FerreiraSilva

Introduction

iShares Emerging Markets Dividend ETF (NYSEARCA:DVYE) is an exchange-traded fund with over 100 holdings, with a mandate to invest in companies in emerging markets with relatively high dividend yields. I covered DYVE in May 2022, however since then, the fund has fallen by more than the S&P 500 index (a popular U.S. equity index); a price-only change of -18.87% vs. the S&P 500’s fall of -10.59%, per Seeking Alpha data. Therefore, it is worth revisiting.

Key Facts

Per iShares themselves, DVYE reported 113 holdings as of September 22, 2022. The 30-day SEC yield was calculated as being as high as 13.00% as of August 31, 2022. The price/book ratio was 0.81x, and interestingly the three-year equity beta was just 0.85x, with a tiny price/earnings ratio of 3.32x.

The combination of recent under-performance, a very high dividend yield, a very low price/earnings ratio, and a sub-1.00x historical beta, makes DVYE appear very cheap.

Comments on Prior Coverage

I was previously bullish on DYVE on the basis of valuation, as discussed briefly above. Bear in mind that the geographical exposures of the fund mean that the fund’s holdings must be valued in accord with country-specific risk-free rates and equity risk premia, which are both higher than U.S. comparables. This explains much of the delta in yields/valuation multiples.

Nevertheless, having previously assessed that DVYE’s underlying fair cost of equity was in the region of 13-14% (implicitly), I perceived DVYE as offering quite a high level of potential return, especially considering that my valuation at this cost of equity implied substantial upside (implying returns of more like 25% per annum on a multi-year basis).

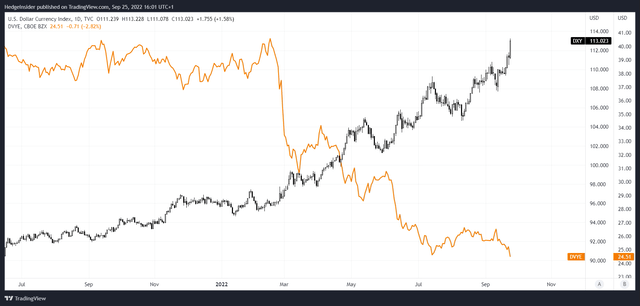

The low historical beta of the fund only helps. However, the U.S. dollar has risen materially since then. The U.S. dollar index has risen by 9% since my last article on DVYE was published.

TradingView

When you are long international stocks, you are indirectly short the U.S. dollar; this explains much of the under-performance. Also, markets have generally fallen, so a lower beta was not of much use in combination with a stronger U.S. dollar and falling U.S. equity markets.

Equity Valuation

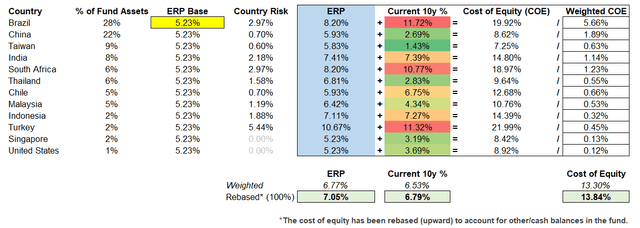

Revisiting the valuation of DVYE, we first need to assess the weighted average risk-free rate per the fund’s key country exposures, as well as the country risk premia for each of the countries. I have used data from Professor Damodaran for this purpose, with my calculations below; the mature market equity risk premium, used as a base, is Damodaran’s 5.10% for September 2022. However, I had used 5.23% in a previous calculation, and so I will keep it set to 5.23% to be conservative. I have also used the World Government Bonds website for 10-year yields, to calculate the average “risk-free” rate.

Author’s Calculations

I come to a very similar cost of equity of just under 14%; 13.84%, vs. my prior article in which I calculated the cost of equity as 13.63%. Previously, this consisted of a 6.63% average risk-free rate and a 6.99% ERP component. Today, my cost of equity consists of a 6.79% risk-free rate, and a 7.05% ERP.

Morningstar provides us with a forward price/earnings ratio of 4.38x, indicating a forward earnings yield of 22.83%, and a price/book ratio of 0.72x, suggesting a forward return on equity of around 16.44%. All of this suggests DVYE is cheap, on the basis that the underlying cost of equity is safely underneath the forward earnings yield.

The countries that DVYE is exposed to tend to carry higher rates of inflation relative to the United States and other major developed economies (perhaps less so recently, but still generally; and more likely so in the longer run). Nevertheless, Morningstar pegs three- to five-year earnings growth for DVYE at “just” 6.21% as of recent. Still, assume that long-term earnings growth (over the next few years and beyond) will hit at least 2%. What would an appropriate price/earnings multiple be?

For this, we would divide 1 by the cost of equity, net of 2% long-term growth to perpetuity. If our cost of equity is 13.84%, and our long-term earnings growth rate is 2%, then we divide 1 over 11.84%. This comes to 8.45x. Even with no growth, we might expect a forward price/earnings ratio of at least 7.23x. I think much of DVYE’s under-valuation seems to be driven by adverse foreign exchange concerns, but on a nominal fixed-rate basis, DVYE looks undervalued.

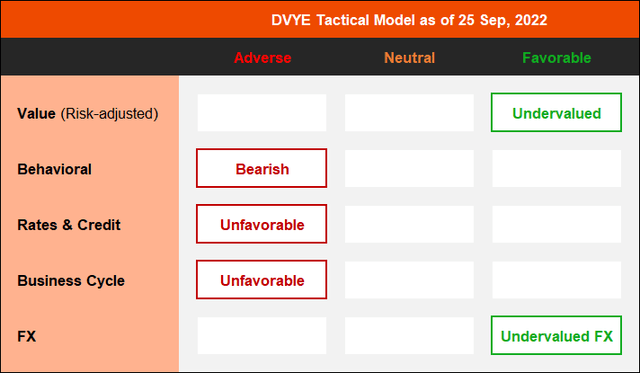

Behavioral Model

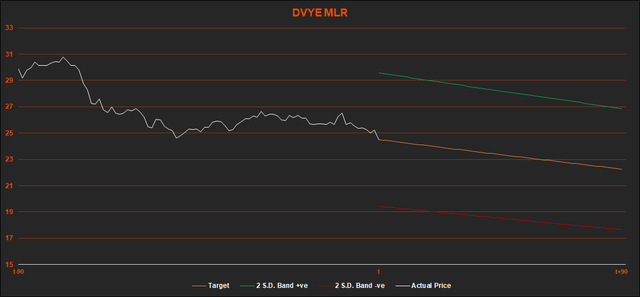

As shares can fall in spite of under-valuation, I am starting to incorporate a behavioral model into my thinking. The below chart is the result of a multiple linear regression with over 100 inter-market variables, tracking DVYE’s movements against broader markets using circa ten years’ data (since DVYE’s inception). Two standard deviations are applied around the forecast, based on DVYE’s historical volatility over the past year.

Author’s Calculations

Based on historical inter-market relationships, the next three months carry a bearish bias for DVYE (about -9% as a base). That does not mean that DVYE will fall in line with the projection, but it is worth considering. In this case, the model is finding one significant negative driver in higher energy prices. Brazil is one significant exposure within DVYE’s portfolio (28% of fund assets as of recent). Brazil is a net exporter of oil. Meanwhile, the model found a positive relationship between DVYE and broader commodity prices, which makes more sense.

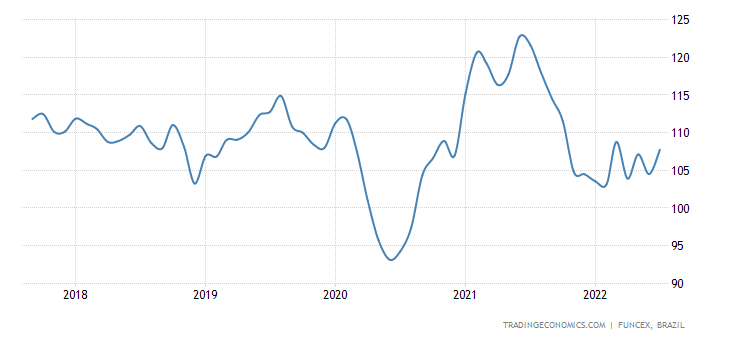

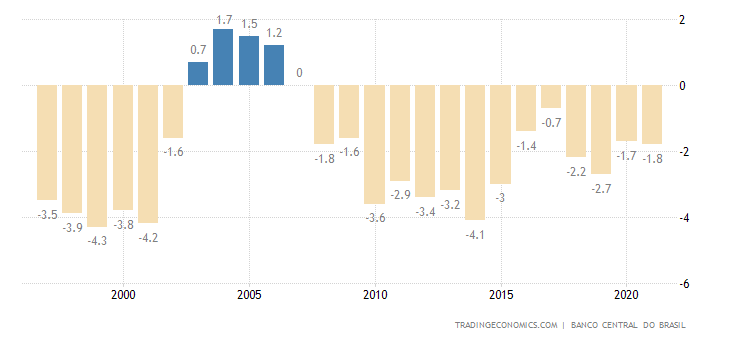

Higher oil prices might correlate negatively with DVYE because higher energy prices can also correlate with inflationary pressures and broader economic ructions. However, the signal is mixed, as higher energy and commodity prices also tend to signal stronger economic growth (or at least, nominal growth). Brazil’s terms of trade have steadied this year (see below); the ratio between export and import prices.

Trading Economics

While DVYE has been following historical market patterns, it is probable that its largest exposures today, like Brazilian stocks, are likely to rebound. However, a cursory look at the Big Mac Index from The Economist suggests the Brazilian real is modestly overvalued on a GDP-adjusted basis. This is a counter-point, which we will revisit briefly later, and might admittedly have a suppressive effect on any equity rebound.

Rates & Credit

The world is currently in a rate-tightening process, although DVYE’s weighted average risk-free rate (the 10-year) has been relatively stable over recent months. Per BIS data, the credit impulse was circa -5.33% in Q1 2022 for emerging market economies. This is a leading indicator on earnings, so it is possible that DVYE will continue to find challenges ahead in the near term. Until central banks pivot, not just in the U.S. but globally, the market environment will remain tough.

Business Cycle

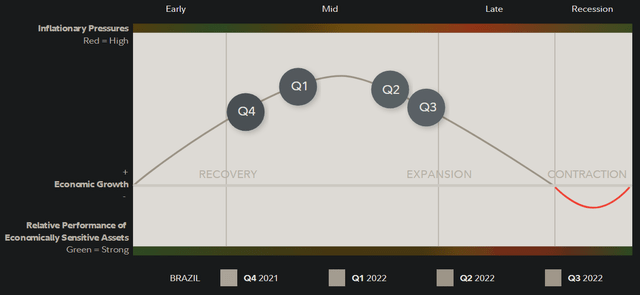

Per Fidelity research, Brazil is entering into the later stage of its current business cycle from Q3 2022.

Fidelity

China, being DVYE’s second-largest exposure, is thought to be in recession. Other top exposures like India are slightly behind Brazil. DVYE seems to have a mix between mid- and late-stage exposures, and recessionary exposures. It therefore makes sense that the fund has struggled to rise in recent months, especially when you couple this with an unfavorable policy environment and a rallying U.S. dollar. From a cyclical positioning perspective, it makes sense that DVYE could continue to struggle in the near term.

Foreign Exchange

I touched earlier on the slight over-valuation of the Brazilian real, using The Economist’s GDP-adjusted Purchasing Power Parity model. Over-valuation also makes sense given that the current account relative to GDP in Brazil (DVYE’s top country exposure) has also been negative, suggesting an expensive local currency.

Trading Economics

However, the Chinese yuan, per The Economist’s model, is undervalued, and so is the Taiwanese dollar, Indian rupee, and South African rand. When the FX tide turns, on a net basis it would appear that DYVE should have plenty of tailwinds from the foreign exchange space.

Summary

In summary, DVYE is likely undervalued on an earnings power basis, and its local currency exposures could provide some longer-term tailwinds for DVYE shareholders. However, in the shorter term, DVYE is poorly positioned given historical inter-market relationships, current monetary policy, an unfavorable credit impulse, and net-negative business cycle positioning.

Author’s Summary

A perverse situation arises in which DVYE falls in spite of being undervalued. As equities tend to fall into recessions, and as recessions can produce significant negative earnings surprises, I am going to take a neutral stance at present. However, on a longer-term time horizon, I would remain bullish, as the fund still appears cheap.

Be the first to comment