D3signAllTheThings

As those who follow the lithium space may have noticed, Sigma Lithium (NASDAQ:NASDAQ:SGML) jumped more than ten percent at the open and closed up 11.42% by the end of trading. This was seemingly unexplained, with no new press release or filing from the company; there was no broader industry rally Monday either (Lithium Americas (LAC) closed down 0.25% for the day). However, upon closer inspection, Sigma Lithium’s ‘Monday Pop’ may have everything to do with Tesla’s (TSLA) renewed interest in lithium refining.

Tesla’s New Lithium Refining Plans

The announcement, last Friday, that Tesla is planning to enter the lithium refining space has been long anticipated.

The latest news of Tesla’s potential foray into lithium refining comes from a form filed with the Texas Comptroller’s Office. The company is scouting for sites with access to the Gulf Coast shipping channel, either in Texas or Louisiana. It is apparently looking at one Texas site to begin construction this year, targeting production in the fourth quarter of 2024. This is likely the Robstown, Texas site where Tesla has filed for property tax exemption.

Despite having strong reverberations in the lithium space, Tesla’s refining interest is still in the exploration phase; the company does not have any permits or contracts yet. Per the company, “only very preliminary development activities have begun.”

The choice of location for the plant is interesting as well. It is near the company’s Texas headquarters and gigafactory in Austin. However, it is far from any of the United States’ potential domestic lithium production. This may help to explain why neither Lithium Americas nor Piedmont Lithium (PLL) reacted heavily to the news, while Sigma Lithium (a Brazilian company) did. Tesla appears to be positioning itself to accept foreign-supplied hard rock lithium for its plant, sourced from overseas (much like Piedmont).

How This Involves Sigma Lithium

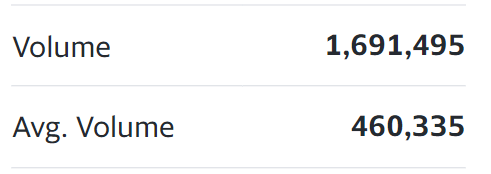

Now, if you read this far and glanced at the title, you may be wondering how this involves Sigma Lithium. Well, to start, it helps to explain why Sigma Lithium jumped 11.42% on Monday. And why the company’s volume was nearly four times its average:

Yahoo Finance

There is no seeming explanation for this jump that can be easily found (until this very conveniently-written article that you are now reading). Sigma Lithium hasn’t issued a new press release since the nineteenth of August (and the September 5 presentation offers little new info).

Even if you look on Google, there are no pointers to what might have caused this rise (other than algorithm-written pieces that will explain what volume is).

However, upon closer inspection, this jolt in the company’s share price seems to have everything to do with Friday’s news about Tesla entering the refining space.

Back in 2019, Sigma Lithium’s CEO announced that the company had held discussions with Tesla about supplying lithium. At the time, CEO Gardner was negotiating with Ganfeng (OTC:GNENF), at Tesla’s request, and held off on a deal:

There’s a bunch of other things that they need, not just prices, but other demands which are a little more complicated that sort of restricts Sigma to almost supplying purely into China, It’s not really what we think we should be doing over the long term.

He also added that Sigma Lithium would much rather directly supply Tesla’s plants. And Sigma Lithium is well-positioned to do that, if Tesla is refining its own lithium hydroxide: Sigma Lithium has committed to producing lithium concentrate, which is the input needed for further refining.

With that background, we can understand why the market may have reacted so heavily on Monday to Tesla entering the refining space. However, this announcement may not be that consequential for Sigma Lithium. The company already has offtake agreements with LG Energy and Matsui and given the supply/demand dynamics of lithium at the moment, shouldn’t have a hard time finding a buyer for the rest.

Yes, Sigma Lithium is well-positioned to supply a Texas plant and yes, it may indeed end up sending some of its production to a Tesla plant, but there is much uncertainty remaining and this is all highly speculative. And given the requirements stipulated in the recent climate bill (based on % of a battery’s mineral value), refining (and thus massively increasing the value) lithium into lithium hydroxide will likely qualify Tesla’s batteries for tax credits even if it supplies some of the raw lithium from non-qualifying countries.

Takeaway

Tesla entering the lithium refining space would certainly be a big deal for the company, further integrating its supply chain and potentially allowing it to achieve a lower production cost than its peers. However, the plant would not be ready for another two years at the very earliest and, even then, would be far from replacing the company’s total lithium needs.

For Sigma Lithium, the location of Tesla’s potential plant (coupled with the two company’s brief history) is somewhat promising for a future deal. At the same time, a deal with Tesla isn’t make or break for Sigma Lithium nor is it clear that Sigma Lithium is currently in negotiations with the company. At the end of the day, this is good news but probably did not warrant a 10% bump in the company’s valuation. For now, investors mainly need to pay attention to whether the company can follow through on its 2023 production targets.

Be the first to comment