Sean Pavone

Earnings of Independent Bank Corp. (NASDAQ:INDB) will most probably surge this year and the next on the back of significant margin expansion amid the rising rate environment. Subdued loan growth will further support the bottom line. Overall, I’m expecting Independent Bank Corp. to report earnings of $5.29 per share for 2022, up 53% year-over-year. Compared to my last report on the company, I’ve increased my earnings estimate partly because I’ve revised upwards my margin estimate. For 2023, I’m expecting earnings to grow by 10% to $5.81 per share. The year-end target price suggests a small upside from the current market price. As a result, I’m adopting a hold rating on Independent Bank Corp.

Benefits of Rising Rates to Appear with a Lag

Independent Bank’s deposit book is heavy on interest-bearing deposits that are quick to reprice, namely savings, money market, and interest-bearing checking accounts. These deposits made up a hefty 58.7% of total deposits at the end of June 2022. In comparison, the loan portfolio is slower to reprice. Only around 34% of the loan book is tied to LIBOR, SOFR, or prime, as mentioned in the latest conference call.

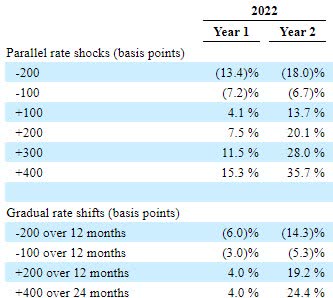

As a result, the rising interest rate environment will affect the net interest margin with a lag. The results of management’s interest rate sensitivity analysis show that a 200-basis point hike in interest rates can boost the net interest income by 4.0% in the first year and 19.2% in the second year of the rate hike.

2Q 2022 10-Q Filing

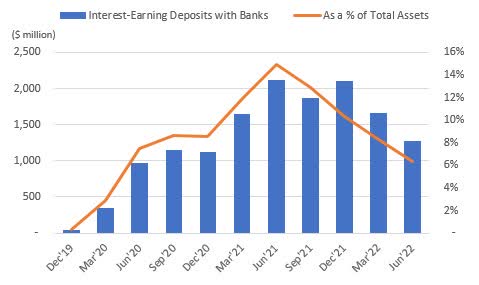

Additionally, the margin can benefit from improvements in the asset mix. Independent Bank has successfully deployed a large part of its excess cash so far this year. Nevertheless, it still has quite high excess cash on its books. If Independent Bank is successful in shifting this excess cash into higher-yielding assets; then it could substantially improve its margin. The following chart shows the trend of interest-earning deposits with banks, which is a component of cash and cash equivalents.

SEC Filings

Considering these factors, I’m expecting the net interest margin to grow by 20 basis points in the second half of 2022 and 30 basis points in 2023. Compared to my last report on Independent Bank, I’ve increased my margin estimate because the ongoing up-rate cycle is more extreme than I previously anticipated.

Loan Growth to Remain Subdued

Independent Bank’s loan growth has been negligible during the first half of the year because the company was running off some of the East Boston acquired loans (note: Independent Bank acquired Meridian Bancorp and East Boston Savings Bank in November 2021). Loan growth will improve in the second half of this year because the acquired loan runoff and pay downs will taper off.

Nevertheless, loan growth will most probably remain at the lower end of the historical range. This is partly because of high interest rates that will discourage borrowing, especially for residential and home equity loans which make up around 21% of total loans.

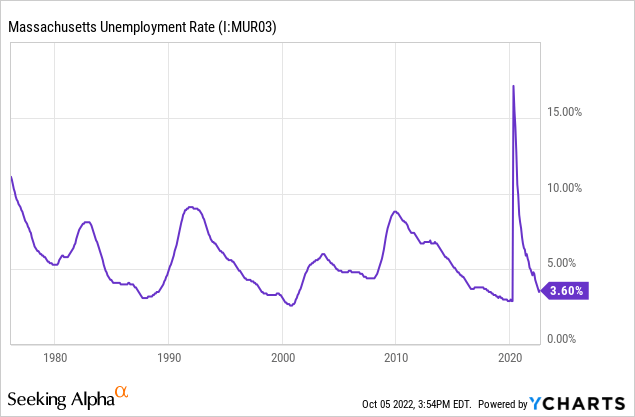

On the other hand, strong regional job markets will likely support loan growth. Independent Bank Corp. mostly operates in Massachusetts, whose unemployment rate is close to record lows, in line with the national average.

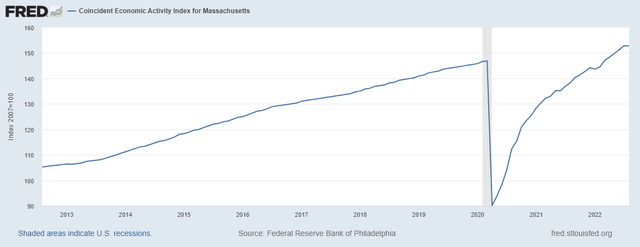

Further, the state’s coincident economic activity index shows satisfactory recovery following the pandemic.

Federal Reserve Bank of Philadelphia

Considering these factors, I’m expecting the loan portfolio to grow by 1.0% every quarter till the end of 2023. Meanwhile, most other balance sheet items will grow in line with loans. However, the equity book value will come under pressure from unrealized losses on available-for-sale securities. As interest rates rise, the market value of fixed-rate, available-for-sale securities falls, leading to unrealized losses. These losses flow directly into the equity account, bypassing the income statement. The equity book value has already dipped by 5% during the first half of the year. As the Federal Reserve is projecting a further 125-150 basis points hike in interest rates till the end of 2023, the unrealized losses will likely continue to grow.

The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |

| Financial Position | ||||||

| Net Loans | 6,842 | 8,806 | 9,279 | 13,440 | 13,803 | 14,364 |

| Growth of Net Loans | 8.7% | 28.7% | 5.4% | 44.8% | 2.7% | 4.1% |

| Securities | 1,075 | 1,275 | 2,348 | 4,789 | 4,253 | 4,339 |

| Deposits | 7,427 | 9,147 | 10,993 | 16,917 | 16,974 | 17,663 |

| Borrowings and Sub-Debt | 259 | 303 | 181 | 152 | 139 | 140 |

| Common equity | 1,073 | 1,708 | 1,703 | 3,018 | 2,806 | 2,924 |

| Book Value Per Share ($) | 38.8 | 49.7 | 51.5 | 74.8 | 60.1 | 62.6 |

| Tangible BVPS ($) | 29.0 | 34.1 | 35.5 | 49.6 | 38.4 | 40.9 |

| Source: SEC Filings, Author’s Estimates(In USD million unless otherwise specified) |

Expecting Earnings to Surge by 53% This Year

The anticipated margin expansion will be the biggest driver of earnings through the end of 2023. Further, mid-single-digit loan growth will also support earnings. As loan growth will likely remain subdued, the provisioning for expected loan losses will also remain low. However, high inflation will somewhat pressurize provisioning.

Overall, I’m expecting Independent Bank Corp. to report earnings of $5.29 per share in 2022, up 53% year-over-year. For 2023, I’m expecting earnings to grow by 10% to $5.81 per share. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |

| Income Statement | ||||||

| Net interest income | 298 | 393 | 368 | 402 | 591 | 661 |

| Provision for loan losses | 5 | 6 | 53 | 18 | 2 | 8 |

| Non-interest income | 89 | 115 | 111 | 106 | 110 | 108 |

| Non-interest expense | 226 | 284 | 274 | 333 | 377 | 404 |

| Net income – Common Sh. | 122 | 165 | 121 | 121 | 247 | 271 |

| EPS – Diluted ($) | 4.40 | 5.03 | 3.64 | 3.47 | 5.29 | 5.81 |

| Source: SEC Filings, Author’s Estimates(In USD million unless otherwise specified) |

In my last report on Independent Bank, I estimated earnings of $4.48 per share for 2022. I’ve revised upwards my earnings estimate partly because I’ve increased my net interest margin estimate. Further, I’ve reduced my non-interest expense estimate because the company has already achieved greater cost savings following the bank acquisitions than I previously anticipated.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, a stronger or longer-than-anticipated recession can increase the provisioning for expected loan losses beyond my estimates.

Adopting a Hold Rating for Now

Independent Bank has increased its dividend every year since 2001. Considering the earnings outlook, I’m expecting the company to increase its dividend by $0.04 per share to $0.55 per share in the first quarter of 2023. The earnings and dividend estimates suggest a payout ratio of 38% for 2023, which is close to the 2017-2019 average of 37%. Based on my dividend estimate, Independent Bank Corp. is offering a forward dividend yield of 2.8%.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Independent Bank. The stock has traded at an average P/TB ratio of 1.92 in the past, as shown below.

| FY19 | FY20 | FY21 | Average | |||

| Tangible BVPS ($) | 34.1 | 35.5 | 49.6 | |||

| Average Market Price ($) | 77.8 | 66.4 | 80.0 | |||

| Historical P/E | 2.3x | 1.9x | 1.6x | 1.9x | ||

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $38.40 gives a target price of $73.80 for the end of 2022. This price target implies a 6.2% downside from the October 4 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.72x | 1.82x | 1.92x | 2.02x | 2.12x |

| TBVPS – Dec 2022 ($) | 38.4 | 38.4 | 38.4 | 38.4 | 38.4 |

| Target Price ($) | 66.1 | 70.0 | 73.8 | 77.6 | 81.5 |

| Market Price ($) | 78.7 | 78.7 | 78.7 | 78.7 | 78.7 |

| Upside/(Downside) | (16.0)% | (11.1)% | (6.2)% | (1.3)% | 3.5% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 18.9x in the past, as shown below.

| FY19 | FY20 | FY21 | Average | |||

| Earnings per Share ($) | 5.03 | 3.64 | 3.47 | |||

| Average Market Price ($) | 77.8 | 66.4 | 80.0 | |||

| Historical P/E | 15.5x | 18.2x | 23.1x | 18.9x | ||

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $5.29 gives a target price of $100.20 for the end of 2022. This price target implies a 27.3% upside from the October 4 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 16.9x | 17.9x | 18.9x | 19.9x | 20.9x |

| EPS 2022 ($) | 5.29 | 5.29 | 5.29 | 5.29 | 5.29 |

| Target Price ($) | 89.6 | 94.9 | 100.2 | 105.4 | 110.7 |

| Market Price ($) | 78.7 | 78.7 | 78.7 | 78.7 | 78.7 |

| Upside/(Downside) | 13.8% | 20.6% | 27.3% | 34.0% | 40.7% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $87.00, which implies a 10.5% upside from the current market price. Adding the forward dividend yield gives a total expected return of 13.3%. This total expected return is not high enough for me. Therefore, I’m adopting a hold rating on Independent Bank Corp. I would consider investing in the stock if its price dipped by more than 5% from the current level.

Be the first to comment