AscentXmedia/iStock via Getty Images

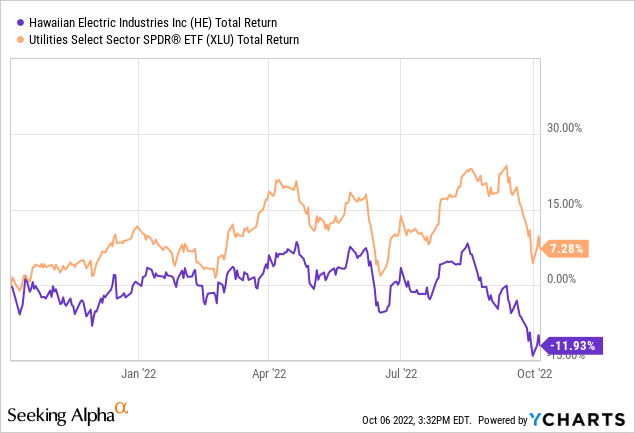

The stock of Hawaiian Electric (NYSE:HE) is down 17% YTD and 20%+ since its high ~$40 in August – significantly under-performing the broad utility sector as measured by the (XLU) Utilities Select SPDR ETF (see graphic below). On August 18th, BofA downgraded Hawaiian Electric to SELL with a $43 price target. However, the selling has been overdone and pushed the stock down to $34.33 as of pixel time. In my opinion, that overreaction (mostly as a result of a Q2 $0.10/share banking related charge) is an opportunity for investors as the stock currently yields 4% and even if it gets only halfway to BofA’s $43 price target over the next 12-months, that would still equate to a 15%+ total return.

Investment Thesis

Utility companies are considered to be relatively defensive stocks because they are typically the source of relatively boring but stable cash-flow, dividends, and dividend growth. Indeed, as seen in the graphic above and despite the 2022 bear-market, the utility sector was up close to 20% as of mid last month. However, as the Federal Reserve continued raising interest rates, some of the steam has come out of the sector. But I would argue that it may be a good time to take a look at Hawaiian Electric, which has a near monopoly in providing a single state with electricity: obviously that is Hawaii. HE’s regulator – the Hawaii Public Service Commission – sets the (usage decoupled) electric rates, but also realizes that investors deserve a return and that it will take investment to reach the state’s goal of being 100% renewable by 2045. That being the case, a new 5-year regulatory plan recently went into effect and it includes annual revenue adjustments for inflation, a performance-based rate making framework, and recovery for capital costs associated with reaching the state’s renewable goals.

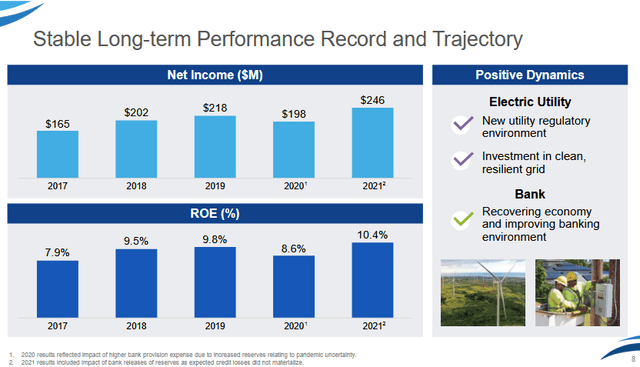

As you can see from the graphic below, other than a dip in 2020 due to the pandemic, HE has a very solid performance and ROE track-record:

Source: HE Investor Presentation

You may have noticed the mention of a “Bank” in this article and the graphic. That is because HE generates about 3/4 of its earnings from its electric utility segment and the rest comes from Hawaii-based American Savings Bank (“ASB”). The bank provides relatively low-cost capital for the utility and keeps a strong balance sheet while making loans only to highly credit-worthy customers. That said, it is a highly unusual corporate profile.

Meantime, as I pointed out in my recent article on the XLU ETF, the fundamental drivers for the utility sector continue to be three demand related catalysts: global warming, greater EV adoption, as well as the Biden administration’s ability to pass very strong clean-energy and infrastructure legislation through Congress (see The XLU ETF: Suddenly, Utilities Rock!).

Earnings

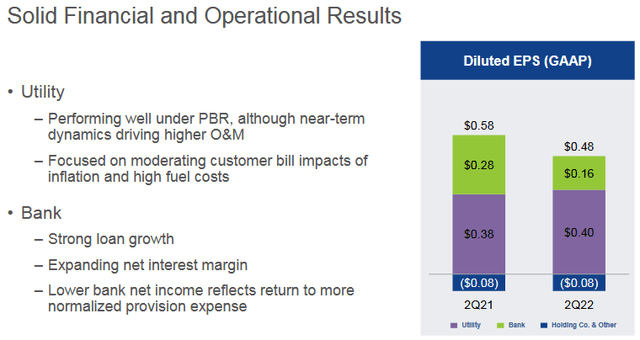

No doubt about it, HE’s Q2 earnings report was weak as compared to last year:

Source: Q2 Earnings Presentation

As can be seen in the graphic, the utility segment performed well, with earnings growing $0.02/share yoy despite higher O&M costs (see below). However, that was over-whelmed by bank earnings that were down $0.12/share yoy, with the result that HE’s overall earnings of $0.48/share were down $0.10/share yoy (17%).

The previously referenced Q2 report said the primary cause of the “miss” was:

The lower net income was due primarily to the prior year’s negative provision for credit losses at American Savings Bank, and the return to a more normalized provision expense due to strong loan growth.

The Bank

Overall, ASB’s Q2 net income was $17.5 million, compared to $23.9 million a year ago. ASB paid Q2 dividends of $12.0 million to HEI.

In addition to strong loan-growth, ASB reported an overall improvement in credit quality and continued progress in making the bank’s digital transformation with the adoption of Zelle – giving customers a fast-n-easy way to send-n-receive money. Meantime, net-interest margin (“NIM”) is expanding due to the rising interest rate environment as dictated by the Federal Reserve. CEO Scott Seu said on the Q2 conference call that ASB now expects net-interest margin for the year to be near the high-end of its previous guidance range of 2.7% to 2.85%. For Q2, NIM was 2.85%, up 6 basis points from Q1. NIM guidance was raised due to the Fed raising rates higher and more rapidly than anticipated at the beginning of the year.

Total deposits at ASB were $8.3 billion, +1% yoy.

ASB has a Tier-1 capital ratio of 7.71%. That is much higher than the 5% “Tier-1” level and equates to ASB having $218 million of excess liquidity above and beyond the “well capitalized” level.

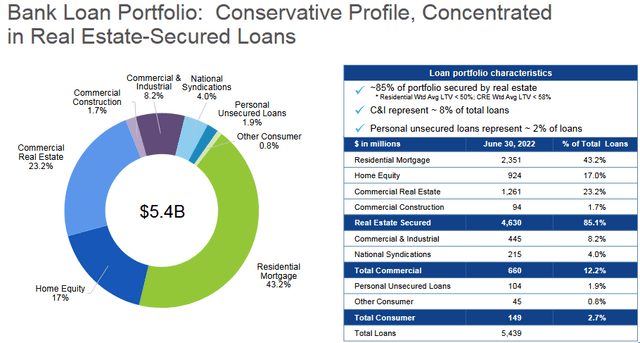

Meantime, ASB’s loan portfolio is rather conservative, with more that 65% of the portfolio tied up in secured loans for residential mortgages & commercial real estate:

The Utility Segment

Q2 Utility segment net income was $44.1 million as compared to $41.9 million. The increase was primarily due to ~$9 million in revenue recovery from what I consider to be a relatively favorable regulatory environment. That was offset by $5 million in rising operational and maintenance expenses (“O&M”) and $1 million for increased interest expense.

On the Q2 conference call, CEO Scott Seu reported on a major development for the utility segment:

We’re approaching a major milestone, the end of coal in Hawaii, a key action in our climate change action plan. The retirement of state’s last coal plant is on track for September 1. The state’s largest solar plus storage project came online, July 31. Two more solar plus storage projects are slated to come online in the next few months and the commission recently approved the last Stage 2 Solar Plus storage PTA [ph] that was awaiting decision.

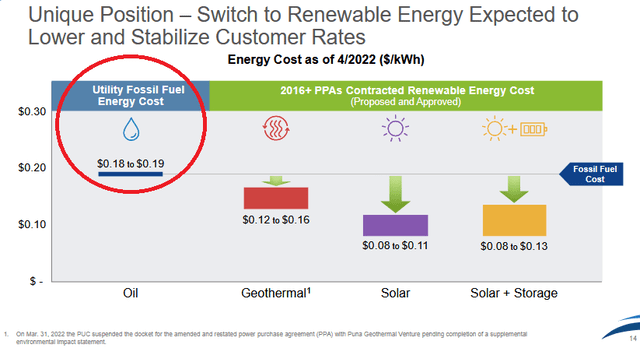

This is good news for Hawaii consumers, who pay some of the highest electricity rates in the country. As the graphic below shows, fossil fuel (coal and fuel-oil) are the highest-cost sources of electrical power in HE’s portfolio:

Source: HE Investor Presentation

Indeed, the midpoint of solar+battery back-up costs (~10.5 cents/kWh) is 8 cents/kWh cheaper than fossil fuels average costs (40%+ cheaper).

HE’s CapEx through Q2 was ~$125 million – lower than expected due to headwinds from supply-chain disruptions, permitting delays, and resource availability constraints. HE now expects that CapEx will be at the low-end of its $350-$400 million range for full-year 2022.

Overall, management expects utility EPS to be at the lower end of its guidance range of $1.68 to $1.78 and expects 2022 through 2024 earnings growth of ~5% with upside from performance incentive mechanisms (“PIMs”).

The Dividend

Hawaiian Electric has consistently paid dividends since 1901. The current quarterly dividend of $0.35/share ($1.40 on an annual basis), along with a stock price of $34.33, equates to a current yield of 4.1%.

The dividend has been growing since 2019 and has averaged around 3% growth per year. However, I expect the dividend to grow ~4% over the coming year, slightly less than EPS growth of 5%. Not exceptional by any means, but investors can expect steady growth in income. Potential upside to the dividend over the short-term would be an expansion of net-interest margin by ABS. However, that may be seen as more of a short-term development that does not make it into the long-term dividend commitment.

Valuation

At the low-end of management’s EPS guidance ($1.68/share), the stock currently trades with a forward P/E = 20x. That compares with the XLU’s broad utility sector average forward P/E = 19x. That being the case, HE doesn’t look especially attractive until you consider the $0.10/share banking related charge this quarter, the potential for net-interest margin growth from the bank, higher efficiency as the utility moves away from relatively higher-cost fossil fuels to renewables+battery backup, and upside PIMs potential.

Risks

While HE’s 4% dividend yield is relatively attractive, as interest rates have risen investors can now get a 4%+ two-year CD that is relatively risk-free. This is likely one reason the utility sector has undergone a rather severe correction over the past month. The other being that rising interest rates could lead to a recession, which would dampen electricity demand – and in the case of Hawaii, lead to fewer tourist visits (which affects both the utility and the bank) which would depress demand and lower earnings.

Today (Thursday) was another big sell-off in the utility sector:

Five of S&P500’s 15 worst performers were utilities sector: (NYSE:CNP) -4.5%, (NYSE:SO) -4%, (WEC) -3.9%, (DTE) -3.7%, (D) -3.7%. Big utility companies like American Electric Power (AEP) -3.6%, Duke Energy (DUK) -3%, and ConEd (ED) -2.5%, were also down sharply.

However, according to Bloomberg, Janney analyst Michael Gaugler said that while 2022 will likely end as a disappointing year for the utilities, the sector is “likely to rally once the U.S. Federal Reserve signals its rate hike policy is coming to a close.” I agree, and thus my contrarian call on Hawaiian Electric.

Many traditional utility investors may not like the combination of what are essentially two very disparate businesses – a bank and a utility. That could lead to a relatively lower-valuation as compared to basic utility companies within the sector. The upside is that HE has exposure to rising net-interest margin that most all other utility are not benefiting from (and never will).

Hawaii’s goal to become 100% renewable could lead to higher cap-ex for HE and, if the regulatory environment were to change, pressure earnings going forward.

Lastly, covid-19 is an on-going issue for Hawaii given the state’s dependency on tourism.

Summary & Conclusions

The recent correction in HE stock was over-done in my opinion and has left it undervalued. The 4% yield is both attractive and safe (the dividend payout ratio is only 60-65%). The move to away from fossil fuels to clean-energy will actually lower HE’s power generation costs by an estimated 40% or so. However, getting there will require significant investment – but the current regulatory framework appears rather favorable in my opinion.

I put a 12-month fair-value around $39 ($4 lower than BofA). I get to $39 by backing out the (one-time) $0.10/share banking provision charge in Q2 and annualizing Q2’s EPS and putting a 17x forward multiple on the result ($0.58*4=$2.32/share; $2.32*17=$39.44). That is a conservative estimate in my opinion given that the utility segment is likely to keep growing earnings ~5% going forward and there could be PIMs related upside.

Combined with the 4% yield, even a 50% re-tracement of the stock’s recent decline – back to $39 – would give investors a total return of 17.5%. HE is a BUY.

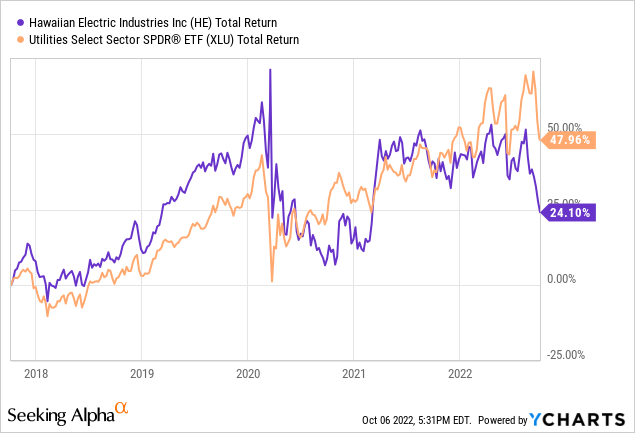

I’ll end with a 5-year chart of HE total returns versus the XLU ETF and note that the big divergence of late is – in my opinion – an opportunity for investors.

Be the first to comment