PJ66431470

One of the best-performing companies over the past couple of months has been the type of firm you might least expect given current economic pressures. The company in question is none other than United Rentals (NYSE:URI), an enterprise engaged in the renting out of a variety of equipment like aerial work platforms, air compressors, and more. You would think that the current economic slowdown would result in pain for the business. But so far, financial performance has been robust. In addition to defying expectations on this front, the company has raised guidance for 2022. It is also engaged in a rather sizable acquisition and utilized long-term debt in order to do so. Given these factors, and considering how cheap shares of the company currently are, I believe that it still represents a compelling opportunity at this time. In fact, despite seeing shares rise materially, I still feel as though it stands as a ‘strong buy’ candidate at this time.

Great developments

Back in early October of this year, I wrote an article detailing whether or not it would make sense for investors to consider buying United Rentals. At that time, I found myself impressed by the strong revenue, profit, and cash flow growth that the company had demonstrated. Even though the company had done well up to that point, shares had been pushed lower because of fears regarding the economy. But that only made shares more appealing and, when combined with the firm’s financial data, led me to rate the enterprise a ‘strong buy’ to reflect my view that share price performance should drastically outperform the broader market for the foreseeable future. So far, the company has done just that. While the S&P 500 is up 5.9%, shares of United Rentals have generated an upside of 25.6%.

There have been a couple of reasons behind the company’s strong price performance. First and foremost, we saw favorable financial data for the third quarter of the company’s 2022 fiscal year. This is the only quarter for which new data is available that was not available when I last wrote about it. During that quarter, revenue came in at $3.05 billion. That’s 17.5% higher than the $2.60 billion generated the same time last year. On a percentage basis, the greatest growth for the company came from its service and other revenues category. But at just $74 million in all, this is a fairly small portion of the enterprise. In dollar terms, the real growth came from the 20% rise in equipment rental revenue, which shot up from $2.28 billion to $2.73 billion. This increase, management said, was driven by two primary things. First and foremost, the company saw a 10.6% increase in average OEC (known as original equipment cost). And second, fleet productivity contributed 8.9% to the sales increase.

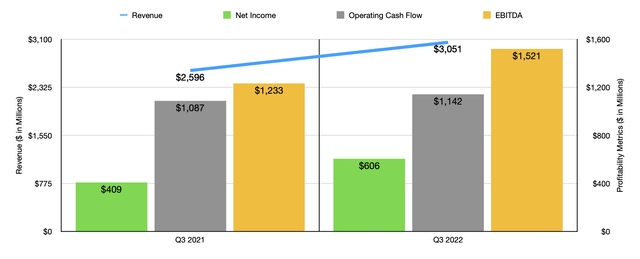

With this rise in revenue, we also saw profitability for the company improve. Net income shot up from $409 million in the third quarter of 2021 to $606 million the same time this year. Of particular help for the company was its gross margin, which increased from 42.5% to 44.8%, largely due to improved pricing that allowed the firm to pass on more than its share of inflationary pressures onto its customer base. While this may not seem like a significant improvement in margin, it alone translates to an additional $70.2 million in profits to the enterprise. Selling, general, and administrative costs also improved, dropping from 12.6% of sales to 11.7%, mostly thanks to better fixed cost absorption caused by higher revenue. Other profitability metrics followed a similar trajectory. Operating cash flow, for instance, increased from $1.09 billion to $1.14 billion. And over that same window of time, EBITDA increased from $1.23 billion to $1.52 billion.

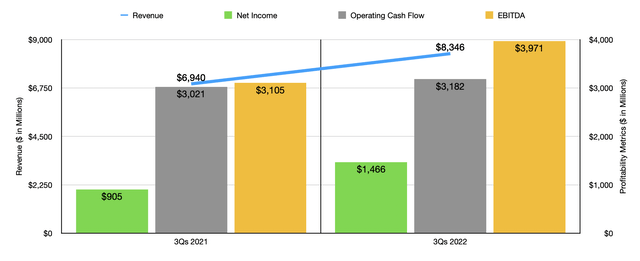

As you can see in the chart above, the third quarter was not the only positive one for the company. The first nine months of 2022 as a whole were positive. In fact, things are going so great that management recently increased guidance for the year. Now, the firm is anticipating revenue of between $11.5 billion and $11.7 billion. The prior expected range involved a low end to that of $11.4 billion. Profitability should also improve, with EBITDA of between $5.5 billion and $5.6 billion compared to prior expectations of $5.4 billion to $5.55 billion. Likewise, operating cash flow is expected to increase as well, coming in at between $4.05 billion and $4.4 billion compared to the prior expected range of $3.85 billion to $4.25 billion.

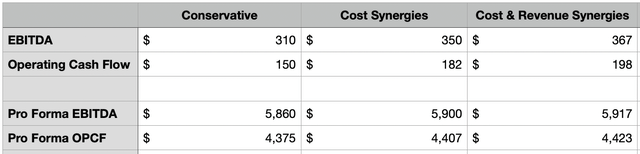

This guidance is independent of another major development that management announced. On December 7th, the company acquired Ahern Rentals, the 8th largest equipment rental company in North America. This maneuver cost shareholders $2 billion. But in exchange, they will receive an enterprise that generates $887 million in revenue and $310 million in EBITDA per annum. There’s also the potential for further upside. In the first 12 to 18 months, management is forecasting annual cost synergies of $40 million. And within the first three years, they are forecasting revenue synergies of $60 million. In order to finance the deal, the company used existing debt capacity for some of the cost. But the vast majority came from a $1.5 billion issuance of senior secured notes. These come due in 2029 and bear an annual interest rate of 6%. The one downside is that the $1.25 billion share buyback program that the company initially announced in October of this year has now been put on hold until the integration of Ahern Rentals has been completed.

In order to value United Rentals, I looked at three different scenarios. Naturally, for all of them, I factored in the cost of the acquisition and the additional debt associated with it. I assumed that all of the debt, including that which the company used existing facilities on, would bear a 6% annual interest rate. I also assumed a 21% corporate tax rate for the business. From there, I looked at a conservative scenario where we only factor in the stated EBITDA and the implied operating cash flow of the acquired entity. I looked at a moderate scenario where we factor in the cost synergies forecasted over the next year or so. And I also looked at a liberal scenario where we account for both the cost synergies and the revenue synergies under the assumption that the additional revenue synergies would bear the same margins that the rest of the acquired entity should bring on.

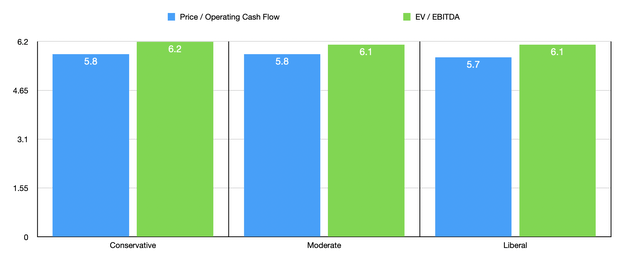

As you can see in the chart above, shares of United Rentals look quite low, with a price to operating cash flow multiple of between 5.7 and 5.8, and an EV to EBITDA multiple of between 6.1 and 6.2. As part of my analysis, I also compared the company to two similar firms. One of these, Herc Holdings (HRI), is probably the most appropriate comparable. The other, Rent-A-Center (RCII), engages in a similar type of business but with radically different products that don’t make it exactly a solid comparable. As you can see, United Rentals is the most expensive of the group, no matter which way we slice it. But the pricing is not so radically different from Herc Holdings that I would call the company overvalued compared to similar firms.

| Company | Price/Operating Cash Flow | EV/EBITDA |

| United Rentals | 5.8 | 6.2 |

| Herc Holdings | 4.7 | 6.1 |

| Rent-A-Center | 3.5 | 1.6 |

Takeaway

Based on all the data at my disposal today, I will say that I remain impressed by United Rentals, its maneuvers, and pretty much everything else about the enterprise. Shares of the company are cheap on an absolute basis and only a bit on the pricey side compared to similar operations. Management continues to increase guidance, and management has looked for and found creative ways to grow the business over the long run. Due to all of these factors, I still feel very comfortable giving the enterprise a ‘strong buy’ rating even after shares have risen materially.

Be the first to comment