Teka77

Author’s Note: This article was originally published on iREIT on Alpha on the 23rd of September 2022.

Dear readers,

The time has come for me to update my thesis on Vonovia (OTCPK:VONOY) (OTCPK:VNNVF). I last wrote an update article a few months back, with a base article back in April this year, back when the Ukraine war was still a fairly new thing. At the time, it was “barely a BUY”, as I said in my article.

Today, it’s a very different situation, and I’m allocating significant capital to Vonovia.

Here is why.

Vonovia – An update.

So, the reasons why I like Vonovia are fairly fundamental and should be easily understood.

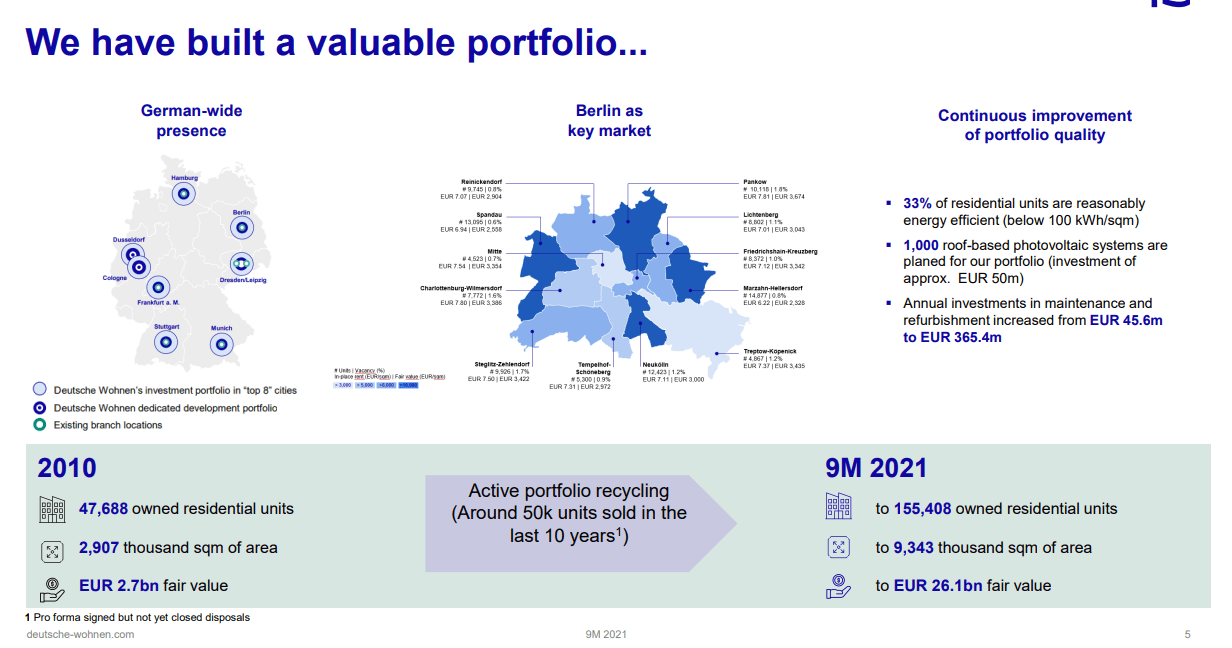

It’s one of the largest real estate companies in all of Europe. It represents an oligopoly for the Berlin housing market. It’s a BBB+ rated dividend stalwart with a good payout tradition, and it’s extremely well-capitalized, with a superb asset portfolio stretching not only across Germany, but including Sweden and other nations as well.

Vonovia IR (Vonovia IR)

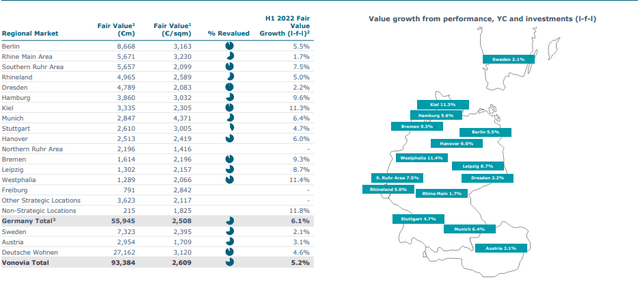

Today the portfolio consists of nearly 489,000 units in Germany, nearly 40,000 in Sweden and 21,000 in Austria, to a total of nearly 550,000 units in extremely tight rental markets.

Vonovia has one of the best capital structures on the market, and consequently borrows at less than 2% interest on average, with a 50%+ rate of unencumbered assets in FY2020/21. The company’s LTV ratio has been going down steadily, and is less than 50% as of 2020/2021E, with a gross cost of the gross debt trending downward as well. LTV is, as of 2Q22, less than 44%.

Point of fact, the company’s debt, and LTV should be even lower, given the massive reevaluation on the positive side Vonovia has been seeing. However, steady M&A coupled with increasing amounts of modernization CapEx as well as a growing dividend has made certain that the company’s debt hasn’t gone down more – and why we won’t see much change going forward either.

All in all, Vonovia has no issue whatsoever funding whatever it deems necessary, and there are no “major” players left on the German market to take over in its proximity.

Why?

Because Vonovia already owns most of them.

Remember though, Vonovia is not a REIT. It’s a standard company. Real estate investment trusts (REITs) work in some countries across the world. The USA has most of them. Great Britain has some. Spain and France also have versions of them. Even Germany has what is known as G-REITs – but Vonovia is not a G-REIT.

What makes Vonovia such a great pick is the mix of the circumstances of its markets, and its valuation. I spoke at length about this in my original article, so only a short recap here.

The basic issue is that there’s a massive scarcity of rental space (units), with current levels at 100% more expensive levels than 10 years back, combined with the factors of:

- An aging population and household downsizing, requiring a higher volume of homes.

- Strong migration waves in 2010-2020, requiring more houses.

- Urbanization.

- Buyer solvency/lower interest rates, pushing end prices.

Vonovia’s position in this value chain is focusing on the most profitable cities, which has put the company in a situation of being able to outperform. The view that there will “always” be a shortage is of course wrong. However, the indisputable fact is that like Sweden, not enough homes are being built in Germany to meet the demand, which means that this imbalance is likely to remain for some time. Couple this with the simple fact that building new units costs too much money relative to the rents you charge, and you end up with new units costing even more compared to what currently available units cost.

There is also the small matter that German tenant mobility is lower than virtually anywhere in Europe. Due to population concentration, jobs are readily available within driving distance to most areas, not necessitating a move. People in Germany consider a drive from Hamburg to be a “long commute” of around 30-50 km. Where I’m from, a “long” commute is anything above 100 km. I currently travel 300 km every 2 days, and that is not considered all that long here either.

Remember, the nation of Germany is smaller than the US state of Montana but houses 25% of the population of the United States, and is one of the most important western industry nations in the entire world, well ahead of the US in terms of industrial complexity (Source:OECD).

Vonovia’s strategy is not to “buy cheap and refurbish”. Rather, it’s to buy the expensive assets available on the market and refurbish further where needed, and then work with rents. This is a segment of the market that requires a great deal of capital, which Vonovia has no shortage of. This makes them a serious player to contend with.

This means that Vonovia has essentially historical zero vacancies (or around 0.1-0.5%, currently 2.2% with all assets included), while new construction starts are at extremely low numbers overall.

Now – risks exist. Read up on the way that Germany and Sweden overall treat landlords, and you’ll see what some of the issues are. The company’s history has been fraught with protests from tenant associations, unions, and politicians for every single deal they made.

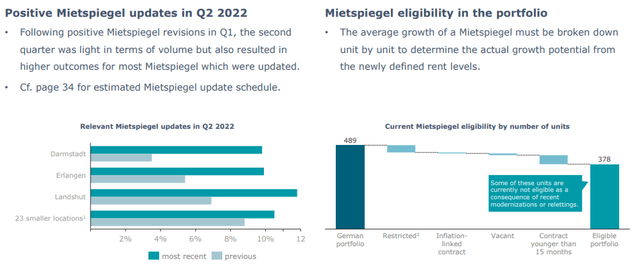

However, these issues have been abating. Mietspiegel increases for the year have been true joys to see, with increases well above what I would have expected.

What we see is essential, since the company cut a net of 6,000 units since the last article, that Vonovia performs at similar/higher levels, while having fewer units. Rent growth is 3.4% organically, and EBITDA, FFO, and group profit metrics are showing double-digit increases on an adjusted basis. LTV is at 43.3%.

Even on a Vonovia-stand-alone basis, and without the addition of DWNI, the company would have seen nearly 10% revenue increases and 4% EBITDA growth. This is impressive, and not at all reflective of what we’re seeing in market trends.

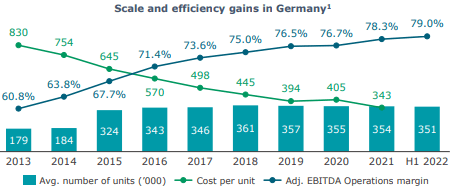

Take a look at how the company has turned more efficient over time in Germany specifically.

Vonovia IR (Vonovia IR)

The rental segment alone is set to generate annual adjusted EBITDA of closing on €4B on an annual basis, and the company’s operating KPIs show no worries or issues whatsoever – even with expensed/capitalized maintenance included. We’re seeing good organic rent growth, with virtually no vacancies due to demand. Vacancies Vonovia has are largely due to investment activity, not because people don’t want to rent.

Even with input inflation and wage increases, maintenance CapEx is close to 2021 levels. That’s really something you need to take into consideration here.

And the rent isn’t the only thing that the company does. Vonovia also does VAP (Value-added-Products/Services), which are currently at low volumes but still going strong. Unfortunately, any growth or efficiencies are currently being consumed by lower expenses in things like Craftsman cost savings, multimedia, residential environment, smart metering, energy, and other savings.

Vonovia also operates its development segment, showing increased margins and volume despite challenging KPIs and inputs. This segment is a lot less linear, historically speaking, and 1H22 contains large to-sell projects on the books, with around 1,088 units completed of which nearly 600 will be sold.

Remember that the political pressure as well as keeping up appearances forces Vonovia to divest some of its newly built stock. Despite this, the company saw valuation growth in virtually all areas and markets across its portfolio.

Some risks, of course, exist. The increased energy prices are a major one – because they don’t just impact specific groups of tenants, but owner-occupiers and tenants who pay the provider itself. It’s a wide social challenge that needs to be properly discounted. A part of the company’s market development can be explained by this. Especially vulnerable groups will be low-income households in houses with low energy efficiency. While much of the company’s portfolio is modernized (and its energy efficiency is higher than the German average), it holds assets in this category.

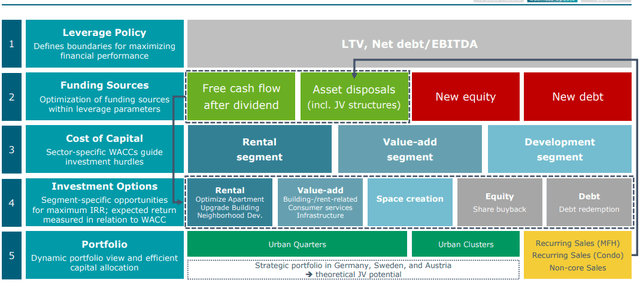

In the second part, we have the higher cost of overall capital. However, with how well-capitalized this business is, the company doesn’t have immediate funding needs. All financing need including the investment program run by Vonovia is currently funded organically, putting Vonovia in a great position.

The majority of its development to-hold projects are being switched to sell, which aside from garnering policy/political favor, will realize cash gains previously booked as a non-cash gains. The company is also increasing its disposals of non-core and is dialing down CapEx after years of overspending on CapEx for several years compared to peers.

Vonovia has no M&A plans – which is logical given the last one.

Vonovia Leverage Policy (Vonovia IR)

In short, Vonovia seeks to monetize its platform by rolling out its service business to third parties and becoming more asset-light. It’s also re-prioritizing capital allocation for a higher interest rate environment as is considering various JV’s for efficiencies sake.

Yet the company’s financial framework is iron-clad. As is the dividend paid by Vonovia. The company considers either equity or debt as non-options at this time. However, all needs are covered, and 2022E guidance is now confirmed.

Vonovia expects no less than €6.2B in revenue for the year, with a 3.3% organic rent growth. Far under inflation, but very much in line with American REIT comps. Out of this revenue, the company expects to be able to pull at least €2.75B in adjusted EBITDA, or €2.B in group FFO. The dividend policy calls for 70% of group FFO after non-controlling interests, which is currently forecasted to equate a dividend of around €1.8/share, implying a well-covered yield of 7%.

Let me reiterate that. That’s a 7% yield, essentially close to inflation, from the largest residential real estate company in Europe, with environments with an extremely tight market in terms of residential supply.

I have no issues with that.

Let me double-check the valuations with you.

Vonovia Valuation

In my last article, I made clear what I called the “mathematics of tears” – tears, in this case, being specific to the market valuing Vonovia at under €26/share. We use NAV comparisons, yield comparisons, public comps, growth estimates, book valuations, and earnings/cash flow multiples. Remember, this is not a REIT, so REIT-specific valuation metrics don’t really apply well here.

Peers are therefore EU companies alone. Investors may want to look at companies like Covivio (OTCPK:FNCDY) and Icade (OTCPK:CDMGF), both French real estate companies in similar sectors. Outside we find a whole slew of Scandinavian RE businesses, such as Castellum (OTCPK:CWQXF), the largest holding in my entire current portfolio.

For peers, Vonovia currently offers a higher dividend yield than the peer group, and most of its peers following the decline. At today’s price, the company’s 2022E dividend implies a yield of over 7%. This puts its well above Deutsche Wohnen’s legacy yield of 3.26%, in the range of Covivio, and above the legacy yield of Icade which pays over 7% (but is also far less safe).

The fundamentals remain the primary arguments for investing in Vonovia. No peer has the size, vertical integration, or position that Vonovia has. It trades at a P/E of below 10x for the native to a normalized GAP EPS. I would continue to apply a premium to Vonovia, but I’m lowering it to 5% here to reflect the higher interest rates and increased cost of capital.

A standard assumption is that Vonovia is a “bond proxy”. This is not really the case. Given its delivery of an asset and earnings yield, the spread between actual bonds and Vonovia’s earnings are as high as 7-8% historically.

Vonovia offers access to one of the most conservative, regulated residential markets on the planet, and I’m not exaggerating when I say that this is probably one of the best management teams in this space in all of Europe. Remember the guidance they gave half a year ago – that guidance is, even with everything, intact today.

This strength is the backdrop for my applying a premium to the company’s valuation, allowing for a combined PT of 1.1x (no longer 1.2x) to a conservatively-calculated NAV and a decent P/E premium. On an average weighted basis, my PT for Vonovia comes to €48/share.

I’m not cutting a cent from that new target, despite the company having dropped as far as it has. I’ve made it very clear that I do not shift my targets due to market temperament, and while I do lower it some to account for aforementioned capital cost increases, I’m unwilling to go much lower than this.

S&P Global comes to the price range of €42 on the low side and €70 on the high side, including the consolidation with Deutsche Wohnen. Out of 17 analysts, 14 have either a “BUY” or “Outperformance” rating on the company at a price of €43.51/share. They have, since the last article, increased their overall targets somewhat.

I want to emphasize that this company holds over half a million units across Europe. This is a very proven business with a concept that works. It’s one of the few players with the financial muscles in all of Europe to move on these opportunities – and that’s why I’m wanting to push my exposure here. There’s a great deal of safety to be had here.

To those of you asking, “But US REITs seem better”.

That’s why my PT is €48/share.

Traditional US REITs have a definite advantage over Vonovia when comparing them as investments. However, if you fully include Deutsche Wohnen’s portfolio in the company, then the company’s current NAV comes to 0.4X. There’s a massive discount to Vonovia 2023E here, and given that I know exactly what sort of properties we’re talking about, I know I want to own them cheap.

I’m not willing to pay any price. If this goes up above €60/share, I’d rather buy Realty Income (O) or other American REITs provided FX goes back to being somewhat more favorable. But at this price, this is the definition of advantageous diversification for me.

So – PT is now €48/share, and I’m a “BUY” for Vonovia here.

Thesis

My view on Vonovia is as follows:

- The largest, most significant real estate company in all of Europe is at a great discount looking at every single perspective you could possibly consider.

- Based on its fundamentals and valuation, I view Vonovia as one of the most real estate companies in all of Europe. Coupled with its credit rating of BBB+, this makes it a “BUY” to me.

- My target PT is €48/share.

Thank you for reading.

Be the first to comment