ismagilov

Introduction

In August 2022, I wrote a bearish article on SA about U.S. gold miner Hycroft Mining Holding Corporation (NASDAQ:HYMC) in which I said that the company seemed to be stalling the development of its flagship project by focusing on exploration. There’s a feasibility study from 2019 that showed an initial capex of $224.8 million yet Hycroft isn’t moving forward to the construction phase despite securing $194 million in gross proceeds in Q1 2022 through capital increases.

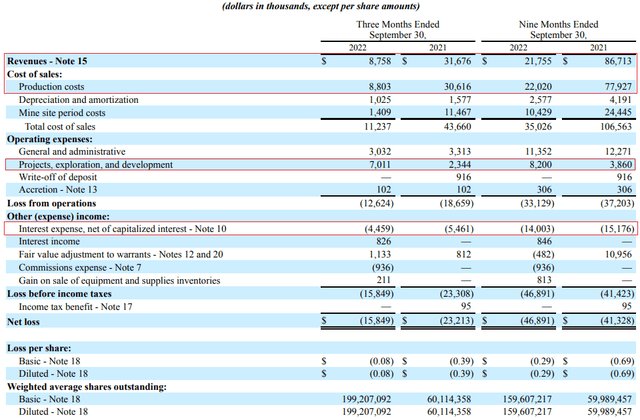

The company completed over 40,000 feet of drilling in Q3 2022, but the released assays looked underwhelming. In addition, the existing pre-commercial scale direct leaching run-of-mine [ROM] operation is still in unprofitable and the loss from operations came in at $12.6 million for the quarter. Overall, the future is looking grim for this former meme stock. Let’s review.

Overview of the recent developments

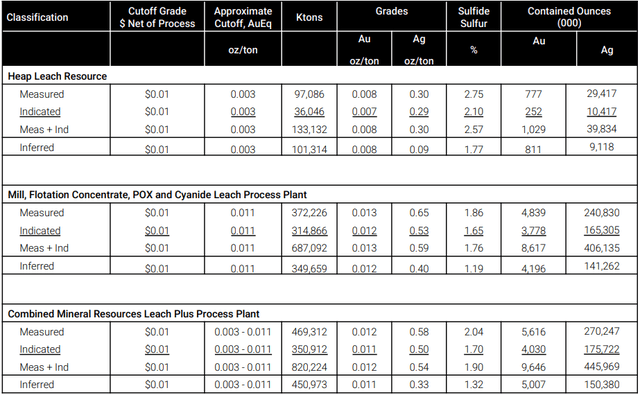

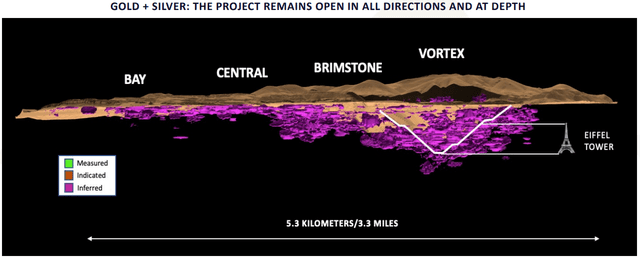

In case you haven’t read my previous articles about Hycroft Mining, here is a brief description of the business. The company holds a gold and silver project in northern Nevada named Hycroft Mine, which is among the largest precious metals deposits in the world with measured and indicated resources of 15.3 Moz of gold equivalent. There’s a small direct leaching ROM operation at the site which will proceed through the end of 2022. The reason gold production will cease after that is because almost all of the material is sulfide, which means that Hycroft Mining needs to build brand-new processing facilities.

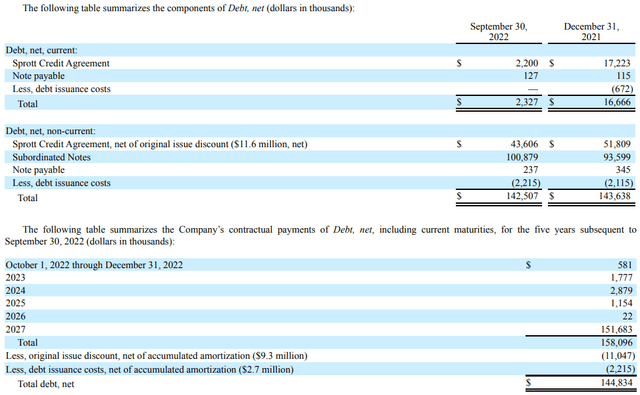

In Q3 2022, Hycroft Mining sold just 8,456 oz of gold and 15,131 oz of silver and generated revenues of $8.76 million. This didn’t even cover production costs this time around, and I don’t expect the situation to be any different in Q4 2022 as gold production comes to a halt. As you can see from the table below, exploration and development expenses soared to $7 million as Hycroft kicked off an exploration program comprising 125,000 feet of reverse circulation [RC] drilling and 20,000 feet of core drilling in July. In addition, the company had $4.46 million in interest expenses despite holding $153.4 million of unrestricted cash and cash equivalents at the end of September.

The reason for this is that Hycroft Mining has debts of $144.8 million, which means that net cash was just $8.6 million at the end of Q3. However, the company is unlikely to run into liquidity issues anytime soon, as most of the debt is payable in 2027.

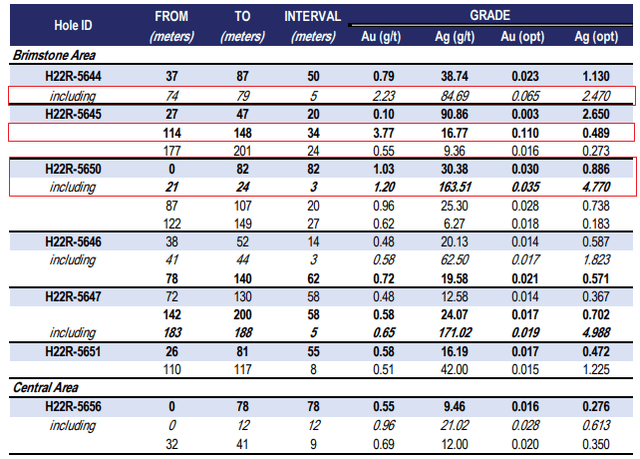

Turning our attention to the drill results, this is the largest exploration program at Hycroft Mine in nearly a decade and is expected to cost between $15 million and $20 million. Hycroft Mining is focusing on potential feeder systems as well as high-grade zones and completed 41,000 feet of RC drilling and 2,300 feet of core drilling in Q3 2022. The initial drill results were released on September 13, but I think they look underwhelming, as there were few drill interceptions above 1g/t gold. Here are the highlights.

In addition, all assays above 1 g/t gold came from the Brimstone area, so it’s unclear if they are inside the computer-generated optimized pit.

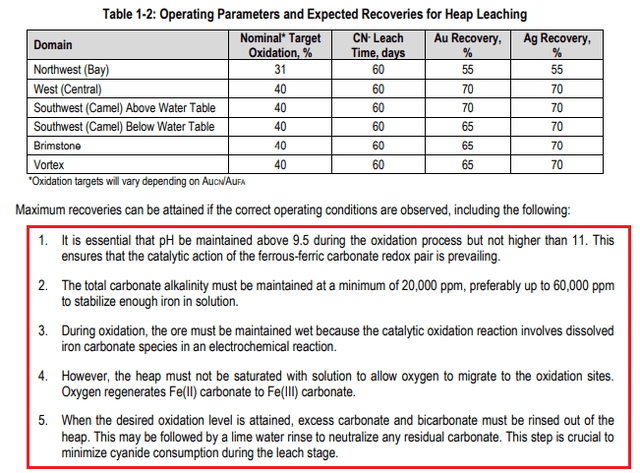

Hycroft Mining will focus on targeted step-out drilling in Q4 2022 within an area of 60,000 acres that has not previously been explored, and I think that finding oxide or low-sulfidation material is crucial. You see, refractory sulfide gold ores have to be processed using sophisticated treatment methods and Hycroft Mining’s plan for the Vortex zone included an unproven technology using iron (as ferric chloride) in the oxidation solutions. However, there are various challenges that need to be overcome for this method to work, and the fact that the company is betting on drilling instead of building the processing plant now that it has the funding secured leads me to think that the odds of this technology working don’t look good.

Hycroft Mining

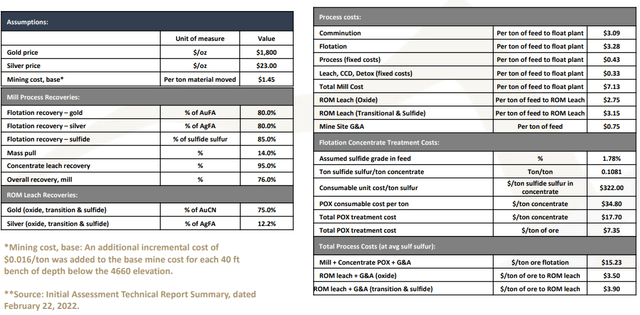

Overall, very few mining companies have managed to make sulfide gold deposits work well in the past and in my view, this makes most of Hycroft Mining’s vast measured and indicated resources close to worthless. Often, the issue is that recoveries are low, and the company was already projecting just 80% recoveries using an assumed sulfide grade in the feed of 1.78%, which is lower than the measured resources.

I’ve never seen a well-funded mining company with a feasibility study stage project launch a large drilling program instead of going into the construction phase. In view of this, Hycroft Mining’s exploration program seems like a Hail Mary move, and the drill results look unimpressive so far. In view of this, I find it unsurprising that the share price is over 30% lower compared to my previous article and I think it could continue to slide as there is little momentum left. And this is crucial for exploration-stage mining companies.

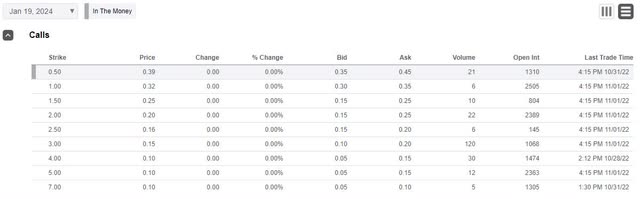

Data from Fintel shows that the short borrow fee rate stands at 5.71% as of the time of writing, so opening a small short position seems viable. However, commodities prices are notoriously volatile, and hedging seems challenging as long-dated call options are expensive at the moment. In light of this, I think it could be best for risk-averse investors to stay away from this stock.

Looking at the risks for the bear case, the major one is that fortune smiles on Hycroft Mining and the company finds a large zone of oxide mineralization. This is likely to send the share price soaring.

Investor takeaway

I think this was another disappointing quarter for Hycroft Mining investors as the pre-commercial scale direct leaching ROM operation continued to bleed money while the initial drill results were nothing special. The company still has a lot of cash in its coffers, but momentum seems low, and the share price is likely to continue to decline in the near future.

However, short selling seems dangerous as hedging is challenging, and Hycroft Mining might get lucky in its exploration endeavors. It could be best for risk-averse investors to avoid this stock.

Be the first to comment