Ryan Fletcher

While Boeing (NYSE:BA) is not quite meeting expectations for single aisle deliveries. I remain upbeat about their recovery trajectory. Most importantly, that is driven by the return of the Boeing 787 in the delivery mix, which is priced roughly three times higher than a single aisle jet. In this report, I will have a look at the orders, deliveries and other backlog mutations for Boeing in September.

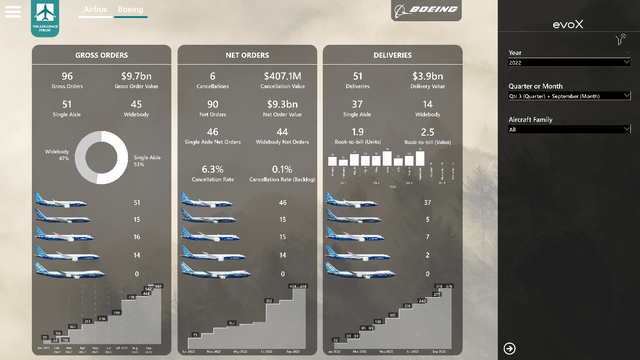

For this report, I will be using the evoX order and delivery monitor developed by The Aerospace Forum. For those who have been following the monthly order and delivery reports that I write for Airbus and Boeing, you might notice that this monitor looks completely different. So, I wanted to briefly introduce this new product that I will occasionally use as the backbone for investor updates. Over time, our data analytics capabilities have significantly expanded. With that come new insights on how to do things better. As a result, I have launched evoX, which combines front-end efforts and back-end improvements to improve our data analytics tools.

The evoX platform introduces a completely new look for interactive monitors, but it does not stop there. We consolidated various monitors and pages into one, making more data accessible with a single tool and from the same data we present more information to you. So, we are better leveraging the hundreds of thousands of datapoints we got, which allows us to better highlight the data-driven approach of the analysis.

Just like before, using these tools we are able to analyze orders and deliveries and see where manufacturers are falling short, meeting or exceeding expectations.

Boeing Orders Climb

Boeing Orders and deliveries September 2022 (The Aerospace Forum)

In September, Boeing booked 96 orders valued $9.7 billion consisting of 51 single aisle jets and 45 wide body aircraft, marking a sequential increase of 66 orders:

- BBAM Aircraft Management ordered 2 Boeing 737 MAX aircraft.

- Fifteen Boeing 767-2C, base aircraft for the KC-46A, were ordered.

- China Airlines ordered 16 Boeing 787-9s.

- An unidentified customer ordered 7 Boeing 737 MAX aircraft.

- An unidentified customer ordered 2 Boeing 777Fs.

- An unidentified customer ordered 12 Boeing 777X.

- WestJet ordered 42 Boeing 737 MAX aircraft.

During the month, the following changes were made to the order book:

- Air China was identified as the customer for 5 Boeing 777Fs.

- All Nippon Airways was identified as the customer for 1 Boeing 787-9.

- A/S Maersk Aviation Holding was identified as the customer for 1 Boeing 767-300F.

- CES Leasing Corporation was identified as the customer for 1 Boeing 777F.

- Aviation Capital Group was identified as the customer for 12 Boeing 737 MAX aircraft.

- Ethiopian Airlines Group was identified as the customer for 5 Boeing 777Fs.

- Five orders for the Boeing 787-8 previously listed under Boeing Capital Corporation have been transferred to American Airlines (AAL).

- Alaska Air cancelled orders for 5 Boeing 737 MAX aircraft.

- An unidentified customer cancelled an order for 1 Boeing 787-9.

Looking at the orders, September was a good month for Boeing. Boeing booked a big order from WestJet for the MAX 10, which I discussed in more detail in a separate report and there was a flurry of wide body orders including an order for the Dreamliner from China Airlines (Taiwan) and an order for 12 Boeing 777X aircraft. Ten of those orders have now been attributed to Cargolux and it will be interesting to see who the customer for the other two aircraft is. There also were tanker orders from the Air Force meaning that all meaningful wide body orders received orders, which certainly is not something that happens every month. What is also appreciable is that the orders were almost equally split between single aisle and wide body orders, and while it is too early to make definite statements, it could be that we are seeing appetite for wide body aircraft revive.

In September, Boeing logged 96 gross, valued $9.7B, while it scrapped six orders valued $407 million from the books, bringing the net orders to 90 orders valued $9.3 billion. A year ago, the U.S. jet maker booked 27 orders and 5 cancellations, bringing its net orders to 22 units with a net order value of $2.0 billion. So, we see that net order inflow increased significantly.

Year-to-date, the Boeing booked 542 gross orders and 114 cancellations, bringing the net orders to 428 units with a net order value of $32.2 billion. In the first nine months of 2021, Boeing booked 710 gross orders and 302 net orders with a net value of $24.4 billion. So, gross orders have trended down year-over-year, but the net order value is more positive, and also the improved mix gives Boeing a year-over-year growth in order value.

Boeing also updated its ASC606 adjustments tally, which is a tally in which Boeing lumps orders that have a purchase agreement but also several other check boxes that need to be ticked in order to count the aircraft orders to the backlog or not. During the month, we saw the tally increase as 49 aircraft 737 MAX were added and three Dreamliners were removed from the tally. While the customer’s name is not disclosed by Boeing, I expect that the 737 MAX additions to the tally come from Akasa Air and Aerolineas Argentinas. Akasa Air might be more inclined to lease aircraft than to directly buy at this point in time and it is highly likely that the order for seven aircraft offsets a possible cancellation from the Argentinian carrier.

If all ASC 606 adjustments result in cancellations, which definitely is not always the case, Boeing would have to scratch an additional 882 aircraft from its books.

Boeing Deliveries Pick Up

In September, Boeing delivered 51 jets compared to 35 in the previous month. The jet maker delivered 37 single-aisle jets and 14 wide-body aircraft with a combined value of $3.9 billion:

- A total of 37 Boeing 737s was delivered, consisting of one Boeing P-8A and 36 Boeing 737 MAX aircraft.

- Boeing delivered five Boeing 767 family aircraft consisting of one Boeing 767-2C and four Boeing 767-300Fs.

- Boeing delivered two Boeing 777Fs.

- Boeing delivered seven Boeing 787s; three -8s, two -9s and two -10s.

In September deliveries increased to 51 units from 35 a month earlier. The delivery figures matched the June numbers but with a more attractive mix as the Boeing 787 is back in the game. Additionally, we saw MAX deliveries outpace production rate which indicates that the inventory has shrunk in September. However, what should also be noted is that during the final month of the quarter deliveries tend to be higher to make quarterly goals or get is much aircraft out as possible and it is not necessarily an indication of sustained reduction in inventory. In previous months, I have not been impressed with Boeing’s delivery numbers, but that is different this month. We saw both the Boeing 737 MAX and Boeing 787 doing well in terms of deliveries.

Compared to last year, deliveries increased by 16 units while the delivery value increased by $1.3 billion reflecting a more appreciable delivery mix. Year-to-date, Boeing delivered 328 aircraft valued at $22.1 billion compared to 241 aircraft valued at $18.5 billion last year. Year-to-date numbers show that Boeing deliveries are significantly higher, driven by the Boeing 737 MAX program. The Boeing 787 totals have yet to catch up compared to last year, but also that program will be a positive to grow revenues this year.

The book-to-bill ratio for the month was 1.9 on unit basis and 2.5 on dollar value basis. For the first nine months of the year, the gross book-to-bill is 1.7 in terms of units and 1.8 in terms of value, while the cancellation rate is 21% and 2.4% when measured against the backlog. The book-to-bill ratio for the year is looking extremely strong. This is driven by strong order inflow, but also by the underwhelming delivery numbers due to supply chain issues. So, book-to-bill ratios higher than one do show balance or oversold positions in general, but in this case, they also reflect the big challenges when it comes to hiking production.

Conclusion: Boeing Delivers, Now Its Stock Price Needs To Deliver

Boeing had a strong month when it comes to orders securing an important order from WestJet for the MAX and also securing wide body orders for passenger aircraft, freighters and tanker base aircraft. We might be seeing the first signs here that appetite for wide body orders is returning and if that is the case, the Boeing 787 is back right in time. However, it should also be kept in mind that during the delivery stop for the Dreamliner, which caught significant negative attention, airlines were unlikely to be willing to make headlines with orders for the type even though significant discounts could have been obtained at the time.

After months of being somewhat bearish on current deliveries while still pointing out the improved prospects for future deliveries, I am now finally turning more positive on the deliveries. Boeing has yet to show sustained inventory reductions for the MAX, meaning deliveries being in excess of productions, but its Dreamliner delivery flow is looking promising.

Last month I pointed out that if you liked Boeing the past year, you will probably like it even more now as delivery flows improve. Boeing is now delivering closer to what I like to see and the next step is for the stock prices to start delivering to investors. The 4% gain compared to a 2% market decline since the previous order and delivery report might be a start of Boeing’s stock improving performance.

Be the first to comment