David McNew

Note: I have covered FuelCell Energy (NASDAQ:FCEL, OTCPK:FCELB) previously, so investors should view this as an update to my earlier articles on the company.

On Thursday, FuelCell Energy reported Q3/FY2022 revenues well above consensus expectations while missing on the bottom line. The topline outperformance was solely due to the sale of another six fuel cell modules to a subsidiary of POSCO Energy (PKX) as part of the recent settlement agreement.

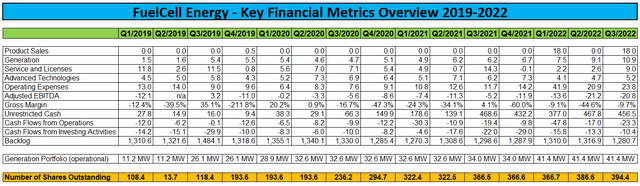

Company Press Releases and SEC-Filings

That said, even after adjusting for approximately $3.0 million in manufacturing variances related to production volumes and unabsorbed overhead costs, product gross margins came in well below 20%.

The company expects to recognize revenues from the remaining eight modules under the firm part of the settlement agreement in the current quarter.

Remember, under the terms of the agreement, POSCO Energy has the option to order another 14 fuel cell replacement modules with an aggregate value of $42 million.

FuelCell Energy continues to burn cash at a rapid pace. Free cash flow for the quarter was negative $33.7 million, but proceeds from relentless common shareholder dilution helped to keep net cash outflows in check:

On July 12, 2022, the Company entered into an Open Market Sale Agreement with Jefferies LLC, B. Riley Securities, Inc., Barclays Capital Inc., BMO Capital Markets Corp., BofA Securities, Inc., Canaccord Genuity LLC, Citigroup Global Markets Inc., J.P. Morgan Securities LLC and Loop Capital Markets LLC (the “Open Market Sale Agreement”) with respect to an at the market offering program under which the Company may, from time to time, offer and sell up to 95.0 million shares of the Company’s common stock. During the quarter, the Company sold approximately 18.5 million shares under the Open Market Sale Agreement at an average sale price of $3.63 per share. Of this 18.5 million shares, approximately 7.8 million shares were issued and settled during the period ended July 31, 2022, resulting in gross proceeds of approximately $27.9 million before deducting sales commissions and fees, and net proceeds to the Company of approximately $27.2 million after deducting commissions and fees totaling approximately $0.7 million. The balance of approximately 10.7 million shares were settled subsequent to July 31, 2022, resulting in gross proceeds (before deducting sales commissions) of approximately $39.2 million, and net proceeds to the Company of approximately $38.4 million after deducting commissions totaling approximately $0.8 million.

Unrestricted cash at the end of Q1 amounted to $456.5 million. In addition, the company still has 76.5 million shares available for sale under the above-discussed “Open Market Sale Agreement“.

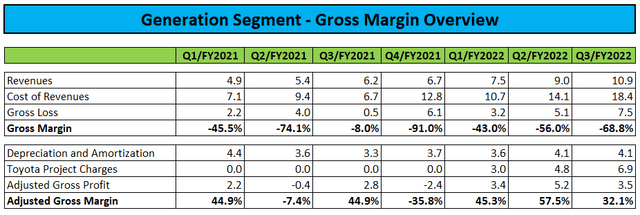

Revenues in the core generation segment increased to an all-time high of $10.9 million, but the strong sequential increase was almost solely related to a $1.7 million sale of renewable energy credits.

Margin performance was again impacted by issues related to the much-touted Toyota Tri-Generation project at the Port of Long Beach as disclosed in the company’s quarterly report on Form 10-Q:

As further background on the costs related to the Toyota project, it was determined in the fourth quarter of fiscal year 2021 that a potential source of RNG at favorable pricing was no longer sufficiently probable for the Toyota project resulting in impairment of the asset. Thus, as the Toyota project is being constructed, only amounts associated with inventory components that can be redeployed for alternative use are being capitalized. The balance of costs incurred are being expensed as cost of generation revenues.

In layman’s terms: Management has simply failed to procure renewable natural gas (“RNG”) for the project in a timely fashion, thus causing a material hit to project economics.

Please note that even when adjusted for the impact from the Toyota (TM) project, generation gross margin was almost cut in half on a quarter-over-quarter basis with no real explanation provided by management.

Adding insult to injury, the company has two additional projects under construction with substantial fuel sourcing risk:

We currently have three projects in development with fuel sourcing risk, which are the Toyota project, which requires procurement of RNG, and our Derby, CT 14.0 MW and 2.8 MW projects, which require natural gas. Fuel sourcing and risk mitigation strategies for all three projects are being assessed and will be implemented as project operational dates become firm. Such strategies may require cash collateral or reserves to secure fuel or related contracts for these three projects. If the Company is unable to secure fuel on favorable economic terms, it may result in impairment charges to the Derby project assets and further impairment charges for the Toyota project asset.

In the 10-Q, the company also provided the results of a recent sensitivity analysis:

A $1/Metric Million British Thermal Unit (“MMBTu”) increase in market pricing compared to our underlying project models would result in a cost impact of approximately $1.4 million to our Consolidated Statements of Operations and Comprehensive Loss on an annual basis. We have also conducted a sensitivity analysis on the impact of RNG pricing and a $10/MMBTu increase in market pricing compared to our underlying project models would result in an impact of approximately $2.0 million to our Consolidated Statements of Operations and Comprehensive Loss on an annual basis.

As the projects have been calculated at substantially lower natural gas prices, project economics are likely to suffer materially, thus impacting margins in the all-important Generation segment.

At least, the company managed to extend the required commercial operations date for the Toyota project from June 30, 2022 to January 31, 2023.

But the bad news doesn’t end here, as FuelCell Energy just opened a new chapter in the seemingly endless Groton Submarine Base project saga (emphasis added by author):

(…)

On April 7, 2022, the Company announced that it had completed the necessary repairs and upgrades to the mechanical component, reinstalled the mechanical component at the project site, and restarted the process of commissioning.

During the restarted commissioning process, the Company encountered performance anomalies primarily in the mixer eductor oxidizer (“MEO”) which is a sophisticated piece of equipment specific to the Groton Project designed to optimize fuel and air flows.

The Company is considering operating the project at a reduced output of 3 MW per platform at the start of commercial operations in order to optimize performance of each of the two MEO units.

Over a period of approximately one year, the Company anticipates implementing upgrades to each of the two MEO units in order to bring the platform to its rated capacity of 7.4 MW.

Under extensions previously received from the U.S. Navy, the deadline by which commercial operations are to be achieved is September 30, 2022.

We expect that the Groton Project could be commercially operational by September 30, 2022 at a reduced power output of approximately 6 MW.

However, commencement of operations at a reduced output of approximately 6 MW requires approval by the Connecticut Municipal Electric Energy Cooperative (“CMEEC”) and the U.S. Navy.

Although the Company is in discussions with CMEEC and the U.S. Navy, no assurance can be given that CMEEC and the U.S. Navy will provide such approval.

Quite frankly, FuelCell Energy’s long-standing execution issues appear to have reached a new level, with the company not being able to deliver a large-scale project according to specifications to a key customer.

The issue has resulted in the requirement to amend the respective $15 million tax equity financing agreement with East West Bank.

Under the original terms, the company would have been eligible to draw the remaining $12 million upon achievement of commercial operations.

Under the terms of this amended agreement, the commercial operations deadline was extended to September 30, 2022. In addition, the terms of East West Bank’s remaining investment commitment of $12.0 million were modified such that East West Bank will now contribute $4.0 million on each of the first, second and third anniversaries of the Groton Project achieving commercial operations, rather than contributing the full $12.0 million when the Groton Project achieves commercial operations. (…)

In conjunction with this amendment, the Company agreed to aggregate fees of $0.5 million, which shall be payable by the Company upon commencement of commercial operations of the plant. Should the project not achieve commercial operations by September 30, 2022, East West Bank will then have a conditional withdrawal right to request the return of their investment at an amount equal to 101% of the amount of the investment.

On the conference call, management spent most of the time elaborating on its strategic vision and opportunities ahead but provided almost zero tangible information.

At this point, I have no idea how the company would be able to achieve its stated $300 million annual revenue target in 2025.

Bottom Line

More of the same at FuelCell Energy with ongoing project execution issues pressuring margins in the core generation segment and mounting fuel sourcing risks for three projects still under construction.

Even worse, the company won’t be able to deliver the large-scale Groton Submarine Base according to specifications, which is likely to result in further pressure on generation margins.

Moreover, FuelCell Energy continues to relentlessly dilute common shareholders under its most recent Open Market Sale Agreement.

Despite these issues, the company continues to trade at a massive premium to its closest and much larger competitor, Bloom Energy (BE).

Investors looking for a somewhat less risky investment in FuelCell Energy should avoid the common shares and consider taking a position in the company’s Series B preferred shares (OTCPK:FCELB) which trade around 55% of face value despite ranking senior to common stock and paying a rather juicy 9.2% cash dividend on an annual basis.

Be the first to comment