Marina_Skoropadskaya/iStock via Getty Images

Investors who thought Desktop Metal (DM) would revolutionize the supply chain in the last two years should have looked at Stratasys (NASDAQ:SSYS) first. At the height of its bubble nearly a decade ago, SSYS stock traded at over $100. Even though Stratasys and 3D Systems (DDD) took advantage of the market’s folly by taking advantage of its lofty stock price, both firms risk slumping further from here.

With the benefit of hindsight, investors realize neither Stratasys nor 3D Systems could accelerate growth by acquiring firms and intellectual property. More recently, Stratasys posted a non-GAAP break-even quarter despite revenue growth in the double-digit percentage.

Should investors give up on the 3D printing market and Stratasys especially?

Stratasys Posted Fourth Quarter GAAP Net Loss

Stratasys posted non-GAAP earnings per share of a penny. On a non-GAAP basis, it lost $4.8 million (7 cents per diluted share). Although it ended Q4 with $502.2 million in cash and cash equivalents and has no debt, the company needs to start turning a profit. Investors are in no mood to speculate on technology firms that are still burning money. Stratasys had decades to fine-tune a sustainable business model but failed to do so.

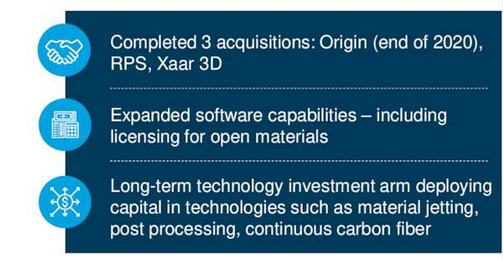

Amortization of intangible assets, restructuring, and non-cash stock-based compensation expenses led to the net loss in the quarter. Stratasys highlighted three acquisitions, expansion in software capabilities, and capital deployment in technologies as its 2021 achievements:

Stratasys Q4/2021 Results Presentation

Source: Q4/2021 Results Presentation

The firm has new 3D printers that serve five industry-leading technologies. This included the Origin One Dental printer and the J5 Dental Jet. Those will serve the growing dental market. Its J5 MediJet printer gives healthcare customers a cost-effective method for printing guides quickly.

After The company’s RPS acquisition, it launched the NEO line of Industrial Stereolithography systems. Its offerings expanded to the large design parts market. If widely accepted, its open software platform, which caters to manufacturing, should expand Stratasys’ addressable market.

Outlook

For the full year of 2022, Stratasys expects revenue in the range of $680 million to $695 million. In the first quarter, revenue will grow in the high teens, similar to the fourth quarter. Furthermore, it targets a long-term gross margin of over 50%. Yet ongoing investments will add up to $25 million more in expenses this year compared to 2021. The firm justifies the higher expenses for investments in new products to accelerate revenue growth. As a result, it will still lose $67 million to $74 million or between $1.00 to $1.11 a share.

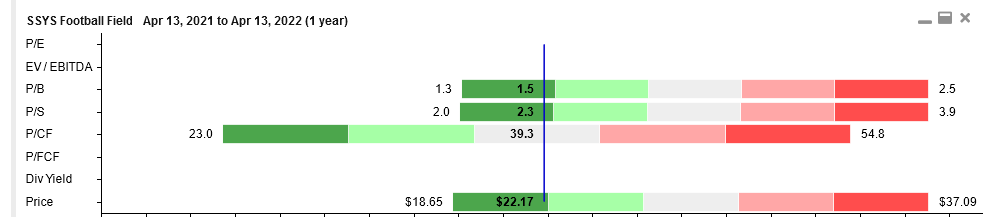

Stratasys views the gross margin pressures as temporary. It has a long-term margin target of over 50%. For now, stock markets are giving SSYS stock the benefit of the doubt. The stock is trading at the lower end of its historical price-to-earnings, price-to-book, and price-to-sales ratio:

Football field of SSYS (Stock Rover)

Shares are also trading close to their 52-week low. In addition, SSYS stock is trading with its year-long trading range of between $20 and $25. After breaking out above key moving averages, lifted by Nasdaq’s relief rally, the moving average convergence divergence crossed over.

SSYS MACD and Price chart (Stock Rover)

In the MACD above, the blue line crossed over the slower-moving green line, a bearish signal. The stock could re-test the $18.65 – $20.00 low. This depends on the market’s sentiment. Investors will find it nearly impossible to predict if sentiment will worsen, hurting Stratasys’ share price.

Opportunity

Stratasys gets one strike for posting quarterly losses and forecasting more. However, it has no debt. The same is untrue for many slow-growing drug companies I covered before. For example, Teva Pharmaceutical (TEVA), Bausch Health (BHC), and Viatris (VTRS) need to pay down debt before their stock price outperforms the market.

Stratasys only needs to improve sales to turn profitable. It introduced many printers that will suit the manufacturer’s needs. For example, in Q4, Stratasys won a $20 million order from the US Navy for 25 F900 manufacturing systems. Granted, companies in the defense, military and aerospace sectors are experiencing hyper-growth due to the Russian war. Still, this contract win might lead to bigger deals next.

This year, the company will establish its leadership in polymer 3D printing. Customers are receptive to Its H350 and Origin One. This suggests Stratasys could double its addressable market in the years ahead.

In the automotive sector, Stratasys may become the one-stop shop for 3D printing solutions. Two years ago, it sold only technology. Today, it is selling the best solution to solve customer problems.

Risks

Investors are wary of relying on the hope that new technology will play out. Fortunately, SSYS stock is inexpensive at current levels. It has ample cash and does not need to sell stock to fund operations.

The stock scores a “B” grade on both value and growth. Only its profitability suffers from a grade of C-.

SA Premium Quant Score (SA Premium)

Your Takeaway on Stratasys

Stratasys is a slow turnaround story for the patient investor. Companies like Nano Dimension (NNDM) and Desktop Metal took advantage of the market’s euphoria for 3D printing solutions. Stratasys is slow in capturing market share. It is showing potential for getting there. As it executes its business plan to increase its addressable market, the stock will rise from here.

Be the first to comment