MarsBars/E+ via Getty Images

Fruits and vegetables are an important part of any balanced diet. And while consumption of these products has generally been on a positive growth trend, some have experienced increases in demand that have been greater than others. One particularly attractive niche in this space involves the avocado. From 2000 to 2020, the volume of avocados produced globally surged from 2.71 million metric tons to 8.06 million metric tons. That works out to an annualized growth rate of 5.6%. Growth has been particularly strong over the past five years, averaging 8.8% per annum. One company dedicated to providing this fruit is Mission Produce (NASDAQ:AVO). However, unlike the sales of the fruit itself, Mission Produce has struggled, up until very recently, to grow its top line. On top of this, supply chain issues and other problems have resulted in margin compression for the business. So long as these trends persist, the company will remain under pressure. But if financial performance can revert to levels seen last year, it could well be a reasonable value prospect.

A play on the avocado

Today, Mission Produce describes itself as ‘a world leader in sourcing, producing, and distributing fresh avocados, serving retail, wholesale, and foodservice customers’. The company does this through two key segments that it has. The first of these is the Marketing and Distribution segment. According to the company, this particular segment sources its products, namely avocados, from growers and other avocado suppliers, and then distributes it through its global distribution network. The Company primarily focuses on selling avocados of the Hass variety. The company’s activities include sorting and packing them in order to match customer requirements. These products may include both pre-ripe and ripe and avocados, depending on said customers’ needs. During the firm’s 2021 fiscal year, this segment accounted for 89.3% of the company’s sales if we ignore intercompany eliminations. And it was responsible for 60.3% of its profits.

The other segment the company has is the International Farming segment. Through this, the company owns and operates orchards that primarily sells said produce to its Marketing and Distribution segment. Activities here range from cultivating early-stage plantings to harvesting products from mature trees. The business also generates service revenue associated with the packaging and processing for producers during the off-harvest season. The company also provides customers with merchandising and promotional support, logistical management, and other related services. During the firm’s 2021 fiscal year, this segment was responsible for 10.7% of the business’ overall sales and for 39.7% of its profits.

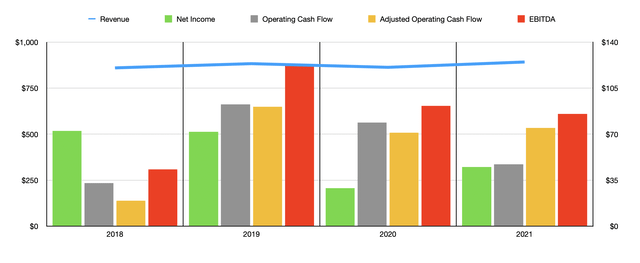

Author – SEC EDGAR Data

Generally speaking, when I write an article, I prefer to look a data covering at least the past five years. But because of when this company went public, I am restricted to four years’ worth of data. Over this four-year window, Mission Produce truly has struggled to achieve any real revenue growth. Between 2018 and 2021, the company’s sales bounced around in a narrow range of between $859.9 million and $891.7 million. If it’s any consolation, the high point experience for the firm was its 2021 fiscal year. That was up from the $862.7 million reported one year earlier. The three percent increase in sales here was driven by a 5% rise in avocado volume sold but it was negatively affected by 2% decrease in average per unit avocado sales prices. The sales price decline, according to management, came as a result of stronger harvests in both Mexico and Peru. Fortunately for investors, the company is seeing a bit of strength in sales covering the first quarter of its 2022 fiscal year. For this time frame, sales came in at $216.6 million. That represents an increase of 25.1% over the $173.2 million generated one year earlier. A combination of lower industry supply out of Mexico and inflationary pressures pushed average per unit avocado sales prices up by 50% year over year. Though this was offset some by an 18% decrease in avocado volumes sold because of lower supply and price sensitivity issues in some markets.

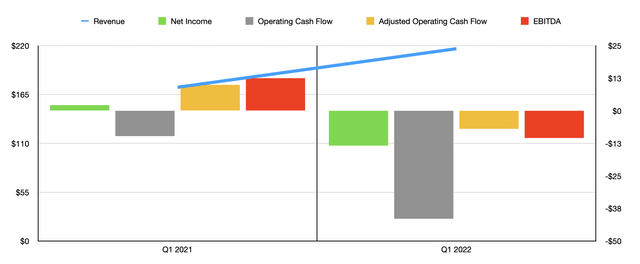

Author – SEC EDGAR Data

When it comes to profitability, the company’s track record has been rather mixed. Back in 2018 and 2019, the company generated net income of over $70 million annually. This plunged to $28.8 million in 2020 before recovering some to $44.9 million last year. Although profitability did post a partial recovery for the year, cash flows worsened. Operating cash flow, after peaking at $92.6 million in 2019, eventually declined to $47 million last year. Fortunately for investors, a big portion of this was distributable to changes in working capital. Adjusting for this, operating cash flow would have ticked up modestly from $71 million in 2020 to $74.7 million last year. However, EBITDA has been on the decline for the past three years, dropping from $123 million in 2019 to $85.3 million last year.

The bad news for investors is that the weakness in the company’s bottom line is continuing into its 2022 fiscal year. For the first three months of the year, for instance, the business generated a net loss of $13.4 million. This compares to a $2.2 million profit experienced the same time one year earlier. Operating cash flow went from a negative $9.7 million to a negative $41.4 million. Even adjusting for changes in working capital, it would have worsened from $10 million to negative $6.9 million. Meanwhile, EBITDA for the company would have dropped from $12.5 million to negative $10.4 million. The biggest pain for the company came in the form of a 98% reduction in gross profit, taking its gross profit margin from 13.1% of sales in the first quarter of 2021 to just 0.2% this year. Although industry conditions for the company may be tight, the business did say that the primary driver of this decline involved the implementation of its new ERP (enterprise resource planning) software that caused inventory management problems and, in turn, significant amounts of waste. Management expects the same issues that affected financial performance in that quarter to persist into at least the second quarter of this year.

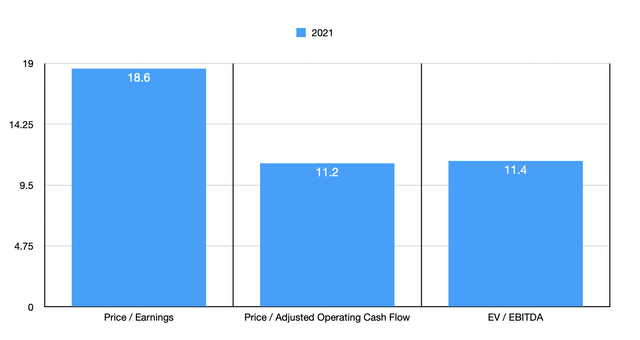

Author – SEC EDGAR Data

When it comes to pricing the company, the process is pretty straightforward. On a price-to-earnings basis, using the firm’s 2021 results, we see it trading at a rather lofty multiple of 18.6. However, the price to adjusted operating cash flow multiple is lower at 11.2. And the EV to EBITDA multiple of the company comes in at 11.4. To put this pricing into perspective, I decided to compare the company to five similar firms. On a price-to-earnings basis, these companies range from a low of 6.3 to a high of 521.3. On a price to operating cash flow basis, the ranges were from 4.5 to 114.5. And on an EV to EBITDA basis, the range is from 3.3 to 102. In all three cases, only one of the five companies was cheaper than Mission Produce.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Mission Produce | 18.6 | 11.2 | 11.4 |

| Sanderson Farms (SAFM) | 6.3 | 4.5 | 3.3 |

| Cal-Maine Foods (CALM) | 521.3 | 114.5 | 102.0 |

| Hormel Foods (HRL) | 30.0 | 23.6 | 20.6 |

| McCormick & Company (MKC) | 34.9 | 31.8 | 25.3 |

| Flowers Foods (FLO) | 26.2 | 15.5 | 13.7 |

Takeaway

Right now, there is a tremendous amount of volatility and pressure affecting Mission Produce. In recent years, the company has failed to really grow revenue and, in some ways, its profitability has suffered as a result of market conditions. Recent troubles are exacerbated by its ERP implementation. But the good news is that this should be transitory in nature. If the company can at least stabilize in the long term to the point that it continues to generate financial performance that matches what investors saw in 2021, I would say that shares of the business are likely than not underpriced. Should the company return to results experienced and even earlier years, then upside might be quite robust. But investors need to be comfortable with the fact that a business in such a commoditized industry generally will be a price taker instead of a price maker. That means that it will have to deal with fluctuating market conditions constantly, leading to uncertainty as to what kind of performance would constitute ‘normal’ performance.

Be the first to comment