Baloncici

Qurate Retail (NASDAQ:QRTEA) is on life support after a disastrous 15 months. Shares have fallen 73% this year and are down 85% from their post-pandemic high. Revenue, earnings, and cash flow are all in decline and the company has resorted to asset sales to pay down debt. What happened to QRTEA? In this article I will interrogate three suspects and provide a theory as to the main culprit behind QRTEA’s collapse.

The Qurate Situation

As a quick refresher, QRTEA is the parent company of the Home Shopping Network, QVC, QVC International, Zulily, and Cornerstone. These subsidiaries sell merchandise (home goods, clothing, accessories, electronics, etc.) across a variety of digital platforms, including dedicated broadcast TV channels, streaming services, mobile applications, and eCommerce websites. QRTEA sources products from a diverse group of suppliers and wholesalers and uses historical sales data to inform purchasing decisions. QRTEA regularly partners with celebrities and luxury brands for special product offerings and promotions. The company’s goal is to build relationships with their customers and provide an engaging experience for those who “love to shop.”

QRETA has a long history of success in cultivating a core of customers that provide repeat business. The company has a history of generating significant and consistent free cash flow. Prior to 2021, QRTEA averaged $1b in free cash flow per year over the last decade, with a minimum of $675mm in 2011. The five year average is even better, coming in at $1.2b with a minimum of $825mm in 2019. 2020 was a record-breaking year; QRTEA generated $2.1b in free cash flow and $1.2b in net income.

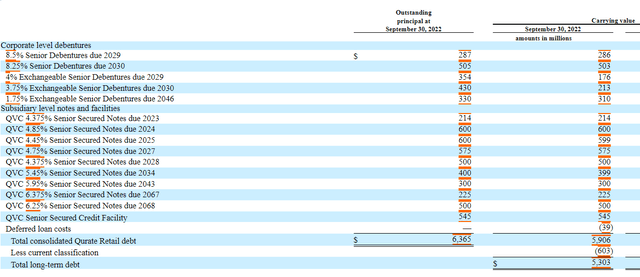

QRTEA has used its consistent and robust cashflow to maintain a high level of debt. At the end of Q3, the company’s total debt burden was sitting around $6.3b, though the maturity of that debt is spread out over decades:

QRTEA Debt Schedule (Company 10-Q)

Prior to Q3 2021, QRTEA’s ample earnings and cash flow could justify the large debt load. Things changed in Q3 2021, as revenue, net income, and free cash flow began to slow and inventory began to build. In Q4 of 2021 a devastating fire in one of QRTEA’s major distribution warehouses destroyed hundreds of millions of dollars of inventory and real estate value and sent the company’s internal supply chain into disarray. From the end of Q3 2021 through Q3 2022, QRTEA had net income of just $334mm (after backing out gains from the sale of real estate and impairment losses) and posted negative free cash flow. This is problematic because the company has over $5b in loans coming due over the next five years.

QRTEA has been able to raise some cash via sale and leaseback transactions involving some of their facilities, but the company doesn’t have enough hard assets to cover its debt. QRTEA will need to generate meaningful cash flow again in the next 3 years to meet its obligations or else the company will be in real trouble and face bankruptcy risk.

How Did we Get Here?

There are three primary explanations for QRTEA’s precipitous fall: poor balance sheet management, an outdated business model, and supply chain disasters. Doubtless all three have played a role, but there is value in understanding which factor deserves the most blame.

Poor Balance Sheet Management

QRTEA has a large debt burden, limited physical assets, and has been quick to deploy cash via special dividends and share buybacks. The company has annual interest expenses of ~$450mm, but it is debt repayments that will cause QRTEA the most stress. QRETA will need to spend an average of ~$500mm annually over the next five years to meet its obligations. QRETA currently has about $600mm in cash on the balance sheet, but management has used well over $2b of cash for special dividends and buybacks in just the last two years. That is roughly fours years worth of debt repayments that the company would like to have back in these more difficult times.

If the company was debt free, not only would they generate an additional $450mm in annual free cash flow, but there would be no repayments to make and there would be much less pressure to generate cash flow in the short term. If QRETA had been more conservative with their cash, they would have a larger cash cushion and not need to sell and lease back facilities.

Outdated Business Model

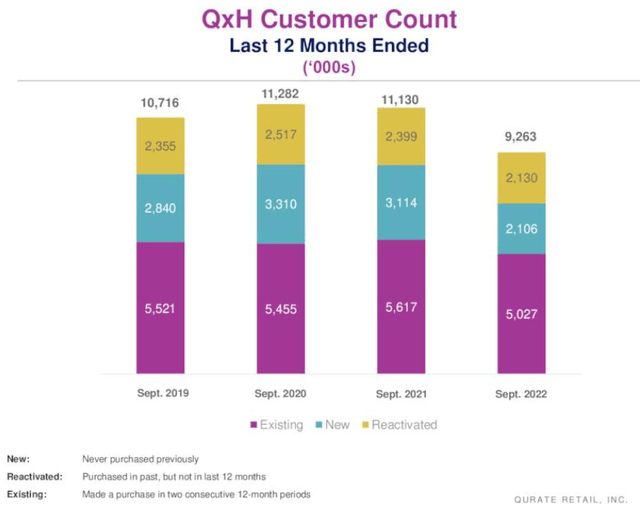

QRETA has a distinct business model that has come under scrutiny in recent years. The company’s flagship subsidiaries are QVC and the Home Shopping Network. These subsidiaries generate the majority of their revenue from broadcast television programming. QRETA’s customer base skews older; programming and products are targeted at women over 50. The company has had difficulty attracting younger customers. Finally, QRETA relies on a core of “super customers” who are loyal to the brand and spend thousands of dollars a year on dozens of purchases. 2022 has seen an unusually sharp decline in the existing customer base, which indicates a potential problem with the company’s operating model:

QVCxHSN Customer Counts (Company Earnings Presentation)

QRETA’s business model will be in danger if they lose a meaningful number of long-term customers that they can’t replace. Management tacitly acknowledged the weakness of their underlying businesses in Q3 by taking a $3b impairment loss against their tradename and goodwill balances.

Supply Chain Disasters

In Q4 of 2021 QRTEA experienced a devastating fire in one of their major distribution warehouses. The fire destroyed precious inventory and caused havoc in day-to-day operations.

Fire Damage at Rocky Mount, NC Distribution Center (ABC11 Raleigh-Durham)

QRETA was already having inventory issues due to global supply chain blockages when the fire occurred. A poor inventory balance led to less favorable sales mix and unhappy customers. QRETA hasn’t been immune to inflationary pressures either; labor and transport costs are both up and are compressing margins. Frustratingly, QRETA moved from insufficient inventory to being oversupplied with inventory in 2022. Until very recently, QRETA was paying millions of dollars to rent storage trailers to house excess inventory (partially due to the lost warehouse space) and has heavily discounted merchandise to lower inventory levels. QRETA isn’t alone in this area; many other major retailers (including Walmart and Target) have had to tackle supply chain and inventory issues over the last 2-3 years, but the distribution center fire was an extra gut punch when QRETA was already reeling.

My Verdict

After reviewing the evidence, it is my opinion that QRETA’s primary problem has been their supply chain issues. Debt repayments might end up being the catalyst for an eventual bankruptcy, but QRETA has carried a high debt burden from day one without it being an operational problem or a drag on the company’s share price. QRETA’s lack of core customer growth and reliance on broadcast television will hamper their future growth prospects and perhaps makes them a slowly melting ice cube, but it doesn’t explain the sudden and sharp drop in customers and revenue. With the same business model QRETA was able to generate $825mm of free cash flow in 2019, $2b in 2020, and nearly $800mm in 2021.

I think the simplest explanation is likely the correct explanation in this situation. Overnight, QRTEA lost a huge amount of inventory in a fire and, more importantly, lost the ability to efficiently deliver products to customers. Operational difficulties worsened the customer experience and made effective merchandise planning more difficult. A big drop in quality paired with a rising cost environment is a recipe for short-term disaster. Some customers likely reined in their spending as inflation ran hot, and others get bored due to a lack of exciting products on offer. These factors combined would explain a sharp drop in customers, revenue, and margins.

Investment Implications

If the core problems weighing down QRTEA are supply chain, inventory, and inflationary issues, then the good news is that these problems are likely temporary and fixable. Management is stepping up to make changes to right the ship and taking accountability to fix the current situation. QRTEA has the luxury of another year or two of runway before things get dire, thanks to a moderate amount of cash on the balance sheet, flexibility from their credit facility, and some breathing room in their debt repayment schedule. If the headwinds are temporary and QRTEA can get back to anywhere near their long-term average cash flow, the company will survive and likely be a multi-bagger over the next two to three years. Annual free cash flow of $400mm per year should be enough to keep them afloat through their debt repayments, and even a modest 6x FCF multiple would send the share price up 3x from its current $2/share. That being said, bankruptcy is a real risk if things don’t turn around quickly. I expect a binary outcome from a QRTEA investment: either it will go to zero or it will provide a 3-5x return.

Risks

Even if QRTEA’s business model is relatively intact, bankruptcy is a real risk for the company. I think it is unlikely to happen in the next two years, as the company can meet its obligations with cash on hand and by dipping further into their revolving credit facility. This assumes the operating business doesn’t deteriorate further. At best, however, the company is fragile and could be knocked out by a prolonged economic downturn. If QRTEA doesn’t return to robust cash flow, then the debt will catch up to them eventually. If QRTEA has already lost too many customers that they can’t replace, then all bets are off and bankruptcy becomes inevitable. I want to stress that a QRTEA investment is risky and is likely to result in an extreme range of outcomes.

Conclusion

I think there is a clear reason to avoid an investment in QRTEA, and that is simply that bankruptcy without any capital recovery is a real possibility. In general if an investment has a chance of going to zero, I am not interested. That being said I do still have a very small position in the company. I think the overall expected value of a QRTEA investment is positive; I think that a return to historic operating performance would result in a 3-5x return at a minimum, while bankruptcy would be a zero. Even if one were to ascribe a 66% chance of bankruptcy (which is roughly what the pricing of the preferred shares and long term bonds are implying), the upside potential still makes this a positive EV bet.

Be the first to comment