gesrey

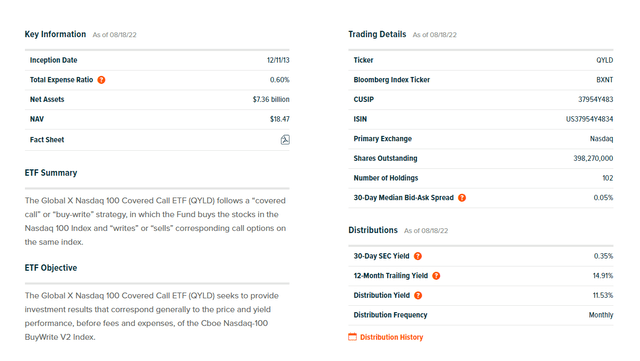

As inflation remains at elevated levels, Covered-Call ETFs continued to gain popularity because of their large yields. Just over 1 year ago, my first article on the Global X Nasdaq Covered-Call ETF was published (NASDAQ:QYLD), and its net assets were $3.81 billion. In just over a year, QYLD’s net assets have grown 93.18% ($3.55 billion) to $7.36 billion. As covered-call ETFs have gained in popularity, they have also gained many critics along the way. QYLD may be the most popular covered-call ETF, and there are a fair amount of bear cases against it. This is not an investment geared toward capital appreciation, and most likely, its chances of outperforming the market on an annual basis without taking its dividends into consideration are slim. This is an investment strictly geared toward income production as the upside is capped through the covered calls written against the index. QYLD hasn’t been the best covered-call ETF from an investment standpoint when you look at the other options from Global X, but it’s still generating monthly income, and its 14.25% yield is hard to ignore. Now that summer is almost over, I will revisit QYLD and see how this investment is performing.

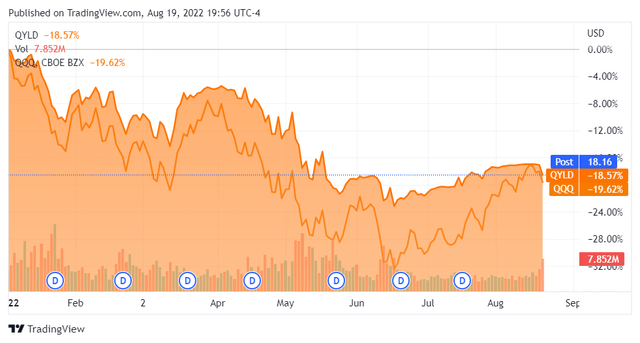

Looking at QYLD compared to the QQQ from a capital appreciation standpoint

One of the most common arguments was that QYLD would break down and significantly underperform the market during a downturn. 2022 has been nothing short of a downturn as the S&P 500 and Nasdaq both entered bear markets, and the U.S economy produced 2 consecutive quarters of negative GDP growth, which is the definition of a recession. So How has QYLD done? YTD, QYLD has declined by -18.57%, while the Invesco QQQ ETF (QQQ) has declined by -19.62%. For the better part of 2022, except for maybe several days in August, QYLD has fallen less on a percentage basis than the QQQ, which tracks the Nasdaq, the index QYLD invests in and writes covered-calls on. Did QYLD decline? Absolutely but no more than the QQQ YTD, and for the majority of 2022, it had outperformed the QQQ by a respectable margin. The questions about how QYLD will do in a downturn have been answered, the results aren’t great, but they are no worse than the Nasdaq.

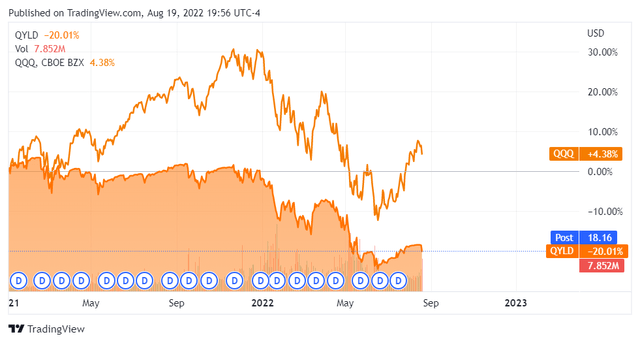

Going back to the beginning of 2021, QYLD hasn’t outperformed or kept pace with QQQ. Since the start of 2021, the QQQ is still in positive territory as all of its gains haven’t eroded while it spent limited time in negative territory. QYLD, on the other hand, treaded water in 2021 and just broke down when the markets tumbled in 2022.

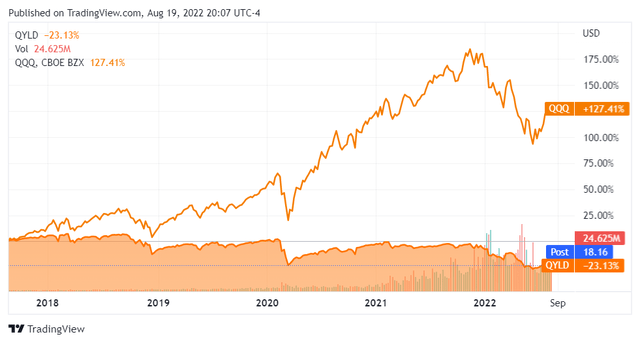

Going back 5 years, QYLD never got back to its 2018 highs prior to the pandemic, and after the pandemic crash when the markets made all-time highs, QYLD wasn’t able to reclaim its previous highs. So why are so many, including myself, infatuated with QYLD and other covered-call ETFs if the capital appreciation isn’t there? There is a school of thought that instead of investing in QYLD, you could just purchase shares of QQQ and sell a share here and there to generate income.

I can’t speak for anyone other than myself. Keep in mind that QYLD is strictly an income investment. The reason I do not purchase shares of QQQ and sell one here and there for income is that I would deplete my shares quicker than they would reappear. QQQ trades at $322.86 per share and pays a dividend of $1.87 which is a 0.57% yield. You would need to purchase 173 shares for $55,854.78 to generate enough income from a dividend (173 * $1.87 = $323.51) to purchase just 1 additional share of QQQ. If I wanted to generate a 10% yield, I would need to sell off 17.3 shares to generate $5,585.48 in income from the initial $55,854.78 investment. This would leave me with 155.7 shares; every year that I sold shares for income, my share base would continue to decline.

QYLD isn’t optimal for capital appreciation, but its income-generating ability is second to none. I look at QYLD as owning a business that distributes cash to me, and I have the option to take it or reinvest it to increase my future cash flow. Since I am not selling shares of QYLD, my share base stays the same, generating distributable cash every month. I have been asked if I am worried about QYLD’s share price declining, and my answer has always been no. I have been planning on owning QYLD for decades, and regardless if the share price is $17 or $21, I am agnostic to it. Yes, I would rather see shares in the low $20 range and the initial capital not erode, but the lower fluctuations in prices allows me to reinvest every distribution and increase my future cash flow. In addition to reinvesting the distributions, I add to my position when shares decline to reduce my cost basis. This strategy may not be for everyone, but it fits on the income side of my portfolio and is a nice complement to my other income-producing investments.

What an investment in QYLD has looked like since the beginning of 2021 and 2022

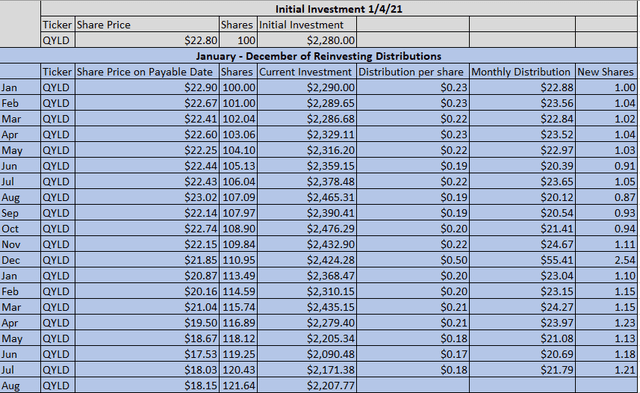

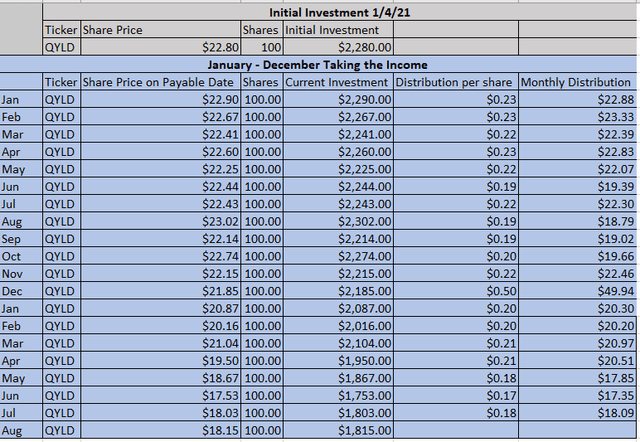

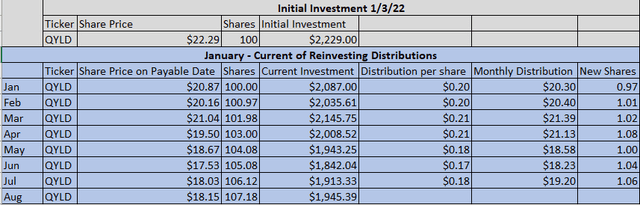

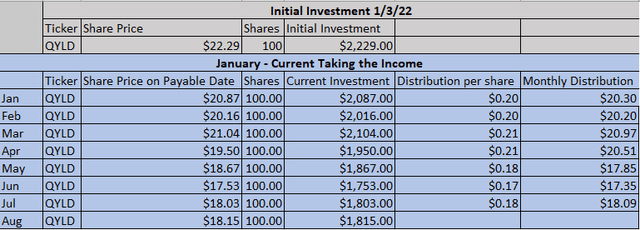

I crunched the numbers and created the tables to illustrate what QYLD has looked like as an investment if you were taking the distributions as income or reinvesting them. I am using a 100-share base as the initial investment at the beginning of each period.

Since 2021 – Reinvesting the distributions

If you had purchased 100 shares of QYLD on 1/4/21, they would have cost $2,280. Each share of QYLD over the previous 19 months has paid $4.20 in distributions. By reinvesting them, the current distributions paid have grown to $459.96. The initial share base grew by 21.64 shares as you would now have 121.64 shares which increases the distributable income by $57.38 based on the TTM distribution of $2.65 per share. The forward annual distribution has increased from $265 to $322.52 since there is an additional 21.64 shares, and each month, additional shares are being added to the share base. Some people may complain because the latest decline has pushed the overall investment value just under the initial investment by -$72.23 (-3.17%), but I am fine with that. The forward yield on the initial investment of $2,280 is 14.15%, based on the TTM distribution. Eventually, the investment position should return to positive territory, but the more important thing is that QYLD didn’t go bust during a bear market and the share base with its distributable income continues to grow instead of having to sell off shares to generate income.

Steven Fiorillo, Seeking Alpha, Global X

Since 2021 – Taking the distributions

The other side of the investment is if you’re currently taking the income rather than reinvesting it. The initial investment would have declined by -$465 (-20.39%). QYLD would have generated $420 in distributions since January of 2021, which is an 18.44% yield on invested capital. When you net out the distributions from the capital depreciation, this investment is at a loss of -$44.67 or -1.96%. The forward projected income is $265.14 based on the TTM distributions. Yes, the investment overall is down, but it’s still generating an 11.63% forward yield based on the TTTM distribution without selling a single share.

Steven Fiorillo, Seeking Alpha, Global X

Since 2022 – Reinvesting the distributions

If you had purchased shares of QYLD at the beginning of 2022, an initial investment of 100 shares would have cost $2,229. Over the past 7 months, QYLD has paid $1.35 per share in distributions, and this would have amounted to $139.22 in distributable income due to the additional shares. The initial share base of 100 would have increased to 107.18. The initial investment would have declined by -$283.61 (-12.72%), but the projected annual income based on the TTM distribution would have increased from $265 to $284.19 for a forward yield of 12.75%.

Steven Fiorillo, Seeking Alpha, Global X

If you were taking the distributions as income in 2022, then QYLD has been rough. You would have generated $135.27 in distributable income, and your share base declined in value by -$414 or -18.57%. The forward projected annual income would be $265.14 or an 11.9% yield on investment.

Steven Fiorillo, Seeking Alpha, Global X

Conclusion

I can’t stress this enough: QYLD is an income investment, not a vehicle for capital appreciation. Based on the data, QYLD has a spot in my income portfolio because I have a tremendous amount of time before I start taking the distributions as income. Every month, my share base increases, creating additional distributable income to be reinvested. If you’re looking for income now or a vehicle for future income, I believe QYLD is an investment worth researching and considering. One of the biggest premises to understand is that you have to be ok with the share price declining. This isn’t an investment that everyone will like or agree with, but it’s not a gimmick ETF as writing covered calls is a viable strategy for generating income. The downside is that upside appreciation is capped. Based on the research I posted in my recent article on the Global X Russell 2000 Covered-Call ETF (RYLD), RYLD has significantly outperformed QYLD since 2021. As of now, RYLD is doing better than QYLD, but I still like QYLD as a part of an overall income strategy, and I continue to add to my position in QYLD.

Be the first to comment