carton_king/iStock via Getty Images

Investment Thesis

Meta Platforms, Inc. (NASDAQ:META) has obviously not fared well in the market’s fears of Ad-Pocalypse, due to the Apple (AAPL) privacy changes and the potential recession. The stock had fallen by -6.1% post FQ2’22 earnings call, given the obvious decline in its revenue and profitability. However, it is important to note that the Ad-Pocalypse is not unique to Meta alone, since slowing revenue growth and sales misses are also reported by Alphabet (GOOG). The latter reported a minimal 12.6% revenue growth YoY, compared to the hyper-growth of 61.6% in FQ2’21, otherwise a 5% ad revenue growth YoY.

These advertising headwinds are mainly attributed to the tough YoY comparison during the hypergrowth in reopening cadence and recent advertising pullback due to the pessimistic macroeconomics. Therefore, indicating temporary headwinds instead of permanent damages to Meta’s fundamental performance. Long-term investors must not forget the fact that Meta continues to command a significant market share of 23.7% in the global advertising market in 2021, coming second only to GOOG at 28.6% then.

Investors should also move past the temporary headwinds from Apple privacy changes and Tik Tok (BDNCE), since Meta has shown much determination in transforming its business operations and monetization capabilities moving forward. Meta’s sustained growth momentum demonstrates that 44.4% of the world’s population still finds Meta highly relevant in their daily social media lives, based on the growth in its Family monthly active people (MAP) by 4% YoY to 3.54B as of June 2022. This impressive fact is only eclipsed by GOOG’s nearly 4B users, given its lion’s share of 92.49% in the global search engine market as of Q1’22.

Therefore, there is no reason to give up on Meta’s massive potential now, especially since it is trading at near bottom levels. Tech investors interested in adding more of this stock should definitely nibble here for long-term investing.

Meta Reported Temporal Headwinds – Not Permanent

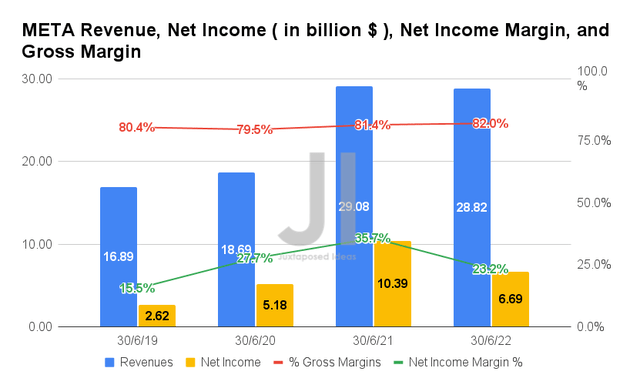

In FQ2’22, Meta reported revenues of $28.82B and gross margins of 82%, representing a YoY decline of 0.89% though an increase of 0.6 percentage points, respectively. In the meantime, its profitability had definitely taken a massive hit, with net incomes of $6.69B and net income margins of 23.2% in FQ2’22. It indicates a tremendous plunge of -35.6% and -12.5 percentage points YoY, respectively.

However, it is also important to note that Meta’s current financial performance represents significant growth in profitability compared to pre-pandemic levels. The company reported excellent revenue growth at a CAGR of 29.16% and net income at a CAGR of 45.96% in the past two years, compared to 31.87% and 7.67% between FY2017 and FY2019, respectively.

Though the eventual monetization of Reels would potentially be a headwind in Meta’s profitability due to the cannibalization trends, we expect an eventual success in the next few years. The segment is already recording a $1B annual run rate in revenue, with analysts projecting an excellent 360% growth by 2023, despite the apparent deceleration in global advertising spending in the short term. The current ad-pocalypse shall pass too, once the macro economy improves by the end of 2023 or 2024.

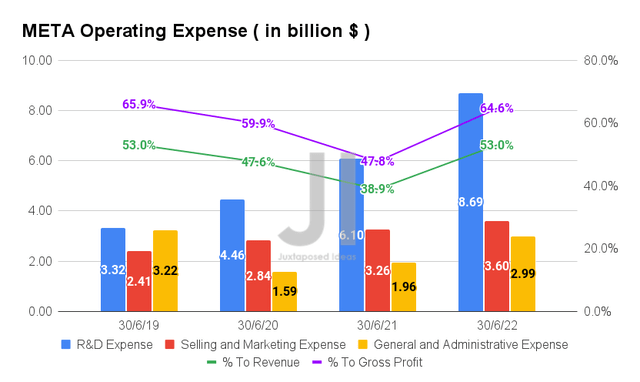

One of the key reasons for Meta’s lower profitability is its massively elevated R&D expenses. By FQ2’22, the company spent $8.69B on its R&D efforts, representing a tremendous increase of 42.4% YoY and 261.7% from FQ2’19 levels. This is on top of the $6.59B reported for Selling, General, Marketing, and Admin expenses in the latest quarter, which grew at a more controlled pace of 26.2% YoY and 17% from FQ2’19 levels. Thereby, impacting Meta’s net incomes, since the ratio of its operating expenses grew faster than its expanding sales.

In FQ2’22, Meta reported operating expenses at a ratio of 53% of its revenues and 64.6% of its gross profits, representing a notable increase of 14.1 and 16.8 percentage points YoY, respectively. Combined with the $10B headwinds from Apple’s privacy changes, it is no wonder that the stock has taken massive beatings in the past few months.

Nonetheless, Meta bulls may be encouraged by the company’s progressive efforts in reducing operating costs by slashing existing manpower and new hires, on top of slower investments in its Reality Labs. Thereby, reversing its reduced profitability over the next two quarters, as the management further moderates its FY2022 expenses to $85B compared to the original guidance of $95B.

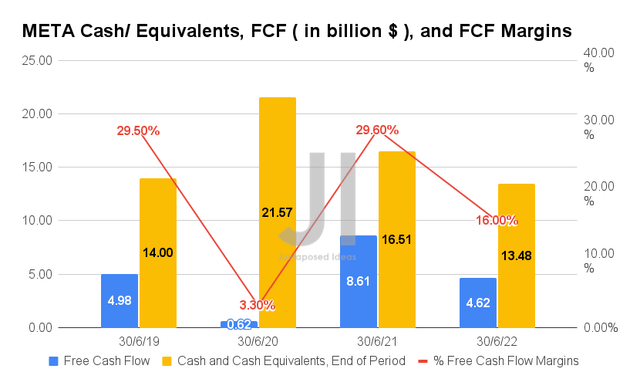

In the meantime, Meta continues to invest in its infrastructure with an elevated capital expenditure of $7.57B in FQ2’22, indicating an increase of 63.1% YoY and 208.5% from FQ2’19 levels. These investments have directly impacted its Free Cash Flow (FCF) generation to $4.62B simultaneously, representing a notable decrease of 46.3% YoY.

However, it is important to note that Meta’s cash from operations remains stellar at $12.19B in the latest quarter, indicating a minimal decline of -7.9% YoY though an excellent increase of 41.5% from FQ2’19 levels. Its cash and equivalents of $13.48B remain more than sufficient for most of its expansion and acquisition plans moving forward, especially combined with its recent $10B debt offering in August 2022.

We are confident that the recent FTC headwinds will pass over with minimal impact, given the massive undertaking and costs the US government needs for the speculative untangling of Meta from Instagram and WhatsApp. If any, the company is likely to be slapped with only a penalty, which may easily be contested anyway. Otherwise, easily paid with its massive FCF and/or cash and equivalents on the balance sheet. Not a big issue.

Mr. Market Continues To Downgrade Meta’s Growth Irrationally

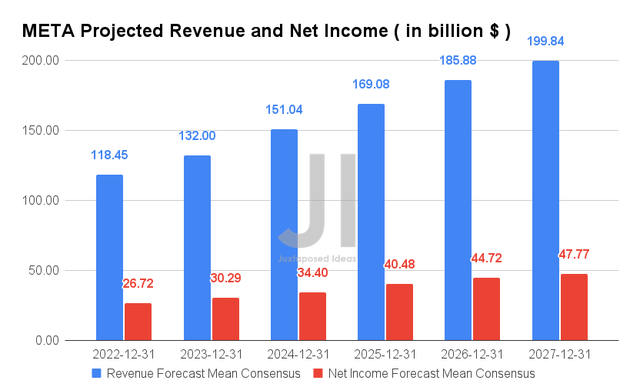

Over the next six years, Meta is expected to report revenue and net income growth at a CAGR of 9.19% and 3.28%, respectively. It is evident that the COVID-19 pandemic has pulled forward the growth in its profitability by easily eight years. Thereby, impacting its net income growth for the next few years, worsened by the aggressive expenditure into Metaverse and the changes in Apple’s privacy settings. These numbers are evident from its reduced net income margins, from 26.1% in FY2019, to 33.4% in FY2021, and finally to 23.9% in FY2027.

In the meantime, Meta is expected to report revenues of $118.45B and net incomes of $26.72B for FY2022, relatively inline YoY though a massive decline of -32.1%, respectively. These numbers also represent a notable moderation in estimates by -16% since February 2022 and -10.3% since May 2022, highlighting Mr. Market’s continued uncertainty in its forward sales.

These were probably attributed to Meta’s lower FQ3’22 revenue guidance of $28.5B, compared to consensus estimates of $30.38B. However, we must iterate that these were driven by softer advertising demand, which was triggered by the rising inflation and macro pessimism. Since the economy is cyclical in nature, long-term investors have nothing to worry about these temporary headwinds. We believe that these fears potentially represent the maximum pessimism surrounding the Meta stock, thereby triggering a time of near bottom levels for bottom-fishing investors. Keep calm and continue adding during dips.

We encourage you to read our previous article on META, which would help you better understand its position and market opportunities.

- Meta Platforms: The Headwind Solidified Its FAANG Stock Status

- Meta Vs. Roblox: The Battle Of Metaverse Commission Rates – 47.5% Vs. 72%

So, Is META Stock A Buy, Sell, or Hold?

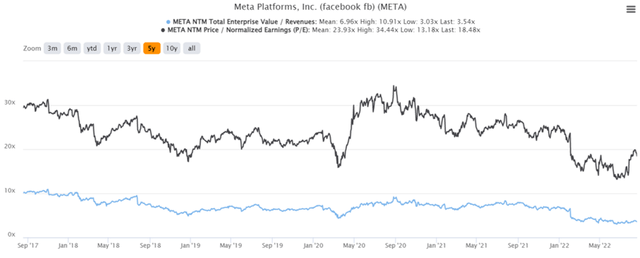

META 5Y EV/Revenue and P/E Valuations

META is currently trading at an EV/NTM Revenue of 3.54x and NTM P/E of 18.48x, lower than its 5Y mean of 6.96x and 23.93x, respectively. The stock is also trading at $167.96, down 56.2% from its 52 weeks high of $384.33, though at a minimal premium of 8.8% from its 52 weeks low of $154.25. Based on its historical stock performance for the past few months, we may potentially be looking at Meta’s new bottom at current prices.

META 5Y Stock Price

In the meantime, consensus estimates remain highly confident about Meta’s eventual recovery, given the price target of $228.43 and a 36% upside from current prices. In addition, we have a more attractive price target of $275 with a 63% upside, assuming a further moderation of its forward P/E valuations to 16x and its projected EPS of $17.14 by FY2027. Otherwise, a rather aggressive $315, based on Meta’s current NTM P/E valuations of 18.48x.

As a result, investors who believe in Zuckerberg’s leadership thus far and in Meta’s future prospects should definitely load up at these levels, given the maximum pessimism surrounding the stock. Do not miss this near-bottom FAANG play.

Therefore, we rate META stock as a Buy.

Be the first to comment