Black_Kira

C3.ai (NYSE:AI) is a data science platform focused largely on providing infrastructure that enables companies who lack expertise to build and deploy scalable AI. This is a large market, but competition is fierce and C3.ai’s broader market appeal has yet to really be established. C3.ai’s stock is now reasonably priced, but given the large amount of uncertainty surrounding the company’s prospects, may still not represent good value.

Market

While the market for machine learning software is large, and likely has a bright future, investor focus is now pivoting to short term prospects, as the specter of a recession threatens IT budgets. Unlike past recessions, artificial intelligence and automation are now viewed as core business drivers, rather than just cost centers. This may mean that rather than cutting budgets, companies turn to artificial intelligence as a way to reduce costs and improve productivity.

More than three-quarters of surveyed tech leaders say that they expect their organization to spend more on technology this year, with investments focused on cloud computing, machine learning, artificial intelligence and automation. Forrester recommends that companies cut costs by eliminating older technologies and underutilized software (unused seat licenses).

Even if data science budgets are left largely untouched, a reduction in IT spending is unlikely to be a positive for C3.ai, as the company is still trying to establish a foothold in the market and expand its customer base. AI vendor DataRobot laid off approximately 7% of its workforce in May, indicating that AI platforms are not immune from economic headwinds.

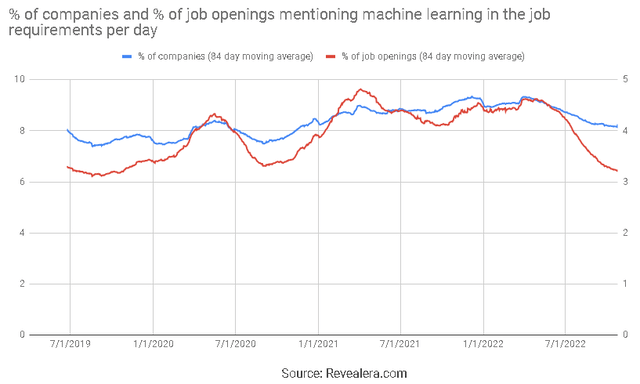

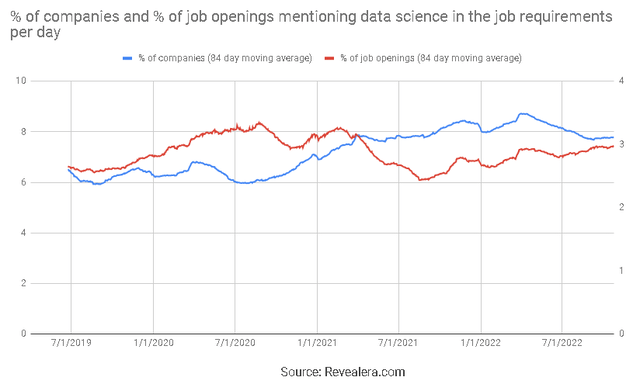

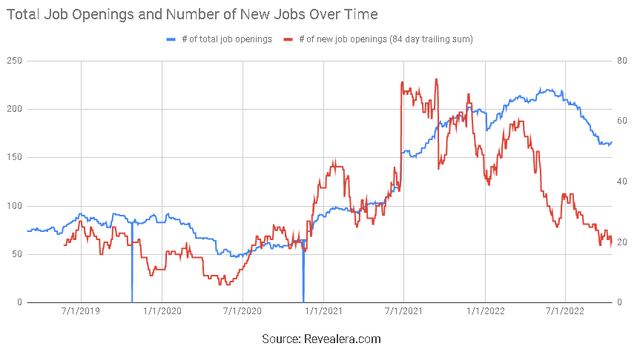

Hiring data points towards a moderation in growth of AI spending, if not an outright decline. The number of job openings mentioning machine learning in the job requirements has declined substantially over the past 12 months, while the number of job openings mentioning data science has leveled off. There is likely an issue with the specific language used in job postings, but it would appear that growth in the number of relevant positions has moderated.

Figure 1: Job Openings Mentioning Machine Learning in the Job Requirements (source: Revealera.com)

Figure 2: Job Openings Mentioning Data Science in the Job Requirements (source: Revealera.com)

C3.ai

C3.ai claims to be an AI company, but is more of a platform-as-a-service for standard machine learning capabilities. Much of their platform’s functionality is aimed at obviating the need for expertise when developing and deploying AI at scale.

Since going public in December of 2020, C3.ai has spent approximately 250 million USD on R&D, amounting to 59% of revenue. The bulk of this substantial investment was focused on the development of Version 8 of the C3.ai Platform, which is expected to provide customers 10x to 1,000x scalability and performance improvements. In addition, there are new data integrations, new no-code, low-code development tools and improved data science tools.

C3.ai continues to invest aggressively in R&D, with those efforts generally targeting the development of use case specific applications. C3.ai has released five new applications since their IPO:

- C3.ai ERP

- C3.ai ESG

- C3.ai Property Appraisal

- C3.ai Law Enforcement

- C3.ai Ex Machina

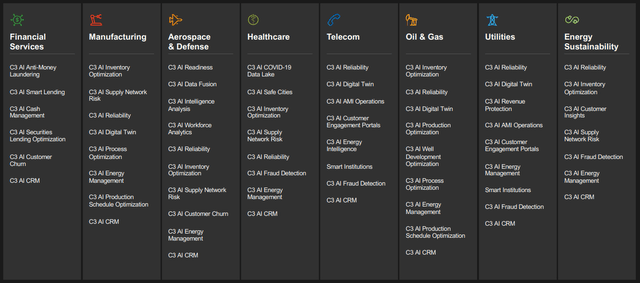

The company expects to have around 100 turnkey applications within the next two years, for industries including banking, manufacturing, oil and gas, automotive and transportation. This focus on applications is at the heart of C3.ai’s business, as the vast majority of their revenue comes from turnkey applications rather than providing customers with tools to develop their own applications.

Figure 4: C3.ai Applications (source: C3.ai)

In addition to building out their portfolio of applications, C3.ai is also trying improve the productivity of their sales function and enhancing their strategic partnering model. The company hopes these efforts will accelerate sales cycles and lead to an increase in market share.

Thomas Siebel characterized the past profile of C3.ai’s sales organization as similar to SAP (SAP) and Oracle (ORCL). The company wants to shift this towards a more highly educated and experienced organization with domain specific expertise. The average age of C3.ai’s salesforce is 35, all of whom have at least one advanced degree and 67% of whom have MBAs. They have 12 years of work experience on average and many have educational backgrounds at organizations like West Point, the Naval Academy, MIT, Princeton, Illinois, Michigan, Berkley, Stanford, MIT, Georgia Tech and Carnegie Mellon. I’m not sure of the efficacy of this strategy, but it will likely result in a sales organization with a relatively high costs basis. If nothing else, it seems to fit with C3.ai’s focus on credentials and appearance.

C3.ai has expanded their partnership with Google Cloud, with Google Cloud increasing its commitment to co-sell and co-fund over 100 new C3.ai Tier 1 pilot deployments. To date, C3.ai has closed over 265 million USD in contracts with Microsoft (MSFT), and Microsoft is funding C3.ai trials to accelerate customer acquisition. AWS is C3.ai’s largest installed base, with approximately 56% of C3.ai’s customers running on the AWS cloud.

Baker Hughes (BKR) is also an important partner for C3.ai. C3.ai is collaborating with Baker Hughes, Microsoft and Accenture to develop and market a comprehensive industrial asset management solution for clients in the energy and industrial sectors.

Financial Analysis

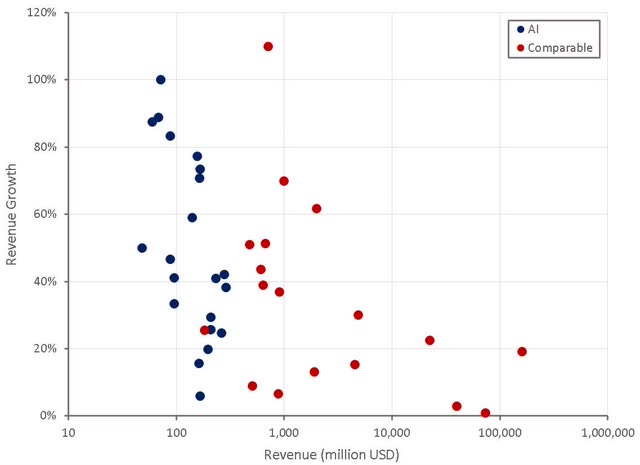

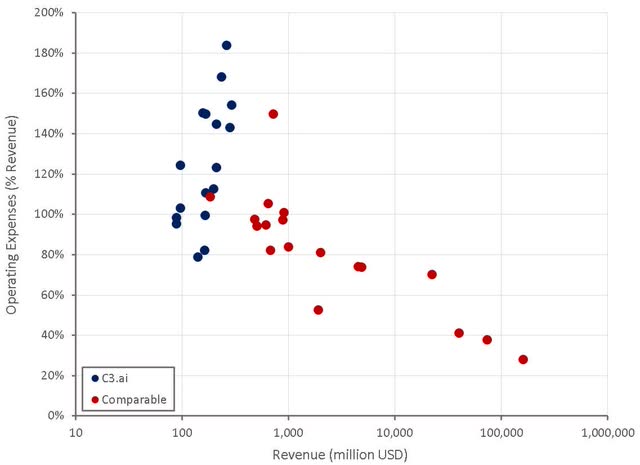

C3.ai’s revenue growth is relatively low given the company’s size, and has been declining rapidly. This is not surprising given C3.ai’s reliance on large customers. It has always been questionable whether the company could successfully penetrate the broader market and there is still limited evidence of an ability to do this.

C3.ai’s reliance on use case specific applications may also limit expansion rates relative to software companies that provide infrastructure that customers build on. This could increase the burden of sales and limit C3.ai’s growth rate.

In addition to uncertainty regarding the fundamentals of C3.ai’s business, there is mounting macroeconomic uncertainty which is likely to weigh on the company’s performance going forward. Management has pointed towards budget cuts and lengthening sales cycles on earnings calls. While some peers are facing similar issues, it should be noted that this stands in sharp contrast to the commentary provided by Alteryx (AYX).

C3.ai’s customer count grew 27% YoY to 228 in the most recent quarter. This growth is being driven by smaller customers, with the number of sub million USD deals growing 44% YoY. As a result, C3.ai’s average total contract value is compressing rapidly. While this is necessary for C3.ai to increase revenue, it potentially also requires a different sales strategy and competencies.

C3.ai is currently in the process of transitioning to a consumption-based pricing model, which they hope will accelerate adoption of their platform. In the past, C3.ai’s sales cycles involved lengthy negotiations of 36-month contracts that included developer license fees, application license fees, data science license fees, professional services and run time fees totaling commitments in the 1-35 million USD range. With a consumption-based pricing model, the cost of adoption is low and the protracted acquisition deliberation process is avoided. C3.ai expects to see more new customers who start smaller but grow over time. As a result, they hope to see a substantial increase in revenue and revenue growth rates after three to four quarters. The near-term impact on revenue and RPO will be negative though.

Figure 5: C3.ai Revenue Growth (source: Created by author using data from company reports)

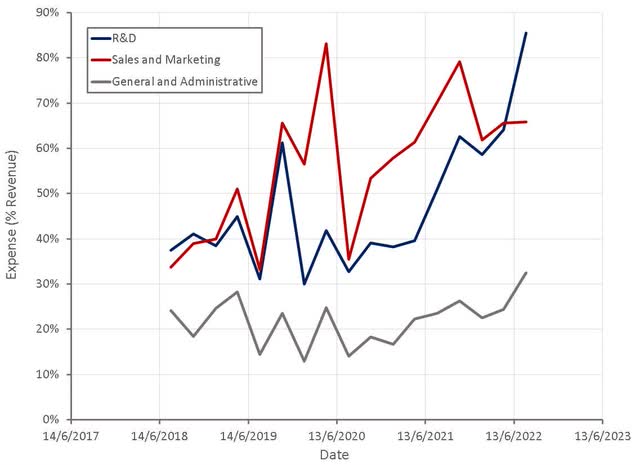

C3.ai is targeting a reduction in marketing expenses from 29% of revenue to 11% of revenue. They also plan on reducing R&D expenses from 44% of revenue to 29% of revenue and general and administrative expenses from 15% of revenue to 12%. Sales expenses are expected to increase from 23% of revenue to 26% of revenue though.

C3.ai expects to be profitable on a non-GAAP basis and be generating positive cash flows from normal operations by the end of fiscal year 2024. These appear to be quite aggressive targets that will likely require significant revenue growth, in addition to cost controls, to achieve.

Figure 6: C3.ai Operating Expenses (source: Created by author using data from C3.ai)

Figure 7: C3.ai Operating Expenses (source: Created by author using data from company reports)

C3.ai has slowed hiring significantly over the past 12 months, as expected given the company’s focus on reducing operating costs. Hiring is still above pre-pandemic levels though, so the company does not appear to be overly concerned with its current financial situation. C3.ai’s large cash balance affords them a buffer to be able to work through short-term macro issues. C3.ai has stated that they continue to hire, especially in sales and engineering, with engineering growth concentrated in Guadalajara due to the cost benefits.

Figure 8: C3.ai Hiring Trend (source: Revealera.com)

Valuation

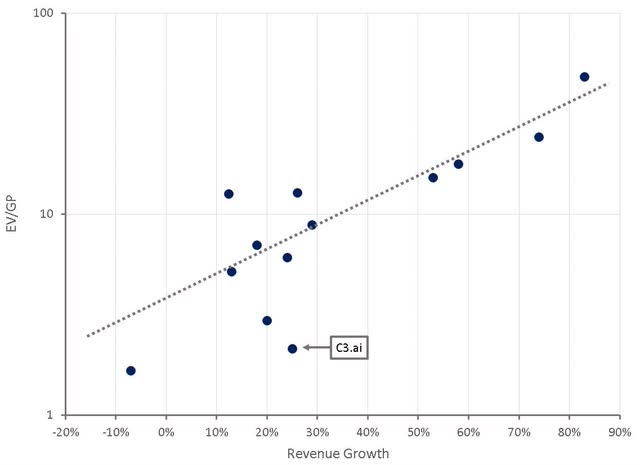

C3.ai’s EV/S multiple appears quite low, although this is somewhat misleading, as the company has nearly one billion USD in cash, which it will likely burn through in coming years. C3.ai certainly could prove to be undervalued if they can accelerate adoption of their platform and improve the productivity of their sales organization, but given the company’s current lack luster performance and macro uncertainty it appears fairly valued.

Figure 9: C3.ai Relative Valuation (source: Created by author using data from Seeking Alpha)

Conclusion

C3.ai’s stock has been punished severely by the market since it went public to much fanfare in 2021. Some of this has been based on valuation, but a lot of it is related to the company’s relatively poor financial performance and uncertain position in a fragmented and competitive market. The shift to a consumption based business model and the restructuring of the sales organization indicate that C3.ai has problems that go beyond simple macro headwinds. It is not clear that these efforts will do much to improve C3.ai’s high costs and low growth though. If the company can find a way to control costs and reaccelerate growth, the stock could prove to be quite cheap at current levels.

Be the first to comment