da-kuk/E+ via Getty Images

One can never be complacent in emerging markets. – John Carlson

Fund profile

The Invesco India ETF (NYSEARCA:PIN) is one of a dozen options that potential investors can pursue if they’re looking for exposure to one of the fastest-growing economies in the world. Is PIN the most optimal Indian-focussed option you could pursue? Well, that’s debatable. If you’re someone who places additional emphasis on the income profile of a fund, then PIN should figure in your thoughts as it has a rather compelling yield of over 7% (this does not appear to be a one-off as the 4-year average is around 8%). Having said that, PIN also appears to be rather pricey, as exemplified by a steep expense ratio of 0.78%; there are cheaper options such as INDA and IXSE that have lower expense ratios of 0.58%-0.65%.

Now, I’ll cover some of the other prominent themes surrounding India and how this could impact PIN’s prospects.

Macros

Foreign investors have always been attracted to India’s compelling demographics and growth potential, but I wonder if fund flows could ease off given some of the recent developments in India.

Firstly, let’s talk about crude; market participants the world over are struggling to determine where crude could be headed; some think it could ease and some expect it to stay elevated. I’m more tempted to side with the latter. Even if there is some rapprochement between Russia and Ukraine, economic sanctions will likely persist on Russia and this could continue to cast aside an important supply source. Countries have been attempting to release strategic reserves but I don’t believe this will move the needle when you also consider that OPEC has been hesitant to ramp up production. The summer travel season too will likely result in a bump up in demand. All in all, even though you may see daily gyrations in the price of oil, I feel the upward trend is here to stay.

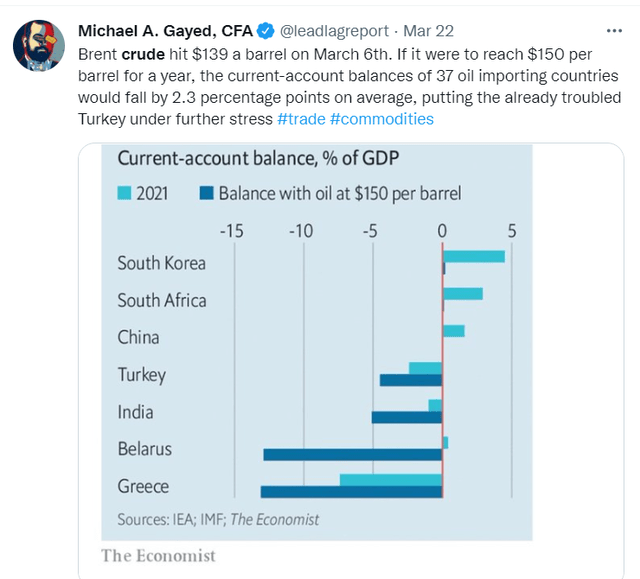

For a gigantic country such as India that imports 80% of its crude requirements, this spells trouble. We’re not there yet and may not get there but as highlighted recently in The Lead-Lag Report, crude at $150 per barrel would annihilate the country’s current account position. Given the country’s dependence on oil imports, India (quite unlike a lot of other major nations) also cannot afford to resist the opportunity to rely on Russian oil imports. You would think that the country’s refiners would be rewarded for some loyalty, but surprisingly, recent reports suggest that Indian refiners have been a victim of discriminatory pricing as they’re now paying nearly the full cost of cargoes even as this is being offered at a discount in Europe.

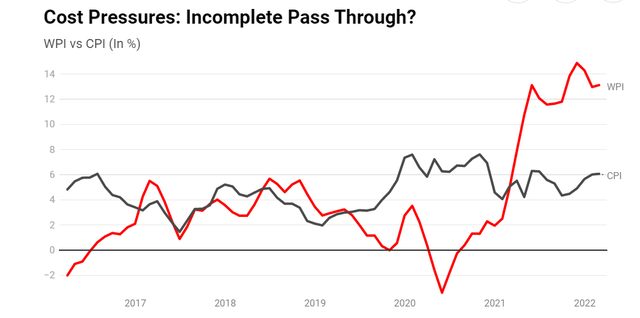

In addition to the direct impact of higher crude prices, also consider the effect this is having on the cost base of Indian enterprises who are finding it challenging to pass heightened pressures to the end consumer base. This is exemplified in the chart below, highlighting the variance in the whole price inflation and the retail price inflation (CPI). Expect to see margin pressures in the coming quarters.

Speaking of the CPI, even though this is below the WPI, the latest reading which came out a few days back caught a lot of people off-guard coming in at nearly 7%, a 17-month high and well above the RBI’s comfort band of 4% with a +/- 2% band. I think upside risks to this number in the months ahead should not be discounted as fuel prices in India were lifted in late March and the effect of this has not entirely been baked in. This could likely prompt the RBI to bring forward its rate hike plans by June. Nomura estimates that the RBI could hike rates by 25bps across its next 8 meetings.

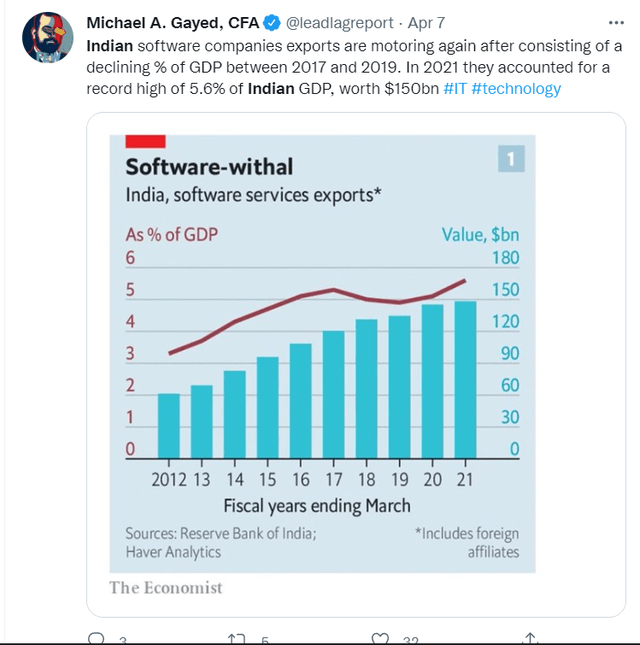

I believe the upward trajectory in rates could be useful for the INR which has had to take it on the chin on account of current account pressures related to crude; on a YTD basis, the INR is down by more than 2% vs the USD. One sector that has benefitted from INR depreciation is India’s tech sector which also incidentally accounts for the largest weight in PIN’s portfolio at 22%. As noted last week in The Lead-Lag Report, demand for Indian tech services from the outside world has ramped up after a lull in 2017 and 2019.

Conclusion

India will likely remain one of the attractive equity stories over the next decade, but I’m not necessarily convinced that one ought to expose oneself to this terrain at this juncture, particularly considering some of the developments that are currently taking place there. Valuations too are hardly cheap with PIN trading at 21x. Conversely, note that the iShares MSCI Emerging Markets Asia ETF (EEMA) only trades at a P/E of 12.5x. Besides, as pointed out in The Lead-Lag Report this week, it appears that short-term market conditions look rather cautious and we’ve seen a decisive move into the defensive side of the general market. It would be prudent to stay defensive rather than load up on a high beta play like PIN.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Be the first to comment