Andrew Burton

Investment Thesis

Paramount’s shares (NASDAQ:PARA, NASDAQ:PARAA) have slipped by over 20% since its last quarterly report. A lot of this is driven by a slowdown in linear TV, streaming, and advertising. But the company is continuing to report healthy growth in paid streaming subscribers. I think that its best-in-class TV ecosystem will continue to be a competitive advantage.

Advertising will likely remain a source of volatility. But I think that there are meaningful tailwinds in the second half of the year. Overall, I believe that shares are undervalued at the current price.

Cord Cutting And Profitability Headwinds

Paramount reported another quarter of solid results. Revenues grew 19% year over year, driven by strong streaming growth and theatrical releases. The company’s flagship Paramount+ added 4.9 million new subscribers in the quarter. These are the best subscriber and net add results of any streaming service during the quarter.

But the company’s guidance was more moderate. Management didn’t withdraw their prior 60% DTC revenue growth target but noted that they may miss it by a little. The current environment is volatile. Management has limited visibility into the second half of the year.

Shares have declined by over 20% since this earnings announcement. Some of this poor performance is due to concerns around Paramount’s linear TV ecosystem. In the last quarter, Paramount’s TV Media segment generated $1.38 billion in adjusted EBITDA. This is down 8% year over year. Cord cutting is happening faster than analysts had previously expected. Total pay TV subscribers were down 8.2% in Q2.

These legacy media segments are a key part of my bullish thesis. Paramount’s direct-to-consumer segment is still incurring large operating losses. But its other media segments are still generating a solid profit. The content these traditional media segments create can then be added to Paramount+. This model effectively subsidizes the company’s streaming content. This ecosystem is critical to Paramount’s long-term success.

Paramount’s Media Properties (Paramount Q2 2022 Earnings Press Release)

So Paramount’s profitability is still significantly exposed to linear TV. The company generates the vast majority of its operating profit from the segment. The broader linear TV ecosystem is experiencing headwinds. But overall, I think that Paramount can be more resilient. The company’s CBS network is consistently the number one network across a number of metrics. It was the number one network for the twentieth consecutive quarter. Paramount had seven of the ten most-watched programs. I think that this can help Paramount fight through these profitability headwinds. The segment’s revenue is actually up by about one percentage point year over year.

Additionally, the company has a lot of sports on its CBS network, such as the NFL and the PGA. The company recently acquired the rights to the Big Ten Conference in a joint deal. It also renewed its right to carry the UEFA Champions League. These programs require viewers to engage with one of Paramount’s services. It should help retain linear TV subscribers. Cord cutters will also be pushed towards Paramount’s streaming offerings.

Advertising Softness

Paramount’s advertising business was softer during the quarter. Within the company’s TV Media segment, advertising revenues declined 5% year over year. Total advertising revenues were down 2% year over year or flat in constant currency.

This hurt Pluto TV, Paramount’s FAST service. Pluto reported a 33% year-over-year increase in monthly active users but only a 10% increase in revenue. This means that revenue per monthly active user declined by 17% year over year. But management says that there are tailwinds that could boost advertising revenue in the second half. They discussed these dynamics on their last earnings call.

As we look ahead in this ad market, there’s two things I’d note. First, we’re really pleased with how the upfront played out and particularly the volume dynamic in it, which was up nicely. Second, there are two important new category tailwinds that we’ll see probably late Q3 and certainly Q4. The first is pharmaceuticals. That came back big in the upfront. That’s super important to us because it’s a big category for us given our demographics and specifically the demos of CBS.

And the second is political. We’re expecting advertising related to the midterm to be very strong given what’s going on there. And I’d note that historically, that’s really a stations business and for sure, it will be a stations business this year. But also with targeting, we see IQ and Pluto playing there and therefore benefiting as well.

Political and pharmaceutical spending should help boost ad revenues in the second half. These are spaces where Paramount is better positioned than its competitors. I think that the company can take advantage of the current situation. It can improve its user counts and engagement for when advertising dollars start to come back.

Paid Subscriber Strength

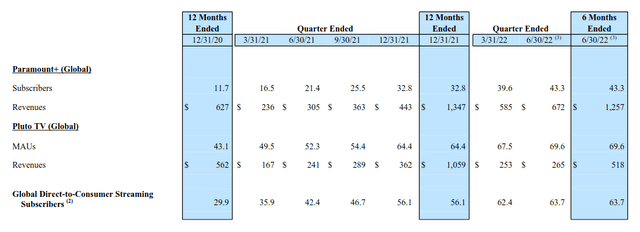

Paramount’s paid streaming services are still doing quite well. The company added 5.2 million subscribers during the quarter. 4.9 million of these ads were associated with Paramount+. The company grew Paramount+ subscribers by 102% year over year and grew revenue by 120%. This indicates a solid paid ARPU expansion of 9% year over year. It’s promising that Paramount is increasing paid ARPU without direct price increases. The company’s model allows it to generate topline ARPU growth without price hikes.

Paramount Q2 2022 Trending Schedules

Paramount’s other paid streaming metrics are still solid. Titles watched per user increased. Hours watched per active user also increased. Management says that this has heavily reduced subscriber churn. This is a promising sign for the future.

The company continued to expand its services into international markets. Paramount+ launched in the United Kingdom, Ireland, and South Korea. The company plans to launch in Italy, Germany, Switzerland, Austria, and France in the second half. Paramount’s strategy of partnering with local broadcasters is a competitive advantage. It gives the company low churn subscribers at a cheap customer acquisition cost. This should be a continued tailwind for subscriber growth into next year.

A Cheap Price And An Improving Debt Burden

Paramount is still trading at a cheap valuation. The company has an LTM P/E of 3.5 times and a P/S of 0.41 times. The business is still heavily indebted, with $15.8 billion of debt on its balance sheet. Adjusting for net debt, the company has an adjusted EV/EBITDA of 6.9 times. I think that this is a cheap valuation for a company with this profile.

Paramount Q2 2022 Earnings Press Release

Paramount has good liquidity, with $4 billion in cash on hand and a $3.5 billion undrawn credit facility. The company is also reducing its debt burden. In the first half of the year, the company paid down $2.39 billion of its debt due before 2026. In its place, the company issued $1 billion of debt due in 2062. Although this debt burden is high at 3.4 times adjusted EBITDA, the company has very long-dated debt. This, plus the sales of assets, should improve the company’s net debt position.

The company has returned to generating positive free cash flow. But the business is still struggling with cash generation. The company reported $440 million in free cash flow during the first half. This barely covers the company’s quarterly dividend.

Management forecasts peak losses in 2023. It’s likely to be a while before the business starts generating serious cash. Until then, the quarterly dividend is likely to be the only direct shareholder return. At the same time, it is yielding over 5% at the current price. That’s solid, especially if Paramount earns the free cash flow to pay it instead of covering it from cash on hand.

There are still risks related to the company’s critical transformation. But I think that the risk to reward is very favorable at the current valuation.

Final Verdict

Paramount is still going through a risky transition in its business. Headwinds in linear TV and advertising have further pushed down the price of the stock. But I think that the bull case is still intact. The company’s paid offerings are continuing to report fantastic metrics. I believe that Paramount’s shares are undervalued at the current price.

Be the first to comment