Win McNamee

This week’s Federal Reserve meeting could prove to be another blow to the global economy and stock markets. Federal Reserve Chairman Jerome Powell is talking tough and might choose to cause a recession.

If Powell goes down that route, it is a mistake, in my opinion. Energy has proven to be the primary driver of inflation and raising interest rates makes it harder for the U.S. to produce more energy.

Raising rates too much will slowdown both energy development and building out supply chains. In that scenario, scarcity returns while the economy slows into recession. That would be the perfect storm of stagflation.

Most leading indicators are already flat or falling, as are many components of inflation. For once, Powell should get out in front and slowdown on rate hikes. He probably won’t. If he makes that mistake, then he’ll doom both global growth and stocks.

Energy And Inflation

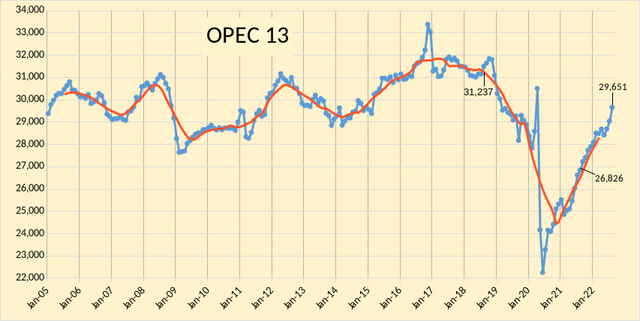

Saudi Arabia has led OPEC to constrain oil output since it massively cut production during Covid. The result has been higher oil prices in line with Saudi Arabia’s preferred price level over $80 per barrel.

OPEC Crude Output (OPEC via PeakOilBarrel.com))

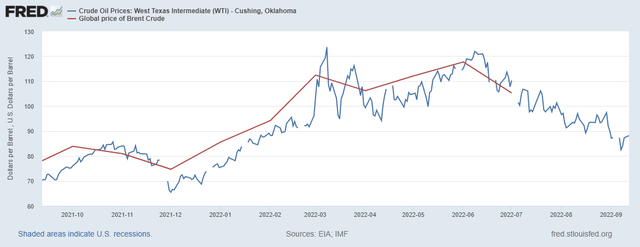

Russia’s invasion of Ukraine further put pressure on oil prices. From December 2021, when we first got warning of an invasion, oil prices rose from around $70 per barrel to a high of $123.70. Oil is now in the $80s as the world slowly adjusts. Another price shock on Russian aggression is not out of the question though.

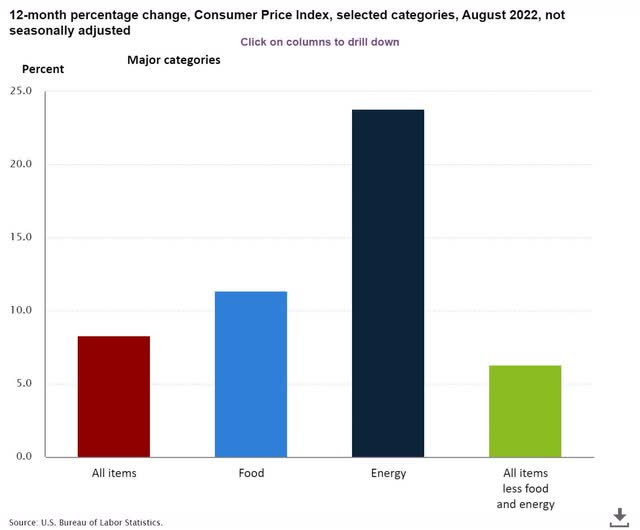

Data presented by the Bureau of Labor Statistics demonstrates that energy is in fact the key component (which jives with history) of inflation.

Energy Impact On Inflation “BLS”

So, while many econo-pundits declare the Fed at fault for inflation, the data just doesn’t support that assertion, at least on CPI.

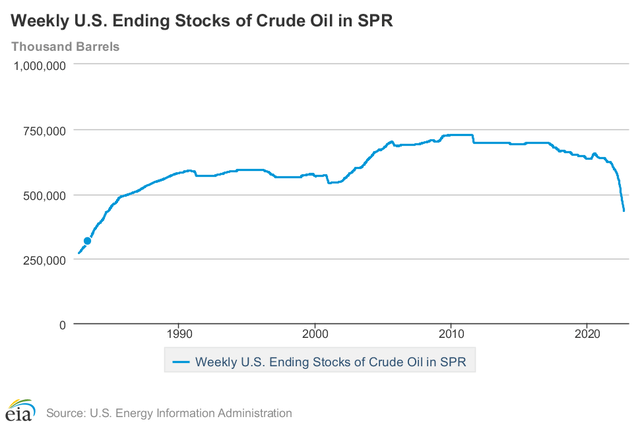

What’s interesting is that oil is off its highs by quite a bit in the past couple months. This coincides with President Biden’s releasing of oil from the SPR (strategic petroleum reserve), which has been used in line with what it was intended to deal with, which is oil price shocks. The impact has been felt at the pumps with a run of 15 consecutive weeks of falling gasoline prices.

Strategic Petroleum Reserve “EIA”

In addition, the year-over-year comps for oil and gas are about to become harder to eclipse. See the oil price chart below. If oil and gas have peaked, then there will be significant downward pressure on inflation by Q1 2023 if oil fails to eclipse the prior year prices.

1-yr Oil Prices “FRED”

With U.S. domestic oil and gas production rising, there is a lot of reason to believe that oil prices will at least remain range bound short-term and then fall by next autumn after drive season. Here is what the EIA is saying:

U.S. crude oil production in our forecast averages 11.8 million barrels per day (b/d) in 2022 and 12.6 million b/d in 2023, which would set a record for the most U.S. crude oil production during a year. The current record is 12.3 million b/d, set in 2019. (Source: EIA STEO)

The EIA further forecasts oil prices to stay under $100 in 2023 even in consideration of “the possibility of petroleum supply disruptions and slower-than-expected crude oil production growth…”

Natural gas prices are also forecast to fall from around $9 per MMBtu to around $6 per MMBtu.

Those forecasts can certainly be wrong, but, without an event that drives prices higher, it seems markets are doing what they do and adjusting.

If the economy slows more than expected, for instance on Fed monetary policy decisions, then energy prices could fall sooner and with it inflation.

There are a few wildcards though.

OPEC could certainly cut production causing oil and gas prices to rise. That would be in the face of a tighter SPR that is less able to continue fueling the domestic oil market.

There is also Vladimir Putin. With increasing pressure at home from both moderates and right-wing hardliners, he might cause a more violent reaction in oil and gas prices.

And, there is still the prospect of Iran getting into a conflict. With Iran playing hardball on the JSPOA (Joint Comprehensive Plan of Action) nuclear deal it is possible the deal does not get done. If the deal does not get done, then the odds of Israel striking Iranian nuclear targets dramatically increases.

In short, oil prices are subject to price manipulation and event risk.

Gundlach Vs Summers

In recent dueling pundit news, Reigning Bond King Jeffrey Gundlach has suggested the Fed should back off on its rate hikes to see what the impact of prior hikes have been. He favors a 25 basis point raise versus 50, 75 or 100.

Not many others have been so dovish.

On the other side is Former Treasury Chief Larry “Restore Fed Credibility” Summers who says the Fed needs to raise by a full point to restore their “credibility.”

Federal Reserve Bank of Minneapolis President Neel Kashkari, who is generally dovish based on demographics, is taking Summers side on aggressiveness here. In addition, Federal Reserve Governor Christopher Waller and St. Louis President James Bullard also supports another aggressive hike. Nomura, among other firms, and most Austrian school economists are also on the hawkish side.

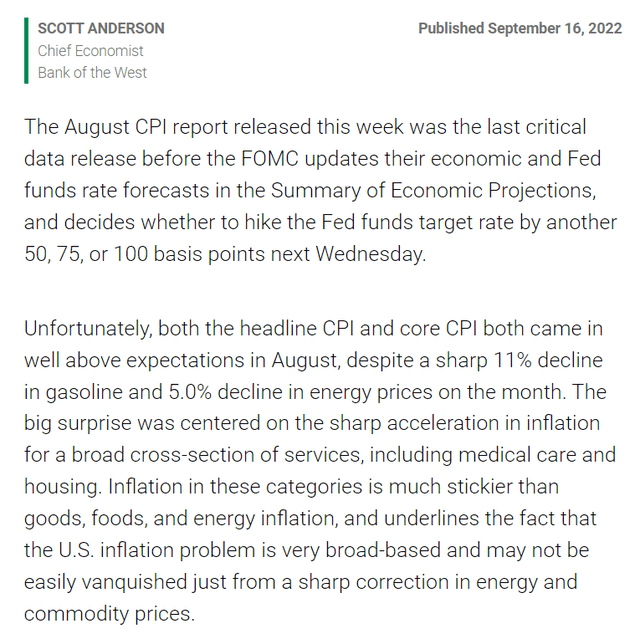

Bank of the West Chief Economist Scott Anderson gave this summary of the inflation situation and what to expect of the Fed:

Inflation & The Fed (Bank of the West )

For my part, I’m with Gundlach. Here’s why.

Powell’s Choice: Slowly Diminishing Inflation Vs Stagflation

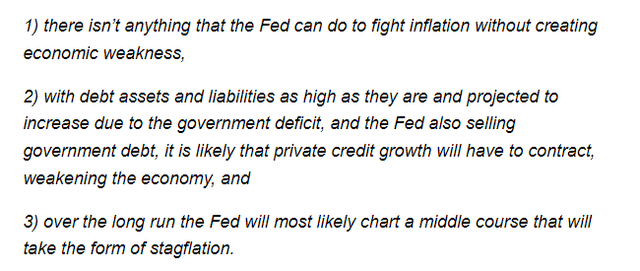

In June, Bridgewater Founder and Chairman Ray Dalio laid this thesis out:

Dalio On Stagflation (Ray Dalio via Seeking Alpha)

I see that as a horrible choice by the Fed. Stagflation should be avoided at any cost as it is a double whammy on standard of living: higher inflation and higher prices.

My thesis is this:

The Fed ought to lower the rate increases to 25 basis points the next two meetings and then decide about the December rate decision after a few more months of data. They do claim to be data dependent after all.

My view of the data is that the Fed should then pause rate hikes in December.

Of course, Jerome Powell isn’t calling me.

Consider the rapidly falling shipping rates and rising store inventories.

- Shipping rates are still falling, in another sign that a global recession may be coming

- Retailers take expensive measures to clear inventory ahead of peak season

Why is that happening? It is because demand is already falling and supply caught up as companies ordered early because of uncertainty with Chinese production and overseas delivery.

I told a story in last week’s macro dashes webinar I told a story about pods in a Target (TGT) parking lot. I asked the store’s manager why they were there. He said the Christmas stuff came early and explained they had ordered early so it would be on time. Well, now they have so much inventory, some of it is sitting in the parking lot.

What happens leading into Black Friday sales and then after Christmas sales? I’d imagine a lot of markdowns. Do things balance out? Hard to know, but that is the nature of markets to find a price to clear at.

What is the impact on inflation and the economy as we clear inventories?

And, is it likely that services prices keep trending higher if other parts of the economy are weakening? I don’t think so.

According to Mark Cabana at Bank of America, the Fed won’t be able to maintain high rates terribly long due to rapid slowing in major parts of the economy. He does though believe that the Fed is going to overdo rate hikes and cause a recession – which is exactly what I hope they avoid.

Powell could choose another approach to imagining himself the next Paul Volcker as some reports suggest he is thinking about. That would be to slow down on rate hikes and see what happens as Gundlach has suggested. I don’t think he will, but maybe he will surprise us.

Here’s a funny thing. If Powell doesn’t raise 75 basis points this week, then I think that probably scares the market because the trader’s narrative will be that Powell is admitting things are slowing down too fast (remember, breathy narratives are breathy because the narrators are breathing – it’s what they do).

I’m not sure I see a winning scenario for stocks in the short-term no matter what Powell does. I still see bad or worse.

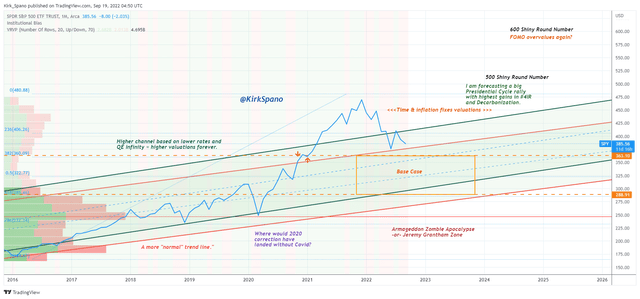

Potential For The Armageddon Zombie Apocalypse

On my charts, I have a zone called the “Armageddon Zombie Apocalypse.” It is what I think can happen if the Federal Reserve makes another mistake or if there is a global economic and financial contagion from any of several potential issues, such as:

- Broader war.

- Energy shock (possibly from broader war).

- Real estate and financial collapse in China.

- Deep European recession with domino effect.

- Pick a black swan that can pop a super bubble.

The “Armageddon Zombie Apocalypse” is not my base case, but, I believe it has a higher potential for occurring than normal. Here’s what it looks like on my SPDR S&P 500 ETF (SPY) chart that I have been updating for years.

SPY scenarios (Kirk Spano)

I am supposing that the worst case scenario is that it tests the base that the market put in during 2014-16 when the Fed first toyed with tightening after the initial QE led post Great Recession recovery. Again, not my base case, but not out of the question.

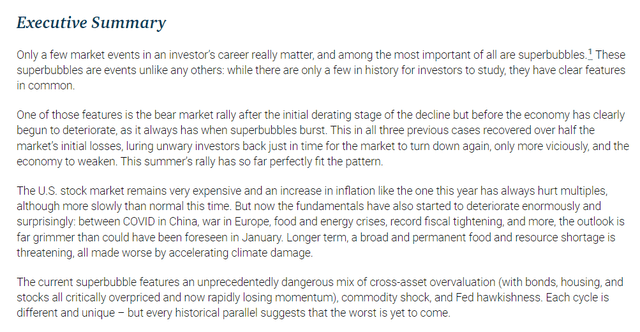

That area of the chart I have a secondary name for: “Jeremy Grantham Zone.” Grantham has famously said we are in store for a massive bear market. I take him seriously, he’s nailed all of the major downturns in my 25-year career.

Read his recent piece: “Entering the Superbubble’s Final Act“

Entering The Superbubble’s Final Act (Jeremy Grantham via GMO)

I am one of the few who wrote about a super bubble in 2007 and early 2008. I was on board with Grantham, Einhorn, Schiff and a few others at the time.

I am not so sure we are about to see a super bubble burst this time. The shenanigans with QE and extreme debt really make this hard to interpret.

I do see some very positive catalysts on the horizon, but the dangers are hard to quantify for me (and I think for most). I would not be surprised to see an epic collapse in the next quarter to year, but my base case remains an S&P 500 in the middle to lower 3000s.

Investment Quick Thoughts

One of the things I have learned playing in professional poker tournaments is that sometimes you have to fold a good hand to an unknown risk. I think that is where we are on many investments right now – simply don’t play the hand.

Even when I am not particularly confident in the stock market short-term, I do not short often and never aggressively. Shorting is a very difficult endeavor due to the very precise timing involved.

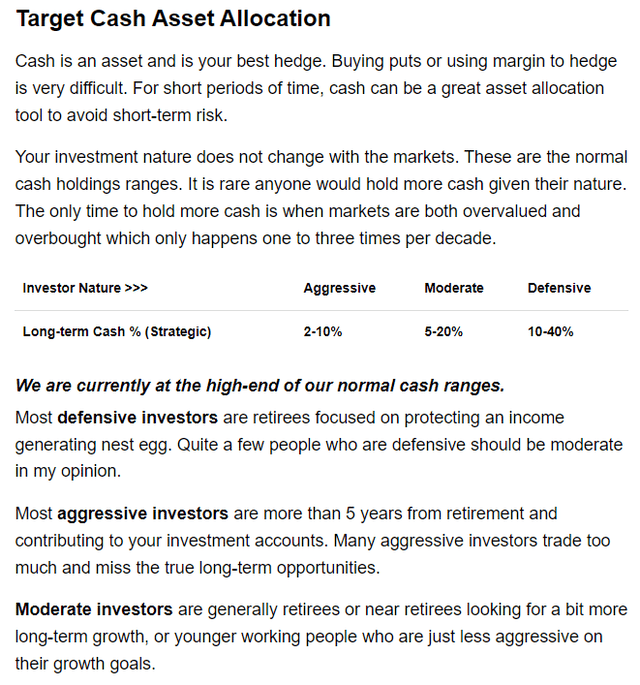

My approach to hedging is to hold extra cash. To that end, this is where we are now per my September Global Trends ETF Report (a monthly ETF asset allocation piece I do for members of Margin of Safety Investing):

Cash Asset Allocation (Margin Of Safety Investing)

As you can see, I am telling defensive investors to be about 40% cash. Most others around 20% cash. And, I would note, that cash was not trash this year. It has actually been a huge winner.

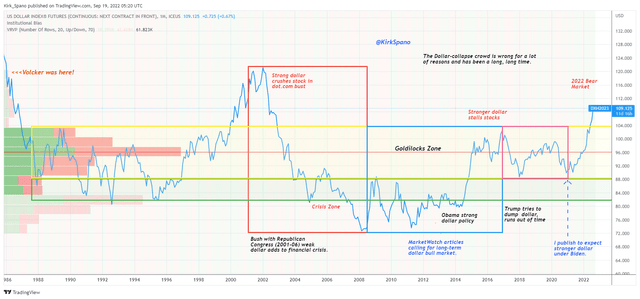

Dollar Strength (Kirk Spano)

I did recently give an interview to Forex Analytix where I said I expect the dollar to peak soon and then start to fall back into the “Goldilocks Zone.”

In another recent Macro Dashes article, I suggested that the stock market could test its bottom or worse. If I think that, why am I not suggesting higher cash asset allocations?

The answer is pretty simple. In the long-term stocks go up and in the short-term we are more likely to be wrong about any forecast.

So, for most people, taking more extreme actions creates more risk, especially since getting back in is psychologically difficult. That is why we have a step-by-step approach for scaling in slowly, but steadily, into positions we want to own long-term.

If your asset allocation is too aggressive right now for your long-term asset allocation approach, then I would consider trimming certain investments to raise cash. But, as soon as you do that, set a series of GTC buy limit orders to scale back in at certain lower levels (we typically use 10-20% price gaps to get back in and make adjustments based on valuations and technical signals in real time).

I do believe that small caps offer some very exciting opportunities now – we have already started to scale in. There is also a growing basket of mid caps that are attractive – we own a few. Large caps are hard to find at valuations with a margin of safety yet – have not added much yet.

I also believe that soon, emerging markets with favorable demographics, resources, education and legal factors will be very attractive. I am focused on technology, but there are a few other spots, including real estate, resources and decarbonization linked industry that could be very attractive once the bubbles finish popping.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment