shaunl

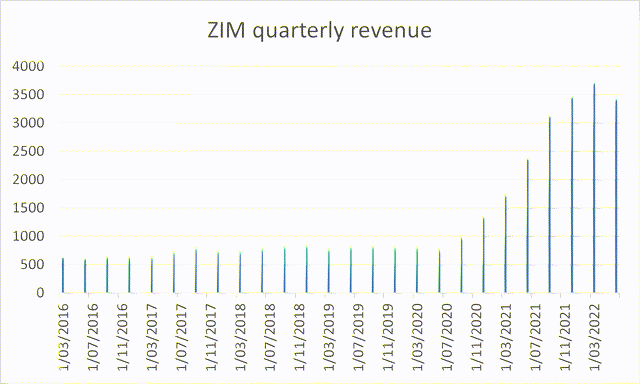

In line with the vast increase in shipping rates, ZIM Integrated Shipping (NYSE:ZIM) has posted stellar revenues over the past 2 years.

Author’s calculations

As costs increased far less substantially, profits have skyrocketed, making ZIM a cash cow with a hefty dividend.

Now that shipping rates have come down in the past few weeks, however, revenue and profits will come down as well. The stock price has moved accordingly, as investors brace themselves for an increasingly more certain new reality of low shipping rates. How does ZIM’s future look in this new reality? Can it remain profitable and cash-generative? Let’s investigate.

What to expect?

Two factors will influence ZIM’s profits: 1) average shipping rate in 2023, and 2) how many containers [TEU] will be shipped.

Average price

In order to look into the future, we may have to look back into the past. Indeed, I believe the shipping environment in 2023 will resemble more the pre-COVID period than it will resemble the 2020-2022 period.

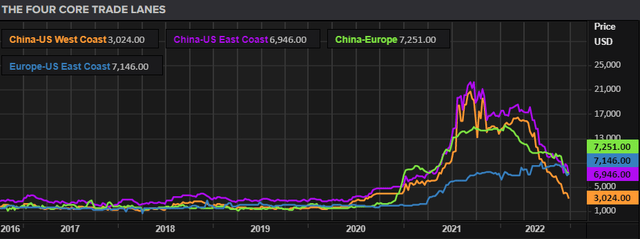

Eikon, based on Freightos data

My educated guess would be that shipping rates continue their decline to pre-COVID levels, but do not dip below those. Port congestion, a big reason for the increase in shipping rates, is lowering while demand drops in a recessionary environment.

At the same time, ZIM and other shippers have signed long-term contracts with clients over the past quarters. While these contracts are likely to be re-negotiated given the huge drop in shipping rates, it is not unreasonable to expect ZIM to earn on average a higher rate than the spot rate in 2023.

Because of these long-term contracts, I could see ZIM charging a rate that is somewhere between the current spot rate and my hypothesized 2023 spot rate (which is half the current spot rate). Hence, I expect ZIM to charge a price of +50% in 2023 compared to 2019.

Containers shipped

Over the years, ZIM has increased its capacity. Carried volume in the second quarter of 2022 was 856 thousand TEUs, compared to 731 thousand TEUs in Q2 2019. This is roughly a 17% increase since pre-COVID levels. Moreover, this number is 7% lower than Q2 2021. Now that rates have come down, we may expect shipped tonnage to recover compared to 2021 and regain that 7%.

Hence, I expect TEUs in 2023 to be around +25% higher than in 2019.

Revenue in 2023

Based on my back-of-the-envelope calculations, ZIM’s 2023 revenue is expected to come in at around ~85% (50% price increase * 25% volume increase) higher than in 2019. Note that this is a conservative estimate, which assumes that (i) shipping rates halve from their current levels, (ii) ZIM’s long-term contracts will be significantly re-negotiated downwards, and (iii) does not take ZIM’s investments in technology (and thus higher pricing power) into account.

Given that revenue in 2019 was 3.3B$ – 1.9% higher than in 2018 – my estimate for 2023 would be 6.2B$.

How about ZIM’s costs?

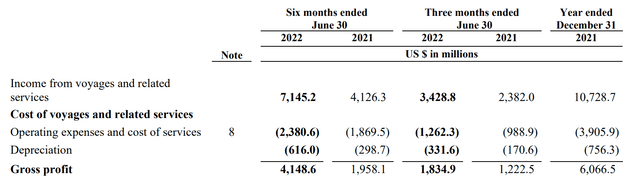

ZIM Q2 earnings

Most of ZIM’s costs are chartering costs, where it pays a fee to ‘rent’ the boat. Last quarter, ZIM paid 1.2B$ in chartering costs, while depreciation on its own assets was only ~330M$.

Hence, if chartering costs would not decrease from their current level, ZIM would be paying ~5B$ in chartering costs; and 1.2B in depreciation – effectively making ZIM breaking-even on gross profits. This, however, does not account for the strong correlation between the chartering price & shipping rates.

Indeed, the price for chartering ships has come down recently as well:

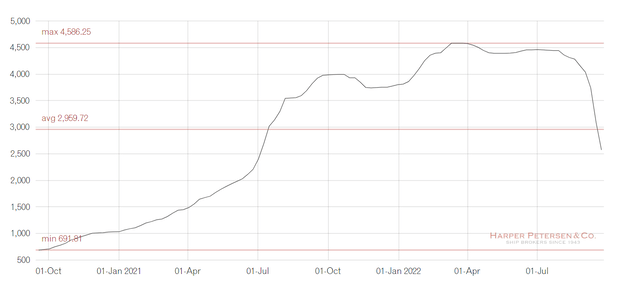

Harpex

While the decline is less spectacular than those seen in the shipping rates, it means that ZIM can charter its new boats now with a ~40% discount relative to its most recent quarter.

On the other hand, charter rates today are still above the levels from Q2 2021 – when ZIM paid around 1.0B$ in charter costs – and 4x higher relative to pre-COVID levels.

Just as I assume shipping rates to decline further, I expect charter rates to drop as well. Again, you have to guess how far these rates will drop, but given the steep decline in shipping rates, I expect chartering rates to follow suit. A decline in costs from 1.25B$ to 1.0B$ quarterly seems very reasonable. Hence, I don’t see ZIM paying more than 4B$ in charter costs over 2023. Combined with the 330M$ quarterly depreciation costs, which are less likely to decrease, costs should be around 5.2B$.

Expected profit

Given that there are around 600M$ in SG&A costs, ZIM should generate an EBIT of 400M$ out of its expected revenue of 6.2B$ in 2023. This is an EBIT-margin of 6.5%, which is still above the pre-COVID level of 3.5%.

Conclusion

Conservative back-of-the-envelope calculations show that ZIM will remain profitable even when shipping rates continue to fall through 2022 and 2023 to pre-COVID levels.

As I expect an EBIT in the ballpark of 400M$ at least, I believe that the enterprise value of ZIM should at the very least be 2.0B$, or 5x its EBIT (remember: ZIM IPO’ed at 5.8x its LTM EBIT). Given the current market cap of 3.0B$, the question now is: will the net cash position at the end of 2022 be larger than 1.0B$?

Currently, after paying dividends, ZIM has a net debt position of 630M$, while management has guided for 3.5B$ EBITDA in the second half of 2022. At the end of 2022, ZIM should thus have a net cash position of more than 2B$. This means that the Enterprise Value will be just 1B$ – half of what I believe to be fair (under conservative estimates).

Fair value

The market cap at the end of 2022 should be 4.0B$ so that Enterprise Value is equal to its fair value of 2.0B$. This means that the current stock should increase by +33%, to 33$, by the end of the year.

Therefore, I initiate coverage of ZIM with a careful ‘bullish’ outlook for the stock – although momentum is severely negative and one could expect that shipping rates coming down further will bring further pain in the short-term.

Be the first to comment