bagi1998

Zinc is a commodity that is less known in the investor community but deserves more attention. Current LME data shows that zinc inventories are at an all-time low historically due to production cuts.

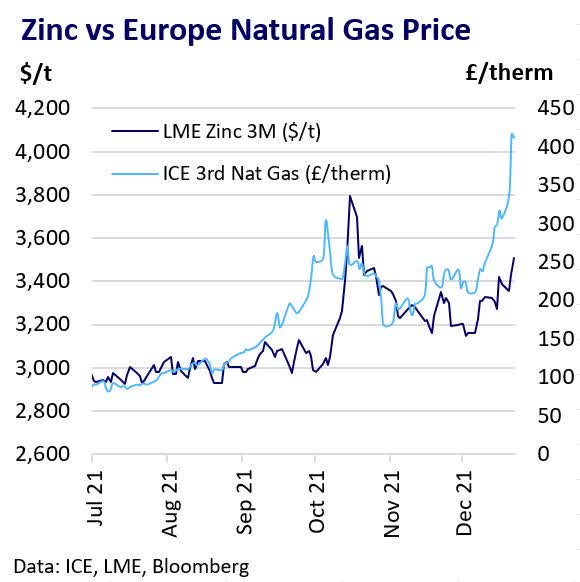

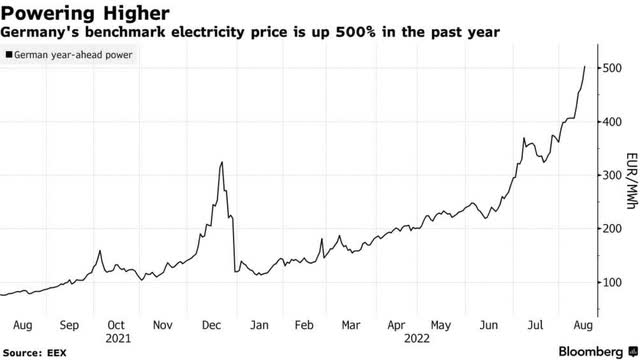

The recent energy crisis in Europe has led to skyrocketing electricity prices, which is now impacting production of zinc. On average, it takes 4,000 kWh of electricity to produce one tonne of zinc. With electricity prices in Europe reaching 500 EUR/MWh it isn’t difficult to see that zinc production is unsustainable. It would cost 2000 EUR of electricity to produce 1 tonne of zinc.

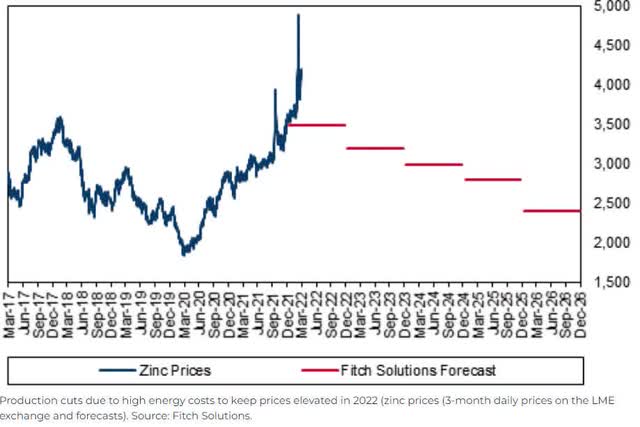

The zinc price currently stands at $3500/tonne and would leave no margin at all when including other costs like raw material and labour. This is why zinc smelters like Nyrstar have shut down their production. Zinc smelters in China are feeling the same pain as 500,000 tonnes of zinc smelting capacity has been shut down. Due to elevated electricity prices, Fitch Solutions estimates that the outlook for the zinc price will stay elevated for quite some time.

The following chart shows that the zinc price is highly correlated to natural gas/electricity prices.

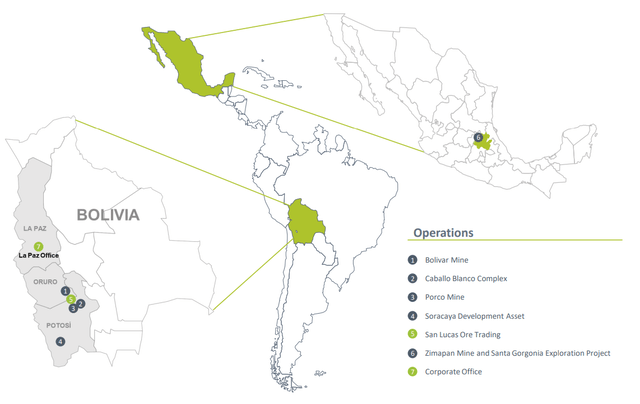

ICE, LME, Bloomberg

This is where Santacruz Silver (OTCPK:SZSMF)(TSXV:SCZ:CA) comes into play. Last year, the company acquired a portfolio of Bolivian assets from Glencore, including a 45% interest in the producing Bolivar and Porco mining operations held through an unincorporated joint venture with Corporación Minera de Bolivia (“COMIBOL“), a Bolivian state-owned entity, (the “Illapa JV“), a 100% interest in the Sinchi Wayra business which includes the producing Caballo Blanco mining complex (“Caballo Blanco“), the Sorocaya project located in Bolivia (“Soracaya“) and the San Lucas ore sourcing and trading business (“San Lucas“). The mine life of these assets are between 10-20 years and were paid for in cash ($20 million) and debt ($90 million over 4 years). Prior to this acquisition, the company only owned the Zimapan mine in Mexico.

These newly acquired Bolivian assets produce mainly zinc with silver and lead by-product. Santacruz Silver sells its concentrate to the Antofagasta smelter in Chile which by coincidence is a country operating at a very reasonable electricity price.

According to GlobalPetrolPrices.com, Chile’s electricity prices are less than half the amount of the German counterpart. This gives Santacruz Silver and its Chilean smelter a competitive advantage compared to European smelters.

Investors don’t seem to have absorbed this news yet as the stock price is still trading at valuations prior to acquisition. The fully diluted market cap of Santacruz Silver currently stands at $135 million. Silver equivalent production for Q2 2022 was 4,046,328 silver equivalent ounces. A rough calculation at spot prices gives us a revenue of $125 million for Q2 2022 or $500 million for the full year. That amounts to almost 4 times the current market cap. On the cost side we can use the AISC per equivalent ounce of silver for Q1 2022 which was $18/ounce, resulting in $70 million in costs for Q1 2022. Q1 only incorporated 13 days of production from the newly acquired Bolivian assets so I expect the AISC to go lower in Q2 2022. Nevertheless, the operating profit should be in the order of $50 million in Q2 2022 with net earnings not too far from that. Annualized, the company is trading at a P/E ratio close to 1, which is a massive buying opportunity. I expect that Q2 2022 earnings will be a real eye-opener for new investors to jump in.

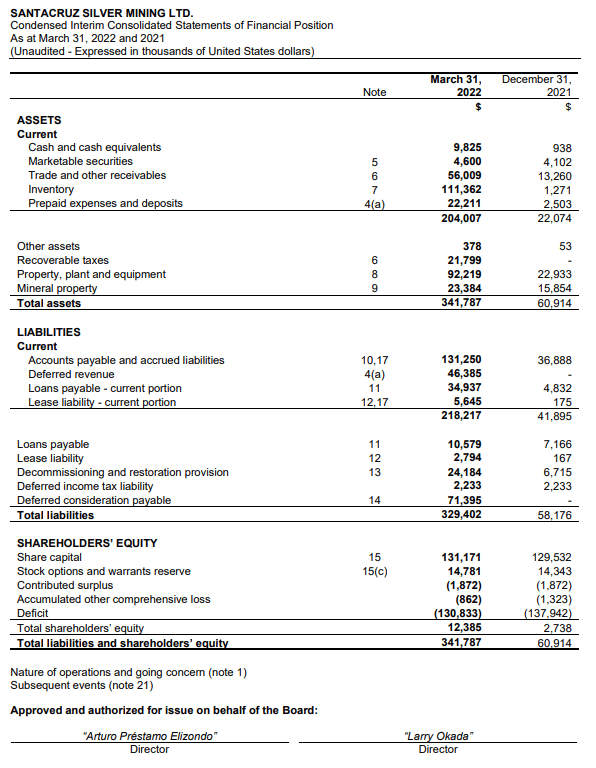

The balance sheet shows an equity of $12 million with $80 million of debt. This is a considerable amount of debt compared to equity, but can easily be paid off over the coming years with incoming cash flow.

SEDAR

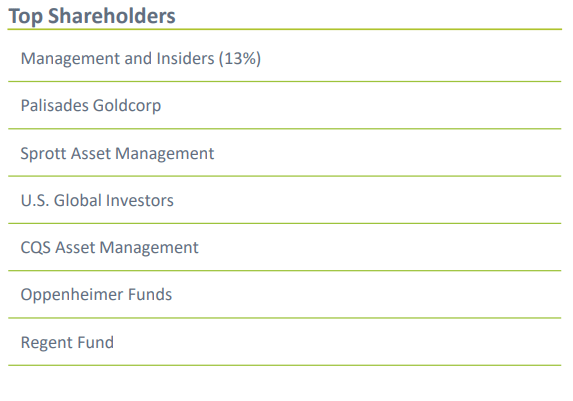

Santacruz Silver has backing from prominent institutional funds like Sprott Asset Management and management owns a considerable amount of stock.

Santacruz Silver

On a final note, there are some caveats investors should take into account.

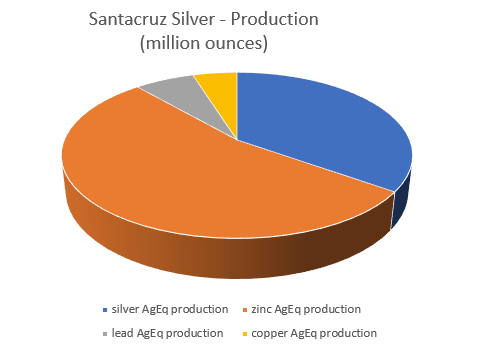

First of all, Santacruz Silver is highly leveraged to the zinc and silver price. Using metal prices of Ag $25.60/oz, Pb $0.94/lb, Zn $1.20/lb and Cu $4.01/lb, zinc occupies about 54% of total production while silver occupies 35%. According to my calculations zinc must stay above $1/lb and silver must stay above $15/ounce to stay profitable.

Santacruz Silver

Second, electricity prices are rising all over the world. Zinc production could be impacted due to higher costs.

Third, the company has $80 million of debt outstanding. If market conditions change, there can be no assurance that this debt can be repaid.

Knowing these risks, I still see Santacruz Silver being an excellent play on zinc and silver considering the risk-reward.

Be the first to comment