Mrkit99/iStock Editorial via Getty Images

Here at the Lab, we are the only ones to cover UniCredit (OTCPK:UNCFF) in the Seeking Alpha community. We initiated with a publication called A Pass Again (For Now) and then, over the year, we moved the second Italian leading bank at an overweight valuation with many follow-up notes. The most important were the following:

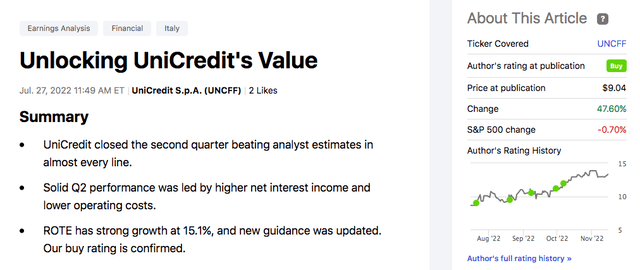

Since July 2022, UniCredit is up by almost 50% (including the tasty dividend per share already paid) compared to a negative return from the S&P 500. Yesterday, we released an update on Intesa San Paolo, whereas today, we decided to deep-dive into UniCredit.

Mare Evidence Lab’s previous publication

The Milanese group, led by CEO Andrea Orcel, has outperformed the EU banking sector by 30% in the last three months reversing the outflow suffered due to its Russian exposure. After having revised its revenue guidance upwards, here at the lab, we remained focused on risk and continue to see a satisfying path of shareholder remuneration. As already mentioned, UniCredit, as promised, is successfully implementing the industrial plan and we are convinced that this positive trend will continue.

Despite the latest stock price appreciation, we believe that UniCredit’s risk-reward remains very attractive as the company is still trading at around a 15% discount to the sector when we look at the price/earnings multiple. Therefore, we continue to value the company at €14 per share, confirming our buy rating on the stock.

Among the favorable upside, we underline the possibility of further upward revisions of the net interest income in the coming months, thanks to the increase in ECB rates. We should remember that the EU bank already revised rates for the third time in 2022. UniCredit guidances are based on the fact that the ECB rate (Deposit Facility Rate) remains stable at the current level of 1.5%. In numbers, It should be remembered that UniCredit has a guidance of €0.5 billion in interest margin more for every 100 basis points of increase in interest rates. Market expectations for EU rates are at 3% by the end of 2023, which clearly leaves room for further upward revisions to the guidance. In this sense, we forecast that UniCredit margins in 2023 (excluding Russia) will reach €10.7 billion and in any case, we assume a prudent cost of the risk level. In fact, another point highlighted is the bank’s attention to risk, which underpins the positive view on loan losses.

At present, the expected loss on outstanding loans is at 34 basis points, on the other hand, the new loan loss is estimated at 26 basis points. This cost of risk remained broadly stable over the past three years and is well below 2016-19 levels (by about 6 basis points). According to Mare Evidence Lab’s expectation, we believe that UniCredit’s cost of risk will reach 45 basis points in 2023, and we estimated a better number than the consensus forecasts set at 55 basis points. This is due to the company’s track record, since UniCredit maintained a better approach to risk, this will translate into lower loan losses for the bank in the short-medium term horizon.

On the capital solidity front, the CET 1 coefficient stood at 15.4% in the third quarter of 2022. At this point, including a full devaluation of the Russian exposure, the CET1 ratio should drop by approximately 100 basis points, to 14.0% with a cushion of 500 basis points above the minimum requirements set by the ECB. We already covered this topic in a previous publication and as reported in ISP’s follow-up note, UniCredit exposure is still higher compared to its Italian competitor (2% of total loans versus ISP at 0.3%).

This additional capital buffer, together with the improvement in profitability, are two important elements that continue to support the capital distribution plan. And that is why we believe that UniCredit could have a total return (total yield, sum of coupon, and buyback) of 15-16% per annum over the next three years, based on a total payout ratio expected in the range of 80-90%. A figure approximately 10% higher than the average total payout of the sector.

Conclusion And Valuation

Looking at the banking P/E sector average, the group is trading at 5.9x with a 50% discount compared to the market. In detail, banks’ free cash flow yield and dividend yield are respectively at 11.3% and 7%. The long-term average discount has always been 25%. Therefore, the whole EU banking asset class remains attractive and represents a cost-effective option due to the increasingly high borrowing costs. Wall Street research analysts expect central bank rates to peak in the next four months.

Going to the valuation, UniCredit 2023 P/E ratio is expected at 5.3x compared to Credit Agricole which stood at 7 times, Intesa Sanpaolo at 6.3 times, Banco BPM at 5.8 times, BPER at 5 times, and Societe Generale at 4.8 times. In addition, based also on a RoTE estimate, the bank is trading at 7.9% in 2022 and 6.5% in 2023, this low valuation is not justified by UniCredit’s net interest income potential given the current raising interest rate environment. This is why we confirm our target price at €14 per share and fully reiterate our initial thesis: UniCredit Could Return Its Entire Capitalisation In 4 Years.

Be the first to comment