FrozenShutter

The Walt Disney Company’s (NYSE:DIS) shares gained 5% on Thursday after the entertainment company blew past expectations for subscriber growth in FQ3’22. Disney also benefited from a return of visitors to its entertainment parks post-pandemic, but results at Disney+ indicate that the streaming company is successfully defying the industry trend of slowing subscriber growth. The potential for Disney’s streaming services is huge as long as the entertainment company gets a grip on its costs!

Disney is rapidly growing its subscribers across streaming platforms

Netflix (NFLX) lost close to a million subscribers in the last quarter and has hinted at the introduction of an ad-supported streaming tier in a bid to tap new customer segments. The loss of nearly a million subscribers in Q2’22 – which followed a 200 thousand subscriber loss in Q1’22 – raised concerns that the streaming industry is set for a period of slowing growth after the COVID-19 pandemic. Additionally, streaming companies are often unprofitable as they spend a lot of money to build out their content libraries and competition in the industry has grown rapidly. As an example, Warner Bros. Discovery (WBD)’s streaming business remained highly unprofitable in the second quarter, suggesting that subscriber growth alone is not everything that companies have to worry about.

While Netflix struggled to attract new users to its platform in the second quarter, Disney added 14.4M Disney+ subscribers to its business in FQ3’22, bringing the total number of subscribers across its streaming services to 221.1M. This number includes subscribers to all of Disney’s streaming services – including ESPN+, Hulu and Disney+.

With 221.1M subscribers at the end of Q2’22, Disney has officially taken over Netflix, which ended the last quarter with 220.7M paid global streaming memberships.

All of Disney’s streaming services performed well in the company’s third quarter. ESPN+, Hulu and Disney+ had 22.8M, 46.2M and 152.1M subscribers at the end of the quarter, with Hulu seeing the strongest year-over-year growth rate of 53%. Disney+, which is Disney’s largest streaming service, grew its subscribers 31.1% year over year to a record 152.1M due to a strong and growing content library. The market expected 147.8M subscribers for Disney+ in FQ3’22.

Disney+ is the biggest success for Disney by far as the streaming platform added 36.1M new subscribers to its platform over the last year and 14.4M in FQ3’22. The expectation was for Disney to add just 10.1M new subscribers to Disney+ in the company’s fiscal third quarter, so subscriber growth at the company is turning out to be significantly stronger than anticipated.

|

Subscribers, in millions |

FQ3’21 |

FQ4’21 |

FQ1’22 |

FQ2’22 |

FQ3’22 |

Y/Y Growth |

|

Disney+ |

116.0 |

118.1 |

129.8 |

137.7 |

152.1 |

31.1% |

|

Hulu |

42.8 |

43.8 |

45.3 |

45.6 |

46.2 |

7.9% |

|

ESPN+ |

14.9 |

17.1 |

21.3 |

22.3 |

22.8 |

53.0% |

(Source: Author)

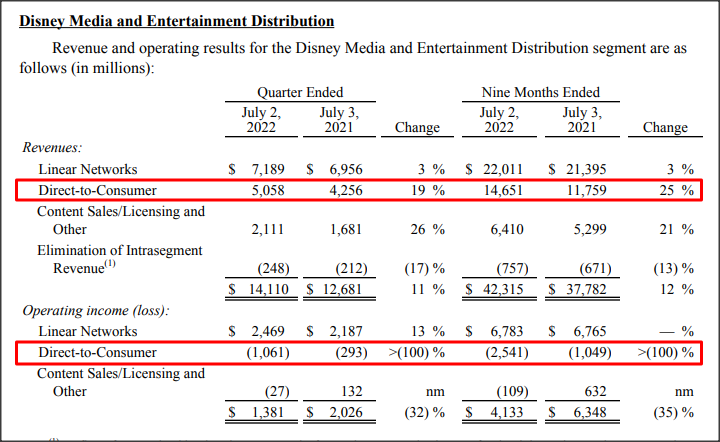

Due to strong customer acquisition in FQ3’22, Disney’s streaming brands – which are part of Disney’s Direct-to-Consumer business – have contributed to a 19% segment revenue jump to $5.1B year over year. However, the Direct-to-Consumer business is not profitable for Disney as the company recorded a $1.1B loss on its streaming operations in FQ3’22. Losses in the Direct-to-Consumer business quadrupled year over year as Disney continues to prioritize subscriber growth over profitability. Losses at Disney+ are driven chiefly by higher programming and production costs.

Disney: FQ3’22 Media & Entertainment Revenue Split

Disney is not the only company whose Direct-to-Consumer business is struggling with profitability. To control its streaming losses and simplify its streaming offerings, Warner Bros. Discovery recently said that it wants to consolidate HBO Max and Discovery into one new streaming brand by mid-2023. The move is designed to cut costs and improve profitability.

But there is another way for companies with Direct-to-Consumer businesses to grow profits and control losses: They can increase subscription prices, which is what Disney is doing.

Disney said that it is increasing prices for its main ad-free subscription tier from $7.99 to $10.99, showing an increase of 38%. Disney’s new ad-supported tier will cost subscribers $7.99 with price increases taking effect on December 8. ESPN+ and Hulu prices are also going up.

The price hike for Disney+ subscriptions alone could translate to about $1.3-1.4B in additional quarterly revenues (assuming no churn) for the streaming company. Since some customers are going to cancel or not renew their Disney+ subscriptions after the price increase, the realized revenue figure may be lower than $1.3B.

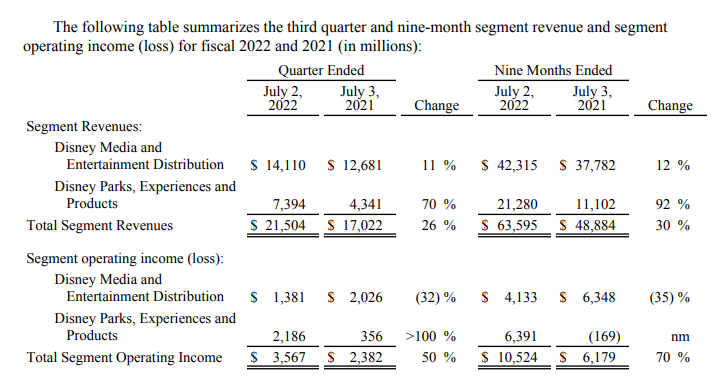

Visitors are returning to theme parks

The biggest revenue growth in FQ3’22 did not occur in Disney’s Direct-to-Consumer business, however. Disney Parks, Experiences and Products generated $7.4B in revenues in FQ3’22, 70% more than in the year-earlier period, as visitors returned to Disney’s theme parks. With pandemic headwinds fading out, Disney may continue to see strong revenue growth in this segment.

Disney: FQ3’22 Revenue Split

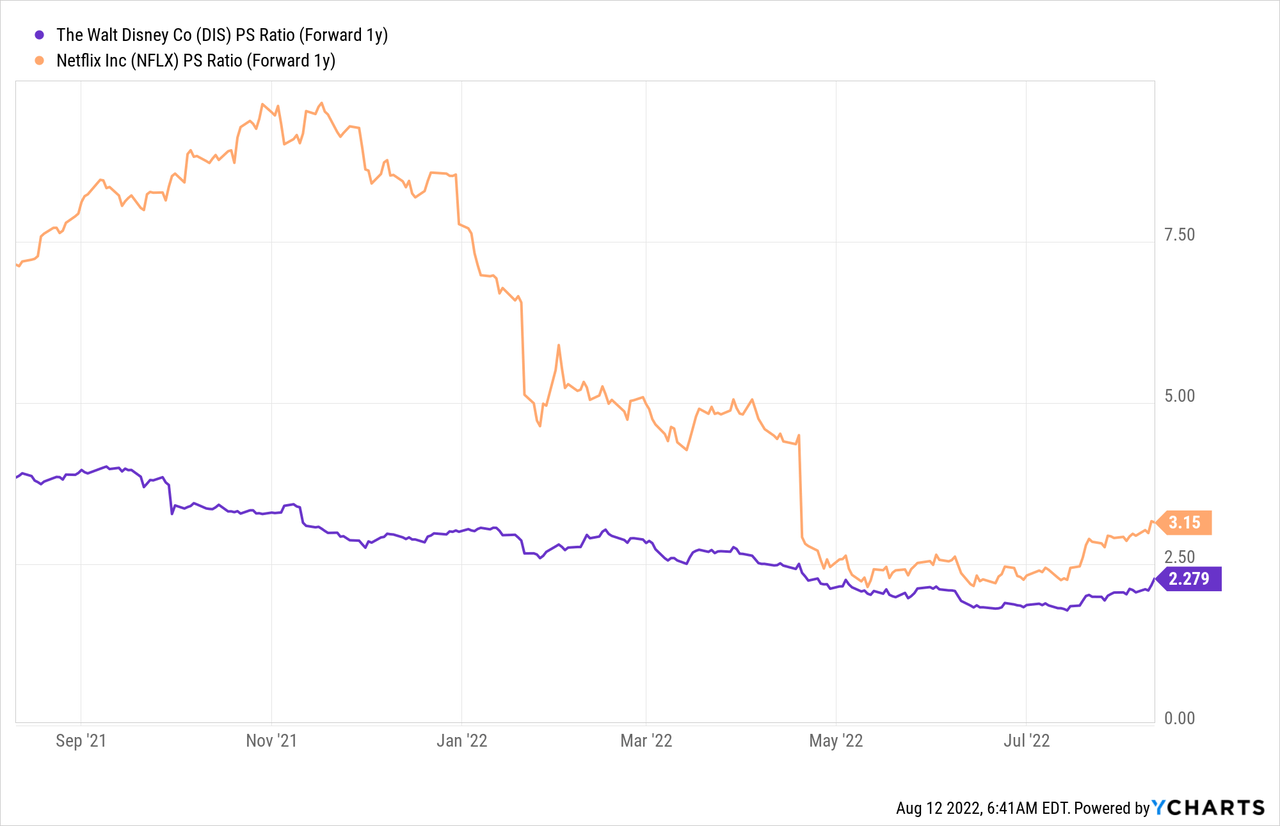

A magical valuation

Disney is expected to grow revenues to $84.7B in FY 2022 and $94.1B in FY 2023, implying growth rates of 26% and 11%. Disney is growing subscribers significantly faster than Netflix, has surpassed Netflix regarding subscriber count in the last quarter, and trades at a significantly cheaper price-to-revenue ratio. Disney has a P-S ratio of 2.3x while Netflix has a P-S ratio of 3.2x. Disney’s valuation is truly magical, and subscription price increases could be a strong catalyst for revenue and profit growth for Disney in the new year.

Risks with Disney

The risk with streaming services, in general, is that content production is expensive, which eats into margins and initially creates a lot of losses. Many streaming companies including Disney are not profitable. Additionally, Netflix has been struggling to add paying subscribers to its platform lately, suggesting that headwinds for the industry as a whole are growing. There is also a risk that streaming companies cannibalize their own revenue streams by offering lower-price ad-supported subscription tiers. A slowdown in subscriber growth and persistent operating losses in the Direct-to-Consumer business are the two biggest commercial challenges that I see for Disney.

Final thoughts

Disney is a true streaming star, trading at a magical valuation. The entertainment company is performing exceptionally well regarding subscriber growth in the Direct-to-Consumer business: Disney added a total of 15.5M new subscribers across its streaming services to its platform in FQ3’22 despite companies like Netflix battling with a subscriber exodus. While Disney still has profitability issues, the increase in streaming prices could improve Disney’s profit situation going forward. The valuation is very attractive. Since the theme park business is also seeing a strong recovery, I believe Disney’s risk profile is heavily skewed to the upside!

Be the first to comment