Galeanu Mihai

Introduction

Even though fuel prices surged to painful levels during early 2022, the outlook for Sunoco (NYSE:SUN) saw their distributions still stuck at their current level, despite the pain at the pump, as my previous article discussed. Even though they enjoyed a surprisingly strong start to 2022, unitholders are only going to see the same distributions with management prioritizing other uses of their capital instead of lifting their high 8.09% yield, as discussed within this follow-up analysis that also reviews their recently released results for the second quarter of 2022.

Executive Summary & Ratings

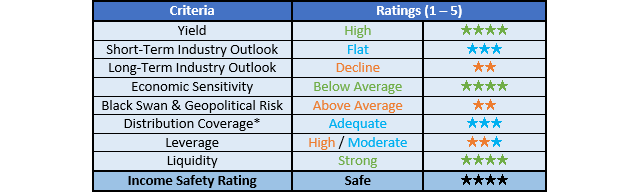

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing distribution coverage through distributable cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

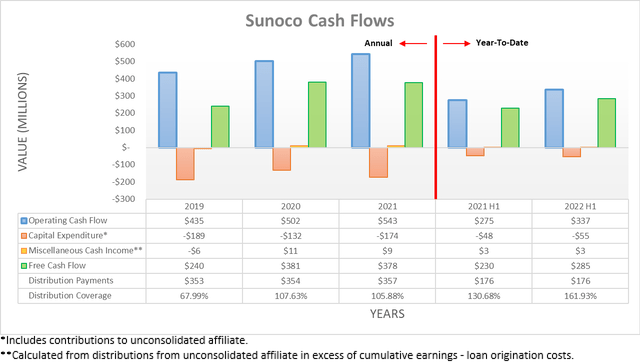

Upon entering 2022, their adjusted EBITDA guidance only saw an increase of 4.77% year-on-year at the midpoint, as per my previously linked article, which theoretically should translate comparably into their cash flow performance given their positive correlations, thereby making for a modest but not resoundingly strong year. Whereas the first half of 2022 was actually surprisingly strong with their operating cash flow landing at $337m and thus a very impressive 22.55% higher year-on-year versus their previous result of $275m during the first half of 2021. Even if removing their temporary working capital movements, this comparison only further improves with their underlying operating cash flow for the first half of 2022 at $356m and thus now a massive 40.16% higher year-on-year versus their equivalent previous result of $254m for the first half of 2021, thereby underscoring their fundamental strength.

This appears to have been driven by a powerful combination of both higher margins and volumes with the former sitting at 12.4 and 12.3 cents per gallon for the first and second quarters of 2022, which represents a sizeable increase versus their respective results from 2021 of 10.3 and 11.3 cents per gallon. Meanwhile, their volumes did not drop and instead rose 1% and 3% year-on-year across these same two periods of time, as per their second quarter of 2022 results announcement. This actually goes against their usual inverse correlation that sees either margins or volume benefitting at the expense of the other, as per my previously linked article.

Despite this surprisingly strong cash flow performance, they did not increase their guidance for 2022 and instead only reaffirmed their original guidance for adjusted EBITDA of $815m at the midpoint, as per their previously linked second quarter of 2022 results announcement. Since there should be a positive correlation between this accrual-based result and their cash flow performance, it implies that as 2022 progresses the second half stands to see a deceleration relative to the first half. The outlook for a recession or economic slowdown on the horizon as the Federal Reserve lifts interest rates makes it likely that either their volumes or fuel margins will subside. Since this also helped suppress their leverage, as subsequently discussed, it saw an analyst asking whether they “…have much desire to raise the distribution”, which they confirmed they did not as they prioritize growth, as per the commentary from management included below.

“Yes. I think right now we’re leaning into growth at the leverage target and with strong coverage. As I said in the prepared remarks, we have increasing amounts of capital to redeploy into organic growth and M&A.”

-Sunoco Q2 2022 Conference Call.

Whilst there is nothing necessarily wrong with this capital allocation strategy, it nevertheless should be remembered that the days of electric vehicles are knocking at the door, proverbially speaking. This leaves their growth investments with a questionable medium to long-term outlook, especially their organic growth as demand for fossil fuels stands to wane over the coming decades. This is obviously not going to happen overnight but at the same time, investing capital into organic growth within an already very mature industry is not always a recipe for desirable long-term returns. To the credit of management, their existing operations are performing very well, although it remains to be seen how they handle the real test coming later in the decade as electric vehicles pick up more market share. It would probably not come as a surprise to those familiar with my articles that I would have personally preferred to see management prioritizing unitholder returns over growth, given this outlook for their industry.

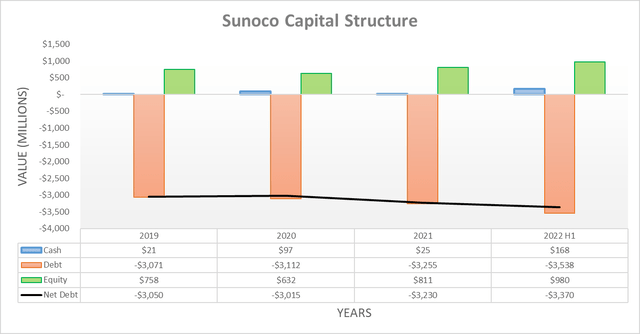

Despite producing ample free cash flow above and beyond their distribution payments, the first half of 2022 still saw their net debt climb slightly higher to $3.37b versus its previous level of $3.23b at the end of 2021, thereby representing an increase of $140m or 4.33%. Similar to during the fourth quarter of 2021, this once again stems from another relatively small terminal acquisition, which this time came from Gladieux Energy for $190m plus working capital adjustments, which brought the total cost to $264m. Whether their net debt starts edging lower or climbs higher will largely depend upon whether management pursues any further yet-to-be-known acquisitions, which are obviously possible given their appetite for growth.

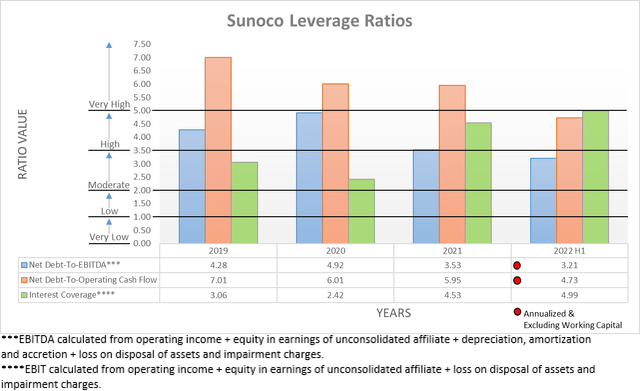

Even though their net debt increased during the first half of 2022, their surprisingly strong financial performance still resulted in their leverage decreasing modestly. This saw their net debt-to-EBITDA sliding to 3.21 versus its previous result of 3.53 following the end of 2021, which is now below the threshold of 3.51 that separates the high and moderate territories. Meanwhile, their net debt-to-operating cash flow saw a relatively larger decrease with their latest result sliding to 4.73, which unlike their previous result of 5.95, now sits below the threshold of 5.01 that separates the very high and high territories. If looking elsewhere, their leverage ratio, as utilized by management, slipped down to 4.17 and thus as alluded to earlier, now sits very close to their target of 4.00, as per their previously linked second quarter of 2022 results presentation.

Whilst this improvement is obviously positive, unless their strong financial performance from the first half of 2022 continues, these two leverage ratios will revert back higher. Even if this improved leverage is sustained, it does not change the fact that management is prioritizing their additional balance sheet strength for growth rather than boosting unitholder returns, at least during the foreseeable future.

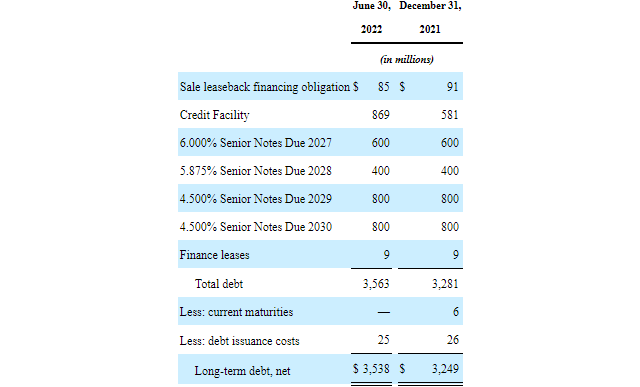

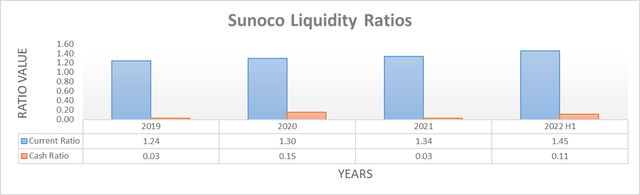

Thanks to their cash balance increasing quite noticeably during the first half of 2022 to $168m versus its previous level of only a mere $25m at the end of 2021, it strengthens their liquidity. They now sport a current ratio of 1.45 as well as a cash ratio of 0.11, the latter of which being a material improvement versus its previous result of 0.03, whilst the former saw a smaller improvement versus its previous result of 1.34. When combined with their credit facility being refinanced during the second quarter to extend its maturity from 2023 to 2027, their liquidity now appears strong, whereas in the past it was consistently only adequate. Since their credit facility maintained its $1.5b limit, they have $625m of availability remaining given their drawings of $869m and $6m of letters of credit, which provides ample additional support if required, especially since they see no other debt maturities until 2027, as the table included below displays.

Sunoco Q2 2022 10-Q

Conclusion

Whilst they have seen a surprisingly strong start to 2022, the lack of accompanying higher guidance implies the second half of the year may see a mild deceleration that ultimately sees an overall modest but not a resoundingly strong performance for the year. Regardless of where these results land, their distributions are still stuck around their current level with management prioritizing growth over unitholder returns during the foreseeable future and thus I still believe that maintaining my hold rating is appropriate. If their unit price were to retreat lower or alternatively, their management starts prioritizing unitholder returns, this would very likely be upgraded to a buy rating.

Notes: Unless specified otherwise, all figures in this article were taken from Sunoco’s SEC filings, all calculated figures were performed by the author.

Be the first to comment