monticelllo

Greenlight (NASDAQ:GLRE) offers to take portions of risk (reinsurance) from other property and casualty insurers. Over the last decade, GLRE has been losing money on insurance, and the investment arm run by David Einhorn (Chairman and 17% owner) called Solasglas has had poor results. From 2010 to now, GLRE’s price to book has fallen from 1.3x book value to 0.58x book value. Over the past several years, management has taken steps to fix the issues. Near-term results have improved, and we believe they will continue to do so.

Reinsurance Book De-risked

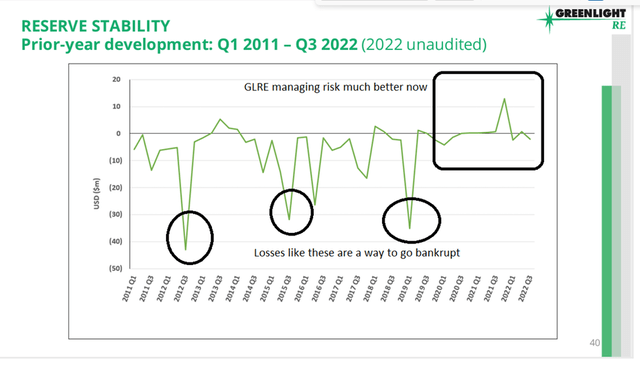

After a bad event in 2018, GLRE set out to de-risk its whole book of business. In fact, in the prior decade GLRE was prone to these, “one-off events”… that just kept happening. The graph below shows spikes down where they were under-reserved (didn’t charge enough premium for the risk taken) for insurance they wrote in the prior year. GLRE has de-risked its book of business by having less liability insurance and more property insurance, i.e., shorter tail risks. Also, by taking on “follow” business where the lead reinsurer sets the terms, GLRE takes a piece of the lead reinsurer’s risk after GLRE has done its own underwriting (evaluation of the risk and terms).

Source for graphics, GLRE’s recent investor deck: Here (the author has added some notations to the graphics)

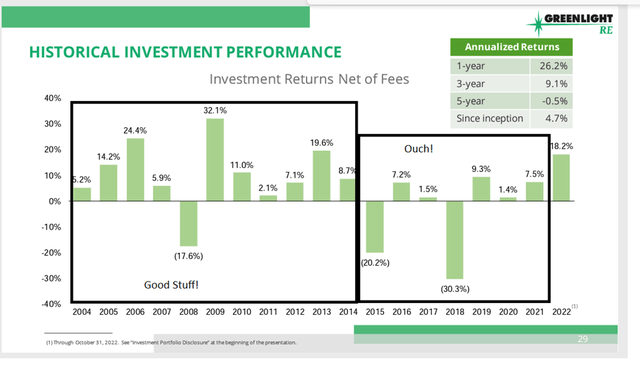

David Einhorn’s Investment Results

Insurance companies need to hold a pile of money to pay out future claims, and the pile of money is called the “reserves”. David Einhorn manages a good portion of these reserves through Solasglas. Solasglas means “greenlight” in Gaelic. David does very good traditional value analysis. David has to be careful not to have big losses as the investment manager else the insurance company can’t pay their claims. Therefore, Solasglas is managed with shorts and longs. Up to about 2013, Solasglas was doing a great job. Once the Fed kicked into money printing, excess liquidity had to go somewhere and it went into speculation. No-profit companies received huge valuations. Solasglas maintained a “bubble basket” of shorts that really hurt results.

Note: As of the end of November, Solasglas is up 21.5% YTD

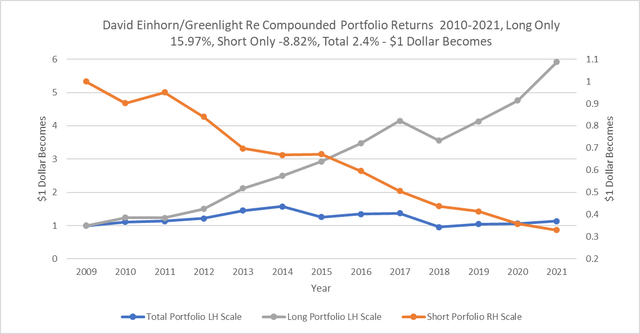

Here are compounded results for Solasglas over the last 12 years. The short positions, “the bubble basket”, took a toll on the overall results.

The source data for Solasglas returns. 2021 10-K plus prior years’ 10-Ks.

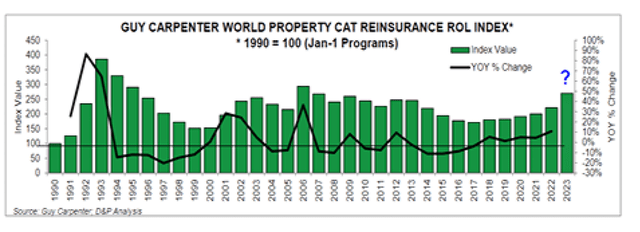

Insurance Rates are Going Up

Because of several bad weather events, the Ukrainian War, the rising costs to replace things (inflation), and big losses in the bond market insurance companies are raising prices. Because there was an excess of capital in the insurance market insurance prices crept down from about 2006 to 2017. All while the risks were similar and inflation was driving up costs. Recently, insurance has been getting healthy price increases. This should help GLRE’s profitability.

GLRE Should Get Revalued

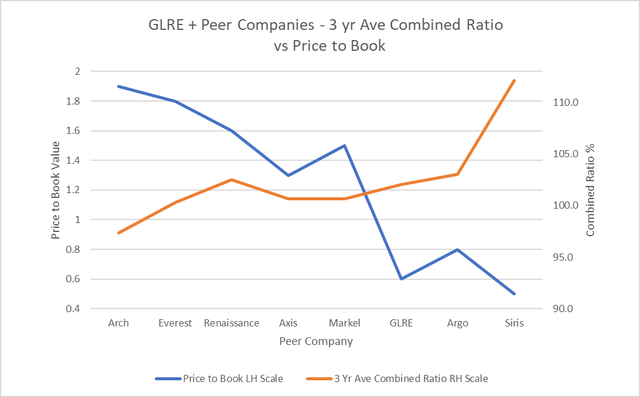

Insurance companies’ valuations are no mystery. Insurance companies that produce good results (not easy) get valuations above book value, and those that don’t go bankrupt or sell below book value. Insurance companies try to sell insurance at a profit. They have to cover losses, pay salaries, and cover other overheads. If an insurance company breaks even selling insurance their “combined ratio” is 100%. If they lose money on insurance their combined ratio is over 100% and if they are making money on insurance their combined ratio is under 100%. Insurance companies want to make a profit on insurance and make a profit by investing the reserves. GLRE has done neither for most of the last decade.

Here is a look at several of GLRE’s peers. Those that make money on insurance get a higher price to book value.

Innovations Sector of GLRE

GLRE has been making investments in “Insurtech” companies. “Insurtech” is a buzzword for insurance company startups applying technology to innovate and reduce costs for insurance. Some are using blockchain-type technologies. To date, GLRE has invested $21.5m into 29 companies and the current value is $60.5m. 77% of this investment is carried in 5 different companies. This is rather unique for an insurance company to be engaged in. GLRE says that for the most part, they are investing in these companies to partner with them to gain more insurance business. Here is a list of those companies. Admittedly because these companies are private this is a bit of a black box. These companies are doing unique and interesting things.

Summary

In the movie, “The World According to Garp”, Garp was looking at buying a house, just as a plane slammed into the house, Garp said to the realtor, “We will take the house”, adding “… it’s been predisastered, we will be safe here”. GLRE has been predisastered.

GLRE has made great efforts to fix the issues plaguing its results. Even if GLRE runs into some bad insurance events, they should be able to power through them. We expect, over the next several years, the investment community will revalue this company back to at least book value as both the insurance results and the investment results improve.

Backstory

In 2010, we went to Panama City Beach, FL (PCB) to check out the damage from BP’s Deep Water Horizon blowout. While there we also started investigating St. Joe Company (JOE). PCB is the home base of JOE. David Einhorn had a short deck out on JOE at the time. David did a very detailed analysis short deck that we agreed with. David does very good work. We continued to follow the JOE story and in 2018 we made JOE our largest holding. David had closed his short years prior. We wrote a timely Seeking Alpha article on JOE in early 2019.

Be the first to comment