Takako Hatayama-Phillips

Main Thesis & Background

The purpose of this article is to evaluate the Pimco California Municipal Income Fund II (NYSE:NYSE:PCK) as an investment option at its current market price. The fund invests primarily in California municipal bonds, and therefore “seeks to provide current income which is exempt from federal and California income tax, as well as the alternative minimum tax.”

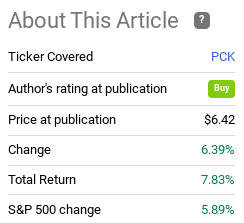

This is an option I suggested readers consider buying back in June – especially those who live in California. In hindsight, this was a timely call. PCK at one point was up about 15% in the interim, although it has given back some of those gains. Yet, it has still managed a total return near 8% in three months, which is pretty darn impressive:

Fund Performance (Seeking Alpha)

Given the sharp move PCK has seen in such a short time period, coupled with the fact it has given up some of its gain more recently, I wanted to take another look at this fund to see if I should change my rating. Simply, outsized moves always give me pause, regardless of the direction. This is no different in the case of PCK. After consideration, I think future returns will cool down a bit, so a downgrade to “hold” is appropriate. I will explain why in detail below.

PCK Valuation Has Shifted From Bargain Territory

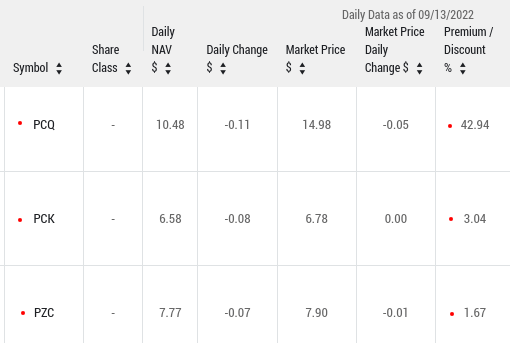

One of my primary concerns supporting my downgrade at this time has to do with valuation. When I looked at PCK in June this was actually a primary catalyst for my recommending the fund. In comparison to its two sister funds from PIMCO, the California Municipal Income Fund III (PZC) and the California Municipal Income Fund (PCQ), PCK had a distinct advantage. PCK was trading at a discount around 3% to NAV, while the other two funds held a premium price. With the case of PCQ, the premium is outrageous at over 40%. Today, that story is consistent, so I continue to caution investors away from that option. However, there has also been a shift in PCK’s relative valuation compared to PZC. The former has moved in to premium territory, and had actually become more expensive than the latter:

CEF Valuations (PIMCO)

This is a very straightforward attribute and suffice to say PCK is no longer the bargain price it once was. While a 3% premium is not anything to get overly concerned with, it is a stark contrast to the 3% discount just a few months ago. Further, PZC now has the valuation advantage between the three funds, which could make it the more interesting play at the moment.

My takeaway here is that this support a more cautious outlook for PCK. I do not believe there is also reason to be overly alarmed here. But given that part of the 8% return from this fund is due to a rising valuation, I believe it should at least give readers some pause.

Rising Interest Rates Continue To Pose A Challenge

Another headwind to bear in mind right now for PCK concerns the entire fixed-income market as a whole. This is rising interest rates, driven by the need for central banks (the Fed included) to fight high inflation. These two market forces – inflation and rising sovereign yields – have been impacting the bond market for some time now. The net result has been quite a bit of pain across the fixed-income CEF universe, with PCK not offering any exception to that:

YTD Performance (Seeking Alpha)

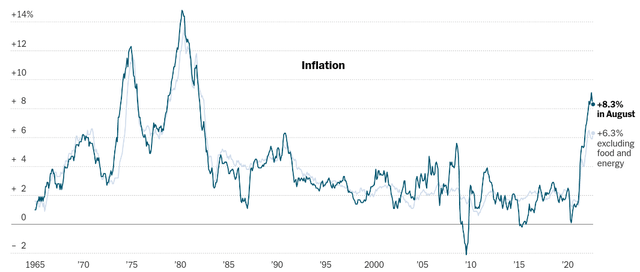

Of course, we should be more concerned with future performance than past performance. But the problem is that the cause of this performance could continue to wear on debt markets in Q4 as well. Inflation remains extremely high, as yesterday’s CPI figures informed us:

CPI Figures (Bureau of Labor Statistics)

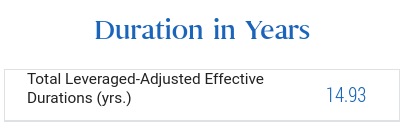

What this means to me is that the Fed (and other central banks) are probably not done hiking interest rates. This poses a real challenge to PCK, and other funds like it. PCK in particular is at-risk because it has a very high amount of interest rate sensitivity:

PCK’s Duration (PIMCO)

What this means is that if interest rates keep on rising, PCK’s underlying value is going to be pressured downward. This has been the case for most of 2022, and the pain has been so pronounced because the Fed has been hiking rates at an aggressive pace in relation to past rate-hiking cycles:

Pace of Fed rate hikes (by cycle) (Charles Schwab)

All this adds up to a difficult environment for PCK. Yes, the fund has seen a strong move higher recently. But this has more to do with the sector being too beaten down than because of any fundamental change in the interest rate outlook. The market expects the Fed to keep on hiking, starting with its upcoming meeting later this month. Yesterday’s (9/13) inflation report did nothing to change that perception, and that means higher rates are all but a certainty. Given how sensitive PCK is to this development, I believe this is another supporting factor for a more neutral outlook going forward.

The Income Story Remains Impressive

While I have touched on a couple of concerns I have for PCK, I must now emphasize I am not “bearish” on this CEF. Part of the reason for my downgrade has to do with the fact that I saw a lot of value in this fund very recently. While that story has been minimized to a degree because of the reasons mentioned above, there are still plenty of positive attributes to consider.

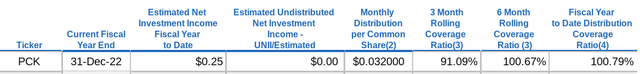

Core among those is the fund’s income story. While PCK’s income metrics have declined slightly since my June review, the most recent figures still show PCK is earning (via income) its stated distribution:

Ultimately the coverage ratios have dropped a bit and the $.01/share in income reserves has been used up. But the fact is this is still a pretty strong report. PCK has an attractive, tax-exempt yield, and these metrics suggest that is going to remain the case for the near term at least.

Muni Yields By Comparison Are Attractive

Expanding on the previous paragraph, income-oriented investors would do well to consider muni bonds as an income source given their relative attractiveness as well. This is true for PCK given the fund’s above-average yield and stable income metrics. But for non-California residents, perhaps this isn’t the best option. The good news is that munis across the board have quite a bit of value at these levels. The drop in the sector seems a bit disproportionate especially when we consider the underlying quality of the bonds.

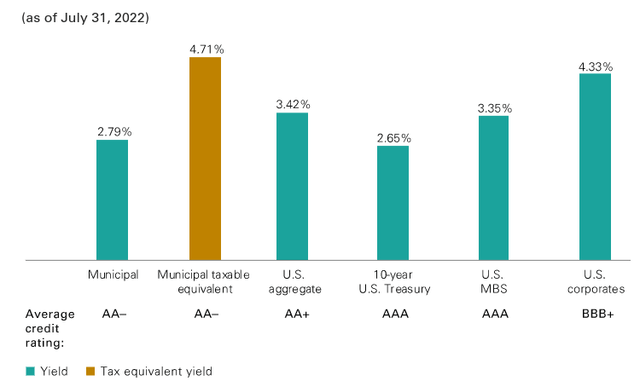

While this has been challenging for investors in 2022 so far, there is opportunity in that. The reason being muni yields are very high on a tax-adjusted basis. This means if investors are looking at the credit markets for the best spot to put their cash, munis have a distinct advantage:

Current Yields (Various Credit Sectors) (Vanguard)

What I am trying to illustrate here is part of the why behind why readers should be consider muni bonds at this moment. This is relevant for PCK, but not just that fund in isolation. There is income and value to be had across the sector, which is why I feel this could be a good starting point for those who have been burned by fixed-income this year and are looking for value now.

California In Good Fiscal Shape

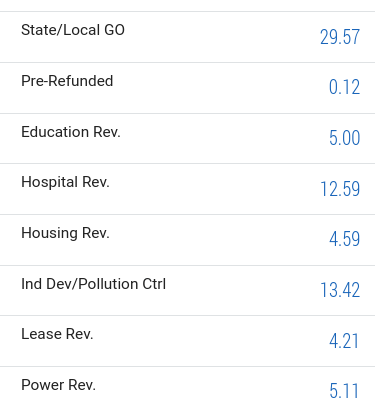

Looking at PCK’s portfolio we will also see some reasons to be optimistic. As followers of this fund should know, PCK is focused on muni debt from California specifically. This fund gives exposure in a number of different sectors within the state, but its primary focus is on General Obligation (“GO”) bonds from the state and local governments within California:

PCK Sector Breakdown (PIMCO)

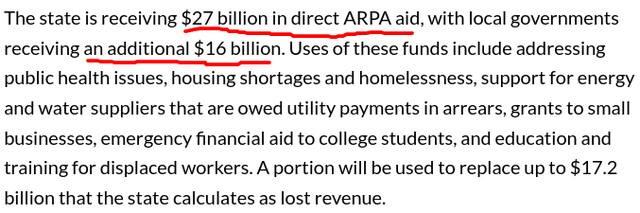

This gives me a fair amount of comfort because the state remains of fairly good financial footing. In a report out last month, Fitch Ratings reiterated its “AA” rating for California’s GO bonds (its second highest rating), as well as gave the state an outlook of “stable”. Beyond benefiting from the broader economic recovery like much of the country, California is also a big beneficiary of federal aid. Whether or not you agree with this is a moot point, the end result is this heavy level of support is a positive for muni debt issuance:

California State and Local Federal Aid (Fitch Ratings)

The conclusion I draw is that credit risk remains minimal in this space. Defaults for munis across the board have been very low in 2022, and even those have been concentrated mostly in the health care sector, specifically in nursing homes and assisted living facilities. PCK has little exposure in that arena, and the fund is made-up mostly of investment grade credit. With the state of California seeing a strong recovery over the past two years and enjoying a high level of federal aid, I would expect the credit quality of the underlying bonds to hold up very well through the remainder of 2022.

Bottom-line

PCK was a great pick-up in June for those who bought in. The fund pumped out a double-digit return, around 15%, in a very short time period. Since then, performance has stabilized, but we are still looking at an 8% return in three months. For a mostly IG-rated muni bond fund, this is pretty impressive performance.

While this bullish momentum is encouraging, I would tend to get a bit more cautious here. The discount to NAV is gone, and the fund now sits with a premium. That always makes me a little more hesitant on new positions. The income metrics are also strong, but they have declined a little bit since that June review as well. Finally, muni bonds as a whole look very attractive to me, but that doesn’t mean PCK is necessarily the best way to play it. For non-Cali residents and for those who prefer funds at a discount, other options are out there. Therefore, I believe a shift to “hold” on this fund is warranted, and I would urge readers to be selective on any new positions at this time.

Be the first to comment