Despite the currently depressed oil prices, Whitecap Resources’ (OTCPK:SPGYF) management announced during the first-quarter earnings it would maintain the company’s dividend.

Before discussing why that decision could have a negative impact on the Canadian oil producer, let’s have a look at how the company is navigating through these challenging times.

Photo by WORKSITE Ltd. on Unsplash

Note: All the numbers in the article are in Canadian dollars unless otherwise noted.

First-quarter results

In the first-quarter press release, management highlighted the company’s strong performance:

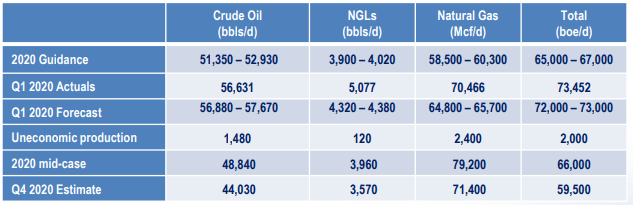

“We achieved average production of 73,452 boe/d which was higher than our forecast of 72,000 – 73,000 boe/d and capital expenditures were $138.8 million which was lower than our forecast of $140 – $150 million.”

That statement doesn’t mention the better-than-expected performance was due to the C$16.2 million acquisition of the Canadian oil producer Hyak Energy on January 15, though.

The company’s Q1 MD&A reveals Hyak Energy contributed to C$2.0 million of Whitecap Resources’ Q1 revenue, which suggests Hyak Energy contributed to more than 500 boe/d of Whitecap Resources’ Q1 production.

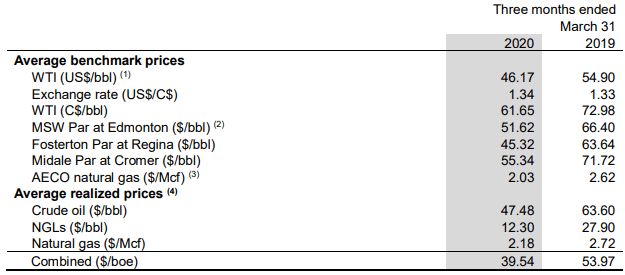

In any case, given the lower year-over-year average commodity prices during Q1, funds flow dropped to C$131.7 million, down 18.2%, despite the 3.9% increase in production compared to last year.

Source: Q1 2020 MD&A

The company’s net debt increased to C$1.27 billion, up from C$1.19 billion at the end of last year, partly because of the Hyak acquisition.

As a result of the increased net debt and lower funds flow, the net debt-to-annualized funds flow ratio jumped to an elevated ratio of 2.4, up from 1.6 three months before.

Also, because of the decrease in forecasted commodity prices, management recorded a huge C$2.9 billion impairment expense.

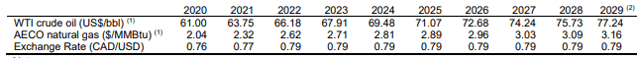

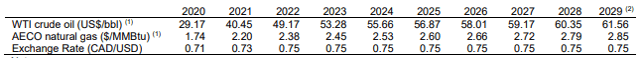

Before the coronavirus-induced oil price crisis, Whitecap Resources had forecasted WTI prices to increase every year over the long term, starting at US$61/bbl in 2020.

Source: Q1 2020 financials

In contrast, you can see below the much more conservative forecasted WTI price assumptions that led to that write-down. The company’s price deck below indicates WTI prices are forecasted to stay below US$50/bbl until 2022 included.

Source: Q1 2020 financials

The increase in the after-tax discount rate used to determine the value of the assets, from 10% at the end of 2019 to 13% at the end of Q1, contributed to C$908.3 million of impairment.

Survival mode

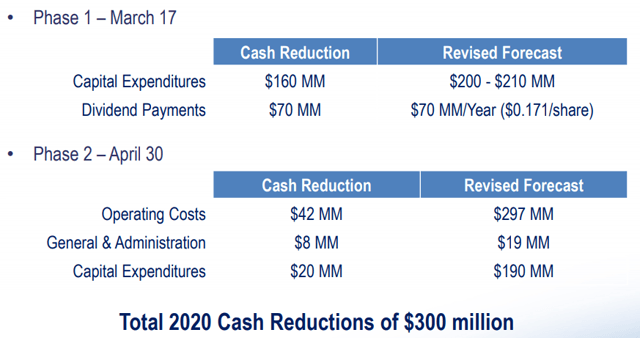

Given the depressed and volatile oil prices over the last few weeks, management announced in March a capital reduction program and a dividend cut to protect the company’s balance sheet.

But since the situation isn’t improving, management announced extra measures last week to avoid producing at losses.

These decisions are summarized in the slide below.

Source: Presentation April 2020

As a result, management plans to shut-in 2,000 boe/d in 2020. And with the company’s reduced capital program, annual production should drop to 66,000 boe/d, down from 71,500 boe/d previously, based on the midpoint of guidance.

Source: Presentation April 2020

Given the company’s capital program of C$138.8 million during Q1, management expects capital expenditures will amount to only C$51 million for the rest of the year to reach C$190 million, which explains the forecasted drop in production to 59,500 boe/d in Q4.

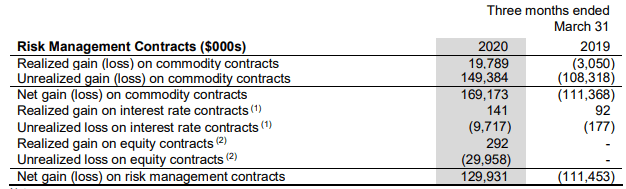

Strong hedges for now

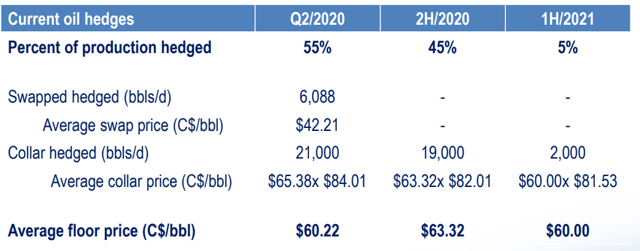

Whitecap Resources should profit from its strong hedging position this year. Its first-quarter funds flow benefited from C$19.8 million of realized gain. And unrealized gain amounted to C$149.4 million at the end of last quarter.

Source: Q1 2020 MD&A

But strong hedges aren’t a sustainable advantage in the context of depressed commodity prices.

As an illustration, the table below shows a summary of the company’s hedges. Whitecap Resources hedged only 5% of its expected oil production in 2021, at lower average collar prices compared to 2020.

Source: Presentation April 2020

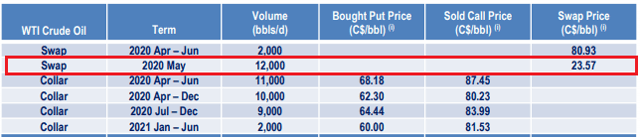

Also, the company added some WTI hedges after Q1 at swap prices that seemed unthinkable a few weeks ago: It hedged 12,000 bbls/d in May at C$23.57/bbl.

Source: Presentation April 2020

Dividends vs. balance sheet and acquisitions

Management is taking the right operational decisions to face this challenging oil environment. But the decision to maintain the dividend could have a negative impact on Whitecap Resources.

After its cut by 50% in March, the annual dividend still represents a cash outflow of C$70 million.

Considering the company’s funds flow of C$131.7 million this quarter and the C$190 million annual capital program, the dividend seems covered by free cash flow if 2020 average oil prices remain constant compared to Q1 prices.

But hoping for average Q1 oil prices to stay constant over the year seems optimistic.

Besides, the company’s production will be decreasing and hedges will expire. Thus, funds flow will diminish at constant commodity prices, which will have a negative impact on the company’s debt ratios.

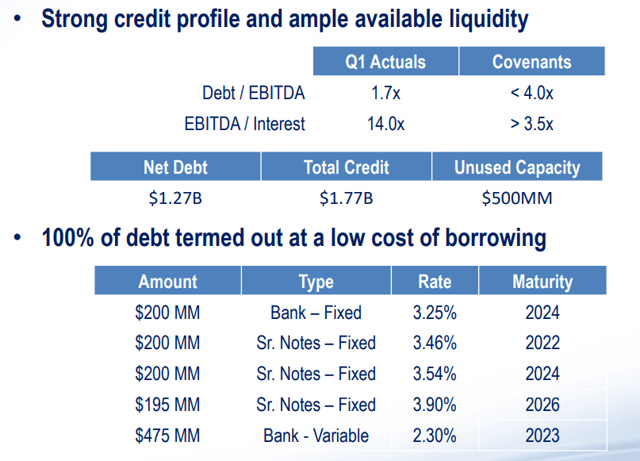

Whitecap Resources’ latest presentation highlights a strong debt profile. However, you should take into account the debt ratios listed in the slide below are based on trailing-12-month results, which benefited from much higher average oil prices than this year.

Source: Presentation April 2020

Given the currently volatile oil environment, debt ratios can worsen quickly. We have seen that at an average WTI price of US$46.17/bbl, the company’s net debt-to-annualized funds flow ratio increased to 2.4 at the end of Q1, up from 1.6 three months before despite a stable Q1 production volume quarter over quarter.

Also, refinancing long-term debt at the same rates as listed in the table above (less than 4%) seems unlikely, and Whitecap Resources will face an increase in its financing costs by 2022.

In addition, in the Q1 press release, management said it is considering acquisitions:

“We believe that mergers and acquisitions in the industry will occur and are necessary for a meaningful recovery in the sector. Whitecap is well positioned with our sustainable income and growth strategy to not only survive but to continue to look for opportunities internally and through industry consolidation to provide enhanced shareholder returns.”

Whitecap Resources could sustain its dividend this year at low oil prices thanks to its strong hedges and reduced capital program. But that strategy isn’t sustainable as production is decreasing and as long as the coronavirus situation and the oil price war persist.

Instead, the company should suspend its dividend and keep the corresponding C$70 million annual cash to reduce its refinancing risks. That would also provide management with extra dry powder for attractive acquisitions in a depressed market.

Note: If you enjoyed this article and wish to receive updates on my latest research, click “Follow” next to my name at the top of this article.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment