thanakornsra/iStock via Getty Images

Flanigan’s Enterprises (NYSE:BDL) is the owner and manager of two dozen restaurants and a dozen liquor stores in the Miami Metropolitan Area.

Last February, I published an article on the company with a hold recommendation, because to me the stock price was a little expensive. Still, I liked the business and their CAPEX system, and the optionality to grow outside of Southern Florida.

The stock price has reached a high of about $40 in May, but has returned to approximately the same level as when I wrote in February. I still consider the stock expensive. In this article I provide more detail on this year’s operations, particularly the effect of cost increases on BDL’s profitability. Also, I comment on the company acquiring a pub in Miami as well as the rights to use their existing brand name. This acquisition may become the sprouts of new avenues for growth.

Note: Unless otherwise stated, all information has been obtained from BDL’s filings with the SEC.

A recap on Flanigan’s

In my February article I listed the points that make me believe Flanigan’s is a well-run business.

From a competitive standpoint, it has grown for over 30 years in Southern Florida, meaning that it is attractive to customers in the region. On an industry basis, the restaurant business is competitive but it also lends itself to moat building, because its customers are final consumers, and because it is difficult to compare restaurants based on objective metrics. The fact that BDL has been able to grow consistently in the region shows it has a moat there.

Financially, BDL is interesting because it has invested without using too much debt. This has been possible thanks to BDL’s limited partnership model, where it can structure its restaurants as LLPs, and BDL acts as general partner and investors as limited partners. The limited partners commit all capital expenses, but BDL obtains 50% of the net income of each restaurant as payment for management and brand. BDL can also sell LLP units of a restaurant once it has been built, therefore recovering previous capital expenditures.

Not all of BDL’s restaurants are structured as LLPs, and in some of them, BDL participates as both limited and general partner. A more detailed explanation is found in my article from February.

In terms of expansion, BDL has not shown any sign of wanting to grow outside of Southern Florida, limiting the financial upside. Not wanting to grow is not necessarily negative, given that a business may have a good moat only within a certain scale or in a certain geography. However, it is something that needs to be considered in assessing the appeal of the stock.

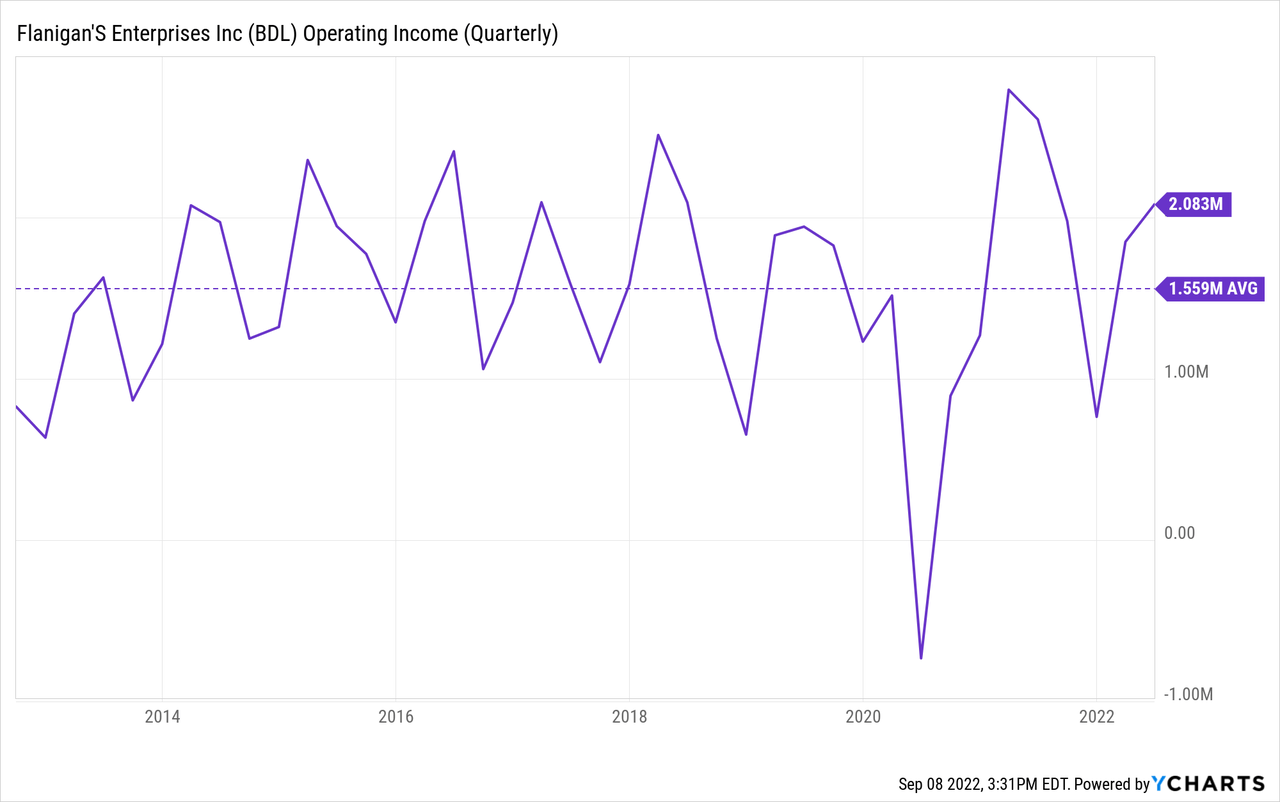

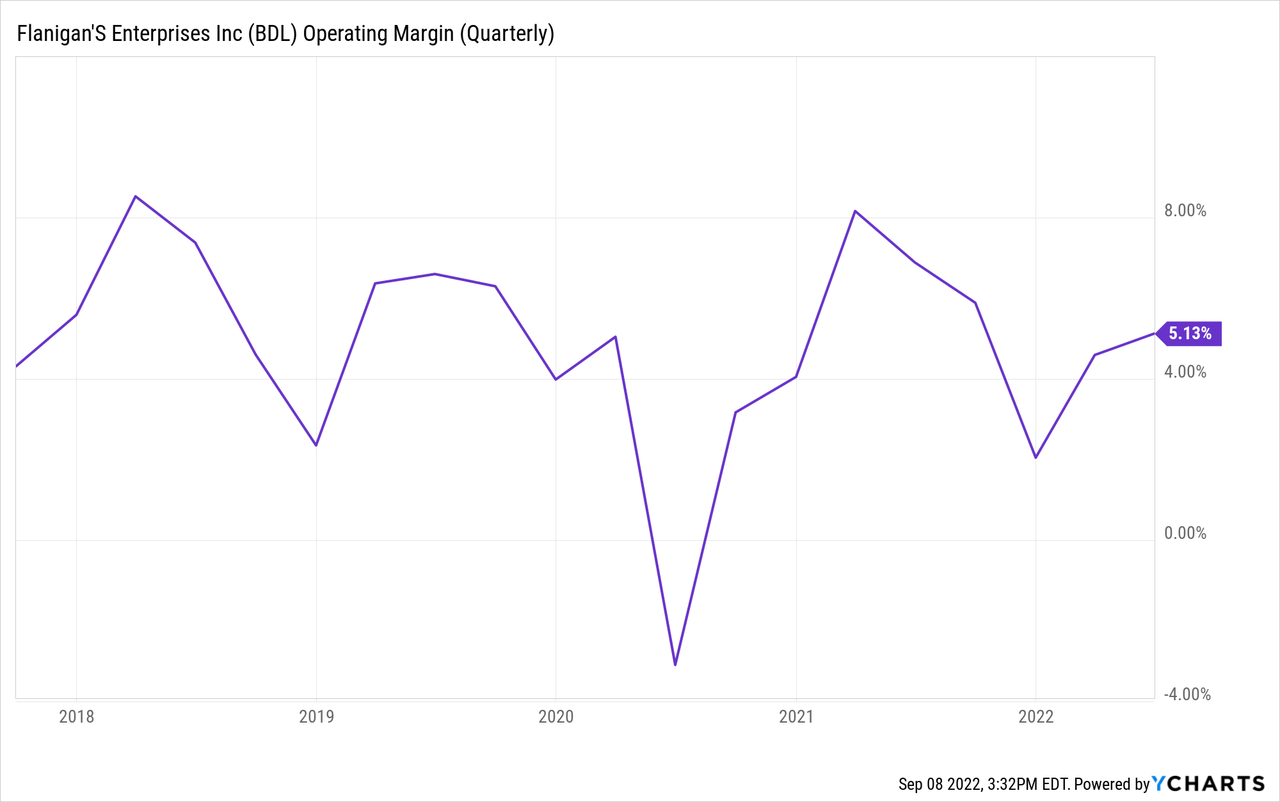

In my previous article, I mentioned that BDL had grown its same-store revenues consistently. I felt that same-store revenue growth could drive profitability growth, however, revenue increases have been largely offset by cost increases. The result, seen below, is that although revenue showed a 6% CAGR from 2013 to 2021, operating income was stagnant. This actually implies a falling operating margin.

Another negative aspect of BDL is its unusual compensation system. The company pays a low base salary to managers ($140 thousand each in 2021). However, it also pays 20% of pre-tax, pre-depreciation income as a bonus to the management team. To many this could sound like a good way of inducing management to increase profits. However, given that management already owns 54% of BDL and portions in some of the limited partnerships, they already have skin in the game. The 20% pre-tax pre-depreciation figure seems excessive.

As a summary, BDL seems like an interesting business with a novel way to finance its growth that for some reason has decided not to grow outside of its core region. The negative portions are its declining operating margin and the relatively excessive compensation to management.

BDL’s past three quarters

Since I analyzed BDL, the company has published three quarterly 10-Q reports.

The most salient issue is the relative fall of operating margins compared to pre pandemic levels. It is true that the decrease in operating margin has not been tremendous, but it is still there. The company argues the costs increases are in part related to opening two restaurants since its latest 10-K in October 2021. In my opinion, it seems like BDL is simply unable to pass its cost increases to customers. BDL has commented on its 10-K that its food has an attractive price. It could very well be that BDL is trying to absorb some of the cost increases to protect demand from falling.

Another salient point is the purchase of a pub called Brendan’s Sports Pub. It is a small place, with a single location. BDL purchased the place but also the service mark.

The company has not mentioned what it plans to do with the recently acquired pub. One option is that BDL will convert the BSP location into another Flanigan’s restaurant. Another, more interesting option, is that it will try to expand BSP’s brand, using a similar model to the one used to expand Flanigan’s.

It is still too early to determine which one will be, but this could be a game changer in the future. Instead of growing outside of Southern Florida, BDL could apply its business and limited partnership model to other restaurant or bar franchises in Southern Florida.

In terms of debt, BDL has continued paying its mortgages and term loan, at $17 million as of 3Q22 (July 2022). For the most part, these mortgages carry a fixed rate of between 3.5% and 5%. Approximately $3 million carry variable interest, including the term loan. These variable interest loans were hedged by a swap, transforming variable LIBOR + 2.5% into fixed 4.5%. Given the increase in rates, the swap is actually generating a profit, because LIBOR stands at 2.5% as of this writing.

BDL’s mortgages are amortizing, maturing at a rate of about $1.5 million a year. Additionally, the company’s term loan matures in 2023, elevating liquidity requirements to $3 million in that year. The remaining debt matures after 2026, and into the 2030s. I do not believe BDL is going to suffer from liquidity problems in the near future.

As for capital uses, I mentioned in my previous article that each of BDL’s restaurants costs about $4 million, between land and construction costs. As of 3Q22, BDL has invested $6.5 million, mostly in construction and renovation. In 2021, the company invested $11 million. Part of that CAPEX was financed by selling $9 million in partnership units for its new restaurants.

Going forward and price considerations

BDL as a business has not changed much, and its stock price has not moved either. Therefore, my conclusions have not changed.

Considering that BDL has not shown interest in growing much outside Southern Florida, investors should ask for the rate of return to be paid completely by current earnings. On the opposite side of the coin, BDL’s earnings are relatively stable, and the company seems to have a moat in Southern Florida. An investor requiring a 10% return justifies a P/E of 10x.

As we saw, BDL has been able to generate about $6 to $7 million in yearly operational income, with an average for the past 10 years of $1.6 million quarterly. This number already includes management compensation.

On top of that, BDL pays approximately 4.5% on its $17 million in debts, meaning about $800 thousand yearly. This is temporarily reduced by net positive swap agreements commented above, and will tend to decrease because mortgages are amortizing.

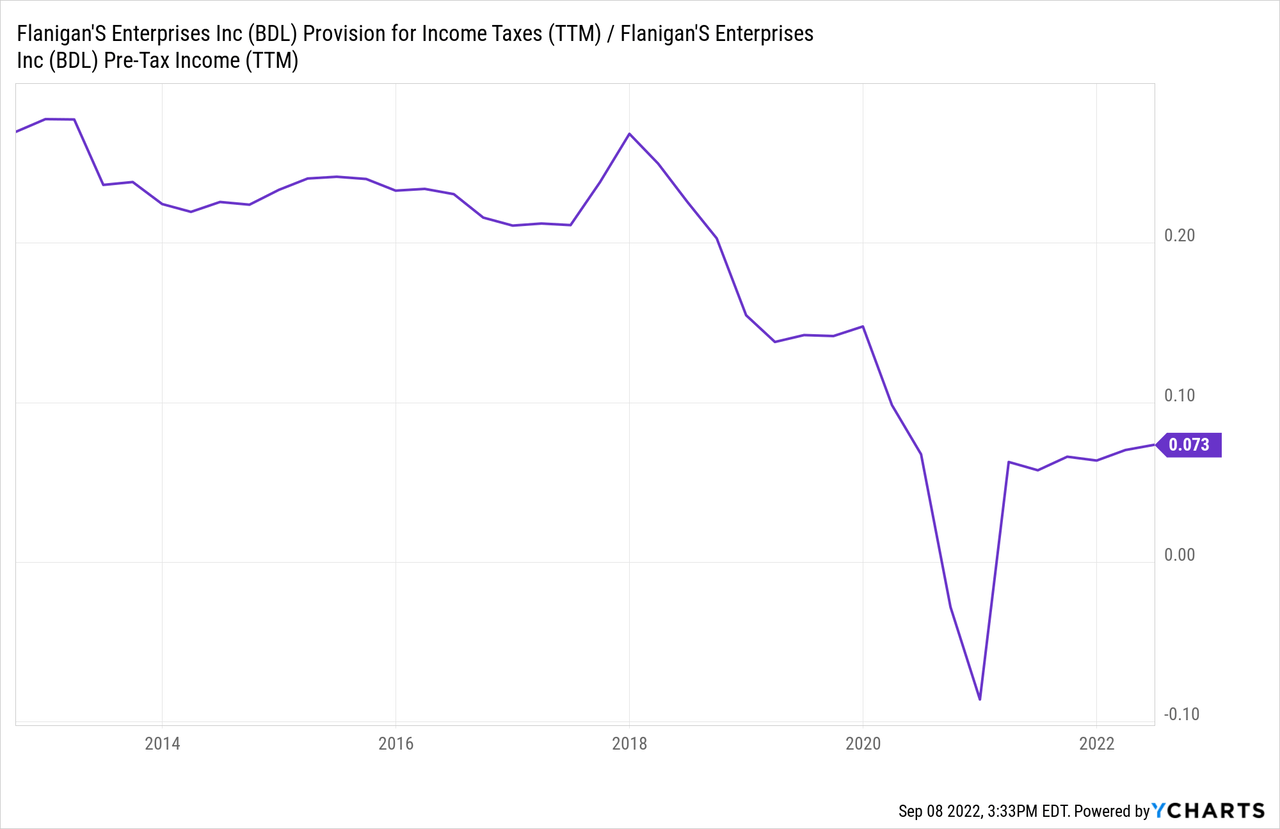

BDL’s long term income tax rate has been 25%, which is understandable given the 21% federal and 5% Florida corporate income tax rates.

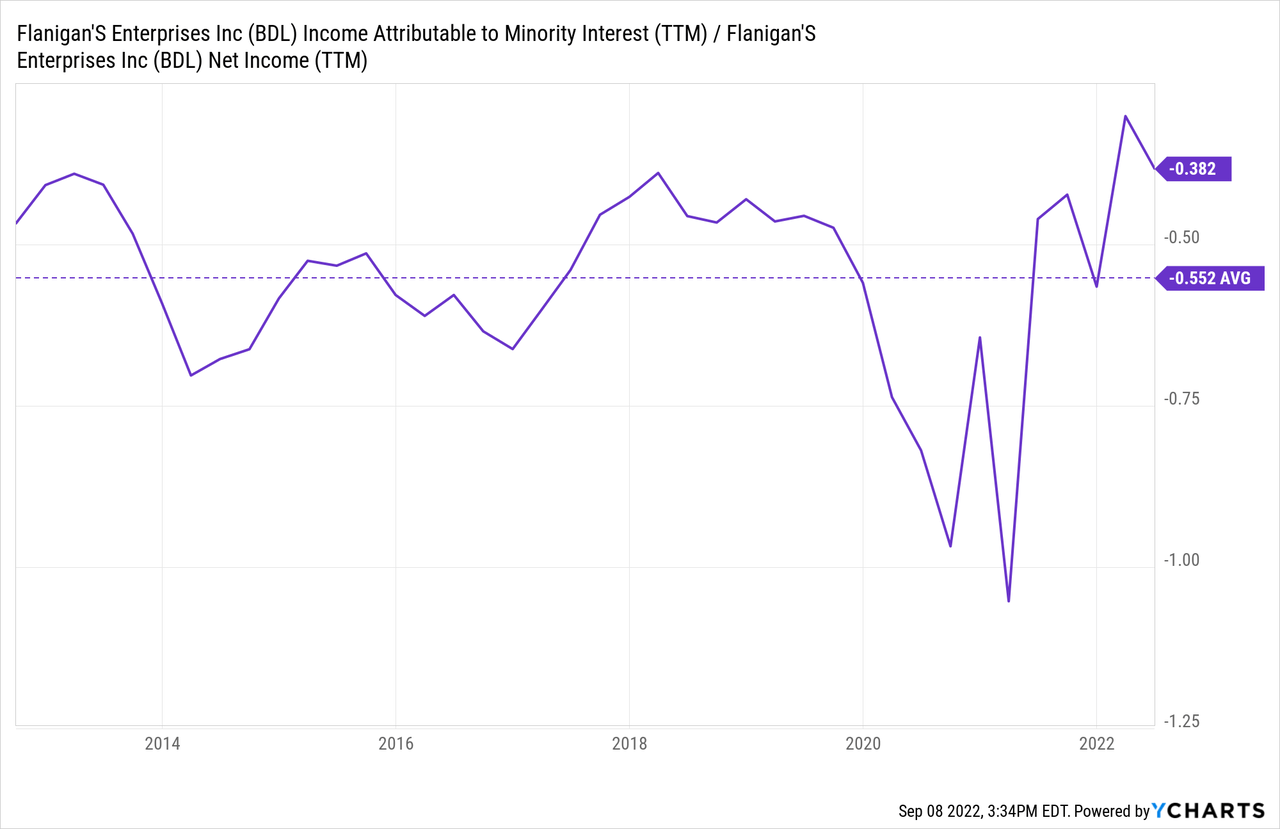

Before distributing to shareholders, BDL has to distribute to the limited partners of its restaurants, accounted for as minority interest. The proportion of after tax income that is distributed at the consolidated level varies depending on how much of each restaurant is owned by limited partners.

The chart below shows that the average distribution for minority interest has been 1/3 of after tax income. Net income in the chart below is accounted for after minority interest is removed.

BDL has historically generated operating income of $6.5 million. After paying ~$800 thousand in annual interest, pre-tax income is about $5.7 million. After tax that becomes $4.3 million. The minority interests receive one third of those proceeds, leaving approximately $3 million for BDL’s shareholders.

Some readers might be surprised reading this, because BDL’s reported TTM net income was $6.5 million as of the latest quarter, and was $12 million a few quarters before. That’s due to the forgiveness of PPP loans, however, with $10 million recognized in 2021 and $4 million recognized in 2022. These items, although boosts to profitability, are non-recurring, and therefore should be removed from a long term calculation.

Conclusions

As mentioned, BDL has not shown signs of operating beyond Southern Florida or expanding its reach via other business ventures (other than the recent Brendan’s Sports Pub acquisition). It has increased both the number of stores it has and the revenue each store generates, but this has not translated into more operating profits. Therefore, I assume no growth for BDL in the future, and consider a P/E of 10x or lower fair.

After removing the one-time effect of PPP loan forgiveness, I expect BDL to generate net income attributable to shareholders of $3 million yearly, or about $1.62 per share. This results in a P/E of 16x at the current stock price, substantially too rich in my view.

Therefore, although I like the company, I would not recommend buying at these prices, given that the promised returns are low. In the future, positive catalysts could be developments related to Brendan’s Sports Club, any plans to open stores outside of Southern Florida, and/or any modifications to the excessive management compensation structure.

Be the first to comment