krblokhin

Introduction

Earnings season has arrived! We’re now confronted by an increasing number of earnings calls from companies across all industries and sectors. That’s fun for many reasons. Earnings not only tell us a lot about companies but they are also sources of industry insights – some are better than others. In the case of J.B Hunt (NASDAQ:JBHT), we’re dealing with one of America’s largest transportation companies. A giant that not only dominates intermodal shipments, but also various other segments like truckload, less-than-truckload, and related services. After discussing the stock from a dividend point of view last month, I will use this article to dive into the company’s earnings using other sources to give us a better insight into the trucking industry.

With that said, let’s start with the company’s numbers.

2Q22 Was Much Better Than Expected

This is one of the articles where I have a hard time deciding where to begin as there’s so much to talk about.

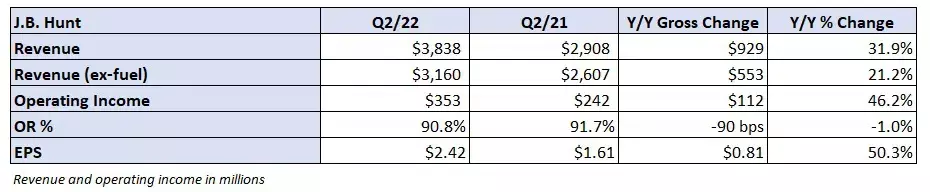

So, let’s start at the very beginning. J.B. Hunt – or JB Hunt as adding these dots takes too much time – did $3.84 billion in quarterly revenue. That’s $230 million higher than expected and 32.0% higher compared to the prior-year quarter.

This allowed GAAP EPS to come in at $2.42. This, too, is higher than expected. In this case, $0.07. Excluding fuel surcharges, revenue rose by 21.2%.

FreightWaves

The operating ratio dropped by 90 basis points, which is a good thing as this ratio measures how much it costs (as a % of revenues) to run the company. In this case, it’s a pretty decent OR, given that trucking companies are far more capital intensive than i.e., railroads.

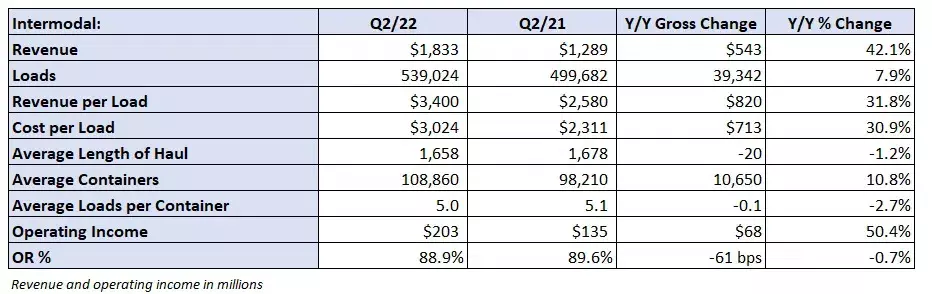

With that said, roughly half of the company’s sales are generated in the intermodal segment. This segment did $1.8 billion in revenues thanks to an 8% surge in volumes. Eastern network loads were up 13%. Transcontinental loads were up 5%.

FreightWaves

While an operating income surge of 50.4% isn’t bad, it could have been higher if it weren’t for issues in the rail industry. According to the company:

Demand for intermodal capacity remained strong throughout the quarter, however rail velocity and customer behavior negatively impacted network efficiencies and container utilization, and ultimately, our ability to execute even greater volume in the quarter.

FreightWaves reports that train speeds were down 11% with Norfolk Southern (NSC) – one of America’s largest intermodal railroads – and flat with Buffet-owned BNSF. Unfortunately, dwell times were up 20%, and 12%, respectively.

It also didn’t help that dwell times at the Ports of Los Angeles and Long Beach, California, reached a new high at 13.3 days in June. The company is working on better transloading opportunities. The company will open a site to serve Southern California ports by moving more goods in 53-foot trailers. In my opinion, this is a big win for JBHT and the railroads servicing these ports – mainly BNSF and Union Pacific (UNP).

Darren Field, responsible for intermodal at JBHT was optimistic going forward:

As we sit here today, we remain optimistic that rail performance and velocity will improve as the rails are not incentivized to move slower, near and long-term growth opportunities for Intermodal business continue to be in front of us and our rail channel partners are well aware of those opportunities.

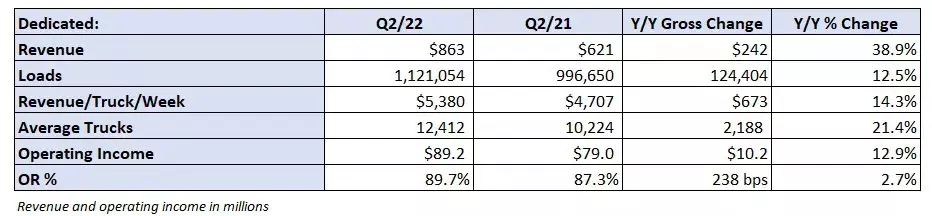

Dedicated contract services (22% of total revenue) saw a revenue increase of 39% to $863 million. This segment helps customers with fleet creation, conversion, and the design and implementation of supply solutions. Productivity per truck rose by 14%. Without fuel surcharges, that number is 5%. Indexed-based pricing more than offset lower production of equipment on new accounts. The net addition of 2,122 trucks in the fleet helped to drive revenue. Customer retention rates remained above 98%, which is obviously a good sign. Yet, higher costs hurt the OR a bit, which increased by 238 basis points.

FreightWaves

According to the company:

This unprecedented demand and growth for our highly engineered Fleet Service has put a strain on the organization, and the team has responded extremely well to the challenge.

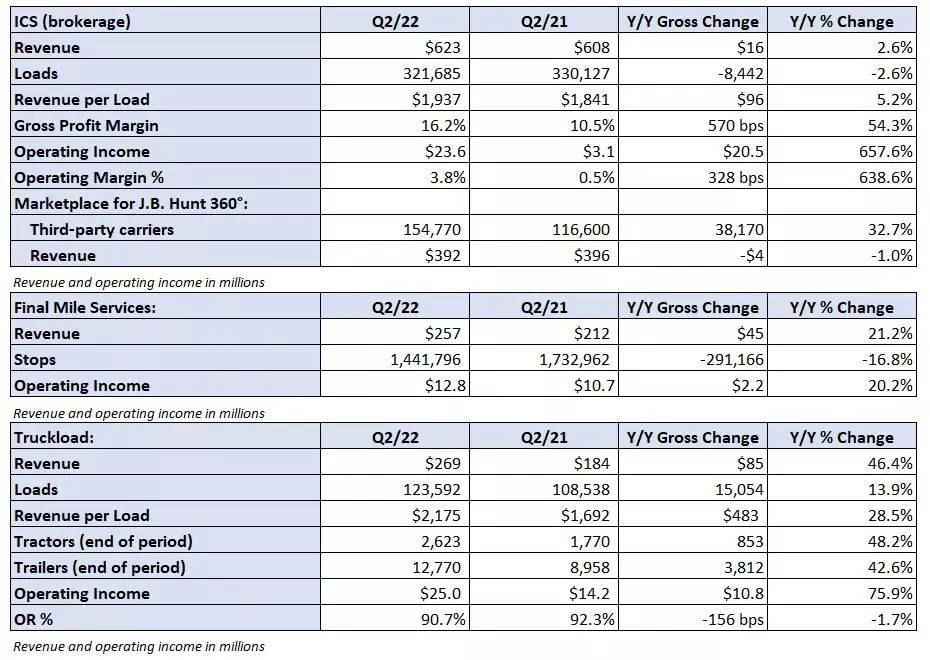

Integrated Capacity Solutions accounts for 16% of total revenues. This segment offers non-asset-based (via third-parties) dry van, flatbed, refrigerated, expedited, and LTL services.

This brokerage segment increased revenues by 3% based on 3% lower volumes. This was consistent with truckload volumes. Revenue per load increased by 5% thanks to better rates and a better freight mix.

Operating margins in ICS rose by 570 basis points. JB Hunt 360 added 32.7% more carriers. Truckload revenues rose by almost 50% based on 14% higher volumes.

FreightWaves

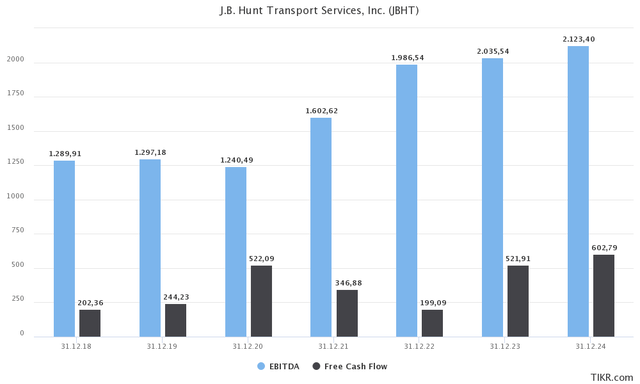

With that said, the company is now on track to do $2.0 billion in EBITDA this year. Free cash flow is expected to be a “mere” $200 million due to a significant increase in capital expenditures. JBHT is looking to do $1.5 billion in CapEx, which could end up coming in lower as the company mentioned having problems getting equipment (due to supply chain problems). That would push CapEx into 2023 and not influence longer-term free cash flow.

Last month, I praised the company’s efforts that finally resulted in significantly improving financials, making the stock attractive despite offering investors a dividend yield of only 1%.

J.B. Hunt is doing a tremendous job accelerating growth. The company is not only streamlining its existing business but actively using technology to deeper penetrate the market for brokerage services and related.

Margins are rising, along with an accelerating uptrend in sales, EBITDA, and free cash flow after 2022.

On top of that, the company is now using its momentum to accelerate dividend growth as management is highly dedicated to boosting shareholder returns whenever possible. Its balance sheet is healthy and peaking CapEx should lead to accelerating free cash flow in the years ahead.

With that said, to discuss the company’s valuation, we need to incorporate a bit more than just its financials numbers – and that’s OK as it’s the reason I’m writing this article.

Valuation & Market Environment

We already discussed the market environment to a large extent in the part above. Demand remains high – so high that shippers cannot keep up with demand. Inflation helps with pricing, and supply chain problems prevent volumes from rising further. Supply chain issues also prevent companies like JBHT from receiving all necessary (or desired) supplies/capital goods.

The other day, the Wall Street Journal published an article covering the emerging downtrend in freight rates.

The situation is a sharp turnaround for shippers who at the start of 2022 were willing to pay record-high contract rates to guarantee space on container ships ahead of this year’s fall and winter peak shipping seasons following severe delays and inventory shortages through much of 2021.

One official at a large U.S. importer said it recently reduced by 15% to 20% ocean contract rates signed several months ago. The official expects further reductions later this year. “Things are trending in favor of the importers,” the official said.

Moreover, and with regard to trucking:

Trucking spot rates fell 22% during the first six months of this year, according to DAT, dipping below the contract rate in May for the first time in two years. By June, the average contract rate for the most commonly used type of trucking, dry van, was $2.93 per mile, 17 cents higher than the $2.76 per mile to move a load on the spot market.

On June 23, I wrote an article on Seeking Alpha to highlight my own transportation outlook. Transportation weakness in July is pretty much what I expected based on developments that started well-before July.

Basically, we were – and still are – dealing with the bullwhip effect. This started as soon as economies implemented lockdowns in 2020. Companies stopped ordering new inventory. Then, when economies reopened, demand came back roaring. Retailers started ordering new stuff, which caused a significant backlog at producers and shippers. Now, as demand is slowly fading again, we’re dealing with too much inventory and too much transportation capacity in some areas.

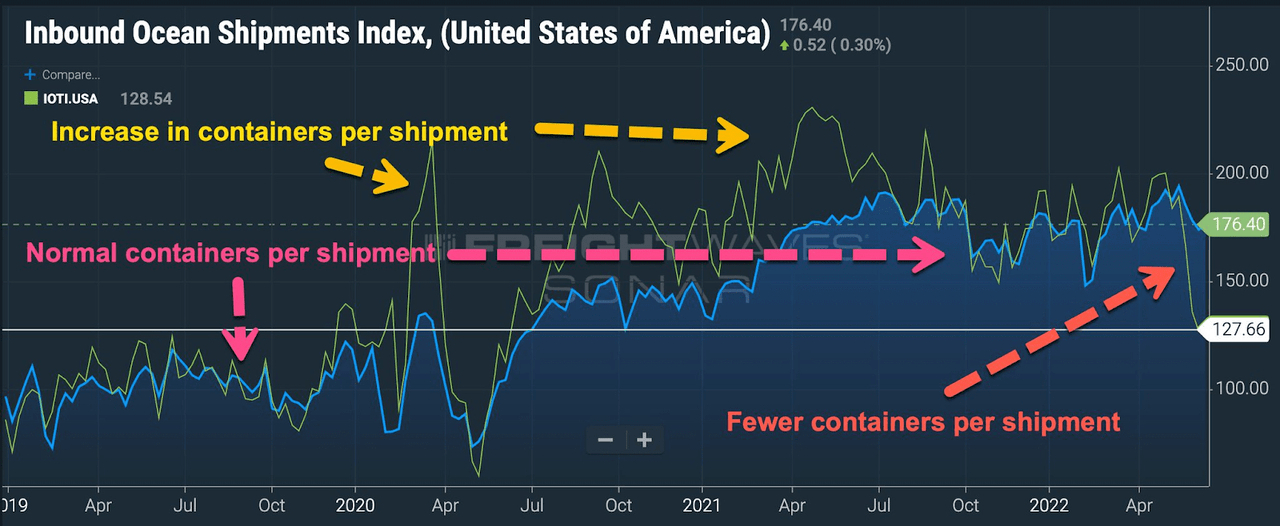

Hence, we’re seeing fewer containers per shipment, which is hurting pricing in container shipping.

FreightWaves

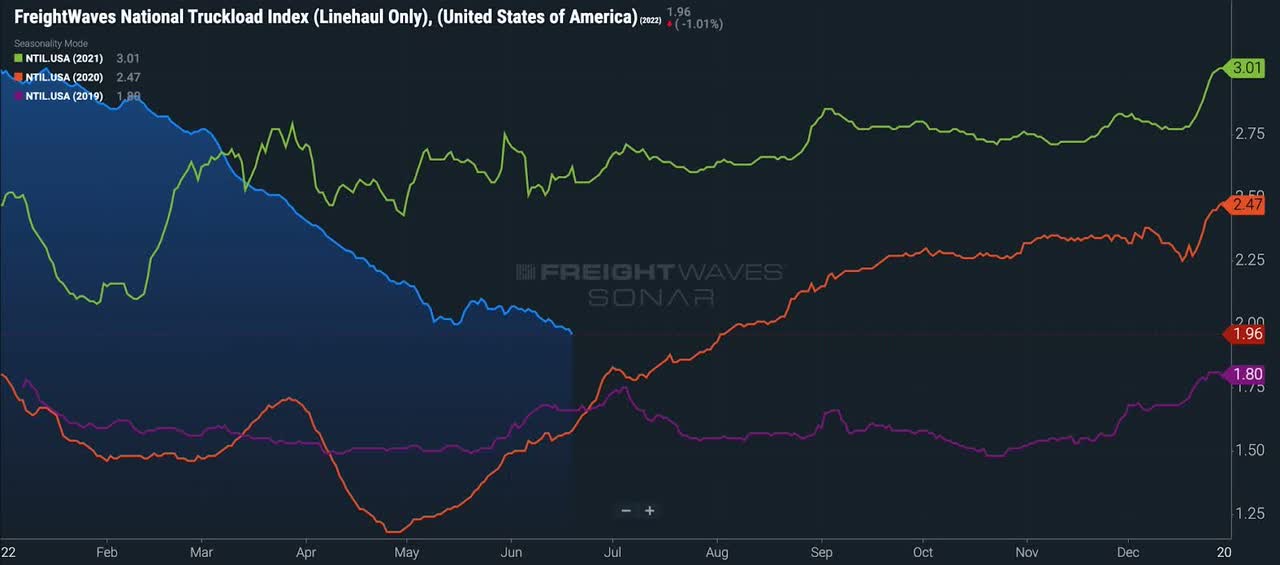

This is also hurting domestic trucking and related industries like intermodal and railroads. The chart below shows the national truckload index, which displays a steep decline in pricing versus 2021 (still above 2019 and 2020):

FreightWaves

The good news is that a lot has been priced in, which is why my JBHT article in June had a bullish tag, which brings me to the valuation.

Valuation

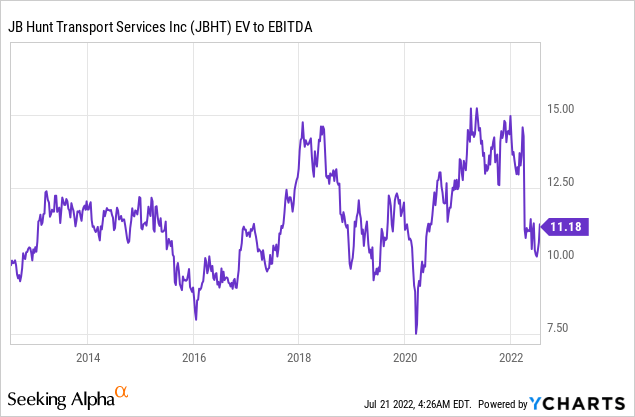

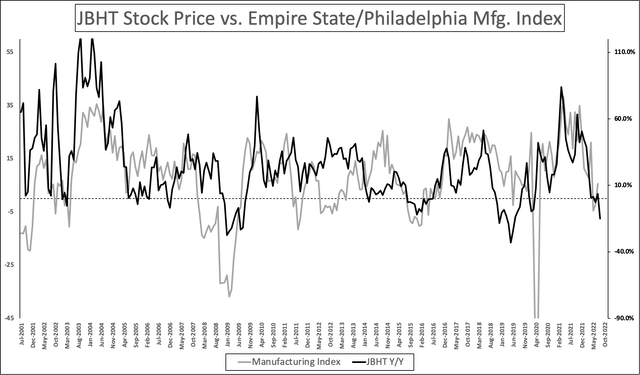

JBHT is now down roughly 15% from its all-time high. The stock is up 11% since my June article. Using the updated chart below, the stock is still in buying territory if economic sentiment refrains from breaking down. The first numbers for the month of July looked promising as the Empire State manufacturing index was able to rebound, yet it needs to be seen if other indicators can follow.

With that said, the valuation has changed a bit. The market cap is higher (now $18.1 billion), 2023 net debt expectations are down from $1.25 to $1.20 billion, which I believe is due to lower expected CapEx, and 2023 EBITDA estimates are down from $2.05 billion to $2.0 billion. Pension liabilities can be ignored.

These numbers give the company an enterprise value of $19.3 billion. That’s 9.7x expected EBITDA.

That valuation is still good, yet the risk/reward has gotten slightly worse versus June, but that’s OK for long-term investors. It’s also the reason why I will maintain a bullish rating, despite ongoing economic risks. It’s all about the longer-term risk/reward, and JBHT’s business investments that are paying off.

Takeaway

I have to say, I was impressed with JBHT’s quarter. They saw very strong demand. Demand was too much to handle as major intermodal partners like Norfolk Southern and BNSF were struggling to efficiently connect buyers to sellers. If you’re interested in the back story, I wrote an article on that this week. The company’s operating ratio improved despite high inflation, and investments in JB Hunt 360 are paying off handsomely.

Moreover, the company is looking positively into the future. I partially agree/disagree with that. Yes, demand is still high and JBHT is benefiting from secular growth thanks to its investments in brokerage services and (related) JB Hunt 360. However, economic data suggests that retailers are reducing demand, which is starting to hurt transportation margins and overall volumes.

The good news is that a lot has been priced in, which is why I remain bullish on JB Hunt. However, please do not expect a strong surge to new highs. The stock – like its many peers – will more than likely encounter some severe bumps along the way.

(Dis)agree? Let me know in the comments!

Be the first to comment