TexBr

By Fei Mei Chan

With less than two weeks remaining in 2022, the S&P/TSX Composite Index is down 5.7% YTD (a relatively mild decline compared to the S&P 500’s 17.9% drop). The S&P/TSX Composite Low Volatility Index has underperformed, which is unusual for a down year, falling by 9.6% YTD.

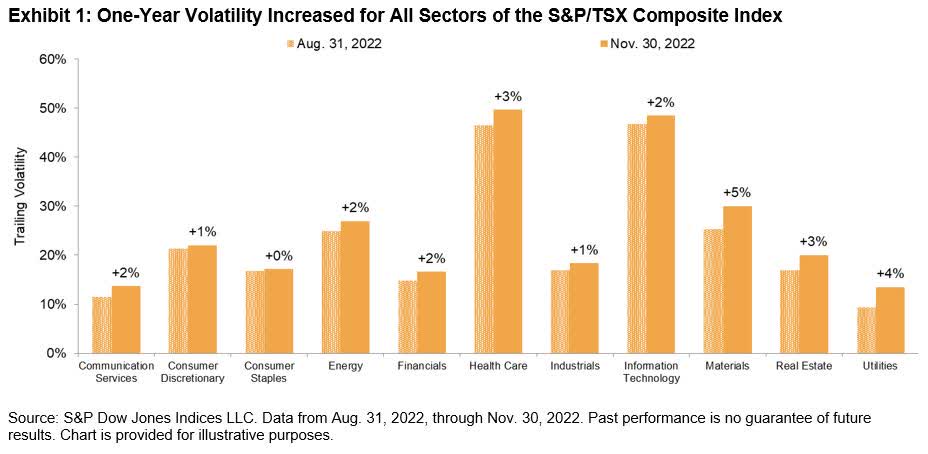

Volatility continued its uptrend since the last rebalance, rising for every sector of the S&P/TSX Composite Index. Materials and Utilities were among the sectors with the biggest hike in one-year volatility, up 5% and 4%, respectively.

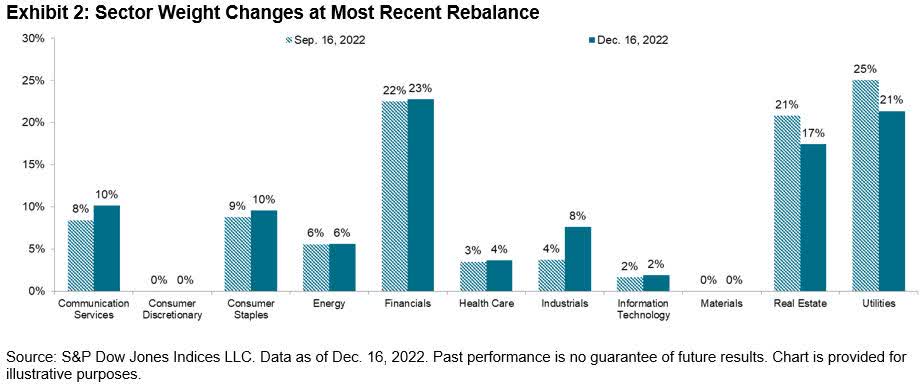

Not surprisingly, the latest rebalance for the S&P/TSX Composite Low Volatility Index scaled back its weight in Utilities. (The index has had zero weight in Materials since its December 2021 rebalance.) Real Estate also pared its weight, while the remaining sectors all increased their presence, with Industrials taking up most of the slack. The latest rebalance took effect at the close of trading on Dec. 16, 2022.

Disclosure: Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI please visit www.spdji.com. For full terms of use and disclosures please visit Terms of Use.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment