Ian Tuttle/Getty Images Entertainment

Roblox (NYSE:RBLX) has seen a dramatic fall from grace in its limited time as a public company. The stock once traded at outright bubbly valuations as the market heated up in anticipation for the metaverse. Hype has quickly left the room amidst a vicious tech crash, leading the stock to trade at a huge discount to all time highs. Yet the stock is still not obviously cheap on account of slowing growth and lack of clarity regarding long term profit margins. Even after the big drop in the stock price, RBLX still trades at a considerable premium to peers. Given that the tech crash has created a plethora of buying opportunities across the tech sectors, it is very difficult to recommend buying RBLX stock at this time.

I want to highlight one of the wonderful things about Roblox is we’re not a game and we’re not really even a game platform, we’re a future human experience platform.

-Dave Baszucki, CEO of Roblox, from 2022 Q2 Earnings Call

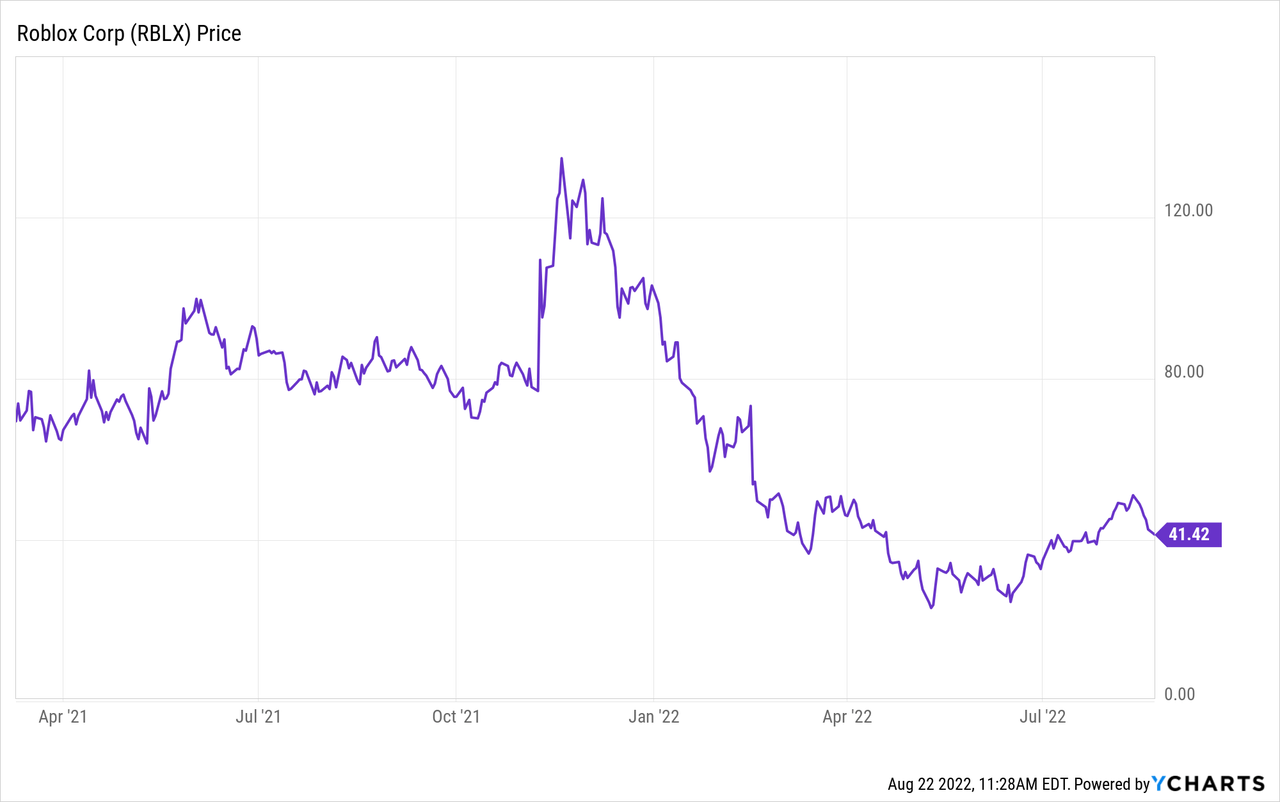

RBLX Stock Price

RBLX peaked at $141.60 per share in late 2021 and crashed as low as $21.65 per share. The stock has since rebounded nearly 100% though still trades around 70% below all time highs.

I last covered RBLX in April where I discussed whether RBLX was likely to see a quick reversal in its stock price. I was skeptical, but the stock proceeded to rebound 30% anyway.

What Were Roblox’s Expected Earnings?

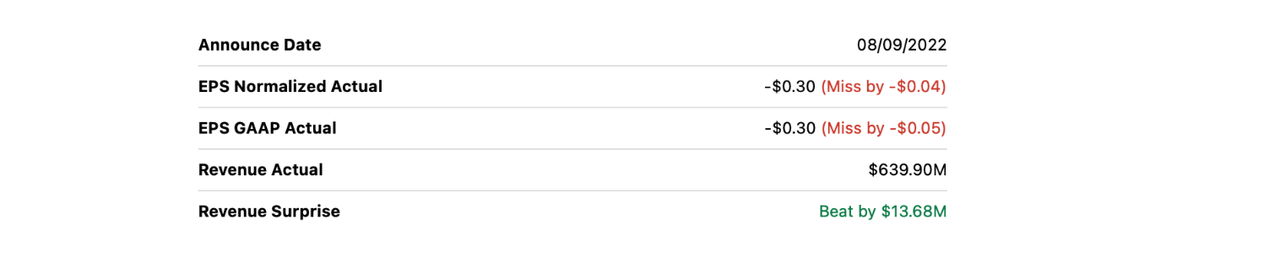

When RBLX reported earnings on August 9th, analysts expected it to report decelerating growth with continued operating losses.

Did Roblox Beat Earnings?

While RBLX ended up beating slightly on the top line, its reported profit was slightly lower than expected.

Seeking Alpha

RBLX Stock Key Metrics

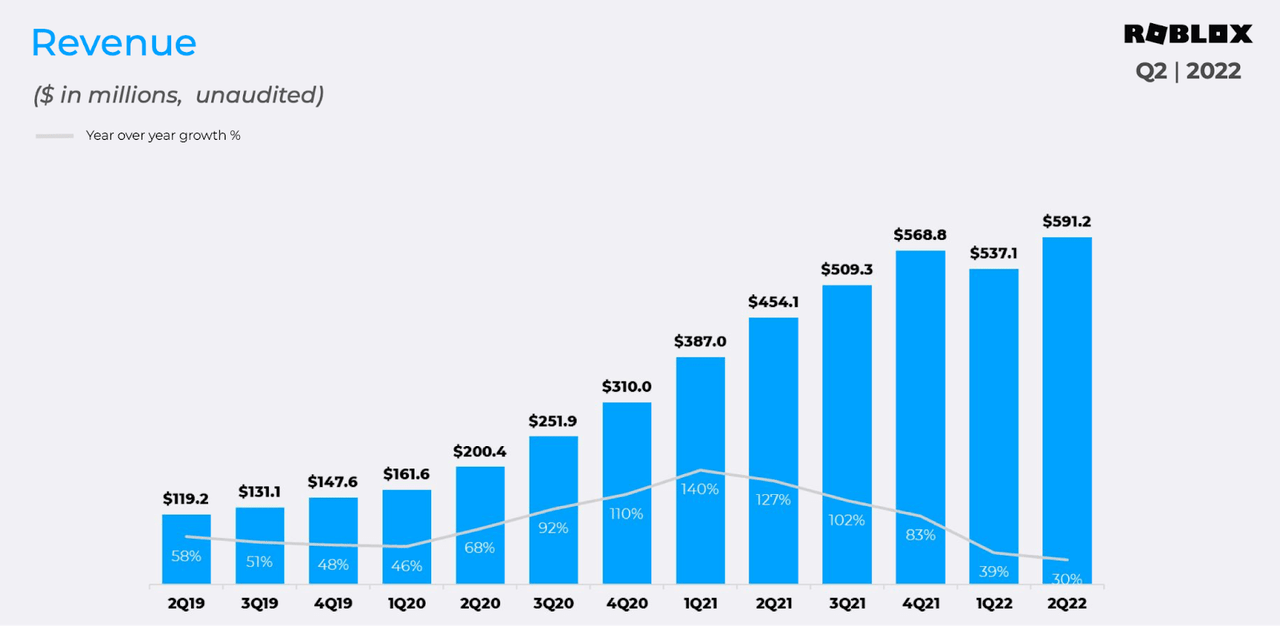

The latest quarter had RBLX showing further decelerating growth rates, with revenue growth coming in at 30%.

2022 Q2 Presentation

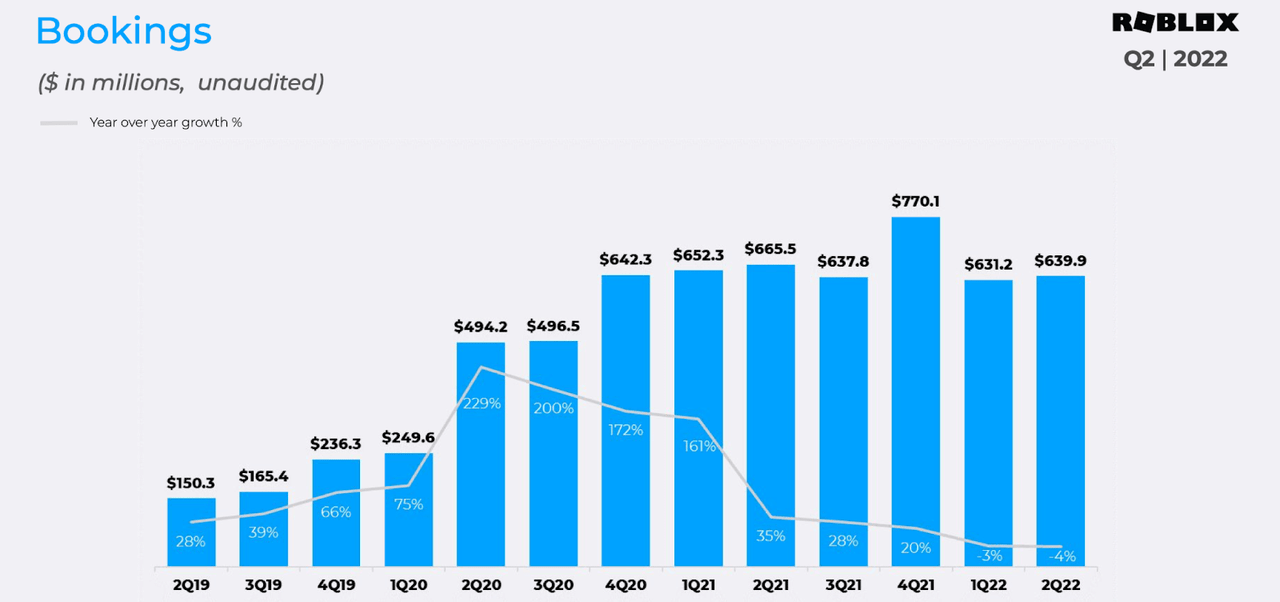

More concerning was that bookings growth was negative again at 4%.

2022 Q2 Presentation

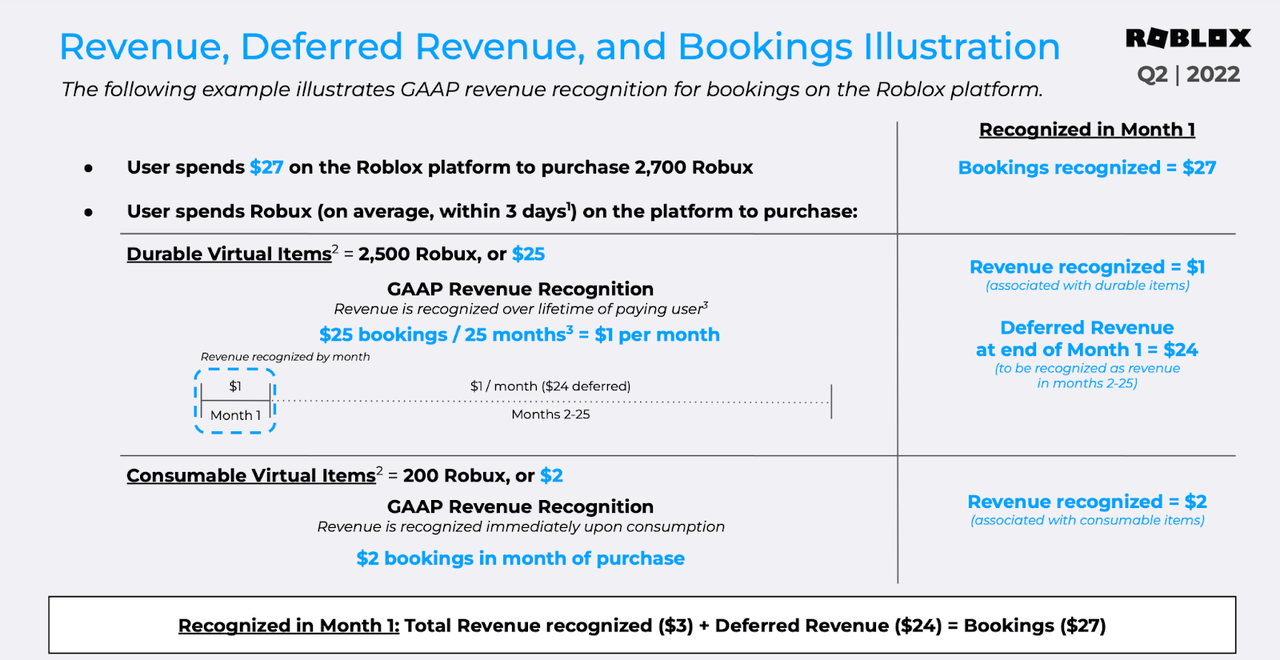

Just a refresher – the difference between revenue and bookings can be seen below. In a nutshell, bookings refer to the cash spent in any given quarter to purchase Robux, the RBLX currency. Revenue refers to the amount actually used in the quarter.

2022 Q2 Presentation

Slow bookings growth may foreshadow slow revenue growth in the future.

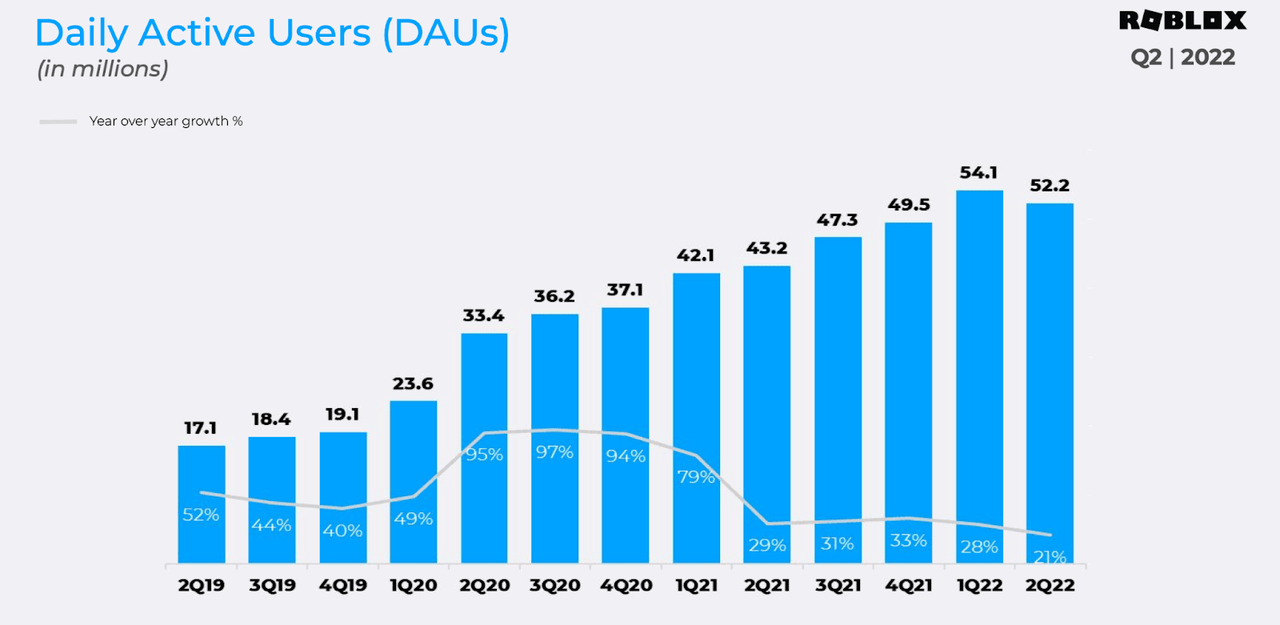

RBLX saw daily active users (‘DAUs’) fall sequentially for the first time though it was still 21% higher year over year.

2022 Q2 Presentation

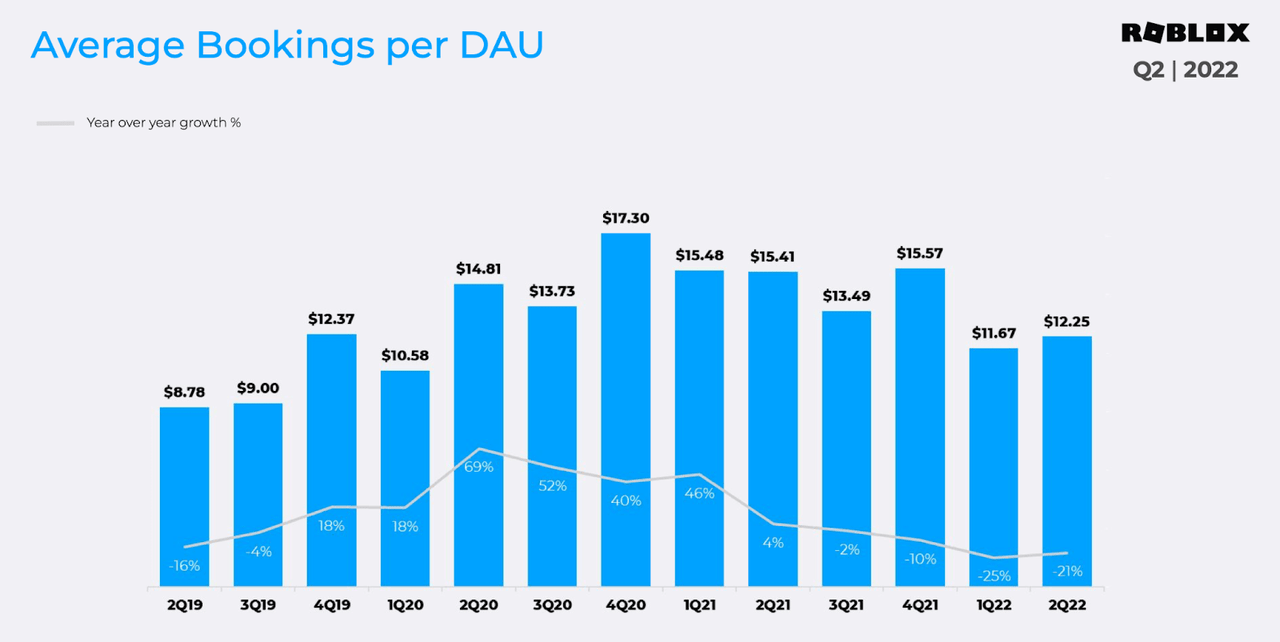

Average bookings per DAU declined by 21% year over year.

2022 Q2 Presentation

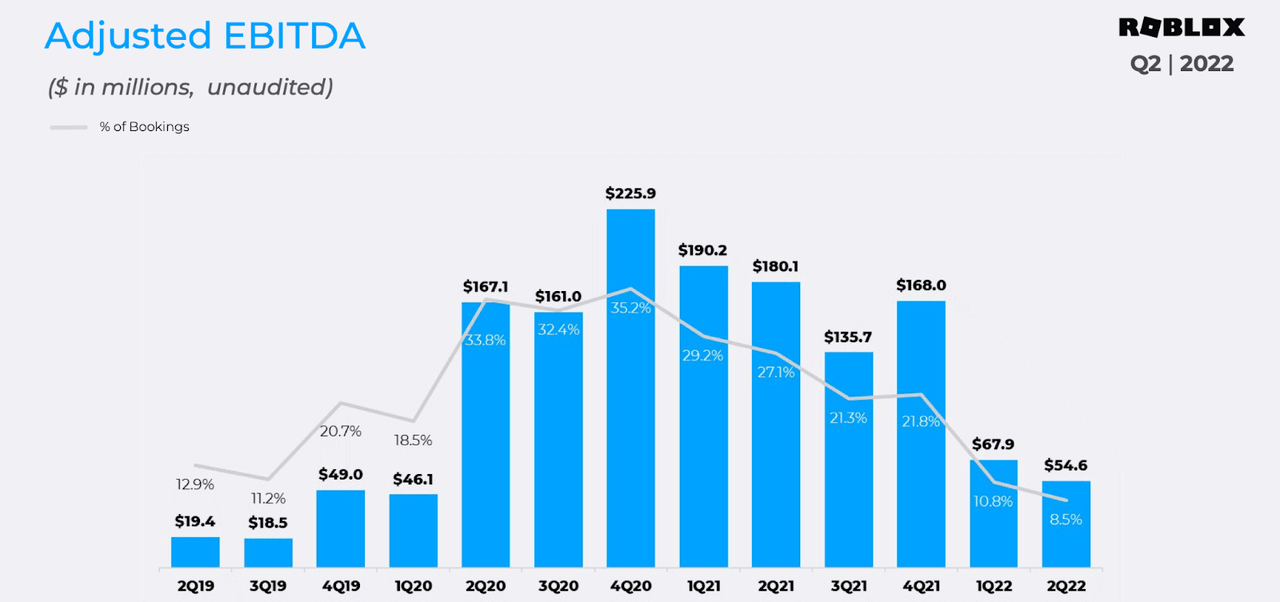

These led to adjusted EBITDA declining to only $54.6 million.

2022 Q2 Presentation

The company ended the quarter with $3.1 billion cash versus $1 billion of debt. RBLX burned through $57 million of cash in the quarter – for now its balance sheet position appears strong enough to fund ongoing losses.

What To Expect After Earnings

On the conference call, management predicted that it would eventually see growth rates improve next year due to overcoming tough comparables. Management stated that the stronger growth may lead to healthier EBITDA margins. Management also guided for roughly 5% of annual dilution moving forward.

Is RBLX A Good Investment Long Term?

A typical long term investment thesis for RBLX focuses on its position in the metaverse. RBLX allows its users to create their own games and play in such created games. This makes it distinctly different from typical game developers and creates a more social feel to the game. But does that make it a good long term investment?

My main reservation with the stock has to do with the net margin it might achieve in the long term. Here’s why.

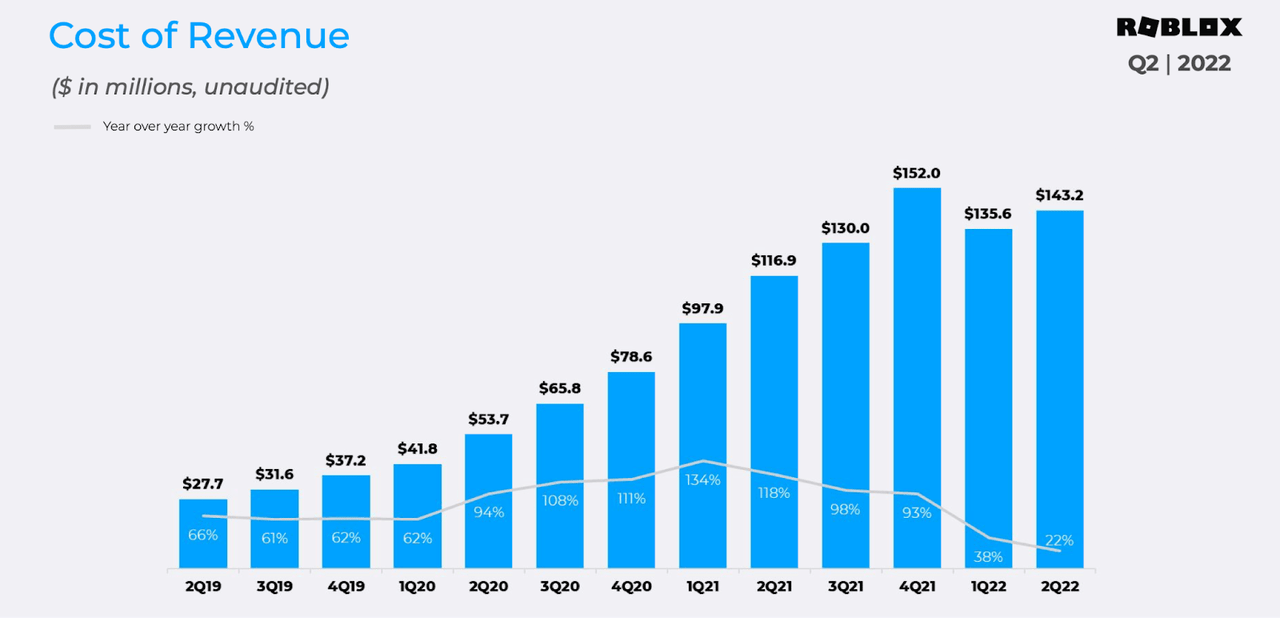

Unlike many tech stocks, RBLX has an extra layer of costs that are unlikely to just disappear. RBLX reported 75.8% gross margins in the latest quarter which are very tech-like.

2022 Q2 Presentation

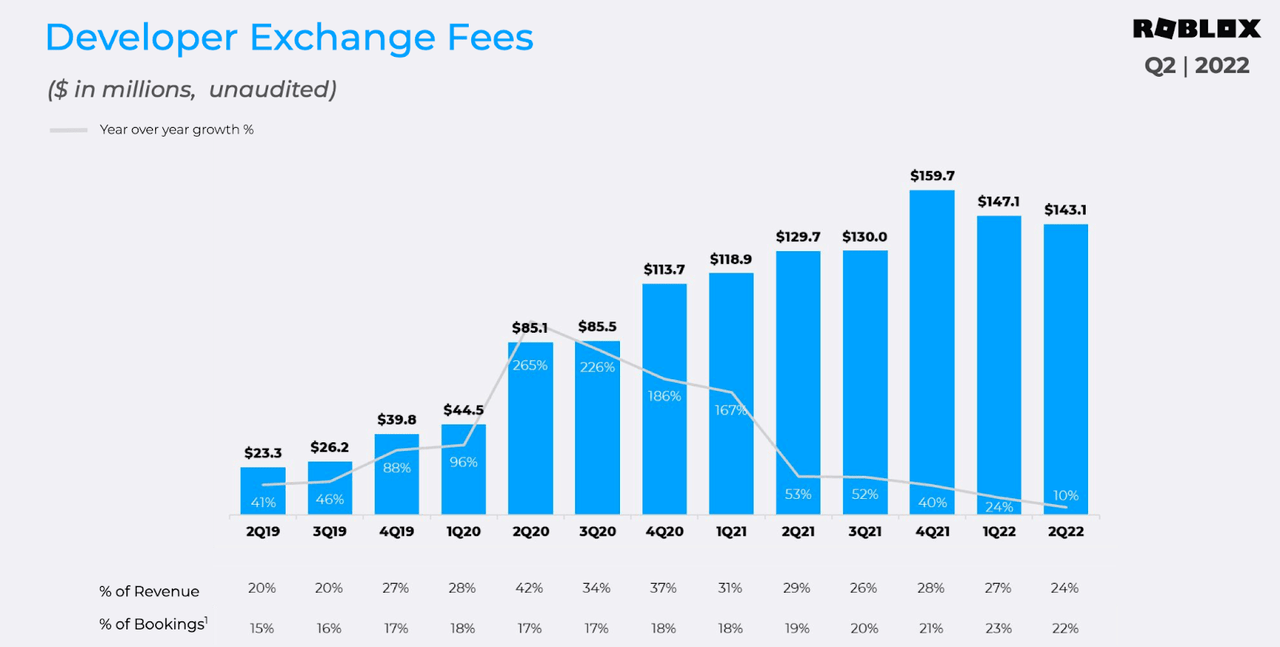

That said, in addition to the typical operational expenses, RBLX has two other expense buckets. The first is developer exchange fees which are paid out to developers of the games. That stood at 24% of revenues in the quarter.

2022 Q2 Presentation

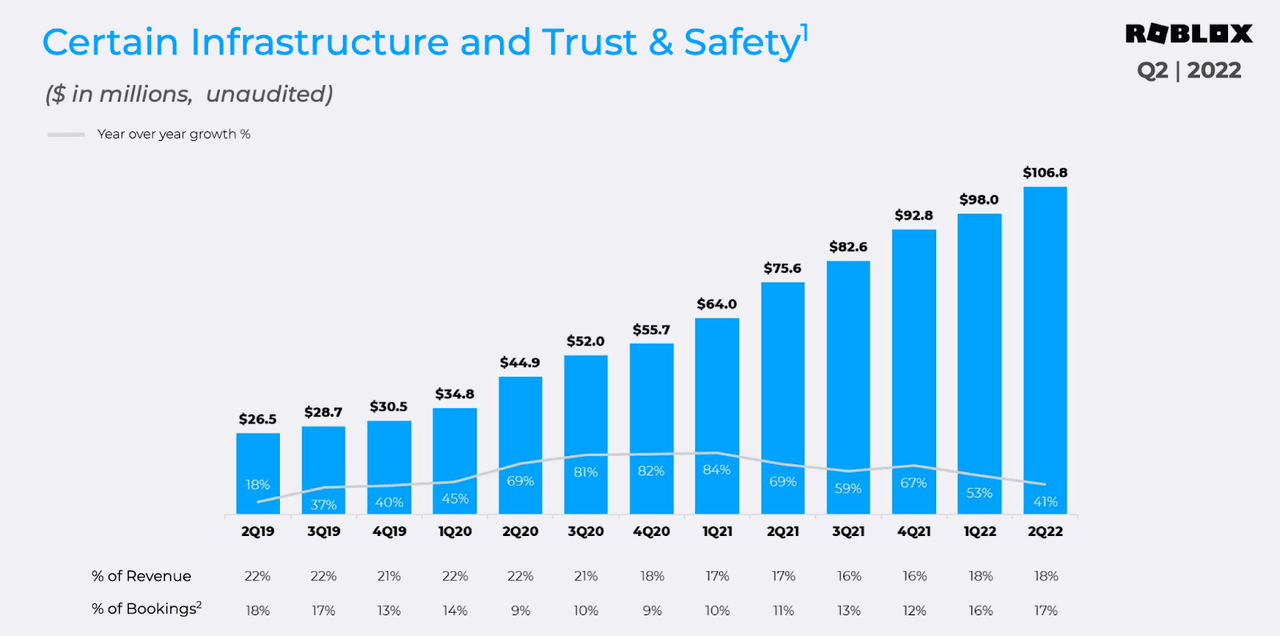

Next, perhaps due to the large number of children who use the platform, RBLX has to invest heavily in infrastructure and trust & safety, which stood at 18% of revenue in the quarter.

2022 Q2 Presentation

Both of those expense buckets seem likely to grow alongside revenue growth, reducing the potential for operating leverage. Even before accounting for the typical development operating expenses, RBLX is already losing 66% of revenues to COGS, developer exchange fees, and infrastructure costs. I typically project tech companies to achieve 30% net margins, but in this case my assumption must be brought down significantly lower – negatively impacting my view of the valuation.

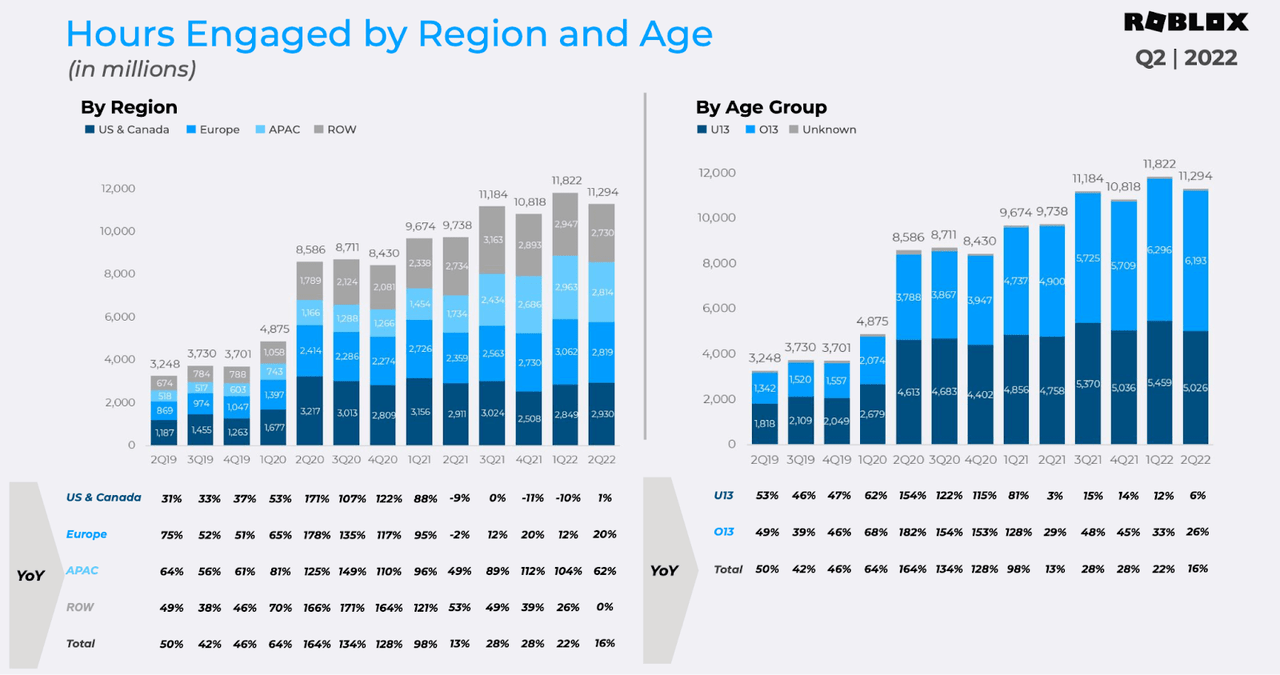

On the other hand, recent developments have shown promise in expanding RBLX’s addressable market. RBLX has seen its fastest growth in its 17-to-24 year old segment, even though its core segment is the 9-to-12 year old cohort.

2022 Q2 Presentation

That may be a sign that RBLX may be able to sustain strong growth for a long time, which may be able to smooth over valuation issues.

Is RBLX Stock A Buy, Sell, or Hold?

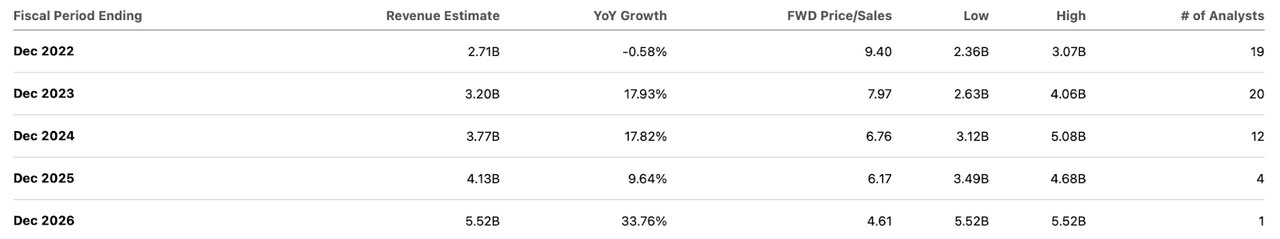

At recent prices, RBLX is trading at around 9.4x forward sales. Revenue growth is expected to pick up starting next year.

Seeking Alpha

I note that consensus estimates of $2.71 billion in revenue appear very optimistic considering that RBLX has only generated $1.1 billion in revenue in the first two quarters of the year.

Gaming peers Take-Two Interactive (TTWO) and Electronic Arts (EA) trade at around 4x forward sales in spite of having comparable forward growth rates. That relative premium only tells half the story with regards to the valuation.

Based on the high expense structure, I expect RBLX to generate around 17% net margins over the long term. Using a 20% long term growth rate and 1.5x price to earnings growth ratio (‘PEG ratio’), my fair value for RBLX hovers around 5.1x sales, implying 46% potential downside (again, that may understate the downside potential considering that estimates are high). In order to justify the current stock price, growth needs to accelerate to around 37% next year, far outpacing the 18% consensus estimate. While RBLX stock has fallen considerably, the steep decline in billings growth does not inspire confidence that RBLX will see a return to all time highs any time soon. Perhaps one might couple any long position with some covered calls in order to juice the returns. Just as an example, the call option expiring in June 2023 with a strike price of $60 is trading for around $6, offering a premium worth 15% of the current stock price while still allowing nearly 50% in capital appreciation before it is called. I however question whether such a strategy is appropriate after a tech crash, as I favor pure-long strategies instead. I rate RBLX a hold as I still cannot wrap my head around the current valuation in spite of the 70% decline from all time highs.

Be the first to comment