David Ramos

Investment thesis

Yes, I know this is probably article number 20 you read about Microsoft (NASDAQ:MSFT) in these past few days after its earnings release. So far, I haven’t written about Microsoft for this exact reason; there are so many contributors on Seeking Alpha writing about Microsoft that it feels a bit unnecessary. But Microsoft is by far my largest personal holding and if I could choose just one stock to invest in for the coming 20 years, my choice would easily be Microsoft (please let me know in the comments which stock you would pick!). And so, I felt like I had to write about Microsoft following its recently released 1Q23 earnings report.

On October 25th Microsoft reported their 1Q23 earnings report and beat both top and bottom-line estimates. Yet, the company dropped hard at market opening on October 26th. This drop was mainly because of slowing growth in the cloud and a difficult outlook, which made investors nervous. As a long-term investor in Microsoft, these slowdowns did not worry me at all, as the long-term trajectory remains perfectly intact, and I remain to believe that Microsoft is the most wonderful business on the planet.

Microsoft has one of the best businesses in the world, driven by growing digitalization and a strong position in all its business segments. I see Microsoft as fairly recession resistant, because of the raw importance of its products and services. I believe that at current prices Microsoft is a no-brainer investment, guaranteed of strong returns. I cannot tell you whether this is the bottom, and the stock might just as well go lower over the coming quarters, but I can tell you that current prices are setting you up for solid returns over the next 10 years when Microsoft will increase its moat in crucial industries such as cloud, gaming, and personal computing.

Microsoft is my highest conviction stock and I rate the company a strong buy on current price weakness.

Microsoft Corporation

Microsoft is an American technology company mostly known for its Windows software, office package (including Word, Excel, and PowerPoint), and Internet Explorer. Nowadays, of course, the company does way more. Microsoft was founded in 1975 by Bill Gates and Paul Allen. Microsoft became dominant with its personal computer operating system first known as MS-DOS and later became Windows. The company has been diversifying its business by making a lot of acquisitions and making the right choices by expanding into the cloud for example, a few years after Amazon (AMZN) did. Nowadays the company offers a wide variety of products for both consumers and enterprises such as desktops, laptops, tabs, and servers including internet search and cloud computing under the name of Azure. To deliver all these products and services, the company has a total employee base of 2,21,000 people worldwide.

Microsoft has been playing a crucial role in the everyday life of many people and businesses and will continue to do so. Microsoft has an incredible number of products that are used every day like LinkedIn, Microsoft Teams, Windows, Office 365, and the Azure cloud platform. I like to believe that without the services and products of Microsoft many people would be unable to do their job. Would you be able to do your job if all Microsoft services would be gone? Could you do without Word? Excel? Windows? Microsoft teams?

Three business segments

Microsoft reports their earnings and growth across three different segments.

Productivity and business processes

This business segment includes products and services in the portfolio of productivity, communication, and information services.

This includes the Microsoft office commercial products being all Office 365 variations and licenses (Office, Exchange, MS Teams, SharePoint, etc.). LinkedIn is also included within this segment and is the most expensive acquisition of Microsoft to date (as long as the Activision acquisition is not completed) with a price of over $28 billion. LinkedIn is a social media platform with a focus on the business sector and talent acquisition. These include earnings from talent solutions and premium subscriptions.

This segment also includes Dynamics business solutions, including Dynamics 365, comprising a set of intelligent, cloud-based applications across ERP, CRM, Customer Insights, and Power Automate; and on-premises ERP and CRM applications.

During FY22 this segment earned revenue of over $63 billion, accounting for 32% of total revenue. Operating income came in at just under $30 billion and therefore accounted for 35.6% of total operating income.

Intelligent cloud

This segment includes the cloud segments consisting of public, private, and hybrid server products. This consists of server products such as Azure, SQL server, Windows server, and more. This segment is mostly dominated by the Azure platform. Revenue for FY22 came in at $75.25 billion and was Microsoft’s largest segment accounting for 38% of revenue. The operating margin was also strong and resulted in an operating income of $32.7 billion, accounting for over 39% of operating income.

More personal computing

The final segment of Microsoft is its personal computing segment, which consists of its legacy Windows products and services. These include all income related to their Windows product. All products of Microsoft are also included within this segment consisting of Surface laptops, HoloLens, and PC accessories.

The gaming part of Microsoft, a fast-growing part over the long run, which Microsoft is expanding aggressively with the acquisition of Activision (ATVI), is also included here. This involves all income related to Xbox hardware, content, and subscriptions. Finally, search and news advertising is also included, which will be boosted by the recent announcement of Microsoft being the ad partner for Netflix’s (NFLX) new ad subscription to be launched in November. Microsoft also earns ad revenue from LinkedIn, which is included here and not within productivity and business processes. This segment accounted for 30% of revenue in FY22, coming in at just under $60 billion. Operating income was $21 billion for FY22, accounting for 25% of total operating income.

Growth opportunities

The thing I like about the business segments of Microsoft is that, despite being a software company, they are very diversified with operations over all sorts of business segments and industries. This strong diversification is visible in the revenue split across all three segments. This opens up a lot of potential growth opportunities for Microsoft. Let’s discuss a few.

Cloud

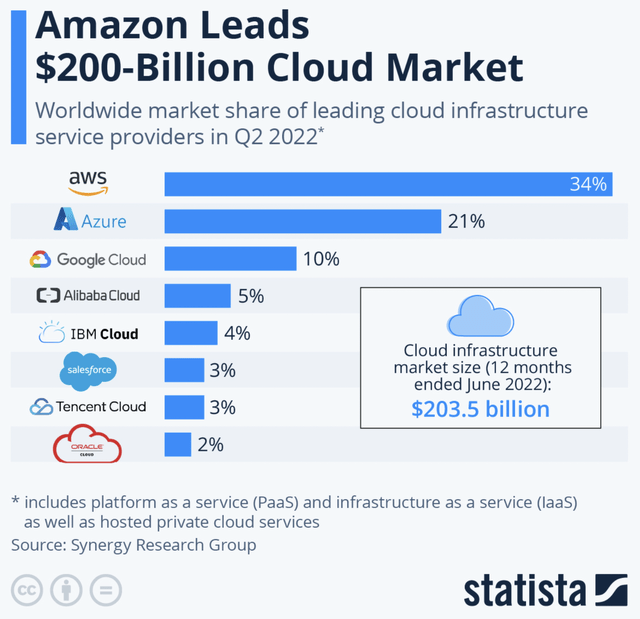

It should be noted that the already largest cloud segment is also the fastest growing, supported by digital transitions and global moves to the cloud. Microsoft has one of the largest cloud platforms with Azure being the second largest, just behind Amazon’s AWS.

According to Fortune Business Insights, the global cloud computing market size is expected to grow at a 17.9% CAGR through to 2028. The total market size in 2028 will be $791.48 billion and therefore creating a massive opportunity for Microsoft. Microsoft has an incredibly strong cloud platform in the form of Azure and is well-positioned to even increase its market share as it has been doing over the last few years. This is a strong secular tailwind for Microsoft.

Advertising

Microsoft may not seem like much of an advertising company. Companies like Alphabet (GOOG) (GOOGL), Snap (SNAP), Meta (META), and the Trade Desk (TTD) are the more familiar names, yet Microsoft should not be underestimated and has a strong ad business already through its Bing search engine and LinkedIn ads. Most recently Microsoft became the ad partner of Netflix. This partnership opens a huge market for Microsoft and gives it the opportunity to grow its advertising business. Microsoft believes it can grow its advertising business to $20 billion in revenue a year. In FY22 total LinkedIn revenue increased by 26% YoY and advertising grew by 15%, both showing strong growth rates.

With Microsoft partnering up with Netflix it gets strong exposure to the fast-growing CTV market and is well-positioned to benefit from an ever-increasing market for advertisement spending. The global advertising market is expected to grow at a 5% CAGR through 2027 to a total size of $792.7 billion. I believe that the Netflix partnership will position Microsoft as a big player in the ad business and will profit from the increasing market share and explosive growth in CTV.

Gaming

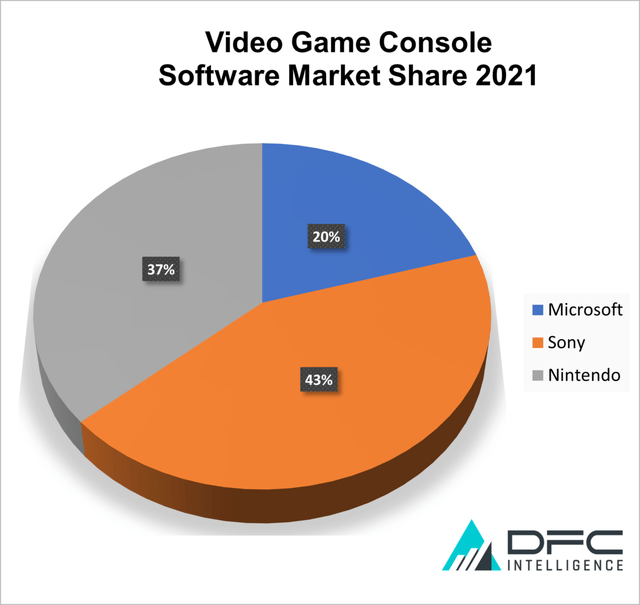

Microsoft is one of the largest players in the gaming industry, mostly through its Xbox product. Microsoft is committing its efforts and money to the gaming industry as it sees this as a huge growth opportunity, and I think they are not wrong. According to Business Fortune Insights, the total gaming market is expected to grow at a CAGR of 13.2% between 2021 and 2028. The total market size will reach $545.98 billion by 2028. In the console market, Microsoft currently holds a market share of 20% and is expected to improve this to 27% by 2026.

But Microsoft is not focused on platform gaming, but on cloud and mobile gaming. Microsoft wants to enable people to play games anywhere, anytime, and on any device. Microsoft is building on this with its Xbox Game Pass, which is a monthly subscription enabling you to play every selected game for free on supported devices. These differ from Xbox hardware to PC and mobile devices.

The newest addition to this concept is cloud gaming. Cloud gaming enables users to play their favorite games without owning the necessary hardware like the Xbox or Sony (SONY) PlayStation, instead, the games are being played in one of the many powerful cloud servers of Microsoft. This is then streamed to your device of choice. This enables users to play their games where and whenever they want without needing the hardware. This means you are able to play the most intense graphical games on your simple smartphone. Microsoft offers this cloud gaming service through its Xbox Game Pass Ultimate. Microsoft owns the cloud server’s software and hardware to realize this on a huge scale with Azure, and owns the gaming platform with Xbox, which positions them perfectly to benefit. Xbox game pass has 25 million active subscribers.

This is where the $69 billion acquisition of Activision Blizzard comes in for Microsoft. The acquisition will position Microsoft as the 3rd largest gaming company by revenue, only behind Chinese Tencent (OTCPK:TCEHY) and Japanese Sony. The acquisition will open Microsoft to the world of mobile gaming, the fastest-growing gaming segment, and adds huge exposure to the fast-growing Indian market. Candy Crush and Call of Duty, two games owned by Activision, are among the top 10 most-played games in India. The Indian market is home to over 430 million gamers and is growing by 35-40% a year, with mobile gaming accounting for 90% of this growth.

Most importantly, the acquisition will give Microsoft access to the over 40 million monthly active users of Activision and can add these games to its game pass subscription. Xbox game pass users will probably get exclusive extras within these popular games, if not exclusive access. The Activision Blizzard deal will be a massive boost to Xbox game pass, as it will allow subscribers to play blockbuster games like Call of Duty across multiple platforms whenever they want.

Activision Blizzard top games (Microsoft Corporation)

1Q23 results were still strong but resulted in a sell-off anyways.

Microsoft reported its 1Q23 earnings on October 25th, 2022. In the three months ending September 30th, Microsoft reported revenue of $50.1 billion, an increase of 11% YoY (16% in constant currency). Operating income came in at $21.5 billion, an increase of just 6% YoY (15% in constant currency). This shows us Microsoft was still able to grow its revenue by double digits, despite a difficult comparison and multiple economic headwinds such as a slowdown in PC shipments and IT spending. Operating income took a bigger hit, though on constant FX this was still a solid 15% increase. So, for the top and bottom lines, I see absolutely no issues.

Net income for the quarter was $17.6 billion and this is a decrease of 14% compared to last year and still an 8% decrease on constant currency. The operating income margin was 43%. Earnings per share of $2.35 were down 13% YoY. And even though these numbers saw a decline, CEO Satya Nadella stayed rather positive:

In a world facing increasing headwinds, digital technology is the ultimate tailwind. In this environment, we’re focused on helping our customers do more with less while investing in secular growth areas and managing our cost structure in a disciplined way.

Revenue in the Productivity and Business Processes segment was $16.5 billion, an increase of 9% YoY (15% on constant currency). Within this segment, we saw a strong continued performance of Office products and cloud services which was up by 7% and total Microsoft 365 consumer subscribers increased to 61.3 million. For a product with already such a strong user base, it is incredible this segment is still growing this strong. It does show the real dominance Microsoft has with its office products and services. LinkedIn also showed its strength and managed to increase revenue by 17% YoY. Dynamics 365 was up a whopping 24% and continuing to grow strong.

Revenue in intelligent cloud grew by 20% to $20.3 billion and most important here was the 35% revenue growth of Azure and other cloud services (up 42% in constant currency). This shows that strength remains for Azure, yet the intelligent cloud segment did see a slowdown compared to previous quarters. This is probably one of the main negatives resulting in a drop of close to 8% for Microsoft during the next day’s trading. Cloud is seen as one of the main drivers of Microsoft and is fairly recession-resistant, because of the strong tailwinds. So, when there is a slowdown within this segment people get nervous. To me, these numbers show, yes, a slowdown, but most of all strong continued growth despite economic headwinds. I remain bullish on the long-term prospects of the cloud business and its near-term resiliency. Microsoft Cloud margin even improved to 73% from 70% last quarter.

More Personal Computing was the only segment seeing a decrease in revenue compared to the year-ago quarter. This is no surprise looking at the total PC shipment number, which has been decreasing over the last few months resulting in profit warnings at the likes of AMD (AMD) and Nvidia (NVDA). Revenue decreased slightly to $13.3 billion, but on constant currency, the segment remained fairly resistant and would be up by 3%. The big problem here was the drop in Windows OEM of 15%, which, yet again, is no surprise. Xbox content and services revenue also decreased by 3% (up 1% on constant currency) and I think this is still relatively resilient compared to the broad gaming slowdown. Advertising revenues were up by 16% (21% on constant currency).

Overall, I was impressed by the strong growth Microsoft managed to show and was therefore surprised by the drop in share price. I believe Microsoft showed during this quarter how resilient its business is and that it will keep growing. I do see single digits growth for the next couple of quarters, but I believe this is already being reflected in the share price. Microsoft remained to see strong performance across the business and outperformed competitors in gaming, advertising, and product shipments.

Microsoft returned $9.7 billion to shareholders during the quarter in the form of dividends and share buybacks. Free cash flow for the quarter was $16.9 billion and therefore comfortably covering shareholder distributions.

Valuation and Balance sheet

Microsoft exited the latest quarter with $22.9 billion in cash and cash equivalents and over $84 billion in short-term investments, totaling $107.26 billion. A massive cash position to say the least. This is $2.5 billion more than 3 months ago. Long-term debt stood at $45 billion, which is $2 billion less than three months ago. Microsoft has a very clean balance sheet and ample cash to spend. This is nothing new and the company remains to strengthen its balance sheet even during these difficult times.

Microsoft also pays a solid dividend and keeps buying back its shares. Total shareholder distributions are well covered by free cash flow, as mentioned before. The dividend yield is not very high at 1.18%. More impressive is its dividend growth at a 5-year CAGR of close to 10%. Microsoft receives an A+ from Seeking Alpha Quant for its dividend growth rate. Dividend safety is also no issue as I already illustrated by the coverage of free cash flow. The company earns massive amounts of cash every quarter and the dividend payout ratio stands at just 26.72%, receiving an A from Seeking Alpha Quant. Microsoft has been paying a dividend for 18 consecutive years now and has been increasing this for 17 consecutive years.

It will come as no surprise that Microsoft is never cheap. The incredible moat, strong financials, impeccable free cash flow generation, and strength in secular growth areas justify a higher valuation. Microsoft is currently valued at a forward P/E ratio of 24.22, 17% below its 5-year average of 29. I believe the company is undervalued right now and trading at a discount following the drop after 1Q23 results and the general drop of the markets since the start of the year. Microsoft deserves a P/E of at least 28-30 and therefore has approximately 17% upside potential. I view the current price as a strong buying opportunity for a long term investment.

Risks

No company is risk-free and the same goes for Microsoft. There is of course the risk of a severe recession looming around the corner and this could also have a significant effect on Microsoft. Microsoft’s growth could drop to low single digits, but I do not see a revenue contraction in the near future. I believe the company has a strong position over multiple high-growth areas and business segments and products such as Microsoft Office are just too important for businesses to cut down on. I believe Microsoft Azure and other cloud services will continue growing under any circumstances thanks to a global ongoing shift to the cloud. For many businesses, the shift to the cloud would actually save money during difficult times.

Microsoft is also still waiting for the approval of the Activision blizzard acquisition. There are worries, mainly from Sony, that Microsoft might want to make blockbusters such as Call of Duty an Xbox exclusive. This would be a huge problem for Sony and their PlayStation platform and be a hurdle in the competitiveness of the market. Microsoft has already stated multiple times that it wants to keep Call of Duty open to PlayStation for the next few years, as long as the agreement goes between Sony and Activision. Worries remain about the competitiveness in the market from the UK regulators. If the deal would fall through, this would be a big hit to the business of Microsoft and probably would mean a drop in share price as the big opportunity in gaming would become less rosy for Microsoft. I would like to highly recommend reading this article from a fellow Seeking Alpha contributor. He provides a very nice in depth look into the acquisition of Activision Blizzard.

I believe the deal will be given the green light from regulators, but probably under certain circumstances.

Conclusion

Microsoft remains my number one stock pick, even after the recent quarterly results as I still see great upwards potential and the long-term investment thesis remains incredibly strong. Microsoft has opened itself up to multiple high-growth sectors like Cloud and Gaming. It already has a strong position in the cloud by leveraging its Azure platform with its 21% share in global cloud computing and offering more abilities to its customers than other platforms like AWS. Microsoft is strengthening its position in gaming by acquiring Activision Blizzard and once given the green light, will become the third-largest enterprise in the gaming segment by revenue. The acquisition will open a door for Microsoft into other high-growth markets such as the Indian gaming market. All this growth is being supported by its legacy businesses in personal computing and other offerings such as Microsoft Office 365 and Windows, which remain massive income sources and cash machines with an incredible moat around them.

I view Microsoft as the strongest business on the planet and it will continue to use its massive cash generation ability to fuel new growth areas and distribute cash to shareholders. Microsoft will be able to keep growing over the next couple of years at a CAGR of double digits. Analysts project growth to slow down next year, to then boost growth again in 2024 by double digits until 2028. At current prices Microsoft is a strong buy and will be able to provide double-digit returns to investors. They will also continue to grow their dividend by 10%+ and therefore be a strong dividend growth investment.

I rate Microsoft a strong buy at current prices.

Be the first to comment