franckreporter

PayPal (NASDAQ:PYPL) submitted its earnings sheet for the third-quarter on Thursday and although the company beat analyst expectations regarding revenues and earnings, the payment platform’s outlook for the fourth-quarter slightly disappointed. PayPal generated strong free cash flow, however, and increased its free cash flow margin to 26%. I believe that shares are undervalued and that the presence of activist investor Elliott Management could lead to higher share prices for PayPal in the long term!

PayPal beats earnings

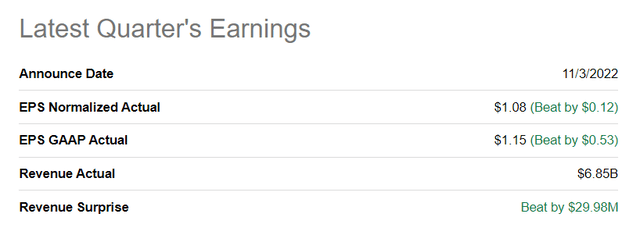

PayPal posted a strong earnings card for the third-quarter that saw the fintech company beat predictions for both revenue and earnings. PayPal generated $1.08 per-share in adjusted earnings which beat the earnings prediction of $0.96 per-share. Revenues were 6.85B beating the prediction by $30M.

Seeking Alpha: Q3’22 PayPal Results

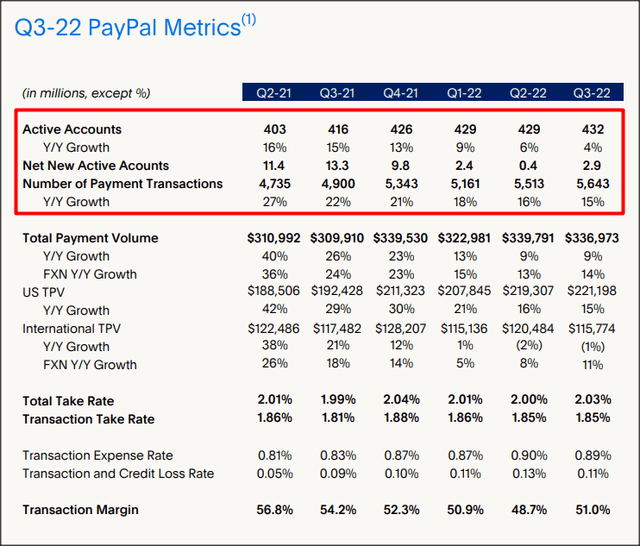

It was a strong third-quarter for PayPal although there is evidence that the fintech’s business is slowing down. PayPal’s account acquisitions rebounded in the third-quarter as the fintech added 2.9M net new active accounts to its platform in the last quarter. In the previous quarter, PayPal only added 0.4M accounts. At the end of the third-quarter, PayPal had a total 432M accounts in its payment system of which 35M were merchant accounts. Account growth, however, has slowed down from 16% in Q2’21 to 4% in Q3’22 due to the pandemic wearing off which has fueled PayPal’s customer acquisition in the previous two years.

Strong free cash flow generation

One of the strongest arguments to buy PayPal stock relates to the fintech’s enormous free cash flow (“FCF”). PayPal generated $1.77B in free cash flow on revenues of $6.85B which calculates to a free cash flow margin of 26%… which was 7 PP higher than in the previous quarter. PayPal continues to be a highly free cash flow profitable company which I believe makes up the core value of the fintech.

|

Q3’21 |

Q4’21 |

Q1’22 |

Q2’22 |

Q3’22 |

Growth Y/Y |

|

|

Revenues ($M) |

$6,182 |

$6,918 |

$6,483 |

$6,806 |

$6,846 |

11% |

|

Free Cash Flow ($M) |

$1,286 |

$1,550 |

$1,051 |

$1,291 |

$1,766 |

37% |

|

FCF Margin |

21% |

22% |

16% |

19% |

26% |

+5 PP |

(Source: Author)

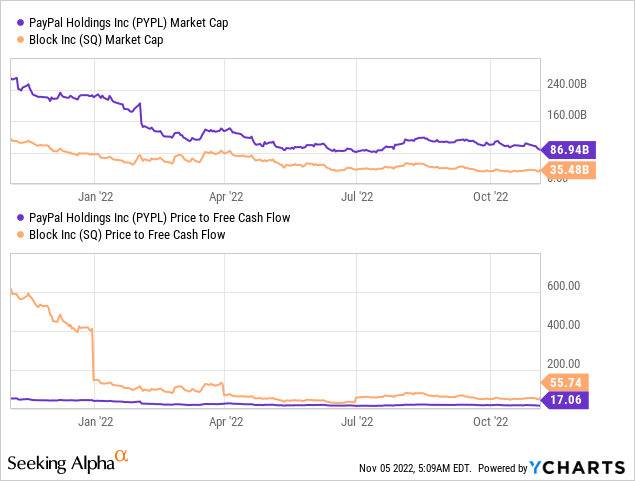

Low valuation based off of free cash flow

PayPal’s shares declined 1.8% after the submission of the Q3’22 earnings card and the fintech now has a market cap of $87B. With $5B in free cash flow expected in FY 2022 – PayPal confirmed its free cash flow guidance for the full fiscal year last week – shares of the fintech are valued at 17 X free cash flow. At the start of the year, PayPal’s free cash flow was valued at twice the valuation factor. Compared to Block (SQ), formerly known as Square, PayPal represents much better free cash flow value: Block’s shares have a P-FCF ratio of 56 X.

Catalyst for growth and higher free cash flow

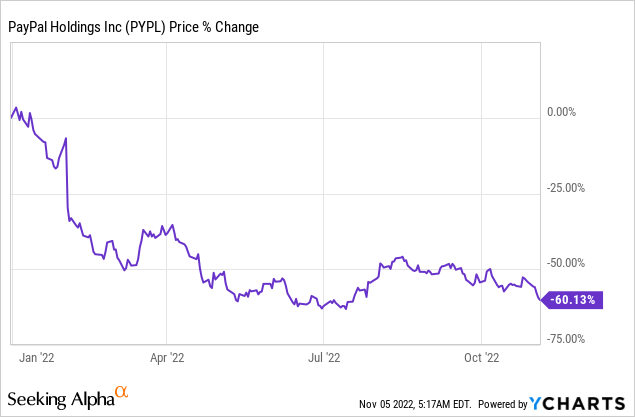

In July, Elliott Management revealed that it invested $2B in PayPal. Elliott Management is an activist investor with a history of pushing for cost-savings and stock buybacks at the companies it invests in. Shortly after Elliott Management got invested, PayPal announced a $15B stock buyback and I believe the activist investors is not to going to stop here. I can see Elliott Management push for a $25B stock buyback – which is roughly the equivalent of five years’ worth of free cash flow – considering that shares of PayPal have become so much cheaper this year. Buybacks make especially sense for a company that has seen its stock price decline as much as PayPal: year to date shares of PayPal have declined 60%.

Outlook for FY 2022: revenue guidance down, EPS guidance up

What disappointed on Thursday was PayPal’s guidance for the fourth-quarter. PayPal said it expects $7.4B in revenue, which would translate to a 9% year over year growth on currency-adjusted terms. The guidance indicates that PayPal expects its revenue growth to continue to decelerate in the near term. The prediction was for Q4’22 revenues of $7.7B.

For the full-year, PayPal now expects $27.5B in revenue, implying a 10% year over year increase. In the last quarter, PayPal guided for $27.9B and 11% year over year growth. While down-grading its revenue projection by 1 PP, PayPal raised its EPS projection from $3.87-$3.97 to a new range of $4.07-$4.09.

Risks with PayPal

The two biggest commercial risks for PayPal are a slowdown in top line growth as well as weaker customer acquisition (fewer net new active accounts). The guidance for Q4’22 indicates that PayPal is seeing continual revenue headwinds in its business. However, considering that PayPal brings in so much free cash flow from its payments platform each quarter, I believe the fintech is reasonably protected against an economic down-turn.

Final thoughts

PayPal’s guidance for Q4’22 was a slight disappointment, but the fintech continued to generate a lot of free cash flow from its payments business… which is really where PayPal’s value is. PayPal may see slower top line and account growth rates going forward, but the ecosystem is soundly profitable and generates a solid amount of free cash flow for the fintech and its investors each quarter. A lot of this cash is going to be returned to investors through stock buybacks in the coming quarters. PayPal’s low valuation based off of free cash flow and the presence of activist investor Elliott Management indicate strong rebound potential for PayPal!

Be the first to comment