Wachiwit

Netflix, Inc.’s (NASDAQ:NFLX) Q2’22 subscriber numbers were better than expected, but that doesn’t mean investors should rush to buy the stock. Shares of Netflix soared 5.6% yesterday on lower-than-expected subscriber losses in the second-quarter, but the streaming company is set to experience a continual slowdown in revenue growth and weaker profitability metrics going forward. Netflix’s shares have skidded 66% this year and with uncertainty around the future subscriber path growing, the risk profile remains skewed to the downside!

Better subscriber numbers not enough to drive long term revaluation of Netflix’s shares

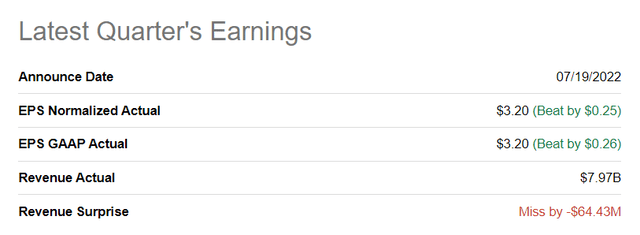

Netflix submitted its earnings card for the second-quarter yesterday that beat EPS predictions but missed on the top line. Analysts polled before earnings expected EPS of $2.97 vs. $3.20 actual and revenues of $8.04B vs. $7.97B actual.

What Netflix beat by a wide margin, however, was its own estimate for subscriber losses in the second-quarter. Netflix expected a subscriber loss of up to 2M when in fact less than a million customers canceled their subscriptions. In total, Netflix lost about 970 thousand subscribers in Q2’22, which was less than expected, but still about five times the number of subscribers it lost in Q1’22. For the first-quarter, Netflix expected a net addition of 2.5M subscribers, but lost 200 thousand accounts instead. The massive miss regarding subscriber count in Q1’22 wiped $50B off of Netflix’s market cap at the time.

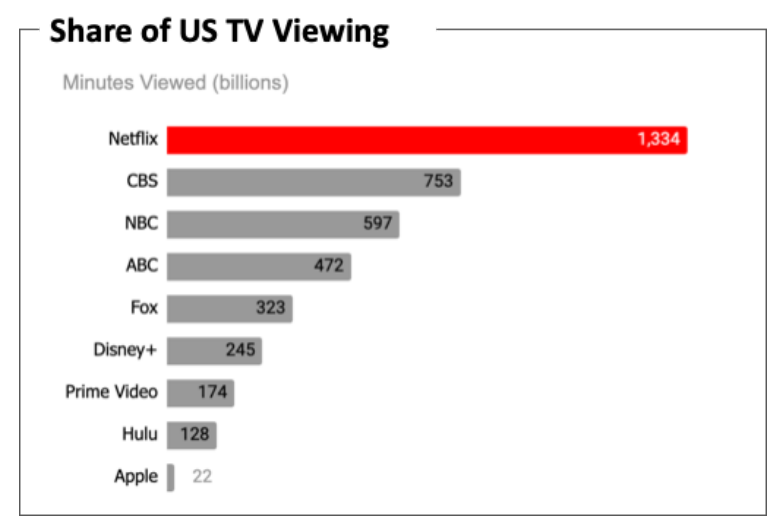

Despite a 1M loss of subscribers, Netflix again achieved the highest share of TV viewing with 1.4T minutes watched, sustaining a significant lead over second-ranked CBS with 753 billion viewed minutes. Netflix sustained its market leading position in TV viewing through hit series such as Stranger Things, The Lincoln Lawyer, and The Umbrella Academy.

Netflix

Changing subscriber mix creates long term profitability challenges

It is a problem that Netflix continues to lose subscribers in markets that have high average membership values and offsets those subscriber declines with paid net additions in markets that have low average membership values.

In the second-quarter, Netflix lost 1.3M subscribers in the North American market — which includes the U.S. and Canada — where the average monthly revenue of a membership/ARM was $15.95. Netflix also posted a net subscriber loss of 0.77M accounts for the European market which has an ARM of $11.17. Netflix offset these subscriber losses with paid net additions from the Asia-Pacific region which saw the generation of 1.08M new paid accounts. However, the region’s ARM was just $8.83 in Q2’22. Since an APAC subscriber is worth approximately 55% of a U.S./Canada subscriber and 79% of a Europe-based subscriber, the shifting subscriber mix creates a long term profitability for Netflix. The change in the subscriber mix and revenue shift to lower ARM-regions also puts pressure on Netflix’s top line growth.

Q3’22 subscriber outlook

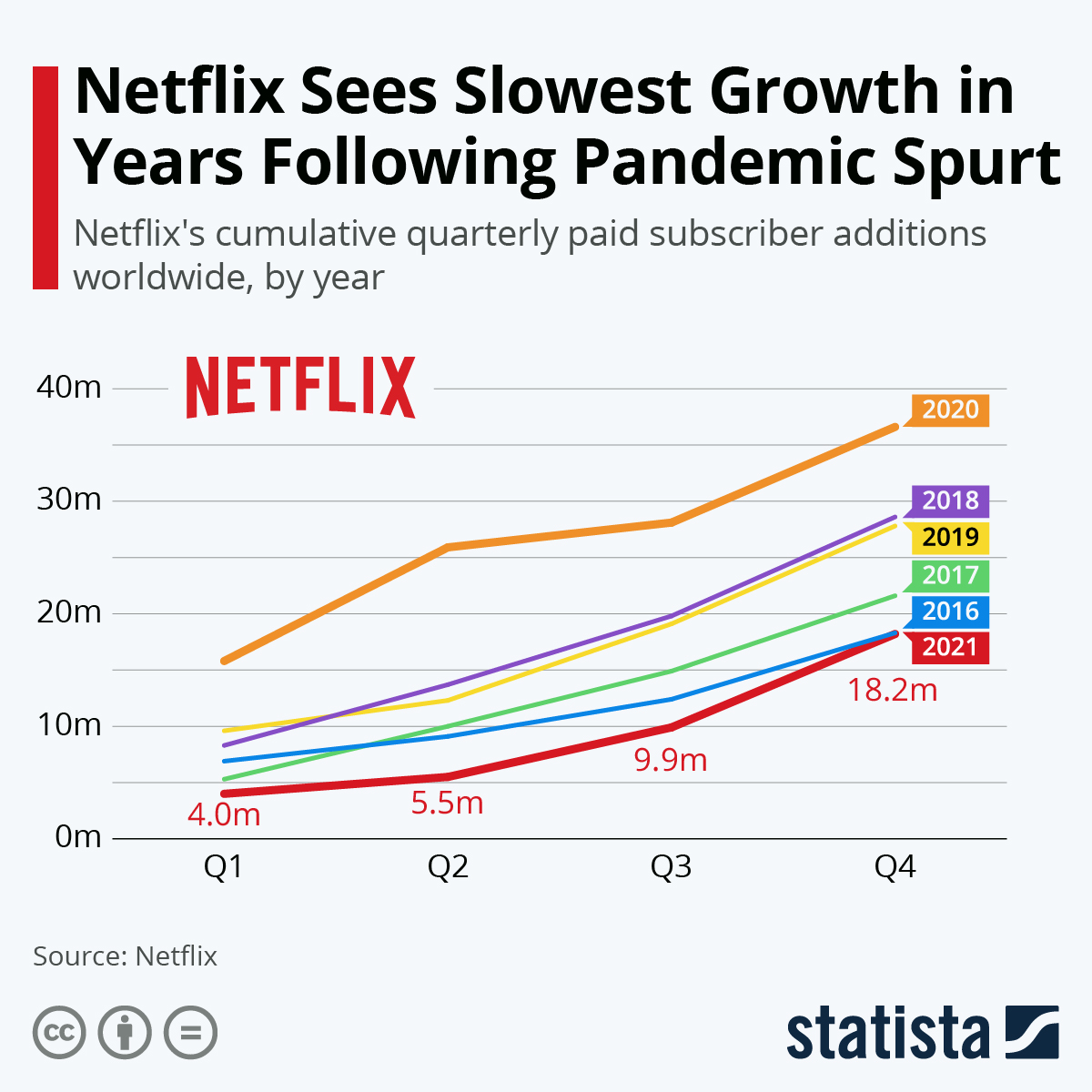

For the third-quarter, Netflix expects a net addition of 1M subscribers. While a 1M addition is not bad, it is materially below last year’s net addition of 4.4M subscribers. Netflix’s subscriber growth started to drop off in FY 2021 as the pandemic fizzled out and FY 2022 is set to see the lowest number of paid net adds since at least FY 2016.

Statista

Building a new, differentiated monetization model

So far, Netflix is monetizing its customers with subscription plans that renew every month unless the customer cancels. Netflix’s subscription offers include differently priced monthly plans that are differentiated by streaming quality and number of screens that can be used. Netflix has been quite successful with this model because it allowed the company to build a 221M-strong streaming platform with a global audience.

But with recent subscriber losses creating a challenge for the streaming platform, Netflix is looking to change its business model and introduce a new, lower-priced subscription tier that will be monetized with ads. Netflix has long played around with the idea of differentiating its tier structure and a new ad-supported format may indeed draw in new customers that haven’t previously subscribed.

On the other hand, the introduction of an ad-supported tier presents a risk for Netflix: users that currently do pay for a monthly subscription may choose to down-grade their subscription and opt for the ad-format instead, thereby exposing Netflix to the very real risk of cannibalizing its existing pricing structure. The new tier is set to be revealed in early FY 2023 but the company has not yet provided pricing details.

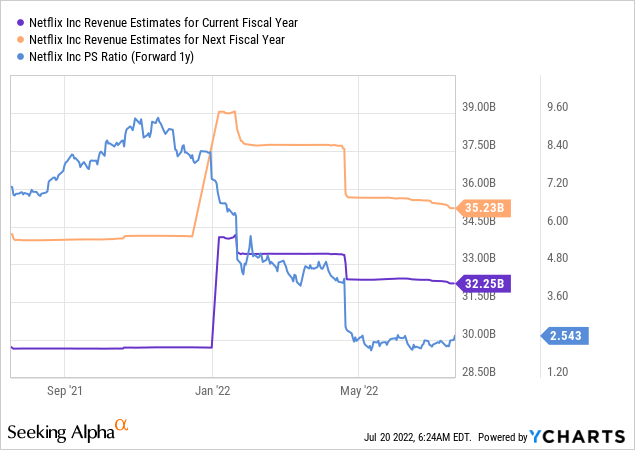

Revenue growth and valuation

Netflix’s revenue growth estimates are sharply resetting and continual revenue headwinds must be expected for two reasons: 1. Netflix is losing subscribers in high ARM-markets like the U.S., Canada, and Europe; and 2. The introduction of an ad-supported format may impact the monetization of Netflix’s higher tier subscriptions in FY 2023 and beyond.

For FY 2022 and FY 2023, Netflix is expected to generate top line growth rates of only 8.6% and 9.24%. Due to subscriber losses and a normalization of post-pandemic growth rates, revenue estimates have corrected sharply. Based off of revenues, Netflix is trading at a P-S ratio of 2.5 X.

Risks with Netflix

Netflix’s subscriber numbers are always a bit of a wild card, but I believe it is safe to say that the super-charged growth rates the streaming platform enjoyed during the COVID-19 pandemic are a thing of the past. A post-COVID normalization of Netflix’s top line growth implies growing business headwinds for the company and its shareholders. Although Netflix has a clear advantage over other streaming platforms due to its sheer size, a slowdown in revenue growth and additional subscriber losses are material risks for Netflix and the stock going forward.

Final thoughts

These are uncertain times for Netflix. A nearly 1M-subscriber loss in Q2’22, although lower than expected, is hardly a reason to celebrate. Netflix’s period of ultra-fast growth has ended and investors must expect continual revenue headwinds as well as a moderating (if not negative) subscriber growth in FY 2022. The introduction of a new ad tier is also problematic: even if it draws in new customers that haven’t had a paid subscription on Netflix before, the platform may cannibalize its own subscriber base. Since Netflix is also losing subscribers especially in high-revenue regions, the risk profile remains skewed to the downside!

Be the first to comment