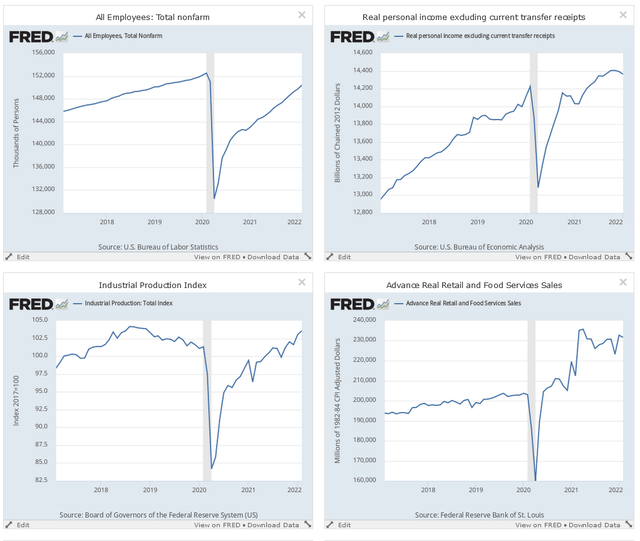

While the company is somewhat recession-proof (consumers will continue to shop in a recession), an expanding economy will obviously provide a more bullish environment. Currently, the US economy is expanding, as shown by the four primary coincidentally economic indicators:

Payroll employment, total income less transfer payments, industrial production, and retail sales (FRED)

Total payroll employment (upper left) continues to grow. The current 3-month average pace of job creation is 554,000. Personal income less transfer payments (upper right) is just shy of a 5-year high. Industrial production (lower left) has regained all its pandemic losses and is just shy of a 5-year high. While real retail sales (lower right) have trended sideways for about a year, they are at high levels.

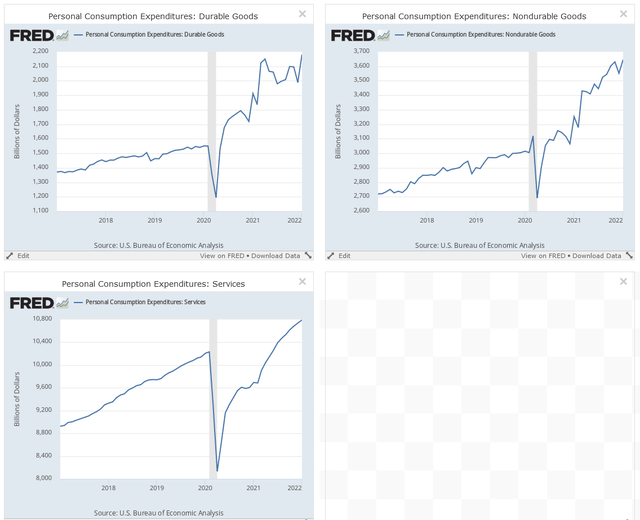

Retail sales only show data at the store level. The personal consumption expenditure data from the Bureau of Economic Analysis captures a wider swath of data:

The three categories of personal consumption expenditures (FRED)

Personal consumption expenditures for durable (upper left) and non-durable goods (upper right) are at 5-year highs, as is spending on services.

The economic backdrop is positive.

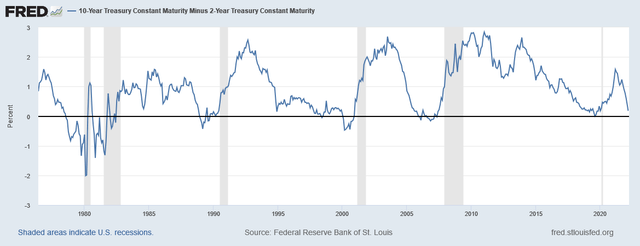

However, the Fed will be raising rates this year. And the 10-year-2-year spread is pointing towards a slowdown:

Now, let’s turn to the company’s financials, starting with gross revenues:

Mastercard gross revenue (Seeking Alpha)

Gross revenue has increased in all but one of the last 10 years — an impressive feat for a company as mature as Mastercard.

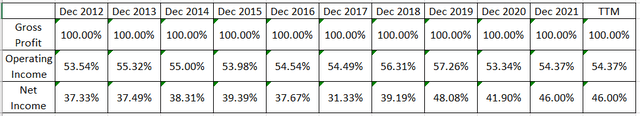

Mastercard gross, operating, and net income percentages (Seeking Alpha)

The company’s gross, operating, and net margins are either steady (see the operating income line) or growing (see the net margin line). Both are great for investors.

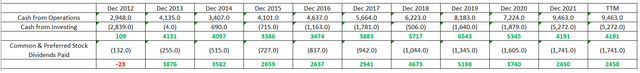

Mastercard cash flow and dividend safety (Seeking Alpha)

The above table is derived from the company’s cash flow statement. It first shows total cash from operations and then investment expenditures. The third line subtracts investment spending from operational cash and shows that in each of the last 10 years, the company has generated sufficient cash to self-fund. The fourth row shows total dividend payments, which are subtracted from the third row. The fifth row shows the remainder, which has been positive in all but one of the last five years. That means the company’s rather paltry .56% dividend yield is safe.

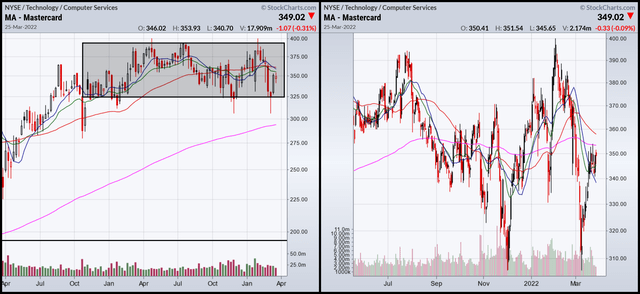

Finally, here are the charts:

Weekly and daily Mastercard charts (StockCharts)

The left chart shows that MA has been trading between 325 and 400 for a year and a half. The right chart shows that the stock is currently trading right below the 200-day EMA.

Due to the inconsequential dividend, the only reason to buy Mastercard is capital appreciation. It’s possible there could be a rise within the near year and a half trading range. But given the Fed’s tightening position, it’s just as likely we’ll see a sell-off. If you have a position, set a sell-stop to lock in profits. If you don’t have a position, look elsewhere.

Be the first to comment