fotoguy22

Earnings of Washington Trust Bancorp, Inc. (NASDAQ:WASH) will take a hit from headwinds in the mortgage banking and wealth management segments. On the other hand, decent loan growth and slight margin expansion will likely support the bottom line. Overall, I’m expecting Washington Trust to report earnings of $4.34 per share for 2022 and $4.55 per share for 2023. Next year’s target price suggests a moderately high upside from the current market price. Further, Washington Trust is offering a high dividend yield for a bank-holding company. Based on the total expected return, I’m adopting a buy rating on Washington Trust Bancorp.

Declining Non-Interest Income to Drag Earnings

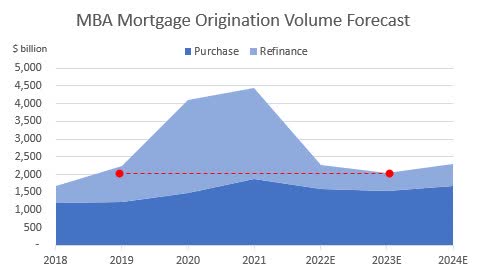

Washington Trust’s non-interest income has now declined for seven quarters straight. Most of the downtrend is attributable to a fall in mortgage banking income as high borrowing costs have slashed the demand for mortgage refinancing. Further, mortgage purchase volume is suffering from the high borrowing costs. As per its latest projections, the Mortgage Bankers Association expects the total mortgage volume for 2023 to be below that for 2019.

Mortgage Bankers Association

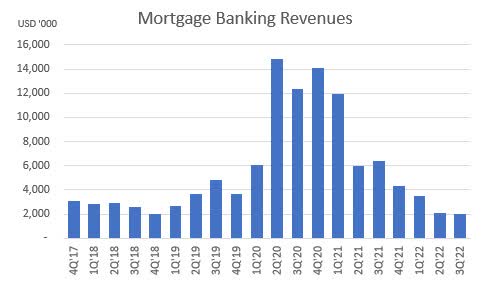

In Washington Trust’s case, mortgage banking revenue is already below the 2019 level, as shown below.

Earnings Releases

Considering the historical trend, I believe mortgage banking revenues won’t decline much from the current level even though interest rates will continue to rise.

However, total non-interest income will continue to decline because of the wealth management division. Four wealth management advisers have recently resigned and already there have been asset outflows of around $412 million, as mentioned in the conference call. To put this number in perspective, $412 million is 6.7% of the total assets under management of $6.3 billion at the end of September 2022, according to details given in the earnings release. The management expects further outflows in the coming months.

Considering the outlook on mortgage banking income and wealth management income, I’m expecting the total non-interest income to decline by 26% in 2022 and 7% in 2023 on a year-over-year basis.

Topline Growth to Counter a Fall in Other Income

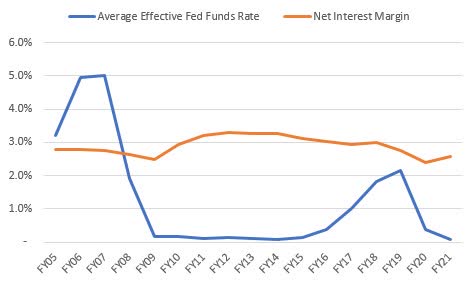

The management expects the net interest margin to expand to 2.85% – 2.90% in the fourth quarter of 2022 from 2.82% in the third quarter, as mentioned in the conference call. This target expansion is below the actual expansion of 11 basis points in the third quarter and 14 basis points in the second quarter of 2022. Nevertheless, the target seems reasonable given that the margin has been barely rate-sensitive historically.

SEC Filings, The Federal Reserve Bank of St. Louis

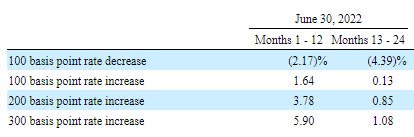

Moreover, the results of the management’s interest-rate sensitivity analysis given in the second quarter’s 10-Q filing show that a 200-basis points hike in interest rates could boost the net interest income by only 3.78% over twelve months.

2Q 2022 10-Q Filing

Considering these factors, I’m expecting the margin to increase by only five basis points in the last quarter of 2022 and a further five basis points in the first quarter of 2023.

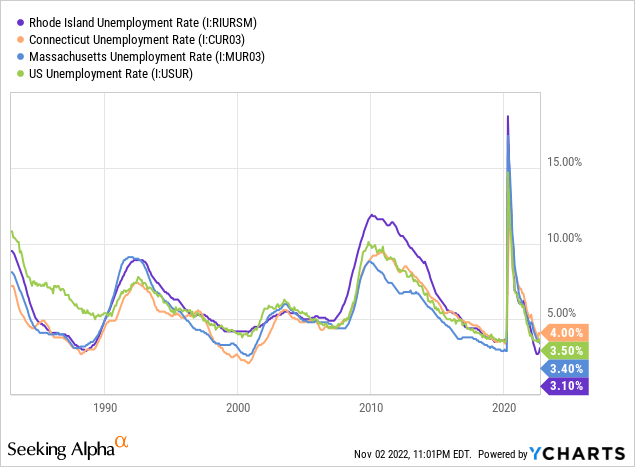

Apart from the slight margin expansion, volume growth will also support the top line. The loan portfolio grew by a remarkable 8.3% during the third quarter (33% annualized) which is extraordinary in a historical context. The most commendable point about this growth is that it was organic and broad-based across commercial, residential, and consumer segments, as mentioned in the earnings release. This loan growth cannot be sustained because it’s out of the ordinary. Further, high interest rates will dampen credit demand. Nevertheless, loan growth will most probably remain at a decent level thanks to strong job markets. Washington Trust operates in Rhode Island, Connecticut, and Massachusetts. All three states currently have very strong job markets from a historical perspective. As shown below, the unemployment rates of all three states are near record lows.

Considering these factors, I’m expecting the loan portfolio to grow by 1.5% every quarter till the end of 2023. This will lead to full-year loan growth of 15% for 2022 and 6% for 2023. Meanwhile, I’m expecting other balance sheet items to grow somewhat in line with loans. The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |

| Financial Position | ||||||

| Net Loans | 3,653 | 3,866 | 4,152 | 4,234 | 4,884 | 5,184 |

| Growth of Net Loans | 9.1% | 5.8% | 7.4% | 2.0% | 15.4% | 6.1% |

| Other Earning Assets | 963 | 984 | 995 | 1,086 | 1,048 | 1,069 |

| Deposits | 3,524 | 3,499 | 4,378 | 4,980 | 5,121 | 5,328 |

| Borrowings and Sub-Debt | 973 | 1,193 | 648 | 197 | 760 | 791 |

| Common equity | 448 | 503 | 534 | 565 | 443 | 482 |

| Book Value Per Share ($) | 25.8 | 28.9 | 30.7 | 32.4 | 25.6 | 27.9 |

| Tangible BVPS ($) | 21.6 | 24.8 | 26.7 | 28.4 | 21.6 | 23.9 |

| Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD thousands unless otherwise specified) | ||||||

Considering the outlook on the net interest margin and loan growth, I’m expecting the net interest income to increase by 13% in 2022 and 18% in 2023 on a year-over-year basis.

Earnings to be Flattish in 2022

The fall in non-interest income will likely drag earnings this year. On the other hand, decent net interest income growth will likely boost earnings through the end of 2023. Meanwhile, I’m expecting the provisioning for expected loan losses to remain near the historical average.

Overall, I’m expecting Washington Trust to report earnings of $4.34 per share for 2022, down 1% year-over-year. For 2023, I’m expecting earnings to grow by 5% to $4.55 per share. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |

| Income Statement | ||||||

| Net interest income | 132 | 133 | 127 | 141 | 159 | 188 |

| Provision for loan losses | 2 | 2 | 12 | (5) | (1) | 4 |

| Non-interest income | 62 | 67 | 99 | 87 | 65 | 60 |

| Non-interest expense | 106 | 111 | 125 | 135 | 129 | 144 |

| Net income – Common Sh. | 68 | 69 | 70 | 77 | 75 | 79 |

| EPS – Diluted ($) | 3.93 | 3.96 | 4.00 | 4.39 | 4.34 | 4.55 |

| Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD thousands unless otherwise specified) | ||||||

In my last report on Washington Trust which was published before the second quarter’s results, I estimated earnings of $4.05 per share for 2022. I’ve increased my earnings estimate as the margin has expanded by more than I anticipated. Further, loan growth has beaten my previous expectations.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, a stronger or longer-than-anticipated recession can increase the provisioning for expected loan losses beyond my estimates.

Moderate Total Expected Return Justifies a Buy Rating

Washington Trust usually increases its dividend in the last quarter of the year. Given the earnings outlook, I’m expecting the company to increase its dividend by $0.02 per share in the fourth quarters of both 2022 and 2023. The earnings and dividend estimates suggest a payout ratio of 50% for 2023, which is close to the five-year average of 51%. Based on my dividend estimate, Washington Trust is offering a forward dividend yield of 4.8%.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Washington Trust. The stock has traded at an average P/TB ratio of 1.96 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 21.6 | 24.8 | 26.7 | 28.4 | ||

| Average Market Price ($) | 55.7 | 50.6 | 37.3 | 52.0 | ||

| Historical P/TB | 2.58x | 2.04x | 1.40x | 1.83x | 1.96x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $23.9 gives a target price of $46.9 for the end of 2023. This price target implies a 0.6% downside from the November 2 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.76x | 1.86x | 1.96x | 2.06x | 2.16x |

| TBVPS – Dec 2023 ($) | 23.9 | 23.9 | 23.9 | 23.9 | 23.9 |

| Target Price ($) | 42.1 | 44.5 | 46.9 | 49.3 | 51.7 |

| Market Price ($) | 47.2 | 47.2 | 47.2 | 47.2 | 47.2 |

| Upside/(Downside) | (10.8)% | (5.7)% | (0.6)% | 4.4% | 9.5% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 12.0x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 3.93 | 3.96 | 4.00 | 4.39 | ||

| Average Market Price ($) | 55.7 | 50.6 | 37.3 | 52.0 | ||

| Historical P/E | 14.2x | 12.8x | 9.3x | 11.8x | 12.0x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $4.55 gives a target price of $54.7 for the end of 2023. This price target implies a 16.0% upside from the November 2 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 10.0x | 11.0x | 12.0x | 13.0x | 14.0x |

| EPS – 2023 ($) | 4.55 | 4.55 | 4.55 | 4.55 | 4.55 |

| Target Price ($) | 45.6 | 50.2 | 54.7 | 59.3 | 63.9 |

| Market Price ($) | 47.2 | 47.2 | 47.2 | 47.2 | 47.2 |

| Upside/(Downside) | (3.3)% | 6.4% | 16.0% | 25.7% | 35.3% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $50.8, which implies a 7.7% upside from the current market price. Adding the forward dividend yield gives a total expected return of 12.5%. Hence, I’m adopting a buy rating on Washington Trust Bancorp.

Be the first to comment