gorodenkoff/iStock via Getty Images

PTC (NASDAQ:PTC) is an attractive software business operating in the higher end of the CAD market, it is also strong in product lifecycle management software, and is expanding into other growth areas such as IoT, Augmented Reality, and mid-market CAD. These initiatives should keep growth at a decent rate for the foreseeable future.

PTC’s CREO is considered a must-have in many complex engineering projects. Meanwhile IoT and AR are growing at a very rapid pace, as well as its Onshape mid-market SaaS CAD software.

The company has almost completed a shift to a subscription model from a license-based model. The company has been very smart partnering with Microsoft (MSFT) and Rockwell Automation (ROK) to promote its IoT platform ThingWorx, which is considered among the best, and where it is gaining a lot of traction.

Competitive Advantages

Besides the intellectual property that goes into the products, and the learning curves the company has had to go through each version of its software to make it better, we believe the strongest competitive moat actually comes from switching costs. The software PTC develops is complex, and it takes a long time to master. As such, it is unlikely that a user would switch quickly to an alternative for a modestly lower price.

Growth

With respect to CAD software, the company expects modest growth, and its objective is to only “beat the market”, which is growing at a ~5% CAGR. Meanwhile PTC has grown the last 3 years at a ~9.7% CAGR. The two key products the company is counting on to win in this market are Creo & Onshape.

The PLM software market has been growing at ~4.7% CAGR, but PTC has been gaining share and growing faster than the market with a 14.1% trailing 3 years CAGR. The company also believes it can continue to “beat the market” in this segment going forward.

The growth markets where the company is content to simply “meet the market” are IoT and Augmented Reality. IoT has been growing at a ~17.9% CAGR, and PTC has grown at ~19.1% CAGR the last three years. As for Augmented Reality, the market has been growing at 61.9% CAGR, with PTC growing even faster with a 70.4% CAGR the last three years.

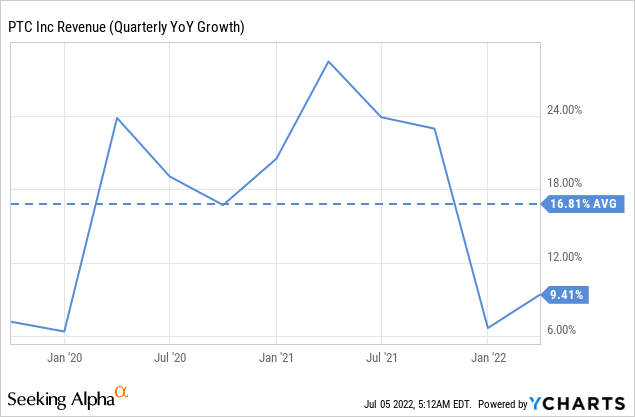

This combination of “beating the market” in the low-growth segments, and “meeting the market” in the high-growth segments should result in an overall attractive growth rate for the company. The company has been able to take share in every market segment, which is quite remarkable and speaks volumes to the strength of its offering. The company had some growth headwinds during its business model transformation to a subscription model, but the last three years it has posted very strong growth averaging ~16.8%. It has decelerated recently, so this is something to keep an eye on going forward.

Financials

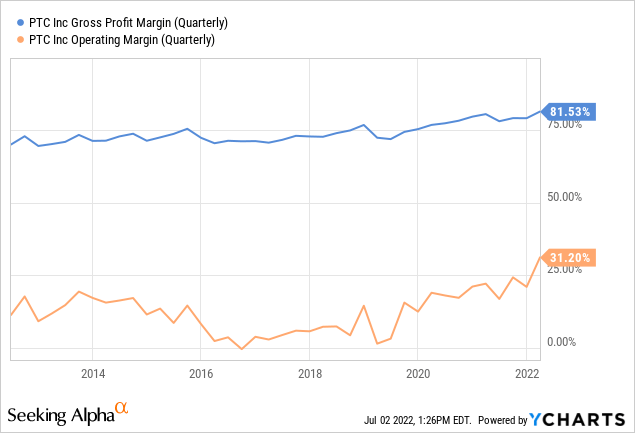

PTC has strong and improving profit margins, with the gross profit margin recently above 80%, and the operating margin above 30%. These are extremely attractive margins, especially for a company that is still growing at a good pace.

PTC believes that the best indicators to judge its business are annual run rate, ARR, and adjusted free cash flow. While we agree that ARR is the best indicator of PTC’s top-line performance, we have an issue with adjusted free cash flow to judge PTC’s bottom-line performance. The problem we have is that adjusted free cash flow ignores stock-based compensation, which we consider a very real expense, and as we’ll see, a significant expense in PTC’s case. In any case, PTC guided for ARR of between $2.0 and $2.4 billion for FY24 and FCF of $700 million to $900 million during their last investor day event.

Balance Sheet

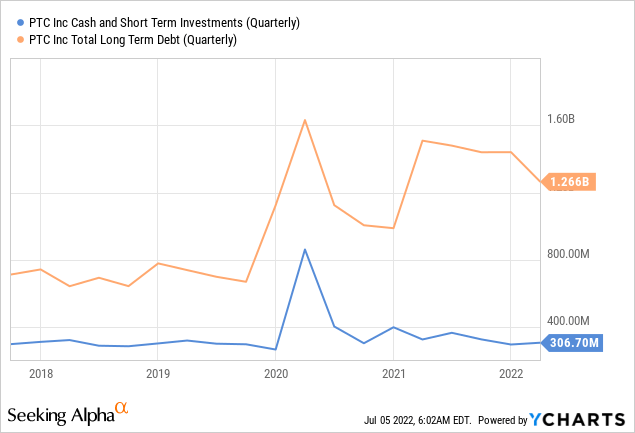

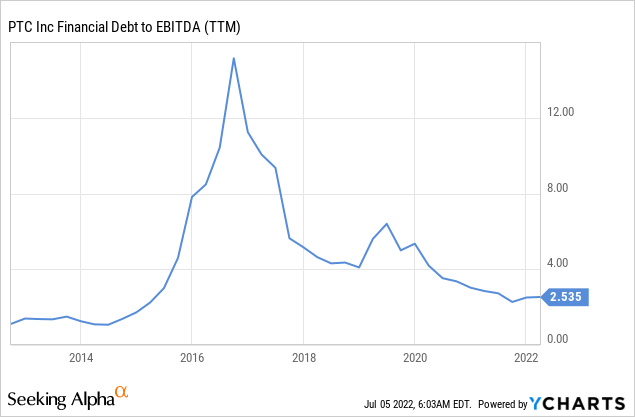

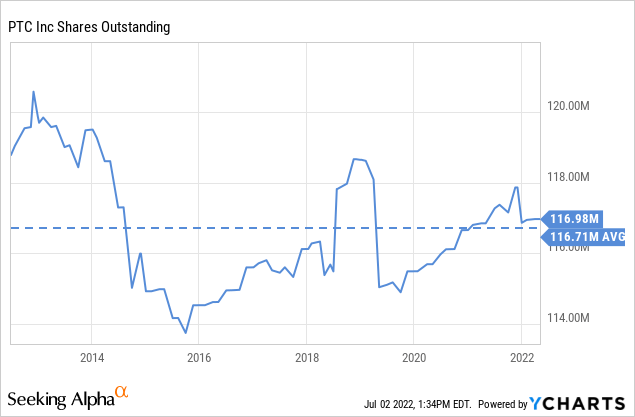

The company has stated that for the remainder of FY22 they plan to focus on deleveraging, and that going forward, their goal is to return approximately 50% of FCF to shareholders via share repurchases, assuming their debt/EBITDA is less than 3x.

The company has a decent balance sheet with ~$307 million in cash and short-term investments, and about $1.26 billion in total long-term debt.

The debt/EBITDA is currently below the 3x target the company has set for itself, so we expect the company to be more aggressive with buybacks going forward.

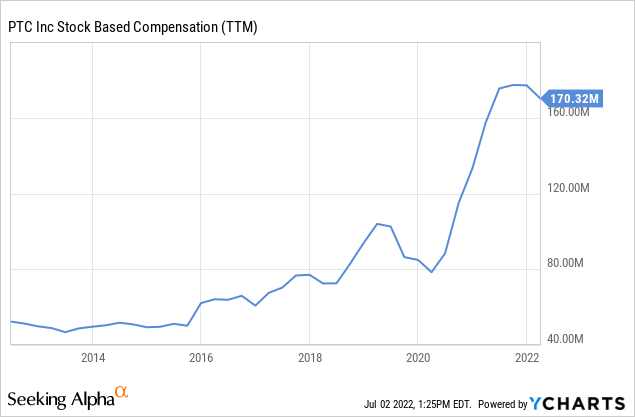

Stock-based compensation

So far we have been positively impressed with what we have seen about the company. Where we are disappointed is when we see the vast amounts of stock-based compensation the company is giving out, especially when it is telling its shareholders to focus on the adjusted free cash flow of the company. While stock-based compensation is a non-cash expense, we consider it a very real expense, so we would subtract it when doing a valuation model, especially given how significant it is in this case. It is almost half of the FCF it is expecting for the year.

Despite the company being active buying back shares, the number of shares outstanding has not declined much given all the stock based compensation it has given out.

Valuation

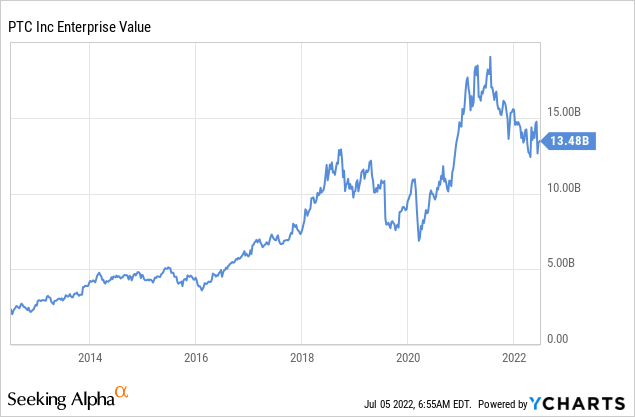

PTC is trading with an enterprise value of ~$13 billion, which at first glance appears reasonable given the expectation that by FY2024 the company could be generating somewhere between $700 million and $900 million in FCF. However, we’ll have to make some assumptions regarding stock-based compensation when estimating an intrinsic value for the shares.

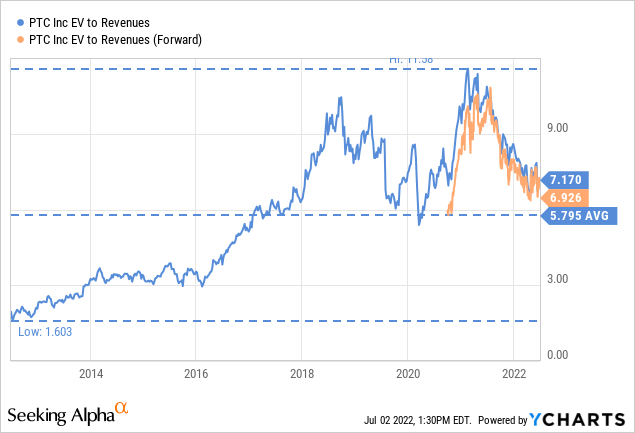

First, looking at the EV/Revenues multiple, we can see that it is getting closer to the ten year average, which suggests that maybe shares are becoming more reasonably valued.

We built a simple DCF model to approximate an intrinsic value per share, without taking stock-based compensation into account, and taking stock-based compensation into account. For stock-based compensation we assumed an expense of $170 million for FY22, growing at the same rate as we assumed cash flows to grow. We could not find any statement by the company describing their stock-based compensation plan for the next few years, so we could be under-estimating it or over-estimating it. Given how fast stock-based compensation has been growing, it’s possible the impact might end up being even more substantial than what we are modeling.

The main result we want to highlight is that we expect stock-based compensation to take about one third of the value away from shareholders. Making shares go from undervalued with a nice margin of safety, to somewhat overvalued.

| FCF per share | Discounted @ 10% | FCF per share minus estimated Stock-based compensation | Discounted @ 10% | |

| FY 22E | 3.42 | 3.11 | 1.97 | 1.79 |

| FY 23E | 4.70 | 3.89 | 3.09 | 2.55 |

| FY 24E | 6.84 | 5.14 | 5.05 | 3.79 |

| FY 25E | 7.59 | 5.18 | 5.60 | 3.83 |

| FY 26E | 8.42 | 5.23 | 6.22 | 3.86 |

| FY 27E | 9.35 | 5.28 | 6.90 | 3.90 |

| FY 28E | 10.38 | 5.33 | 7.66 | 3.93 |

| FY 29E | 11.52 | 5.37 | 8.51 | 3.97 |

| FY 30E | 12.79 | 5.42 | 9.44 | 4.00 |

| FY 31E | 14.20 | 5.47 | 10.48 | 4.04 |

| FY 32 E | 15.76 | 5.52 | 11.63 | 4.08 |

| Terminal Value @ 3% terminal growth | 225.11 | 71.73 | 166.17 | 52.95 |

| NPV | $126.67 | $92.68 |

Risks

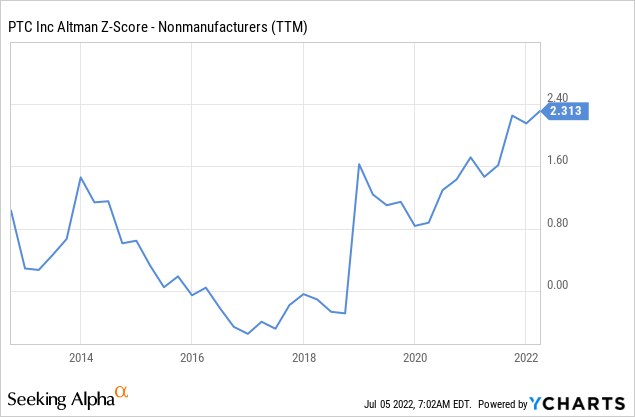

The main risks we see with an investment in the company is the high valuation, and excessive stock-based compensation. The balance sheet seems healthy enough, although we would feel more comfortable if the Altman Z-score was above 3.0.

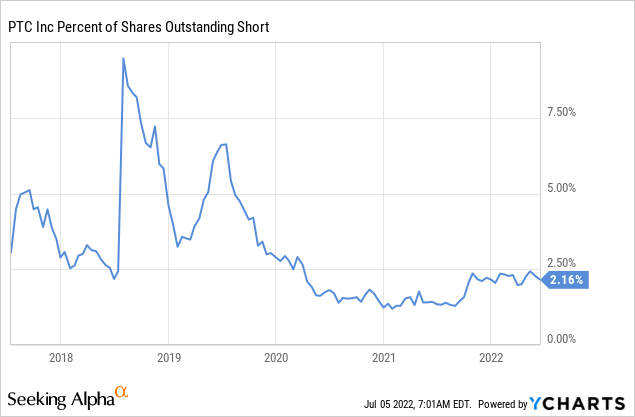

The percent of shares outstanding short remains low, despite seeing a modest uptick recently. We therefore don’t see anything to worry about here either.

Conclusion

PTC is a very attractive business with strong competitive advantages, derived from high-quality software products and high customer switching costs. We expect the company to grow at a rapid pace the next few years, especially in its growth markets of IoT and AR. We believe shares would be under-valued were it not for the excessive amounts of stock-based compensation the company has been giving out. For this reason we are rating the company a ‘Sell’ instead of a ‘Buy’.

Be the first to comment