naphtalina/iStock via Getty Images

French advertising company, Criteo S.A. (NASDAQ:CRTO) has been a market laggard since its listing in 2013. This is despite a history of profitable growth. Questions about the resilience of the business have held the stock price down. In answer to those questions, management has, since 2018, worked on turning the company into a more resilient, diversified business. Given management’s success so far, it is likely that the company will be able to retain its profitability in a more resilient business model. Four years into its transformation, the company looks stronger, and its free cash flows (FCF) are trading at very attractive levels.

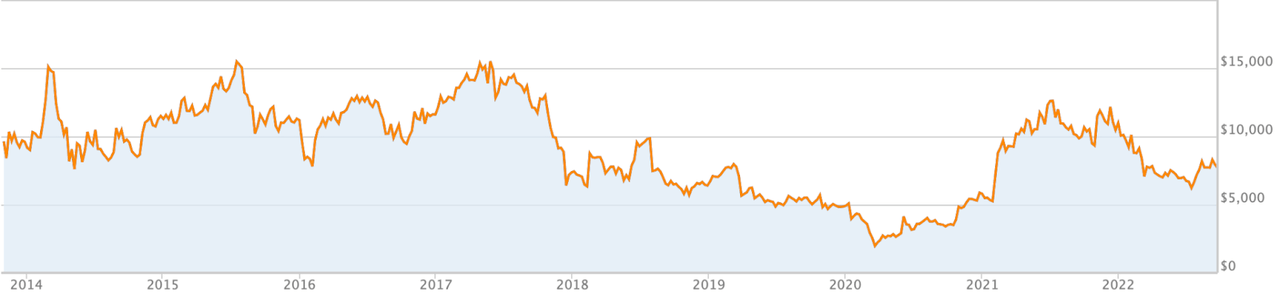

Criteo Has Been A Market Laggard

Investors in Criteo have earned a total shareholder return of -23% since the company went public in 2013.

Source: Criteo S.A.

Simply, the company has been a bad investment.

Strong Financial Performance

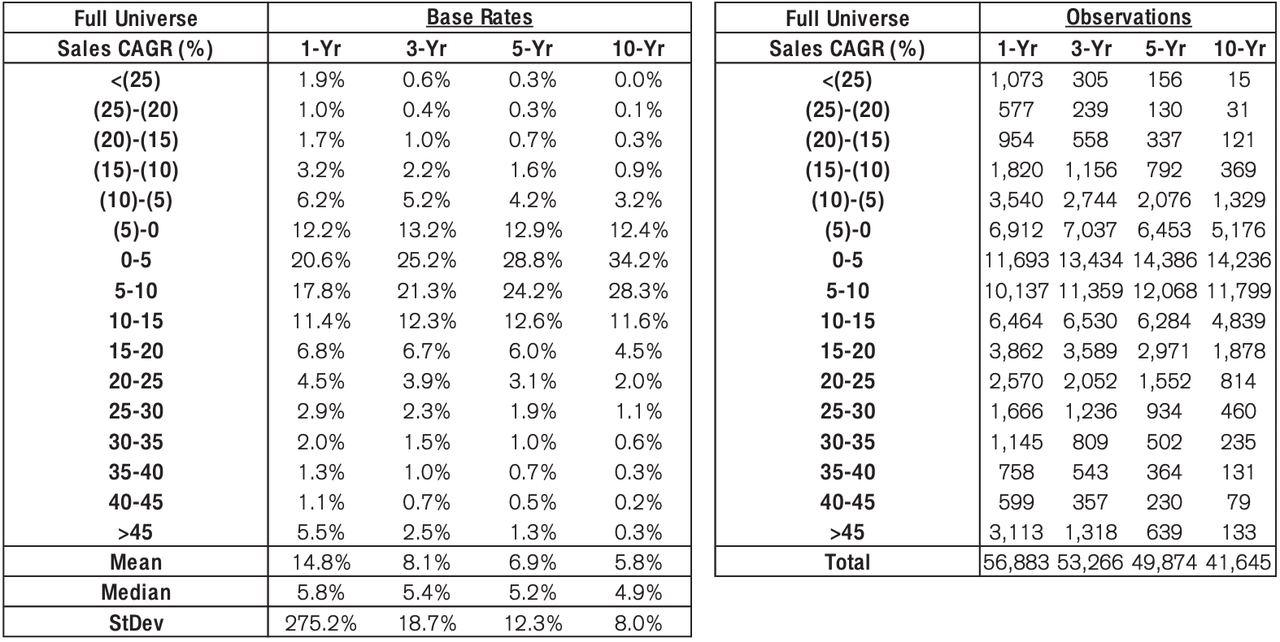

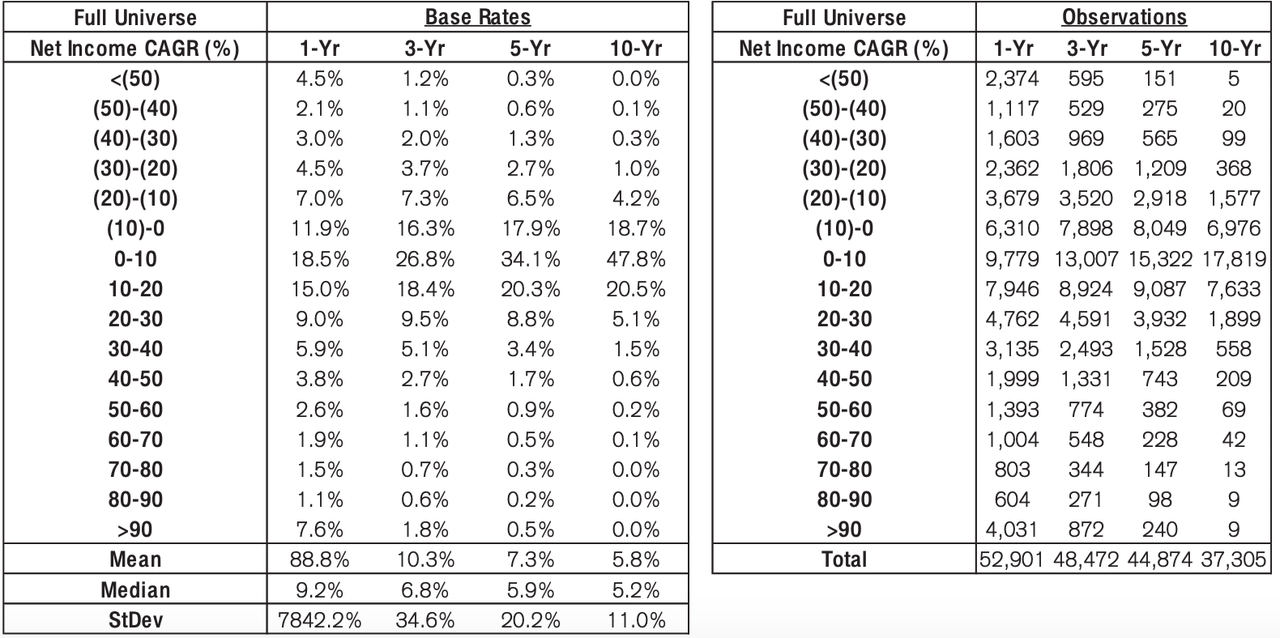

Criteo has grown revenue from nearly $272 million in 2012 to more than $2.25 billion in 2021, for a 10-year revenue compound annual growth rate (CAGR) of 23.56%. According to Crédit Suisse’s The Base Rate Book, just 2% of firms achieved returns of that magnitude between 1950 and 2015. Revenue in the trailing-twelve-month (TTM) period is nearly $2.17 billion.

Source: Crédit Suisse

Although gross profitability declined from 0.74 in 2012, to 0.34 in 2021, it remains higher than the 0.33 threshold Robert Novy-Marx found to be attractive. In the TTM period, gross profitability rose to 0.42.

Criteo’s operating profit margin rose from 3.3% in 2012, to 6.7% in 2021, falling to 3.2% in the TTM period.

The company’s net income rose from $0.98 million in 2012, to nearly $134.5 million in 2021, for a 10-year net income CAGR of 63.58%. According to The Base Rate Book, just 0.1% of companies in the 1950-2015 period attained a similar growth rate.

Source: Crédit Suisse

In the TTM period, net income has risen to more than $84 million.

Criteo’s FCF shot up from -$1.76 million in 2012, to nearly $166 million in 2021. In the TTM period, FCF is $146 million.

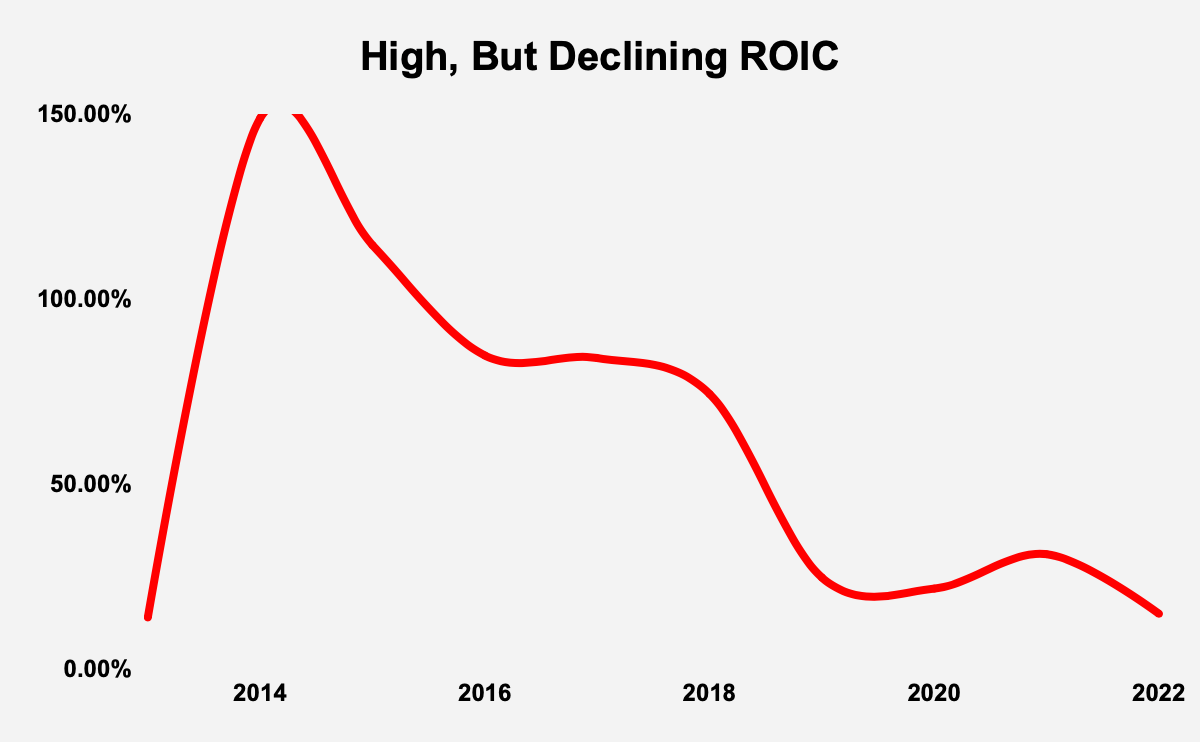

The company’s competitive positioning, indicated by its declining gross profitability, is further demonstrated by its high, but declining return on invested capital (ROIC). Having started at 13.9% in 2013, ROIC shot up to nearly 149% in 2014, and has steadily declined since, reaching 31% in 2021 and 14.9% in the TTM period.

Source: Author Calculations, Criteo Annual Reports

As a growth stock, Criteo has rapidly grown its assets, from over $137 million in 2012, to nearly $1.99 billion in 2021, at a 10-year asset CAGR of 30.63%. There is an inverse relationship between asset growth and future returns, known in the academic literature as the asset growth effect. The risk of misallocation of funds and oversupplying the market leads to this inverse relationship. Therefore, it is interesting that the company’s assets have declined in the TTM period, to just over $1.87 billion, while the company’s profitability has increased.

Building Resilience Into Criteo

Criteo’s poor market performance is a reflection of the challenges it has faced as a firm in the digital advertising sector. The business model is fairly standard: the company shows interactive banners ads that appear based on a person’s browsing preferences and behavior. Criteo is paid on a pay per click/cost per click (CPC) basis.

Digital transformation has disrupted the advertising business, with advertising shifting from print, TV and radio, to digital media. However, advertising obeys network effects, and this lends the industry to winner-take-all outcomes, and, Alphabet Inc. (GOOGL) and Meta Platforms, Inc. (META) have been the big winners. Hence, although the company has clearly been well run and able to generate strong financial results, there are significant doubts over whether it will be a winner in the market.

Criteo has not been able to build the kind of resilient business model that digital advertising makes possible.

Apple Inc’s (AAPL) 2017 introduction of the Intelligent Tracking Prevention (ITP) feature in Safari 11 caused the company to lose $25 million in revenue. The company redesigned its platform architecture in response, with revenues in 2018 falling just 1%. Criteo has also been affected by perceptions that the European Union’s (EU) General Data Protection Regulation (GDPR) would hurt it.

The company’s struggles reflect the importance that Apple, Alphabet, Meta, Amazon (AMZN) have on the digital advertising solutions market. Criteo has an obvious disadvantage with regards to those firms, because they can leverage the data gathered from their platforms, and use those platforms, to achieve scale economies that elude Criteo. Those businesses are larger, better resourced, and able to compete on price. Those companies also provide self-service options that users of their platforms can use to promote their brands. This is a far greater problem for Criteo than competition from true peers, because true peers cannot move the market or disrupt it like Big Tech can. There is also a risk of firms such as Adobe (ADBE), Oracle (ORCL), and Salesforce Inc. (CRM) creating tools that allow them to create their own in-house campaigns.

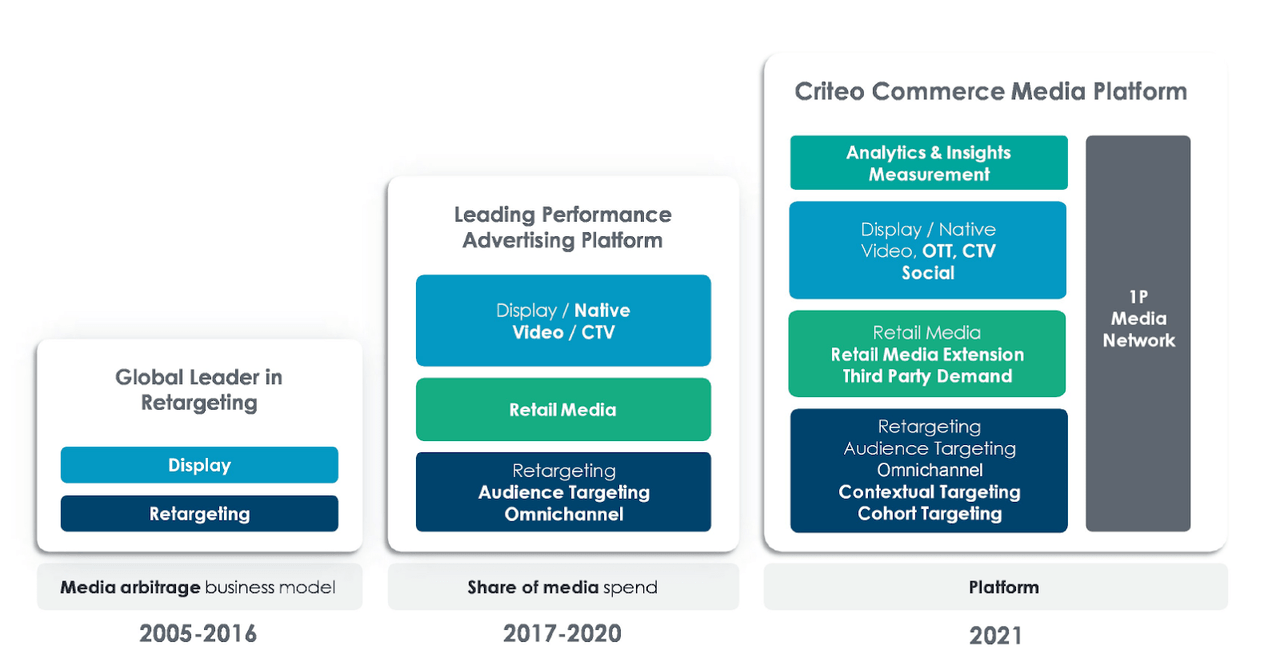

The 2018 return of the company’s founder, Jean-Baptiste Rudelle, as CEO of the company, was in response to the greater existential questions that the company’s financial performance belies. The company has, since then, worked on a transition toward a multi-product platform, the Criteo Commerce Media Platform, in an attempt to build resilience into the company’s business model. Megan Clarken has been CEO since late 2019, and has continued the company’s long-term transformation plan.

Source: 2021 Annual Report

The company has been able to grow profitably despite the many questions on its business model. That is a reflection of the quality of the business, which has been able to exploit the significant and still existing tailwinds in digital advertising:

-

Ecommerce remains a stronger driver of growth, despite returning to the pre-pandemic trend line.

-

First-party data has shown that it can provide meaningful value creation, with Amazon.com, Inc., Walmart Inc. (WMT), and Walgreens Boots Alliance, Inc. (WBA) showing strong ad revenue growth.

-

The EMEA State of the Retail Media Industry Study commissioned by Criteo found that 92% of brand advertisers believe that their growth depends on retail media.

-

34% of retailers believe that their success will depend on their ability to form meaningful partnerships with ad tech and media companies.

Criteo’s success thus far suggests that the long-term transformation plan will deliver a profitable and more resilient business.

Valuation

The company has a price/earnings (PE) ratio of 21.12, against a 5-year average of 18.46. The S&P 500 is trading at a PE ratio of 18.99. Criteo appears overvalued. However, in terms of its FCF yield (FCF/enterprise value), the company has an FCF yield of nearly 12.3%. This is vastly more attractive than the FCF yield of the 2,000 largest businesses listed in the United States, which New Constructs calculates as 1.5%. Criteo’s fast-growing FCF are, therefore, trading at a much more attractive valuation than the market’s FCF.

Conclusion

Criteo has greatly underperformed the market since going public. This is despite a demonstrated ability to grow profitability. Nevertheless, questions about the company’s business model, given the nature of digital advertising, has caused its underperformance. The business has been steadily changing its business model, and, given that it has so far been profitable, its more resilient business model should make Criteo a more attractive investment. In addition, the company’s fast-growing FCF are trading at a level comfortably higher than the market’s.

Be the first to comment