Alena Zharava/iStock via Getty Images

The Vanguard Dividend Appreciation ETF (NYSEARCA:VIG) might be a good long-term investment for investors with moderate risk tolerance, but it won’t offer protection against inflation and broader market volatility. Its stock portfolio carries a high risk since almost half of its holdings are susceptible to economic and interest rate uncertainties. As the Fed moved to a 75 basis point rate hike in a bold move to curb inflation, the ETF doesn’t appear to have bottomed out yet, and the downtrend is likely to continue into the second half of 2022. In contrast, its competitors are offering better risk-reward and their portfolios align with the current market conditions.

VIG Doesn’t Offer a Hedge Against Market Volatility and Inflation

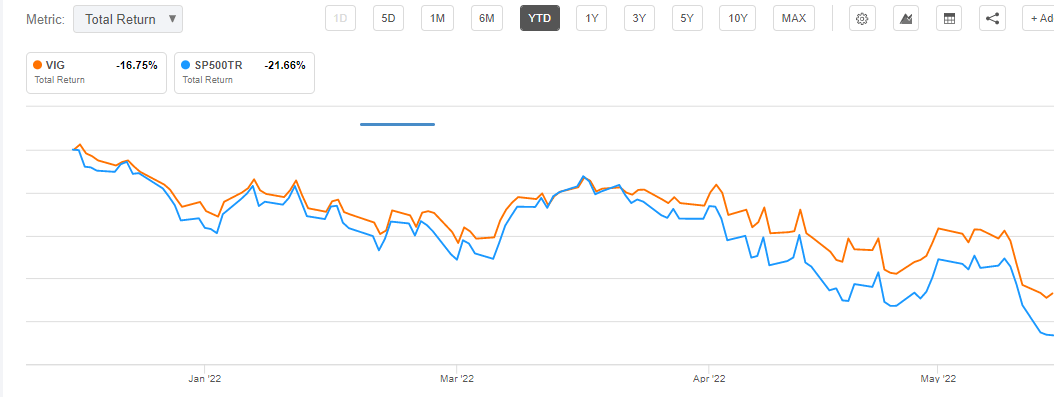

VGI total return in 2022 (Seeking Alpha)

Dividend growth investing is one of the best ways to beat the market in a volatile environment, but finding the right ETF or stock is crucial to generating solid returns. The share price of VIG, which tracks the S&P U.S. Dividend Growers Index, has fallen nearly 17% year to date, slightly below the S&P 500’s fall of 20%. In addition, VIG’s total returns declined at a double-digit rate in the first half of 2022, and there is a possibility of more losses in the second half if market uncertainty continues. The negative returns don’t make VIG a hedge against inflation, which is hovering well over 8.5% at present. Furthermore, VIG’s latest performance suggests that it does not offer stability to the portfolio in volatile market conditions. However, an expense ratio of 0.06% and a total return of 207% in the past ten years make VIG a good candidate for the long term.

VIG’s Portfolio Composition Doesn’t Match With Market Trends

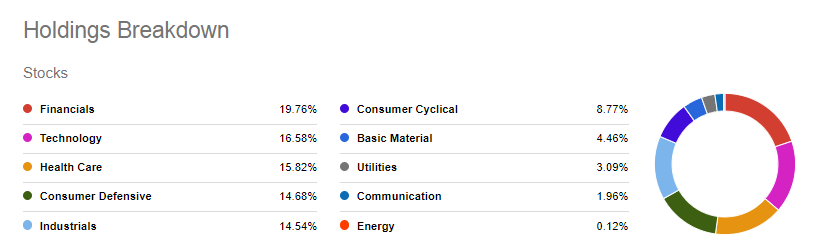

VGI portfolio allocation (Seeking Alpha)

The fund is vulnerable to market uncertainty as financials, consumer discretionary, and information technology stocks make up about 45% of the overall portfolio. For example, its large position in JPMorgan Chase (JPM) is declining faster than the S&P 500 while the stakes in data exchange companies including S&P Global (SPGI), MarketAxess Holdings Inc. (MKTX), and Moody’s Corporation (MCO) continue to add pressure on the fund’s share price.

Meanwhile, the information technology and consumer discretionary sectors have been rated as the largest laggards so far this year due to economic and monetary concerns. VIG’s stakes in consumer discretionary stocks such as The Home Depot (HD), Lowe’s Companies (LOW), Avery Dennison Corporation (AVY), and V.F. Corporation (VFC) are falling at a faster pace than the S&P 500, as retailers forecast slower revenue growth amid higher inflation and declining purchasing power.

On the plus side, its positions in healthcare, industrial, and consumer defensive stocks are outperforming the market and showing resilience to economic headwinds. However, returns from these companies are not enough to beat inflation. For instance, The Coca-Cola Company (KO) has generated a total return of just over 1.5% so far in 2022 while Johnson & Johnson (JNJ) stands at less than 1%. Overall, it appears that half of the portfolio is vulnerable to economic headwinds while the rest is struggling to produce notable returns rather than serving as a hedge against inflation.

Peers Offer Better Risk Reward than VIG

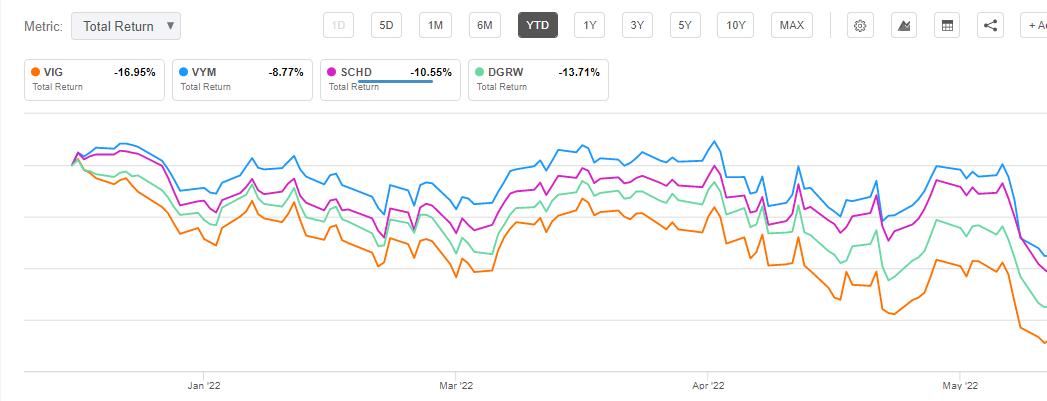

Peer group returns (Seeking Alpha)

In comparison to VIG, Vanguard High Dividend Yield ETF (VYM), WisdomTree U.S. Dividend Growth ETF (DGRW), and Schwab Strategic Trust – Schwab U.S. Dividend Equity ETF (SCHD) offer better risk-reward in current market conditions. VIG’s four-year annual yield stands at 1.75%, while VYM’s, DGRW’s, and SCHD’s dividends yielded around 3.11%, 2.09%, and 3.14%. Moreover, VIG’s faster share price drop than the peer group demonstrates its high sensitivity to interest rates and economic uncertainty. Similarly, Seeking Alpha’s quant grade of B for VIG’s momentum indicator compared to A for SCHD and A- for VYM means VIG has less upside than peers.

A significant difference in VIG and its peer group performance is mainly attributed to portfolio composition. VYM’s portfolio is less concentrated in technology, consumer discretionary, and communications stocks. Rather, its portfolio is focused on energy, consumer defensive, and health care stocks. In 2022, Schwab U.S. Dividend Equity ETF, which seeks to track the Dow Jones U.S. Dividend 100 Index by using the full replication technique, outperformed its peer group and earned a strong buy rating with a Seeking Alpha quant score of 4.52.

In Conclusion

As the Fed decided to raise the interest rate by 75 basis points for the first time since 1994, equity and risky assets are expected to continue to slump in the second half. Therefore, the recent dip in VIG’s price does not present a buying opportunity. In addition, the ETF does not seem like a great choice for inflation protection as its portfolio is heavily concentrated on sectors that are sensitive to economic and growth headwinds. Investors should explore other alternatives that offer stability to their portfolios in bearish market conditions.

Be the first to comment