Lemon_tm

We’ve seen some exciting price action in recent weeks. The S&P 500/SPX (SP500) dropped by approximately 20% from its mid-August high to its current bottom at 3,500. I called the August top in the “Near-Term Top” article and a series of other bearish articles I published around that time. I’m not saying that the bear market is over or stocks are heading to the moon from here. However, now that the market is significantly lower, we could see another powerful countertrend rally ahead. The upcoming Fed rate hike is likely priced in, and we see earnings coming in better than expected. If the constructive earnings theme continues, we could see stocks rebound substantially in the coming weeks.

Finally, A Technical Setup We Can Work With

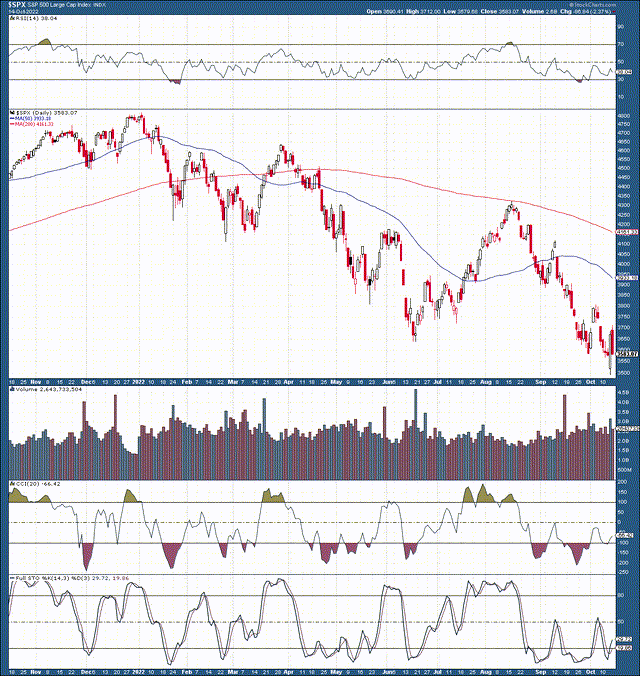

SPX 1-Year Chart

SPX (StockCharts.com)

The SPX bear market decline has been about 27% from peak to trough. However, the SPX dropped by a whopping 20% since mid August. That’s just two months. The SPX and stocks, in general, got severely oversold. We saw the RSI drop below 30, and the CCI dipped below 200, indicating extremely oversold market conditions. Perhaps most importantly, we witnessed a significant panic-driven reversal last Thursday. The market opened significantly lower with capitulation-style selling, but after the relentless selling, the buyers came in, reversing the market by nearly 200 points. We probably witnessed seller exhaustion, and around 3,500 many market participants did not want to sell anymore. Then the algos and the bulls took over, driving stocks to close at session highs. In short, we may have put in another near-term bottom, and we could see the SPX rally to the 3,800-4,000 resistance point from here and possibly higher after that.

It’s All About the Fed and Earnings Right Now

While the near-term technical image has improved substantially, it’s still all about the Fed and earnings going into November. Despite the higher-than-anticipated CPI reading and the better-than-expected employment report, the Fed will probably still hike interest rates by 75 basis points at the next meeting.

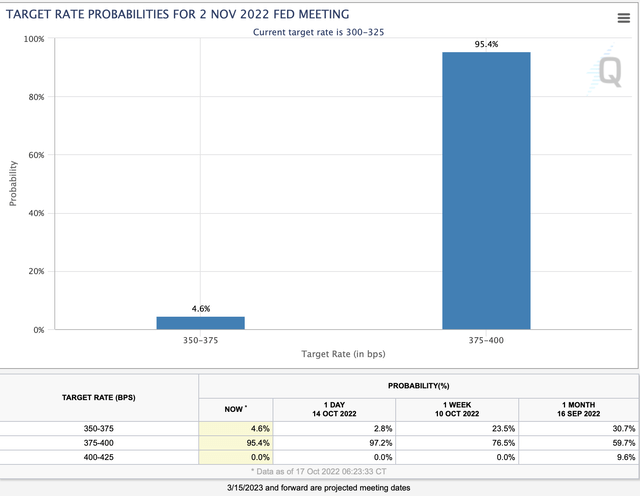

Rate Probabilities

Rate probabilities (CMEGroup.com )

There’s now about a 95% probability that the Fed will raise the benchmark to 3.75-4% (75 basis points) at the next FOMC meeting in roughly 16 days. While 95% is higher than the 50%-70% expectations we had in recent weeks, it was still likely that the Fed would make another 75 basis point move. Therefore, the market has been preparing for the rate hike in recent weeks, has dropped significantly, and the upcoming rate increase should be fully priced in by now. Moreover, once the Fed raises by 75 basis points at the next meeting, it will probably only move by 25-50 basis points at the December FOMC event, suggesting that we may get a significant relief rally after the Fed’s decision on Nov. 2.

Positive Earnings Are a Catalyst for Higher Stock Prices

It’s primarily about making or beating your earnings estimates at the end of the day. Forward guidance is an essential element, but I have not heard too much negative news from the recent bellwether names kicking off earnings season. On the contrary, we see banks and other significant corporations reporting better numbers than the street expected, and that’s bullish for stocks.

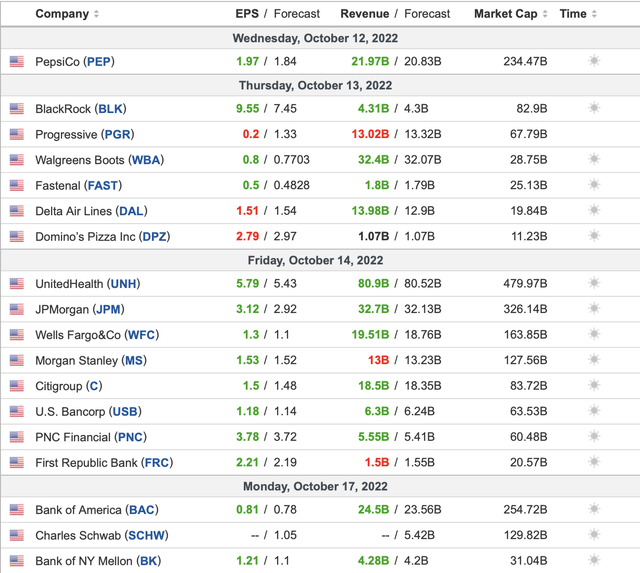

Here’s What We’ve Seen So Far

Earnings (Investing.com)

While it’s not much, we see much better than expected results from big companies. I want to draw your attention to the big banks as they typically set the tone for the entire earnings season. Look at JPMorgan (JPM), Wells Fargo (WFC), Citigroup (C), Bank of America (BAC), and other smash earnings. This phenomenon implies that despite massive drops in stocks, the U.S. economy remains remarkably resilient, and we should see more upside for stocks in the weeks ahead. Moreover, it’s not just the banks. Other companies are reporting better-than-expected earnings figures, and this trend should transition in the weeks ahead. Robust earnings from big tech companies and other bellwether names should fuel the recent rally further, leading to higher stock prices in the near term.

Portfolio Strategy

Since recognizing the near-term market top in mid August, I’ve been reducing risk, hedging, and raising dry powder. I published the results from the most recent round of hedging here. All hedges were closed in early trade Thursday and posted in real-time in our AWP chat room. In addition to closing hedging positions, I increased the All-Weather Portfolio’s“AWP’s” long holdings.

More specifically, I increased or initiated long positions in Meta Platforms (META), Block (SQ), Advanced Micro Devices (AMD), Qualcomm (QCOM), Roku (ROKU), and Zoom (ZM). These tech adds brought the AWP’s Technology Plus portfolio segment holdings to roughly 22% of total portfolio assets. Additionally, I added to my NIO (NIO) position and initiated a position in XPeng (XPEV). I also doubled my Lithium Americas Corp (LAC) position during Thursday’s selloff.

While the AWP is roughly flat for the quarter, I’m confident that the portfolio is set up to outperform in the coming weeks, months, quarters, and future years. The AWP has significantly outperformed the S&P 500 and other major averages in prior years. While we’ve made several missteps, the AWP is up by approximately 6% YTD, substantially bettering the SPX’s 25% decline and the Nasdaq’s 34% YTD crash. Best-of-breed companies, effective hedging, timely rotation, and portfolio adjustments around the peaks and troughs should enable the AWP to continue beating major market averages as we advance into 2023 and beyond.

Be the first to comment