gece33

Introduction

Janus Henderson Group (NYSE:JHG) published 2Q22 results in late July. In this note, I depart from my usual approach of analyzing key quarterly operational performance outcomes, and instead focus on what can be discerned from the materials and commentary put forward by the group’s new CEO. In addition, I provide an update on my fundamental valuation of the stock, full details of which are set out below.

New Leadership – Significant Disruption Expected

2Q22 was the first set of JHG quarterly results to be delivered by the group’s new CEO, Ali Dibadj. In my May 2022 JHG Seeking Alpha note, I commented that “it would come as no surprise if Dibadj announced a raft of new strategic initiatives in late 2022”; the CEO’s commentary at 2Q22 confirms that changes are indeed coming.

In his 2Q22 management speech and the subsequent Q&A session, the new CEO made the usual obligatory complimentary remarks about his new employer, with references to JHG’s “very talented and motivated employees”, the existence of a “portfolio management powerhouse at the firm”, and the “potential” in the business. More interesting, and relevant to the investment case for the stock, were Dibadj’s comments referencing headwinds for the business, market share losses, and share price underperformance. As to Dibadj’s thoughts regarding the underlying causes of JHG’s problems, his comment regarding the lack of a sense of accountability and urgency struck me as highly pertinent. In his management speech, the CEO wrapped up his initial summary of JHG’s strategic position and outlook as follows:

Source: JHG 2Q22 Presentation, slide 17.

The transition period that the CEO referred to is likely to involve material costs and organizational disruption. It was something of a relief to see the company acknowledge the need to drive increased efficiencies in order to help fund and facilitate these changes; however, it would be prudent to anticipate significant restructure charges in coming periods.

Dibadj has already made some personnel changes. A few days before Dibadj formally joined JHG, the company announced the departure of Global Head of Distribution, Suzanne Cain – the wording of the announcement refers to a separation agreement, which is often a sign that the departure was not on the best of terms. Whilst Cain left prior to Dibadj taking the reins, it is likely that he approved the decision, and in my opinion, he may well have triggered the move.

Further executive changes have been announced in recent weeks. Two new appointments were made to the North America sales team in mid-July, and a new Global Head of Enterprise Data Management was appointed just nine days later. We can expect to see more press releases of this nature in the coming months. I also expect that there will be plenty of senior staff movements that will not quite be high-profile enough to warrant press releases, but that will be material in terms of impact on the business. Introducing new and more detailed performance metrics to drive improvements in accountability and urgency sounds like a sensible move, but to do so without incurring downsides relating to micromanagement and staff burnout risk is not easy.

Whilst high rates of staff turnover at senior levels is somewhat concerning, it ought not to come as a surprise given that Dibadj is a) an external appointment, and b) has a background in strategy-focused roles (Dibadj was Head of Strategy at AllianceBernstein). I think that it is fair to say that Dibadj was hired to be an agent of change – and it looks as though he intends to strive to meet that expectation. Shaking up JHG’s sales team and approach is likely to be a major group focus over the next six to twelve months.

Excellence in strategic analysis alone is not sufficient to drive successful organisational change – leadership and people management skills will be vital if Dibadj is to deliver results for the Board and shareholders. For those investors hoping for a quick fix and turnaround in JHG’s fortunes, I’d point to the comment from the CEO below:

But in this industry, as you know, each change one makes takes a long time, typically more than a year to deliver signs of progress.

Source: Seeking Alpha JHG 2Q22 Results Transcript, page 10.

Other noteworthy points that the CEO raised include:

- Product investment performance is good, but is not being properly leveraged due to low levels of brand awareness.

- Sales resources can be better aligned to faster growing markets/channels.

- JHG’s client service levels are high and a competitive advantage.

Product Offering Gaps – Acquisitions Ahead?

Dibadj believes that JHG’s clients want to do more business with the group, but are unable to do so due to gaps in the product set. The term ‘gap’ here is very broad, with the CEO mentioning asset classes, channels, geographies and vehicles. I find this aspect of the CEO’s analysis rather vague, as almost all fund managers would have product gaps when looked at from such a wide perspective. The move to fill in the gaps is already underway, with a team of four investment managers recently hired from Danske Bank Asset Management to run a new JHG emerging market debt offering.

I would much rather see a business filling in product gaps organically than via acquisition. The former approach takes time of course, and I suppose that few CEOs are willing and incentivized to focus on something that may not deliver meaningful results during their tenure (and unfortunately too few Boards are willing to drive longer-term agendas). In my experience, acquisitions by large fund managers of successful smaller businesses tend to deliver handsome rewards for the owners of the acquired fund managers and very mixed results for shareholders of the acquiring entity. High-performing innovative, specialist and boutique operations have a habit of fading to average after being swallowed up by industry mammoths. One thing in JHG’s favor at present is that weaker investment markets will hopefully reduce the risk of the company paying excessively high prices when shareholder funds are used for the purposes of filling in product gaps.

Another stock that I cover, Franklin Resources, Inc. (BEN) has gone on an extended acquisition spree in order to diversify its business and fill in product gaps. I am less than optimistic about the prospects of BEN’s strategy delivering genuine value for shareholders. Refer to my November 2021 BEN publication for further discussion on the topic, and note that BEN has continued to acquire in 2022.

Fundamental Valuation

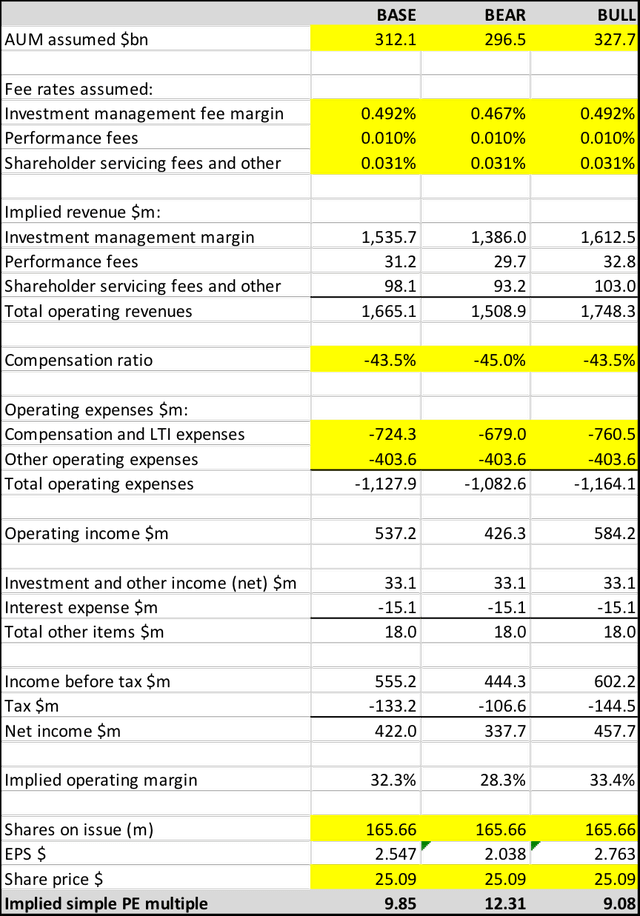

In the calculations below, I put forward a simple P&L model for JHG that can readily be flexed to consider a number of scenarios. Note that the calculations are in line with the adjusted results that JHG’s management presentations refer to. I direct readers to my previous Seeking Alpha JHG notes for detailed discussion of the normalized earnings valuation methodology adopted.

Under normal circumstances, my Base Case valuation builds up from the most recently published AUM (30 June 2022, 2Q22). At the time of writing, equity markets have risen materially since 30 June 2022, with the S&P 500 total return index up 9.6% and the MSCI World TR index up 7.7% for the period to 22 August 2022. Given the high sensitivity of asset management earnings to AUM levels, using the 30 June 2022 AUM would generate a valuation that is not closely reflective of the current underlying position. Working from JHG’s 2Q22 AUM asset mix, my estimated mark-to-market AUM is around 5.6% higher than the reported 2Q22 level. Note that I have also made an explicit allowance in the valuation AUM for the remaining -$4.0bn redemption relating to a European insurance client mandate loss. In line with previous research notes, the Bear Case assumes a 5% fall in AUM from the Base Case level, and the Bull Case assumes a 5% increase in AUM. The valuation summary on this basis is shown below.

Table 1:

Source: Author’s calculations using data from JHG financial reports.

Conclusion – Downside Risks Priced In – Buy Retained

My fair-value benchmark for a fund manager is a P/E of around 12x. At $25.09 per share, the valuation scenario framework outlined above indicates that JHG is trading at a P/E of between 9.1x and 12.3x, with a Base Case of 9.9x. On that basis, JHG looks to be around 20% cheap.

Focusing on the Base Case scenario, if I were to simply adopt the 30 June 2022 reported AUM level (adjusted for the flagged -$4.0bn redemption), then the implied P/E would increase to 10.8x. Put another way, if investment markets retract to levels seen at the end of June, JHG at $25.09 per share will still look quite cheap, but with approximately half the potential upside that exists at current market levels.

The near-term downside risks associated with the strategic changes being pushed through by the new CEO are material. If JHG executes well on the change agenda it is possible that substantial value upside will emerge but it must be recognized that this will play out over a multi-year timeframe. There are clearly a few negative issues to consider in regard to the attractiveness of JHG’s investment case but the stock is cheap enough to justify retention of a BUY rating.

Be the first to comment