ablokhin

It’s been a rough year thus far for the major market averages, with both major indices down over 25%, putting a severe dent in investment portfolio values and consumer confidence. While this has led to significant drawdowns in growth stocks as higher discount rates are used to calculate future cash flows, and we see valuations return to more reasonable levels, defensive names have held up quite well, with fund managers looking for a sanctuary among the storm.

One name that’s managed to eke out a positive year-to-date return is Casey’s General Stores (NASDAQ:CASY), up 2.6%, handily beating the Nasdaq 100 ETF (QQQ). This can be attributed to its strong accelerated unit growth that helped drive record earnings, solid margin performance despite inflationary pressures, and a boost in margins in its fuel segment. However, while CASY is expected to see another year of double-digit annual EPS growth, I don’t see enough margin of safety in the stock here. So, while I see it as a solid buy-the-dip candidate, I believe patience is the best course of action for now.

Casey’s General Stores (Company Presentation)

Q1 Results

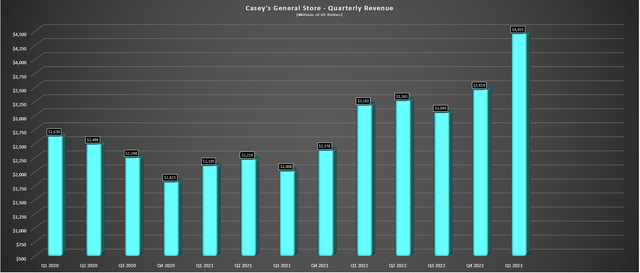

Casey’s General Stores (“Casey’s”) announced record Q1 results last month, reporting fiscal Q1 2023 revenue of ~$4.46 billion, a 40% increase from the year-ago period. This was driven by a double-digit increase in inside sales at its general stores, higher fuel gallons sold (related to its acquisitions), a higher retail fuel price, and a mid-single-digit increase in total stores. Combined with a sharp increase in gross profit in its fuel segment due to rising retail fuel prices, the company’s quarterly earnings per share soared to a new high at $4.09, translating to 28% growth year-over-year.

Casey’s – Quarterly Revenue (Company Filings, Author’s Chart)

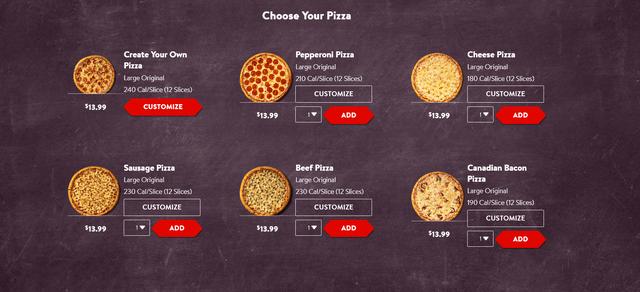

Digging into the results a little closer, Casey’s reported inside same-store sales of 6.3%, helped by strong performance in pizza, breakfast sandwiches, burritos, and non-alcoholic and alcoholic beverages. Notably, the company believes it is taking share in the breakfast daypart vs. quick service with its conservative pricing, and its pizza offerings are also looking more and more attractive from a value standpoint, with its most expensive pizza at $15.99, with most of its pizzas below $15.00. With its new rewards program reaching 5+ million members, guests can also look forward to their eleventh pizza being free, which is applied to the most expensive pizza in their next order.

Casey’s Pizza Offerings (Company Website)

At a time when we’re seeing several quick-service and fast-casual restaurants increase pricing somewhat aggressively, pizza and breadsticks for ~$20.00 at Casey’s is an easy way to feed a family of four that can’t be done at many fast-food restaurants, and certainly not in fast-casual where Chipotle (CMG) doesn’t seem phased by selling 10 dollar burritos. In addition to a breakfast pizza that Casey’s hopes will be popular with tailgates, the company noted that it would be keeping its limited-time BBQ Brisket Pizza on its menu, given the demand for the product that exceeded expectations. So, with menu innovation, pricing below competition, and less competition due to its position in less densely populated areas, Casey’s could be able to gain market share across multiple dayparts in prepared food.

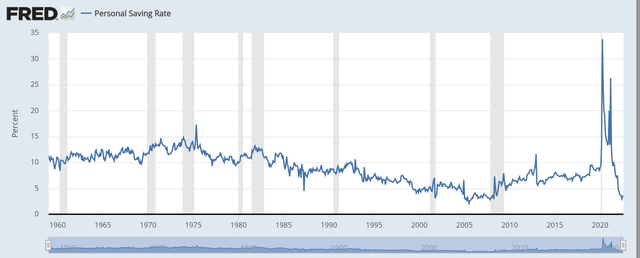

Moving over to grocery & general merchandise, same-store sales were up 5.5% in the period and up 12.5% from a two-year stacked standpoint. Notably, margins in this segment increased from 33.0% to 33.9% despite inflationary pressures, helped by strategic pricing, and increased private label penetration. In fact, private label sales increased to more than 5% penetration and could continue to grow given that Casey’s can offer very competitive prices with sales still being margin accretive. When it comes to a cash-strapped consumer, this is a great position to be in for Casey’s with its private label business.

Personal Savings Rate (St Louis Fed)

Finally, in the fuel segment, fuel margins soared to 44.7 cents vs. 35.1 cents, and while gallons were down on a same-store sales basis, they were up on a volume basis due to the higher store count. This allowed the company to report a gross profit in its fuel business of more than $300 million, a significant tailwind from a profitability standpoint that helped to pad earnings in the period. Obviously, this could be a headwind and create difficult comps next year, but with Casey’s being relatively recession-resistant and a potential trade-down beneficiary, it should be able to pick up some slack from a margin standpoint in private label and a sales standpoint with a slight uptick in its store count.

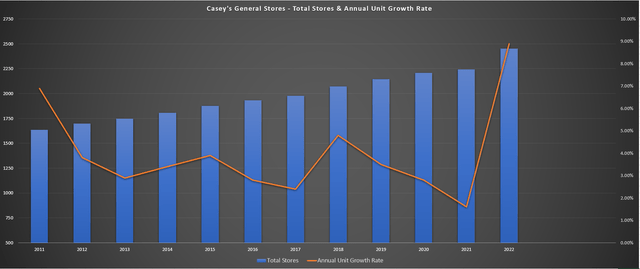

Unit Growth & Earnings Trend

Moving over to unit growth, we saw a much stronger trajectory for Casey’s over the past year, with its annual unit growth rate jumping from low single digits to nearly 10% with acquisitions of multiple stores (Buchanan Energy, Circle K, Pilot). This helped the company finish the period with ~2,450 stores. Casey’s also noted that its acquisition pipeline is looking very strong and has a nice pipeline of small deals and a few larger deals it’s looking at currently. While there are no assurances that it will acquire, this would boost annual EPS next year, helping it to lap the difficult comps from the soaring retail gas prices.

Casey’s – Unit Growth (Company Filings, Author’s Chart)

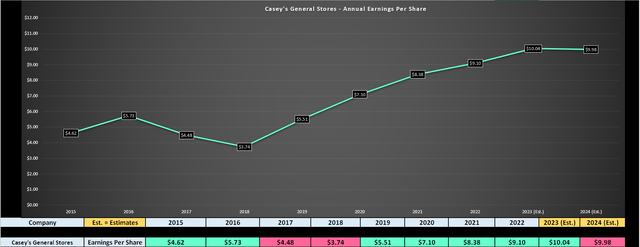

Moving over to Casey’s earnings trend, the company just came off a record quarter, with EPS up 28% year-over-year ($4.09). This has placed the company in a position to grow annual EPS to $10.00+ in FY2023, translating to 10% growth year-over-year despite headwinds (more challenging macro environment, lower fuel margins). Looking ahead to FY2024, annual EPS estimates are pointing to a slight decline, but this is not alarming after a more than 80% increase in annual EPS vs. FY2019 levels. That said, we are seeing a little bit of deceleration in the annual EPS growth rate, but this could be cured if the company grows units further through acquisition in what could become a more favorable environment to acquire or if it steps up share repurchases ($400 million authorized).

CASY – Earnings Trend (YCharts.com, Author’s Chart, FactSet)

Valuation & Technical Picture

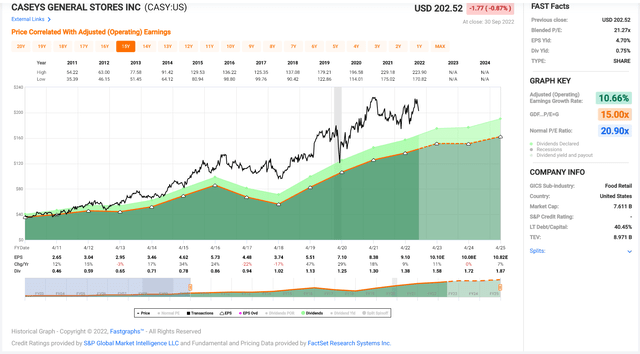

Looking at the chart below, we can see that Casey’s has historically traded at ~21.0x earnings and is currently trading at a slight discount to this figure at 20.2x FY2023 earnings estimates. Given the company’s solid execution and the fact that it could gain market share in the current environment, similar to Walmart (WMT), I believe an earnings multiple of 22 for the stock is appropriate, 5% above its historical average. While this points to a 9% upside to fair value ($220.90), I generally prefer to buy at a deep discount to fair value, even if buying defensive stocks that are lower and can smooth out portfolio returns in a cyclical bear market.

Casey’s – Historical Earnings Multiple (FASTGraphs.com)

Based on a required 20% discount to fair value to justify starting new positions, I see the low-risk buy zone for Casey’s coming in at $176.70, which is well below current levels. The stock doesn’t have to head towards this low-risk buy zone, but this is where I believe the stock would become more compelling, trading at ~17.6x earnings, offering some protection if we see further multiple compression and the market heads lower. So, while I think Casey’s is a solid buy-the-dip candidate for those looking for safety, the time to buy the stock was up against support at $174.00, as I discussed in my update last year, not after a sharp rally when there isn’t nearly as large of a margin of safety.

CASY Article – September, 2021 (Seeking Alpha Premium)

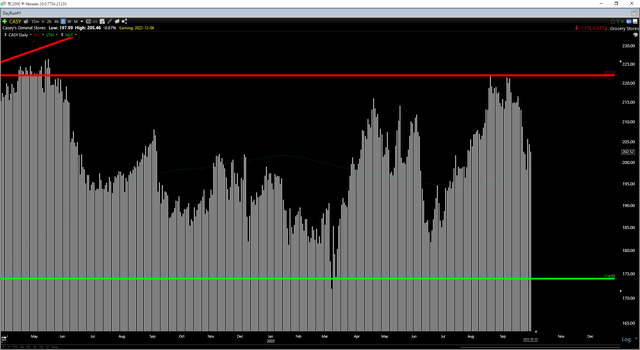

Finally, looking at the technical picture, we can see that CASY is currently near the middle of its support/resistance range, with strong support at $174.00 but a brick wall of resistance at $222.00. When starting new positions, I prefer a minimum 4 to 1 reward/risk ratio. From a current share price of $203.00, Casey’s has just $19.00 in potential upside to resistance and $29.00 in potential downside to support – a reward/risk ratio of 0.65 to 1.0. The current reward/risk ratio, which is unfavorable, doesn’t mean that CASY must head lower. Still, similar to the fundamental picture, the more attractive buy area is below $180.00 per share and closer to technical support.

Summary

Casey’s just came off a strong year and has now put together an impressive fiscal Q1 report, highlighted by record sales, earnings, and solid margin performance despite inflationary pressures. Just as importantly, the macro backdrop looks to be favoring the company, with value in focus for many consumers, and Casey’s is certainly offering value with its private label products in its grocery/general segment and affordable take-out, which can compete with quick-service restaurants. That said, even if the backdrop is favorable and Casey’s is a solid defensive name, I prefer to buy at a deep discount to fair value, no matter the setup. So, while I think CASY is worth keeping an eye on, I see the more attractive buy-point being at $180.00 or lower.

Be the first to comment