buzbuzzer/E+ via Getty Images

Investing in real estate can be incredibly lucrative. Although it might not be the most exciting type of asset to own, it does tend, if you own quality real estate at least, to generate consistent and growing cash flows over time. One company that is now looking fairly attractive that happens to own a sizable portfolio of open-air shopping centers, is RPT Realty (NYSE:RPT). Like many other companies, RPT Realty has seen its share price decline with the broader market in recent months. While this has proven to be painful for investors who have been along for the ride, it does now seem to offer an attractive opportunity for those wanting to buy on the cheap. The company is not the cheapest player out there. But with recent performance coming in strong and given how cheap shares are on an absolute basis, I have decided to change my rating on it from ‘hold’ to ‘buy’.

Recent pain has created an opportunity

Back in December of 2021, I wrote an article discussing whether it made sense to buy into shares of RPT Realty. At that time, I acknowledged that, after years of pain, the company had finally started to see improvement on both its top and bottom lines. This growth was driven in large part by the acquisition of additional assets that management had identified. And at the end of the day, I even went so far as to call it a turnaround prospect that looked, fundamentally speaking, promising. Having said that, I did also say that the market seemed to be pricing in a full recovery for the firm at that time. And that led me to rate it a ‘hold’, reflecting my belief that it would generate returns that would more or less match the broader market for the foreseeable future. Since then, my call has proven to be pretty accurate. While the S&P 500 is down by 17.6%, shares of RPT Realty have generated a loss for investors of 19.7%.

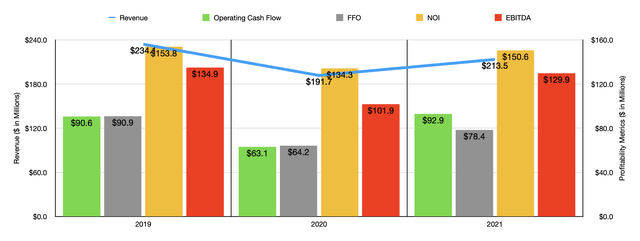

Normally, when you see a decline in the double-digit range, you would expect it to be accompanied by weak fundamental performance. But that has not been the case. Consider how the company performed in 2021. Revenue of $213.5 million translated to a year-over-year increase of 11.4% compared to the $191.7 million generated in 2020. Operating cash flow rose from $63.1 million to $92.9 million. Operating FFO, or funds from operations, rose from $64.2 million to $78.4 million. Net operating income, also known as NOI, rose from $134.3 million to $150.6 million. And finally, we have EBITDA, which increased from $101.9 million to $129.9 million.

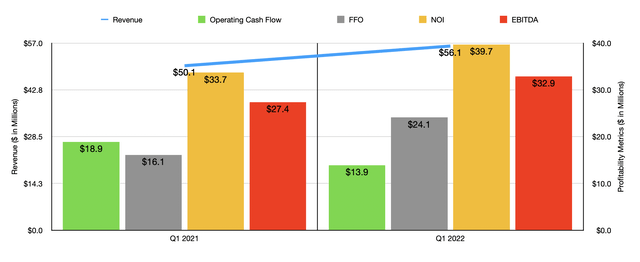

Performance for the company has continued to improve in the 2022 fiscal year. Revenue of $56.1 million in the first quarter of the year beat out the $50.1 million achieved one year earlier. Part of this increase was driven by a rise in occupancy from 90.9% to 91.2%. Profitability metrics were somewhat mixed but generally positive. Consider, for starters, operating cash flow. In the latest quarter, it came in at $13.9 million. This was down from the $18.9 million achieved one year earlier. But if we adjust for changes in working capital, it would have risen from $19.8 million to $25.7 million. FFO improved from $16.1 million to $24.7 million. Net operating income rose from $33.7 million to $39.7 million. And EBITDA increased modestly from $27.4 million to $32.9 million.

When it comes to the 2022 fiscal year, management has some pretty high expectations for the company. They currently anticipate making acquisitions of around $225 million. This would be funded in large part by the sale of assets that the business no longer sees as valuable enough to keep. Total planned divestitures could be up to $200 million. These activities, combined with same-store net operating income growth of between 2.5% and 4% are forecasted to increase operating FFO per share to between $1.01 and $1.05. This translates to FFO of $88.1 million, which would be 12.4% above what the company generated in 2021. No guidance was given when it came to other profitability metrics. But if we assume that they will increase at the same rate that FFO should, we should anticipate net operating income of $169.2 million, adjusted operating cash flow of $97.7 million, and EBITDA of $146 million. As a note, the operating cash flow figure strips out the preferred distributions the company should pay out this year. That better reflects the mandatory cash outflows of the company in my opinion. And for the purpose of valuing the firm relative to 2021 results, I have done the same thing.

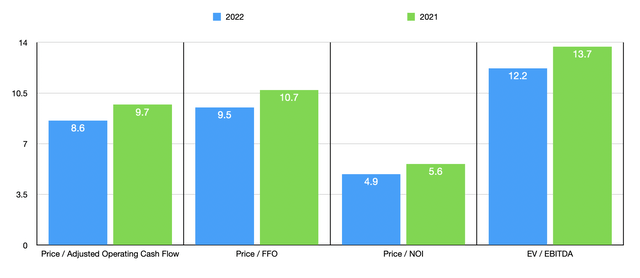

Using all of the aforementioned assumptions, valuing the company is not that hard. The forward price to operating cash flow multiple should be 8.6. That’s down from the 9.7 reading we get if we use 2021 results. The price to FFO multiple should drop from 10.7 last year to 9.5 this year, while the price to net operating income ratio should fall from 5.6 to 4.9. Meanwhile, the EV to EBITDA multiple should drop from 13.7 to 12.2, with net debt of $837 million and preferred stock worth $92.45 million impacting this multiple. As part of my analysis, I also decided to compare the company to five similar firms. On a price to operating cash flow basis, these companies ranged from a low of 5.6 to a high of 23.7. And using the EV to EBITDA approach, the range was from 10 to 28.8. In both cases, only two of the five companies were cheaper than RPT Realty.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| RPT Realty | 9.7 | 13.7 |

| The Necessity Retail REIT (RTL) | 5.6 | 14.2 |

| NETSTREIT (NTST) | 23.7 | 28.8 |

| Urstadt Biddle Properties (UBA) | 8.7 | 12.9 |

| Alexander’s (ALX) | 12.3 | 10.0 |

| Whitestone REIT (WSR) | 10.3 | 16.1 |

Takeaway

All the data provided right now suggests to me that RPT Realty is doing pretty well for itself. The company has certainly gotten cheaper, both from a dollar perspective and from a valuation perspective, compared to when I last wrote about it. At the end of the day, shares definitely look cheap enough to draw my attention. This is not to say that it is the best prospect on the market. There certainly are better ones. But for investors who take a fancy to this particular enterprise, I don’t think a ‘buy’ designation would be unrealistic.

Be the first to comment