marrio31/iStock via Getty Images

On 7/28/22 the GDP report came out with a negative 0.9% real GDP in the 2nd quarter of 2022. That makes for the second quarter in a row of negative GDP which puts us in a technical recession. Various entities are mincing words debating whether or not it is actually a recession given the strong labor market, but I’m more interested in figuring out where the recession is.

As earnings season rolls through, there is a distinct pattern of which companies are beating estimates and growing earnings and those which are struggling. I posit that physical world companies are doing well while the recession seems to be isolated to the digital world.

The market is pricing in recession almost evenly with basically everything down in 2022 and I think this creates opportunity. Portions of the market not only avoided recession, but are thriving and yet the associated stocks are priced for recession.

Physical taking market share from digital

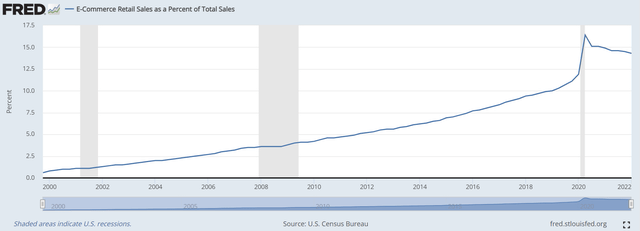

During the pandemic, digital took a massive amount of market share from physical. It wasn’t exactly a fair fight either as physical places were prohibited from opening.

In 2022, however, the world is re-opening and physical gets to fight on a level playing field. It turns out that now that we can see people in real life and go to actual places there just isn’t demand to hang out in the metaverse.

Facebook (META) and Snapchat (SNAP) got clobbered on their earnings reports.

All these digital companies and pandemic beneficiaries are starting to struggle on a fundamental basis with the consumer dollars being re-routed to real world businesses. Peloton (PTON) is teetering on disaster, but my local Planet Fitness (PLNT) is packed every day. Humans are inherently social creatures and even though you could buy something online, sometimes we like to go to an actual store, touch the merchandise and see real people.

As the pandemic accelerated the growth in E-commerce market share the market believed it was a permanent shift. They said it instilled a learned behavior and preference for the convenience of online shopping. However, it has dropped all the way back down to the former trendline.

I believe it would actually be far below trendline if things like BOPIS (buy online pick-up in store) were properly accounted for as brick and mortar sales. Further, if goods purchased online and returned in stores were properly counted as negative online sales rather than negative brick and mortar sales, the true E-Commerce market share would be substantially lower.

Teladoc (TDOC) is collapsing as it lowers the midpoint of its guidance on a realization of physical in-person medicine regaining its market share.

Former growth company Netflix (NFLX) is losing subscribers and digital ad-spend is dropping.

This is where the recession lies – pandemic beneficiaries that facilitated digital activity. It is a big enough section of the economy to pull overall real GDP into negative territory.

The physical world, however, is not in recession.

As a REIT analyst I get a close look at the physical world as REITs deal in physical property and are closely tied to the in-person economy. REITs want people to be traveling, shopping and working in-person.

Observable strength in REIT earnings

2nd quarter earnings season is about half-way through and so far, it is strength across the board for REITs.

- Towers are growing with beats and raises from Crown Castle (CCI) and American Tower (AMT)

- Apartments continue to have pricing power with NexPoint Residential (NXRT) increasing same store NOI an average of 16.4%

- Industrial warehouses are hitting record rent levels with Rexford (REXR) re-leasing its properties at more than double expiring rent.

- Retail is thriving with bellwether Kimco (KIM) raising guidance on strong leasing and occupancy numbers. From the earnings release: it “signed 498 leases totaling 2.3M square feet with blended pro-rata rental-rate spreads on comparable spaces increasing 7.1% and with rental rates for new leases up 16.6% and renewals and options climbing 5.6%.”

- Life science real estate is succeeding even as venture capital investment pulls back on biotech startup investment with Alexandria Real Estate (ARE) raising rents by 45% in 2Q22 and raising guidance

- Farmland is benefiting from high commodity prices, allowing Farmland Partners (FPI) to raise its rents by 15% and increase the midpoint of AFFO guidance by $0.03.

The only real estate sector that seems to be feeling recession is office and that has far more to do with excessive supply of properties than a lack of demand. SL Green (SLG) posted strong numbers in 2Q with growing FFO/share, but I still intend to stay away from the sector.

Substantial mispricing brings opportunity

There has been so much talk about recession that the market has priced it in almost universally. Some areas have fallen more than others, but nearly everything is down at a sector level. This indiscriminate pricing has created huge opportunity in physical world companies which are down along with digital stocks. Even with the earnings season rally, REITs are down almost 15% on the year.

I find this to be an interesting contrast, to have the blockbuster reports discussed above correspond to a 15% decrease in market price.

It is a rare opportunity to get expansionary fundamentals at recessionary market pricing. As earnings continue to roll through, I think it will become increasingly obvious that even if we are in recession, certain areas of the economy are not participating in it.

The digital recession is actually great news for REITs and facilitates them recapturing the market share lost in the pandemic.

Valuation

The average REIT is growing FFO/share at a pace of about 7% annually while paying an average dividend yield of 3.22%. That combination of dividend and growth sums to expected annual returns for the sector just north of 10%.

This is made possible by the discount at which REITs trade. The median REIT is trading at about 82% of NAV and a price to 2023 estimated FFO of 14.5X. They historically trade roughly at NAV and a P/FFO multiple closer to 18X.

The lower entry point, thanks to the market downdraft, juices forward returns without a corresponding increase to risk.

Risks to the sector

As participants in the physical world and the real economy, REITs are susceptible to recession, but they are more exposed to nominal GDP than they are to real GDP (inflation adjusted). Rent tends to be of a non-discretionary nature, so even as people are spending more money on gas and groceries, individuals and businesses will generally tend to pay their rent. Thus, REITs are doing fine in this real GDP recession because nominal GDP is still strongly positive.

An early warning sign that could portend weakness in REITs would be significant softening of the labor market. So far jobs are plentiful and pay fairly well, but if unemployment crests 5% I would anticipate weakness in the more cyclical REIT property types.

Be the first to comment