JHVEPhoto

Introduction

I give Pfizer (NYSE:PFE) a buy rating because I believe it will be an excellent defensive recession play for the upcoming economic uncertainty. Pharmaceutical companies are uniquely positioned to weather the storm in times of economic uncertainty. Because of Pfizer’s size, it is better prepared than most.

Pfizer is a large pharmaceutical company headquartered in New York City with a market cap of $258 Billion. Since the company was founded in 1849, it has produced numerous drugs on its own and through acquisitions and partnerships. Most recently, the company created a COVID-19 vaccine in collaboration with German biotech company BioNTech (BNTX). To see the immense size of Pfizer, the company states in its Q2 investor presentation that through the first two quarters of 2022, ~854 million people had taken a Pfizer medication or vaccination.

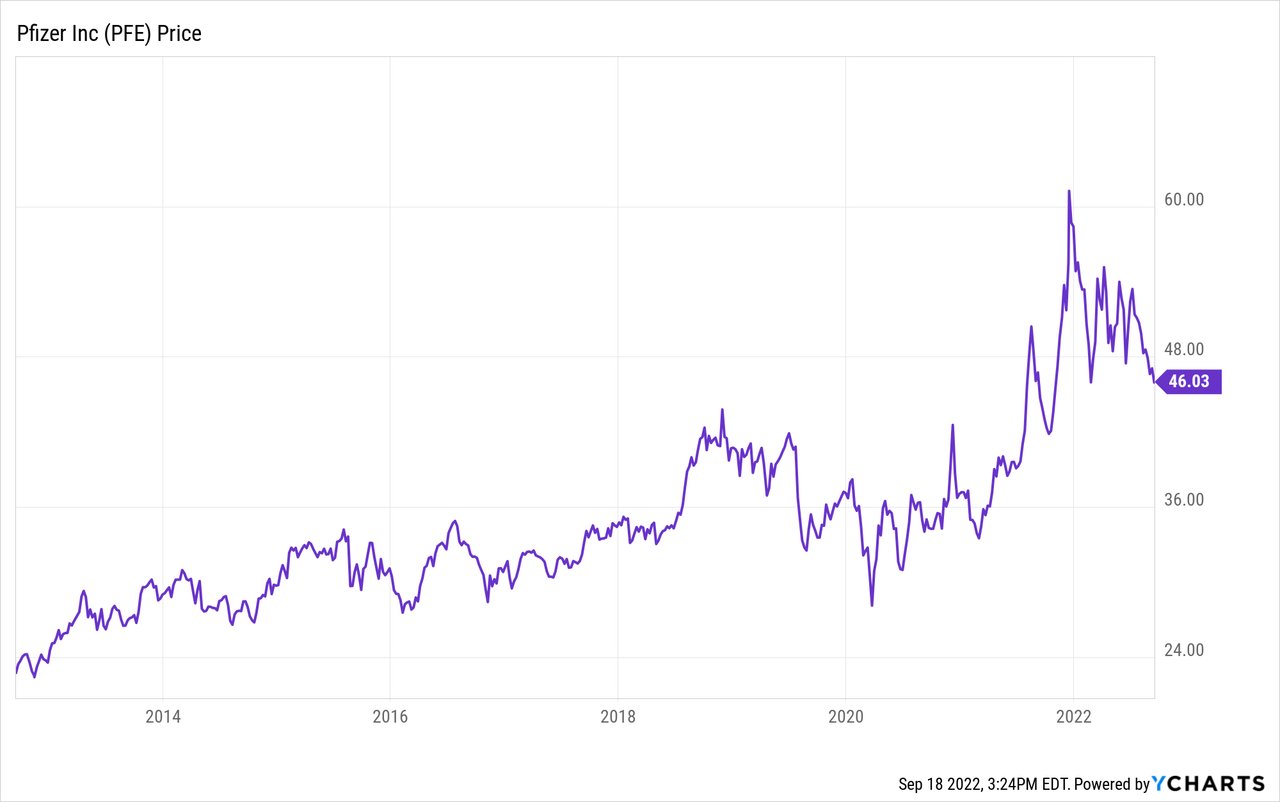

As of this writing, shares traded for $46.03, with an average of 18 million shares traded daily; Pfizer has an EPS of 5.14, creating a low PE of 8.96 and a 3.48% dividend of $1.60. Per the company’s last SEC filing, the company had $27.7 billion in revenue, leading to $9.9 billion in net income. Finally, the company had just over $33 billion in cash, cash equivalents, and short-term investments. This pile of cash puts the company in a great financial place to fund its dividend.

Four Reasons That Pfizer Is A Recession Play

The number one most important reason is the sector that Pfizer is in. The health care sector and, more specifically, the pharmaceutical industry is uniquely well suited for performance during a recession. While the pharmaceutical industry, especially a juggernaut the size of Pfizer, will most likely not start achieving massive growth, it will also not likely experience a huge hit to its current growth. Pharmaceutical companies experience consistent demand for their products, and people usually cannot cut back on pharmaceutical-related expenses as much as they can with other companies. For this reason, pharmaceutical companies’ underlying businesses are not affected by economic conditions as much.

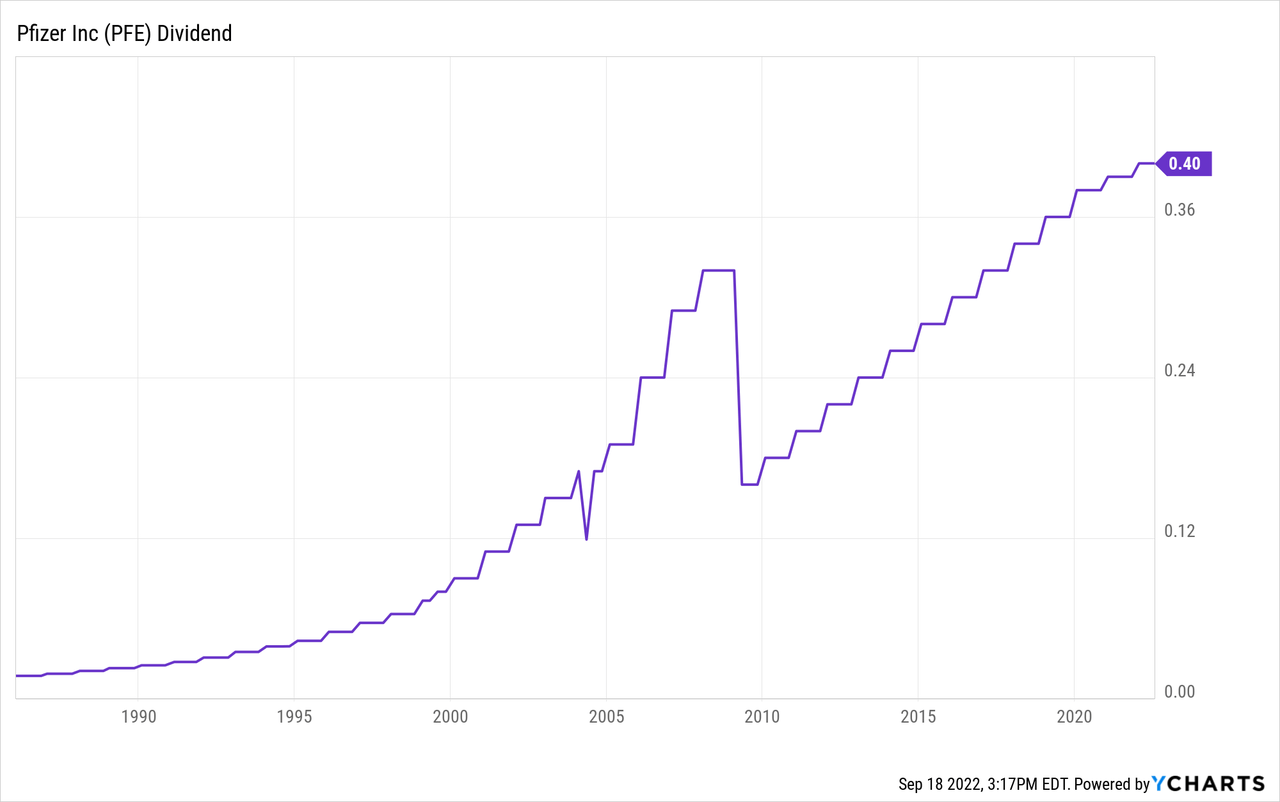

The second reason is the 3.48% dividend that Pfizer pays. A dividend shows the financial strength a company has. The only time over the last almost 60 years that Pfizer has had a significant cut to its dividend was during the 2008 crisis. Strong leadership has consistently allowed Pfizer to pay dividends to investors during different economic conditions.

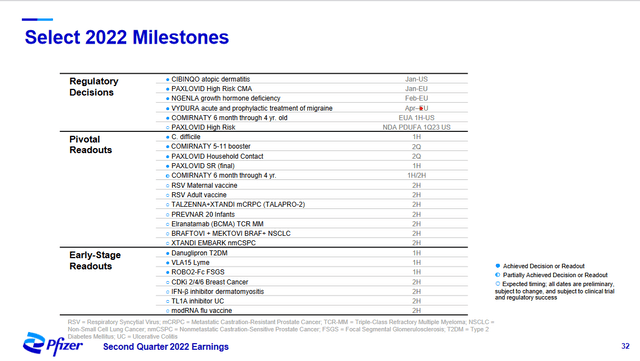

The third reason is Pfizer’s immense drug pipeline. Outside of the many high-earning drugs that Pfizer currently has, including Paxlovid earning $8.1 Billion a year, Comirnaty earning $8.8 Billion a year, Eliquis earning $1.7 billion a year, Prevnar earning $1.4 Billion a year, and Vyndamax earning $552 million a year, Pfizer still has or will have 12 pivotal data readouts this year. The picture below from the company’s second-quarter presentation does not even include any promising partnerships Pfizer has (including in gene editing) or the future money-generating drugs Pfizer could likely acquire.

The fourth and final reason is that Pfizer has an excellent track record of returns. Looking at the chart below, we can see that Pfizer has grown 98.23% over the past ten years. This averages out to 9.8% per year. If you add in the roughly 3% dividend Pfizer pays, the company has returned approximately 12% annually for the past ten years without reinvesting the dividend. While past performance is no guarantee of future performance, I feel good about the future considering Pfizer’s immense pipeline and proven track record. While unseen in the dividend number, what can be seen in the share price growth is from the company returning shareholder’s capital through stock buybacks: the company did $9.9 billion in the last three years and $2 Billion in the first two quarters of this year.

Risks & Conclusions

The risk with Pfizer over a long period is that they have to find new drugs to bring to the market consistently. While this can be very difficult, they have managed to do this for over 150 years. Additionally, the pharmaceutical industry is not known for rapid growth, so investors might risk missing out on outsized gains in other higher-growth stocks.

Pharmaceutical companies in general and in our case, Pfizer, are usually great defensive plays for recessions. Pfizer’s lack of a cyclical nature and strong cash position has led it to this position. Nobody can predict the future or where inflation and interest rates will be in one or five years. This uncertainty can cause many people worries. If you are worried about the economy, then investing in Pfizer might be a good decision, in my opinion.

Be the first to comment