Sundry Photography

Investment Thesis

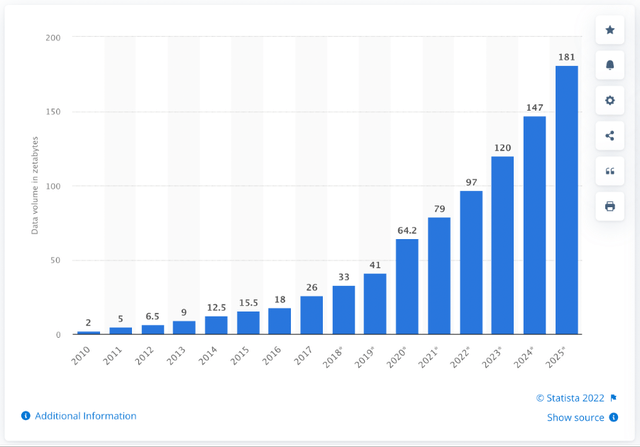

Data-driven is a phrase that has been thrown around for some time now, but how does an organisation become data-driven? In the past, companies were able to handle their own ‘big data’, but big data has become bigger and bigger – and businesses are starting to turn to specialists in order to make sense of all the data they collect.

Volume of data/information created, captured, copied, and consumed worldwide from 2010 to 2020, with forecasts from 2021 to 2025 (Statista)

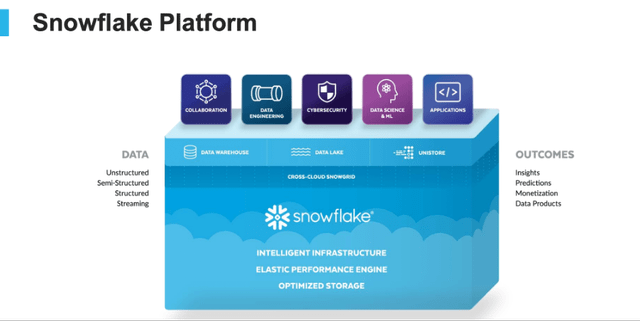

Enter Snowflake (NYSE:SNOW), a cloud data platform that helps transform the incredible amount of data that companies ingest every day into actionable business insights. The company is cloud-agnostic, meaning that it can bring data from any of the major cloud providers into one ‘single source of truth’.

For me, one of the most compelling aspects of Snowflake as an investment is the sheer amount of optionality that the company has, as our ‘data-driven’ future opens plenty of opportunities.

Snowflake Q2’23 Investor Presentation

You may have heard also the phrase ‘data is the new oil’ thrown around over the past 5 years (although admittedly, I know which one I’d prefer a bit more of right now…), and Snowflake is the type of business to invest in if you believe this trope to be true.

So, does Snowflake look like a good investment right now? I put it through my framework to find out.

Business Overview

Snowflake operates a leading independent cloud data platform, with a mission to ‘enable every organisation to be data-driven’. This platform is used by companies across a multitude of industries to consolidate their data into a single source that can be used to create actionable insights, build data-driven applications, and share data.

Snowflake Q2’23 Investor Presentation

Perhaps surprisingly, Snowflake operates a usage-based revenue model. Its product revenue is based on each customers’ consumption on Snowflake’s platform, as opposed to a classic SaaS business that receives subscription-based revenue regardless of usage.

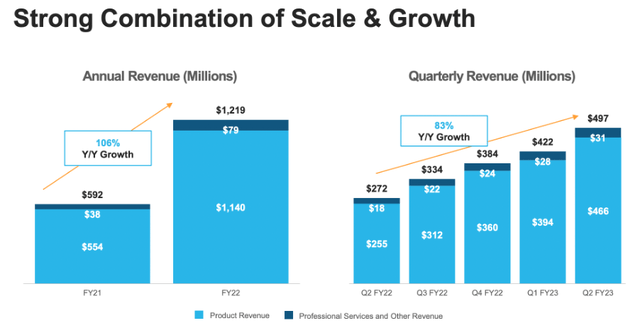

The majority of Snowflake’s revenue comes from the use of storage, compute, and data transfer resources consumed on the platform. One of the benefits of this model has been Snowflake’s ability to grow revenue rapidly, as its customers continue to utilise more and more Snowflake solutions. This can clearly be seen by the stellar growth in revenues that Snowflake has been enjoying.

Snowflake Q2’23 Investor Presentation

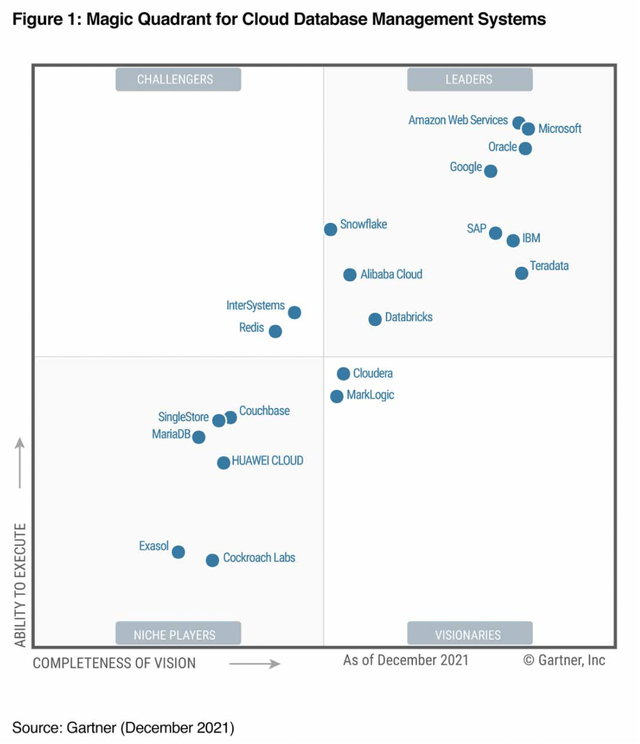

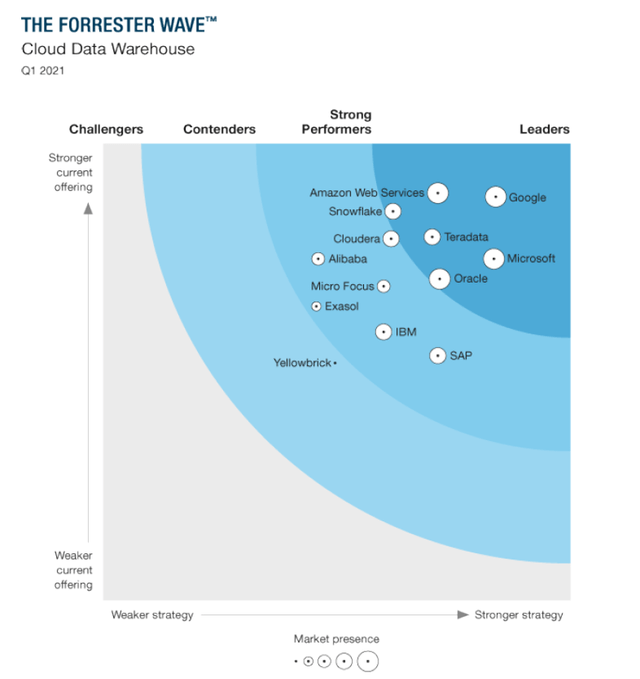

The company has also been named as a leader in both the Gartner Magic Quadrant for Cloud Database Management Systems and the Forrester Wave for Cloud Data Warehouse. It’s worth highlighting that, whilst Snowflake was named a leader, it was not named as a clear leader in either & doesn’t appear to be the ‘Top Dog’ in the space according to these two sources.

Yet this should not distract from the astounding growth that this business has seen over the past few years, so clearly the company is doing something right – so what makes Snowflake such a powerful business?

Economic Moats

With every business, I look to see if there are any durable competitive advantages (aka economic moats) that will help the company continue to thrive whilst protecting itself from competition.

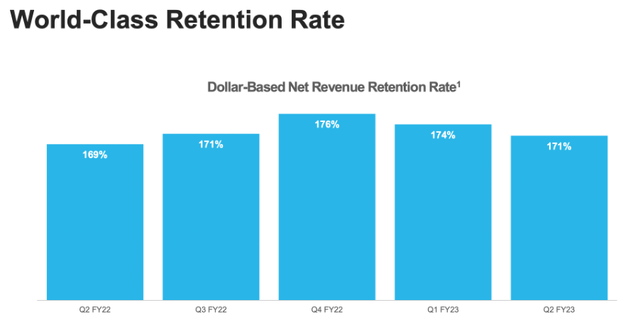

The most obvious economic moat that Snowflake benefits from is high switching costs. Once a company has embedded its data into Snowflake’s Platform, there is very little incentive to switch away; doing so would be a huge hassle. In fact, once a customer joins Snowflake’s platform, they end up spending a lot more money with Snowflake as time passes. Just take a look at Snowflake’s dollar-based net retention rate, which is without a doubt the best DBNRR that I have ever seen.

Snowflake Q2’23 Investor Presentation

This means that not only are customer cohorts staying with Snowflake, but the amount they are spending is 71% higher than it was one year ago – absolutely crazy figures for a company that has taken in ~$1.6 billion in revenues over the past 12 months.

Switching costs, however, are a moat that can be seen across most cloud and data services. Whilst this does not make it any less of a moat, it doesn’t necessarily differentiate Snowflake from its competitors – but there is something else that does.

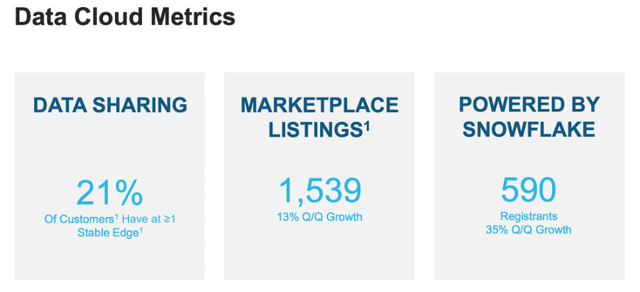

I believe that Snowflake benefits from a substantial network effect, and this is primarily thanks to the data sharing side of its platform. Snowflake customers have the ability to share their data with other Snowflake customers (and get paid for doing so), and this can work as a fantastic customer acquisition tool. If a Snowflake customer wants to share data with a non-Snowflake customer, then that non-Snowflake customer would have to become a Snowflake customer in order to benefit from this data sharing.

Snowflake refers to data sharing as a ‘stable edge’, defined as:

A “stable edge” is an edge that has produced at least 20 transactions in which compute resources are consumed and such consumption results in recognized product revenue over two successive three-week periods (with at least 20 transactions in each period).

In the latest quarter (Q2’23), 21% of Snowflake customers had at least one stable edge, whereas in Q2’22 that figure was just 15%. When it comes to the total number of customers using stable edges, the figure has been growing substantially faster than Snowflake’s overall customer acquisition; whilst total customers grew 36% YoY in Q2’23, the number of stable edges grew by a whopping 112% YoY. Considering that stable edges power this network effect, it’s easy to see why I think this is becoming one of Snowflake’s strongest economic moats.

Snowflake Q2’23 Investor Presentation

There could also be a counter-positioning argument made for Snowflake, particularly against its cloud-provider competitors of AWS (AMZN), Google Cloud (GOOGL), and Microsoft Azure (MSFT). Snowflake operates an independent, agnostic, multi-cloud platform that can centralise data regardless of who the cloud provider is. As companies look to adopt a multi-cloud strategy, Snowflake’s platform could prove to be even more important in ensuring more independence within customers’ operations.

Outlook

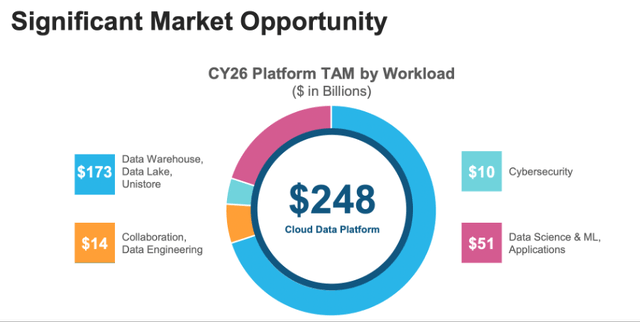

As is implied by Snowflake’s high valuation (which we’ll get to later), the future opportunity is both huge and expanding. The company sees the Cloud Data Platform market size reaching $248B by CY26; by comparison, Snowflake’s revenue over the past 12 months implies that it has captured just ~0.7% of this massive opportunity.

Snowflake Q2’23 Investor Presentation

I also believe that the world will continue to see the sheer volume of data increase exponentially over the upcoming decade, meaning that companies who can help make use of this data will be very-much in demand.

Snowflake has also shown its ability to create new solutions & products for its customers, and this ability to innovate could lead to additional revenue sources in the future that I couldn’t even think of right now.

In short, I believe that the outlook is very bright for this company.

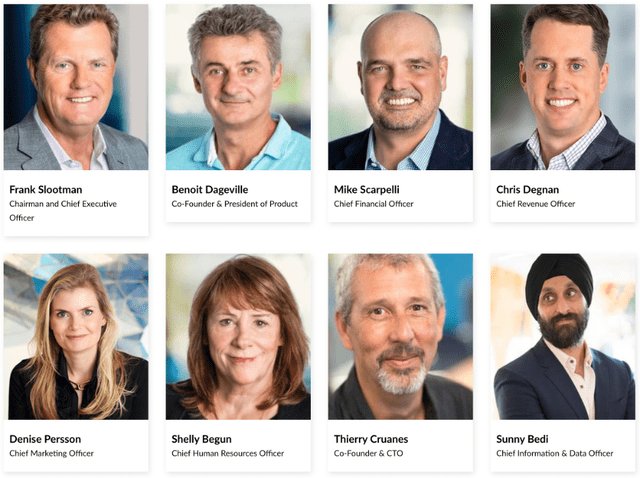

Management

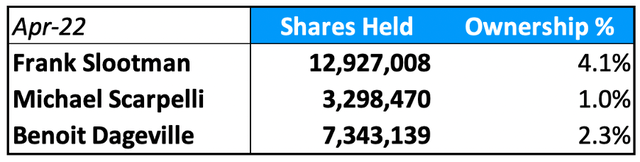

When it comes to fast-paced, innovative companies, I always aim to find founder-led businesses where inside ownership is high. Whilst Snowflake does not have any founders in the CEO role, Co-Founders Benoit Dageville and Thierry Cruanes are both still involved with the business, having roles as President of Product and CTO, respectively.

In that CEO role is Frank Slootman, a seasoned executive who was CEO of ServiceNow (NOW) from 2011-2017, guiding the company through its IPO process.

I want to invest in companies where leadership has skin-in-the-game, and perhaps surprisingly Snowflake ticks this box. I say surprisingly because normally it is the founders who own the most shares, but this is not the case for Snowflake – in fact, Co-Founder Cruanes is not even mentioned in the latest proxy statement.

The biggest surprise is that CEO Slootman is the largest insider owner, holding 4.1% of all shares outstanding, followed by Co-Founder Benoit Dageville & CFO Mike Scarpelli. Investors may lament the level of stock-based compensation dished out by Snowflake (we’ll get to that), but I am pleased to see that insiders have a good amount of skin-in-the-game as a result.

Overall, insiders own just under 9% of all Snowflake shares outstanding.

Snowflake 2022 Proxy Statement / Excel

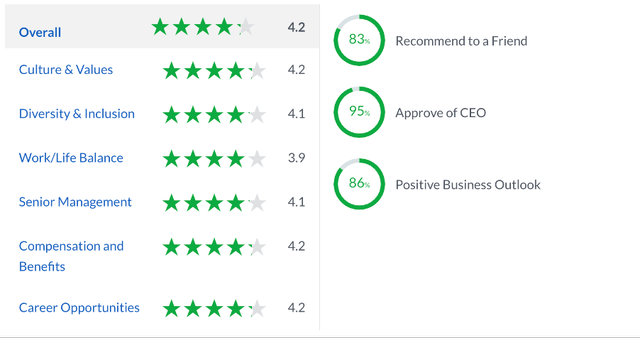

I also like to take a quick look on Glassdoor to get an idea about the culture of a company, and Snowflake gets some great scores from the 339 reviews left by employees. Any score over 4.0 is impressive, and Snowflake achieves this virtually across the board.

The two items that stand out to me as being well above average is the CEO approval rating of 95% (another nod to the job that Slootman is doing) as well as the 86% Positive Business Outlook rating. Normally, this rating on Glassdoor is lower, even for technology companies, so it goes to show that Snowflake employees truly believe this company is on course for success.

Financials

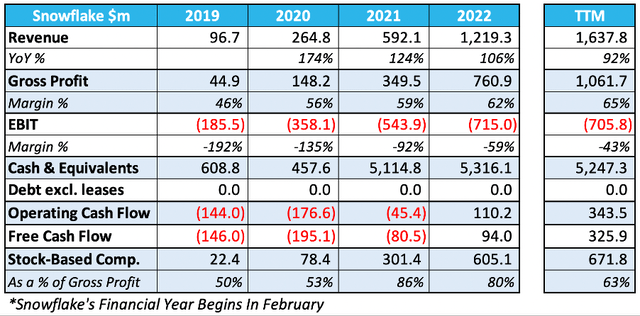

Snowflake’s financials are unlike most other businesses, and it still blows my mind when I look at its revenue growth. The company has seen triple digit YoY revenue growth over the past few years and has achieved a revenue CAGR of 133% from 2019 through to 2022 – which is even more impressive when you consider that these growth rates are off an already high base! In 2022, revenue grew by 106% to reach ~$1.2B.

Yet investors may be concerned about the, erm, ‘slightly’ negative EBIT margins… and I understand this concern. It’s not fun to see a company that appears to be losing money hand over fist, but if you want to invest in Snowflake, then this financial profile is something you’ll have to accept for the coming years. The losses in 2021 and 2022 have been significantly impacted by stock-based compensation, with a good amount of this relating to Snowflake’s $33 billion IPO back in September 2020.

If you are investing in Snowflake, then know that this business will not be profitable for a while. It will reinvest in itself to try and capture as much market share as possible – which is fine with me, because this is a huge opportunity & the platform itself has such high switching costs that aggressive customer acquisition spending makes sense.

The main reason that I am comfortable with these losses right now is because of Snowflake’s positive free cash flow & impeccable balance sheet. The company has a net cash position of ~$5.2B with zero debt, and it is bringing in more cash than it is spending. So, whilst Snowflake might be making a substantial GAAP loss right now, I don’t think the business itself is at any risk of going bust. Those EBIT margins may not make for great reading, but they are heading in the right direction, and I believe they will continue to do so for years to come as Snowflake continues to scale.

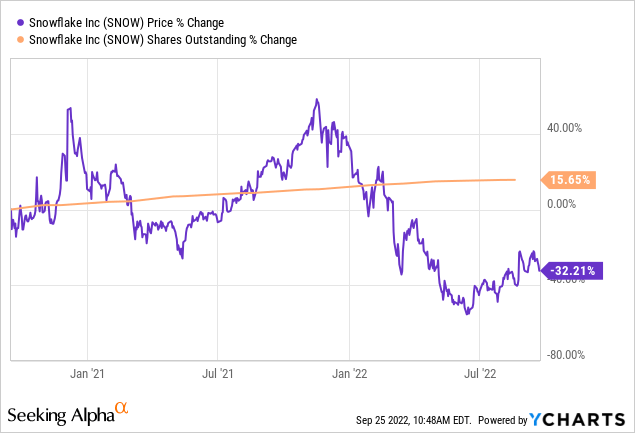

The cost of remaining free cash flow positive is, unfortunately, shareholder dilution. This stock-based compensation has resulted in Snowflake’s shares outstanding increasing by just under 15% in the two years since its IPO, and the share price itself hasn’t delivered for investors over that same period.

I do understand why investors are unhappy with Snowflake’s liberal use of stock-based compensation, and I would certainly like to see it ease up over the next few years (ideally to less than 5% dilution annually). But it is not a dealbreaker for me…

Valuation

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Snowflake is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

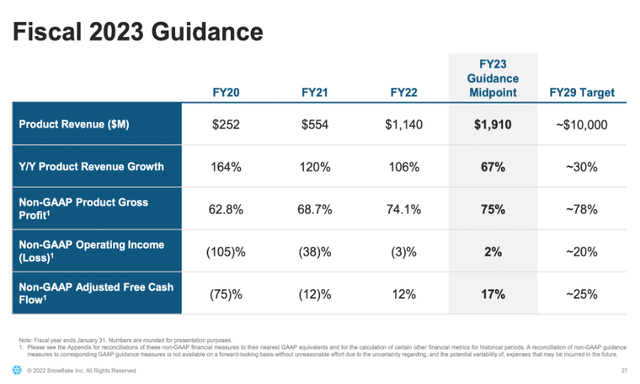

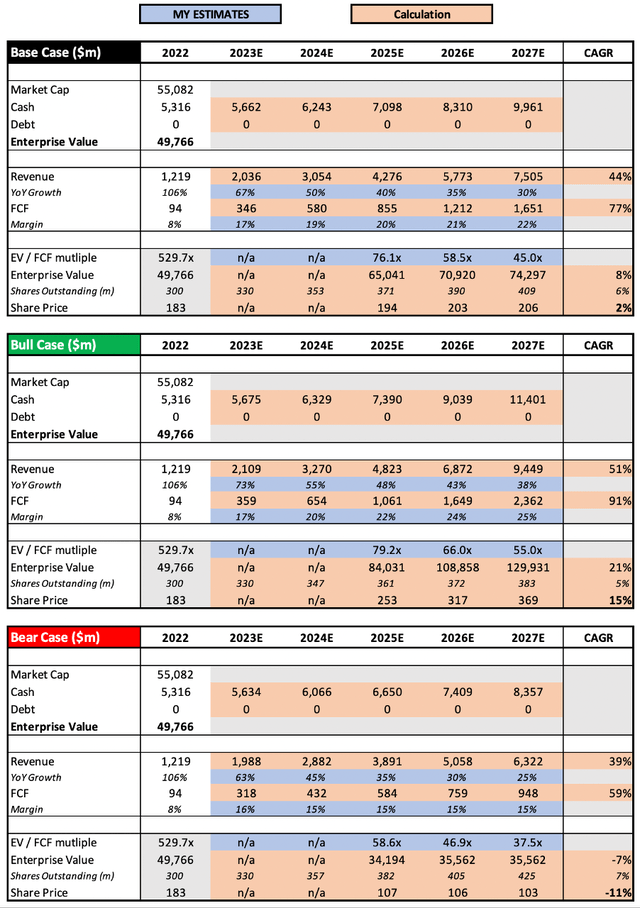

In my base case scenario, I have assumed FY23 figures to be more or less in line with management’s latest guidance. In terms of the development of revenue growth and free cash flow margins, I have also used management’s long-term business outlook as a point of reference.

Snowflake Q2’23 Investor Presentation

I’ve also assumed that shares outstanding will increase by a 6% CAGR over the period, given Snowflake’s history of shareholder dilution.

The bull case scenario for my valuation model is, perhaps unsurprisingly, a revenue growth story. I believe that Snowflake is capable of unlocking new revenue opportunities that are impossible for investors to see right now, and this should help the company continue to grow its revenues at an accelerated pace for the foreseeable future. My bear case scenario is essentially the opposite, whereby Snowflake’s hyper-growth flattens out & much of the success that is priced into its shares right now does not materialise.

Put all that together, and I can see Snowflake shares achieving a CAGR through to 2027 of (11%), 2%, and 15% in my respective bear, base, and bull case scenarios. To me, this implies that the current share price is ‘expensive’, but not insanely so.

Risks

Like many businesses out there, Snowflake runs the risk of being negatively impacted by a harsh and prolonged recession. Whilst I think the company is fairly recession-resistant due to the business-critical nature of its platform, there is a risk due to its usage-based business model. If economic activity slows down, then businesses may be receiving less data than usual, and therefore may be running fewer queries, which would lead to a reduction in Snowflake’s revenue. I believe that in the long run, the availability of data will exponentially increase, but this is a short-term risk to consider.

Another risk for Snowflake is competition. It’s going up against some huge FAANG competitors, and whilst it has been able to hold its ground so far, there is always the risk that an Amazon or a Google could swoop in & come up with a solution that is more appealing for customers. It also has more direct competition from the likes of Databricks, and the Gartner Magic Quadrant & Forrester Wave referenced earlier show that Snowflake is not the clear industry leader yet.

Finally, as we just saw, the current share price does imply a lot of future growth. If Snowflake fails to achieve this level of growth, or even gives an indication that growth is slowing down quicker than expected, then shares could tumble pretty quickly.

Bottom Line

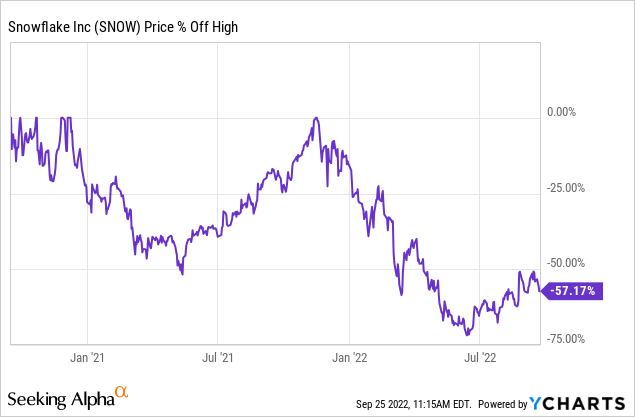

There is an awful lot to like about this business; it is in a rapidly growing industry, it is rapidly growing itself, it has a history of finding new revenue streams, it benefits from some powerful economic moats, it has a stellar balance sheet, and it still has founders involved. Yet it is an almost impossible company to value, and that has resulted in a rollercoaster ride for investors throughout this volatile market.

I think that Snowflake looks like a fantastic investment for a particular type of investor and looks like an investment to avoid at all costs for another type. If you are an investor who likes predictable businesses & steady growth, then avoiding Snowflake may be best.

However, if you are an investor who is okay with uncertainty, who understands that quality businesses can succeed for reasons beyond your initial investing thesis (look at Amazon with AWS, Apple with the iPhone, etc.), then Snowflake can look like an extremely attractive investment.

I fall slightly more into the second camp. When investing in high growth, innovative businesses, I don’t necessarily look for predictability – I look for a company that is set up to capture a huge opportunity ahead of it, possessing durable competitive advantages, with a history of increasing its TAM through creating new revenue streams, and with skin-in-the-game to ensure shareholder incentives are aligned with management.

Put all that together, and I am going to give Snowflake a ‘Buy’ rating. There are clear risks with this investment, and I will position it accordingly within my portfolio, but I know that Snowflake is a company that I want in my portfolio for the upcoming decade.

Be the first to comment